Report Overview

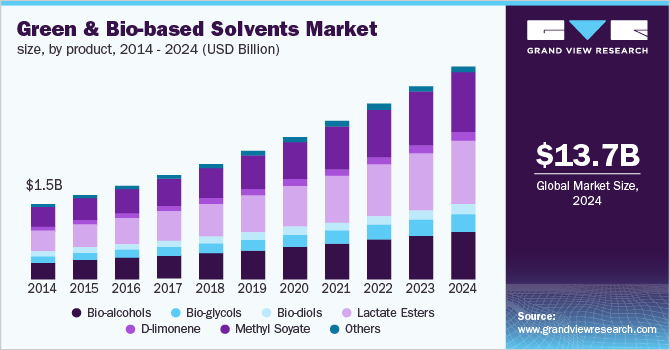

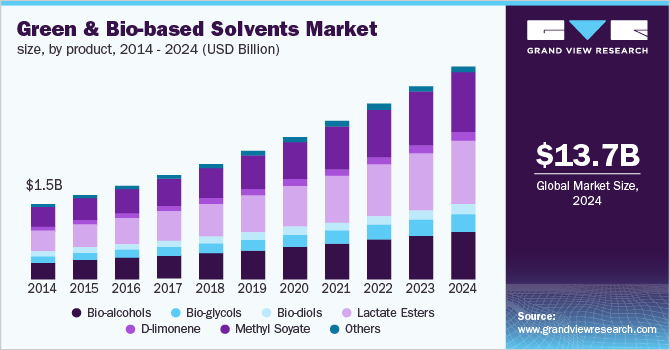

The global green & bio-based solvents market size to be valued at USD 13.74 billion by 2024. The market is primarily driven by rising demand from key application segments such as paints and coatings, adhesives, and pharmaceuticals. Growth of the paints and coatings, as well as adhesives industries, can be attributed to the increasing population and the resultant growth in industries such as real estate, public works, and building and construction.

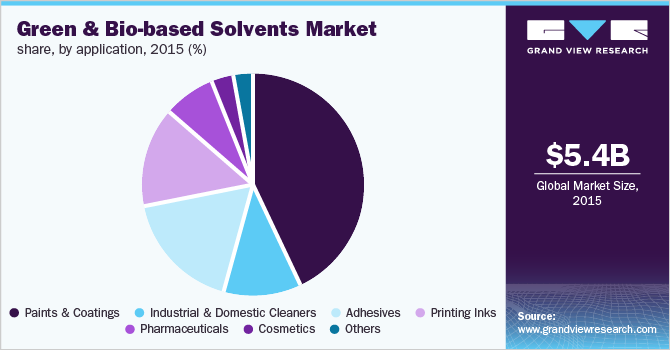

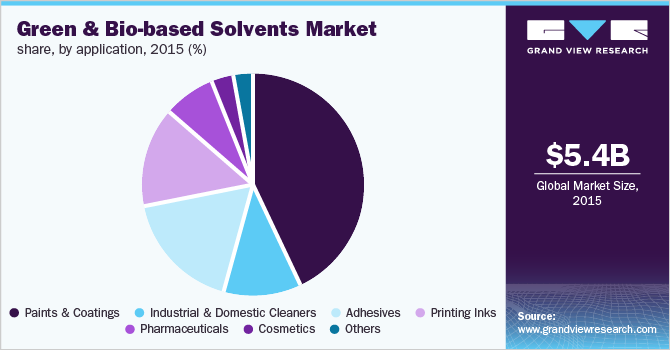

These products find significant demand in applications such as paints and coatings, industrial and domestic cleaners, adhesives, printing inks, pharmaceuticals, and cosmetics. Increasing the R&D capabilities of the manufacturers for the development of additional feedstock and manufacturing technologies to facilitate large-scale production is another key factor driving the market.

Key challenges faced by the industry include increasing demand for bio-based raw materials in other end-user industries and misconceptions among consumers regarding the cost and performance of bio-based solvents. Increasing demand for raw materials such as soybean oil and corn starch for the generation of biofuels may affect the availability of these materials for the development of bio-based solvents.

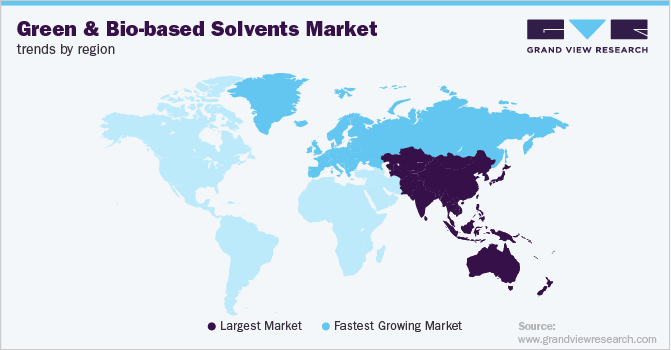

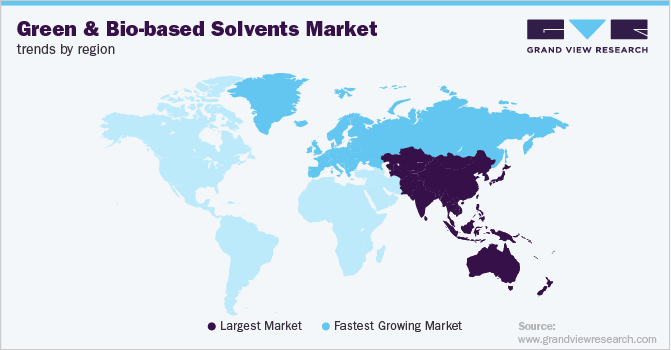

The Asia Pacific is estimated to witness the highest growth during the forecast period, owing to the availability of raw materials, low cost of production, presence of a large number of manufacturers, and high demand for environmental-friendly solvent solutions for several end-use verticals. The growing middle-class population and rising disposable income in the region have led to rising consumer awareness regarding the environmental impacts of paints, coatings, and adhesive products with high-VOC content.

Green & Bio-based Solvents Market Trends

The increased need for environment-friendly solvents across various sectors is the primary reason driving the market’s growth. Owing to the factors of lactate ester solvents such as non-carcinogenic, non-corrosive, and non-ozone-depleting, replacing the use of synthetic solvents such as toluene, acetone, and xylene in the preparation of green solvents. This is expected to drive the green and bio-based solvent market growth over the forecast period.

The use of green solvents as byproducts in the manufacturing of various products in sectors such as inks, detergents, paints & coatings, cosmetics, adhesives, pharmaceuticals, and others, as well as the presence of rules and regulations set forth by the European Commission's Eco-Product Certification Scheme (ECS) for eco-friendly paints & coatings, are anticipated to boost the global market.

Concerns over the reliability and enough supply of feedstocks, as well as high costs connected with production and performance concerns, are expected to hinder industry expansion. Moreover, over the forecast period, ionic solvents, supercritical fluids, and deep eutectic solvents (DESs) are expected to pose a threat to the green and bio-based solvent market.

Other growth factors such as diverse advancements in production technology and product innovations. Bio-solvents are used in agriculture to improve product quality, boost output, and lower production costs. The rising demand for consumer goods such as perfumes, intensive research and development efforts, and a greater focus on sustainable development, are expected to create lucrative opportunities for the green and bio-based solvent market over the forecast period.

Product Insights

Based on the product, the green and bio-based solvents market is categorized as bio-alcohols, bio-glycols, bio-diols, methyl soyate, and lactate esters. Globally, lactate esters dominated the overall industry with a revenue of over USD 1.5 billion in 2015. This segment is also expected to witness the highest growth during the forecast period due to increasing applications, easy availability of the raw materials such as lactic acid, and low production cost.

Methyl soyate is one of the major product segments in the overall market. The segment is projected to register a CAGR of over 11.0% during the forecast period. This growth can be attributed to rising demand for methyl soyate in automotive, industrial equipment, and engine applications.

Application Insights

The market is segmented on the basis of application as industrial and domestic cleaners, paints and coatings, adhesives, printing inks, pharmaceuticals, and cosmetics. The paints and coatings segment dominated the market as of 2015, generating a revenue of over USD 1.0 billion. The application segment is primarily driven by rising environmental concerns over usage of chemical-grade industrial solvents with high VOC content in paints and coatings solutions.

The adhesives segment is expected to register the highest CAGR of over 12.0% in terms of revenue during the forecast period. This rapid growth can be attributed to increasing demand from the automotive industry, which is witnessing significant growth in Asia Pacific and North America.

Awareness regarding effects of chemical-grade industrial solvents on environmental and human health is increasing across the globe. This, in turn, is driving the demand for bio-based alternatives in core applications such as paints and coatings as well as adhesives in the end-use industries, including construction and automotive.

Regional Insights

Asia Pacific and Latin America are likely to offer significant growth potential for the market over the coming years. The growth is attributed to technological advancements, industrial and economic growth, and low production cost in countries such as Brazil, China, and Japan. Moreover, in recent years, end-use industries such as building and construction as well as automotive have been witnessing significant growth in these countries.Asia Pacific is expected to witness the highest growth during the forecast period primarily due to rapidly growing construction and automotive industries in the region.

The industry in Europe is currently witnessing moderate growth, mainly driven by changing political and economic dynamics of major countries such as U.K. and Germany. The recovery of the automotive and construction sectors in these countries will enable market growth in Europe.

Key Companies & Market Share Insights

Key players in the global market include BASF SE, Huntsman Corporation, Archer Daniels Midland Co., The Dow Chemical Co., and DuPont. These players are focusing on new product developments and partnerships as key strategies for strengthening and sustaining their positions in the global market, amidst the intense competition from suppliers and manufacturers in Asia Pacific.

Recent Developments

-

In May 2022, BASF SE expanded its automotive coating center in Mangalore, India. This expansion aims at continuing investments in India for OEM coatings and long-term automotive market growth in the region.

-

In February 2022, Lyondellbasell announced an investment in a circular plastics fund led by infinity recycling. The investment will enable the company to expand its capital activities that aid in the reduction of plastic waste.

-

In October 2021, Tork, an Essity brand launched a biobased cleaning cloth. With the launch of this new product, Tork aims to boost business by improving both efficiency and sustainability.

-

In May 2023, Dow collaborated with New Energy Blue to develop a bio-based ethylene from renewable materials. The team up aimed to reduce the carbon emission from plastic production used across footwear, transportation, and packaging.

-

In September 2022, BASF offered neopentyl glycol and propionic acid with zero product carbon footprint (PCF). BASF aimed to be the leading company offering zero PCF to its customers through the use of waste material in production systems.

-

In August 2022, ADM and LG Chem launched joint venture to produce lactic acid and polylactic acid in U.S. The joint venture aimed to meet the growing demand for plant-based solutions by producing 75,000 tons of polylactic acid and 150,000 tons of lactic acid.

-

In July 2022, Dow announced partnership with BSB Nanotechnology to expand its bio-based product portfolio and prioritizing high-quality solutions. The team up aimed to benefit consumers in the cosmetic applications by delivering a unique sensorial experience.

Green & Bio-based Solvents Market Report Scope

|

Report Attribute

|

Details

|

|

Revenue forecast in 2024

|

USD 13.74 billion

|

|

Base year for estimation

|

2015

|

|

Historical data

|

2013 - 2014

|

|

Forecast period

|

2016 - 2024

|

|

Quantitative units

|

Revenue in USD billion and CAGR from 2016 to 2024

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, application, region

|

|

Regional scope

|

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

|

|

Country scope

|

U.S.; U.K.; Germany; France; China; India; Japan; Brazil; South Africa

|

|

Key companies profiled

|

BASF SE; Huntsman Corporation; Archer Daniels Midland Co.; The Dow Chemical Co.; DuPont

|

|

Customization scope

|

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country; regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Global Green & Bio-based Solvents Market Segmentation

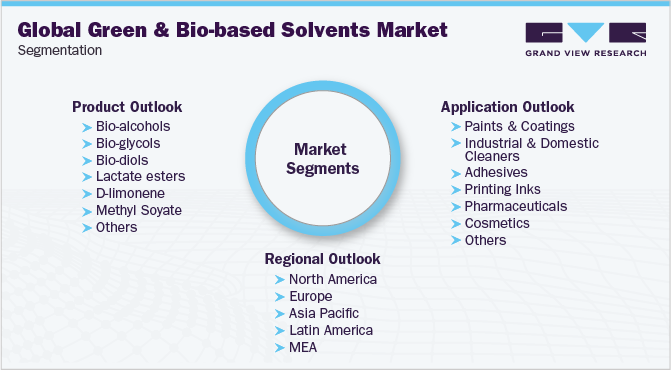

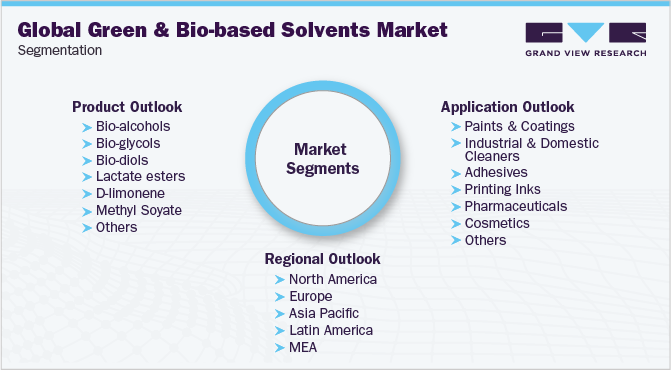

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2013 to 2024. For the purpose of this study, Grand View Research has segmented the green & bio-based solvents market on the basis of product, application, and region:

-

Product Outlook (Volume, Kilo Tons; Revenue, USD Million;2013 - 2024)

-

Bio-alcohols

-

Bio-glycols

-

Bio-diols

-

Lactate esters

-

D-limonene

-

Methyl soyate

-

Others

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million;2013 - 2024)

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2013 - 2024)