- Home

- »

- Consumer F&B

- »

-

Greek Yogurt Market Size & Share, Industry Report, 2030GVR Report cover

![Greek Yogurt Market Size, Share & Trends Report]()

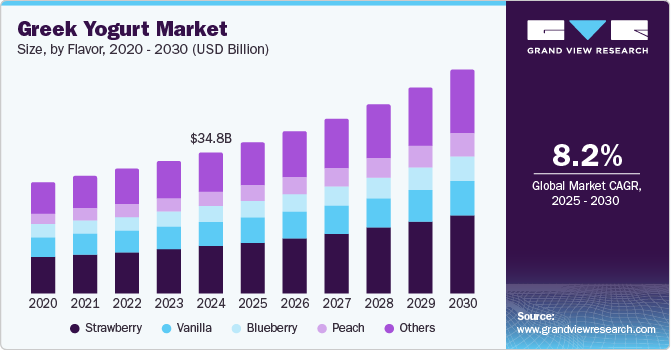

Greek Yogurt Market (2025 - 2030) Size, Share & Trends Analysis Report By Flavor (Strawberry, Vanilla, Blueberry, Peach, Others), By Distribution Channel (Supermarkets, Convenience Stores, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-948-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Greek Yogurt Market Summary

The global greek yogurt market size was estimated at USD 34.75 billion in 2024 and is projected to reach USD 55.14 billion by 2030, growing at a CAGR of 8.2% from 2025 to 2030. The increasing demand for clean-label and natural products offering high nutritional value has been the primary factor aiding market growth.

Key Market Trends & Insights

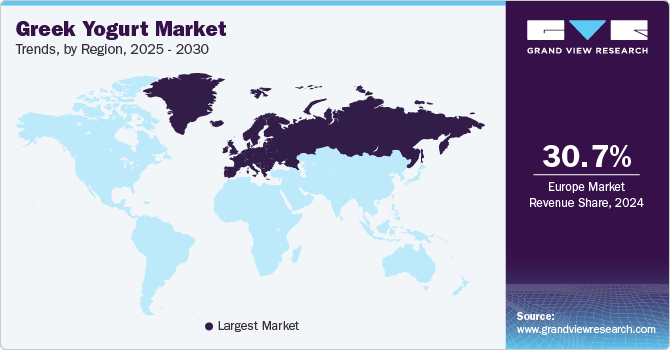

- The Europe Greek yogurt market accounted for the largest global revenue share of 30.7% in 2024.

- Germany accounted for the largest revenue share of the regional Greek yogurt industry in 2024.

- By flavor, the strawberry-flavored product segment accounted for the largest revenue share of 33.7% in 2024.

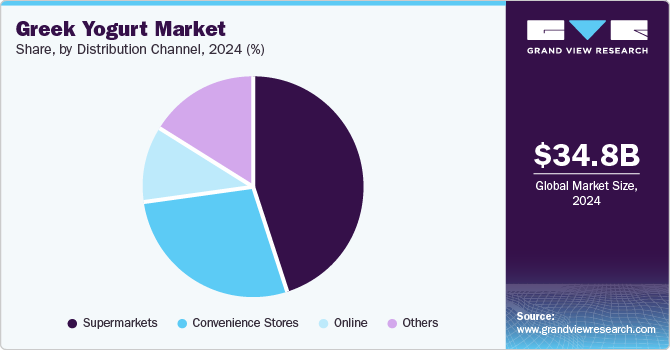

- By distribution channel, the supermarket segment accounted for the largest revenue share of the global greek yogurt industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 34.75 Billion

- 2030 Projected Market Size: USD 55.14 Billion

- CAGR (2025-2030): 8.2%

- Europe: Largest market in 2024

Greek yogurt is widely recognized for its higher protein content compared to regular yogurt, making it an attractive option for the rapidly expanding health-conscious consumer demographic. Protein-rich diets are gaining popularity globally, especially those focused on fitness, weight management, and muscle building. Moreover, the convenience and on-the-go consumption features of these products have made them a preferable option for urban consumers who increasingly seek healthy snacks or meal replacements.

Greek yogurt is known for its versatility, allowing it to be consumed as a snack, a breakfast option, or an ingredient in recipes, making it an attractive option for a broad range of consumers. It can be used in smoothies, topping for desserts, or savory dishes, adding to its appeal across various meal occasions. The product is additionally known for its low-calorie content, enabling manufacturers to promote it as a viable option for weight management. It further helps boost satiety for longer periods, making it an attractive choice for those following weight-loss or portion-control diets.

Greek yogurt is rich in calcium and protein, which are both essential for maintaining strong bones. Adequate calcium intake helps prevent osteoporosis and supports overall bone density, making Greek yogurt a beneficial addition to a bone-healthy diet. Regular consumption of this item has been linked to lower cholesterol and triglyceride levels, which can reduce the risk of heart disease. The potassium content in Greek yogurt also helps maintain healthy blood pressure levels by balancing sodium intake. Thus, the increasing prevalence of various lifestyle disorders among the global population has boosted the visibility of healthy products such as Greek yogurt, leading to substantial sales.

The greek yogurt industry has witnessed increasing competition in recent years due to rising consumer demand, compelling brands to launch products in different flavors and forms to appeal to a wider demographic. For instance, Enlightened, a New York-based frozen dessert company, has a wide range of healthy yogurt offerings for customers. In July 2023, the brand announced the launch of the Greek Frozen Yogurt Pints product line that features improved texture and taste while maintaining the nutritional value of Greek yogurt. The products are available in different flavors, including Salted Caramel Cookies, Brownies & Cookie Dough, Coffee Toffee, Mint Chip, and others.

Greek yogurt is a premium product compared to its conventional variant. Consumers are becoming aware of the importance of integrating higher-quality, indulgent, and functional foods into their diets, enabling leading and emerging brands to tap into the premium food segment. With the rise of plant-based diets, many companies have introduced alternatives made from coconut, almond, soy, or oats. These alternatives cater to vegans, those with lactose intolerance, and consumers seeking dairy-free options. Companies are also partnering with celebrities and athletes to enhance product perception among audiences and boost their sales.

Flavor Insights

The strawberry-flavored product segment accounted for the largest revenue share of 33.7% in 2024 in the global greek yogurt industry. Strawberry is one of the most popular flavors in the yogurt category, making it an attractive option for consumers looking for both taste and functional benefits in their product. Consumers often associate fruit-flavored yogurt with natural ingredients. Strawberry is widely considered a natural flavor, which aligns with consumer interest in minimally processed foods containing real fruit or fruit puree. Furthermore, the strong appeal of this flavor among children has encouraged Greek yogurt brands targeting family-oriented markets to launch strawberry-flavored options that combine health benefits with an appealing product texture and taste.

The peach segment is anticipated to advance at a substantial CAGR in the greek yogurt industry from 2025 to 2030. Peach is a naturally sweet and refreshing fruit flavor popular among a wide range of consumers, particularly those looking for a fruity, mildly tangy yogurt option. It offers a lighter and less intense flavor profile than traditional choices such as strawberry or chocolate, making it an attractive alternative for people seeking a subtler taste. Moreover, peach-flavored Greek yogurt serves as a base for various flavor combinations with ingredients such as honey, granola, vanilla, or other fruits. This helps create unique flavor profiles that appeal to consumers seeking more exciting and diverse eating experiences.

Distribution Channel Insights

The supermarket segment accounted for the largest revenue share of the global greek yogurt industry in 2024. These outlets provide a major avenue for in-store promotions and product sampling. Brands can easily offer free samples, discounts, or bundle deals to encourage consumers to try Greek yogurt, especially if they are unfamiliar with the product. Supermarkets also allow brands to cross-promotion with other food items such as granola, fresh fruits, or nuts, allowing prospective buyers to understand how to incorporate them into their meals and snacks. This creates an opportunity for complementary sales while demonstrating the versatility of Greek yogurt. Companies that launch new flavors target such locations to boost product visibility and consumer awareness. For instance, in January 2025, La Terra Fina, a U.S.-based food manufacturer, added the Jalapeño Ranch flavor to its Greek yogurt dips and spreads portfolio. The product has been launched at Kroger locations across the U.S. and is further scheduled to be available at select Costco stores in the near future.

The online segment is expected to advance at the highest CAGR during the forecast period. Increasing sales of dairy products through online channels in recent years have provided a notable avenue for companies aiming to launch premium offerings in this market. In addition to selling products through platforms such as Amazon, companies are also extensively promoting their products through their websites, allowing consumers to select from a variety of options easily. Furthermore, the availability of coupons and discounts, easy checkout and tracking options, and the opportunity to understand the health benefits of different products have shifted a rising number of health-conscious consumers towards this distribution model, avoiding the hassle of physical shopping.

Regional Insights

The Europe Greek yogurt market accounted for the largest global revenue share of 30.7% in 2024 due to changing dietary preferences among consumers and healthy lifestyle practices. European consumers are increasingly focused on healthy eating habits, which has led to the rising popularity of Greek yogurt due to its high protein content, lower sugar levels, and presence of probiotics that promote gut health. Furthermore, the availability of Greek yogurt in supermarkets across Europe has increased significantly to address its rising popularity. Major brands such as FAGE and Danone have expanded their regional availability through extensive marketing campaigns, promoting Greek yogurt as a premium, healthy product. In March 2024, the yogurt maker ONKEN announced a campaign featuring comedian Paddy McGuinness to boost awareness regarding its yogurt offerings in the UK. The announcement was part of the company’s ‘Feed Your Inner Happiness’ campaign and ran from April to October through multiple channels.

Germany accounted for the largest revenue share of the regional Greek yogurt industry in 2024 due to the increasing popularity of the Mediterranean diet among German consumers, which emphasizes healthy fats, fresh vegetables, and dairy products. Additionally, the expansion of private-label Greek yogurt brands in Germany has increased market competition, making these products more affordable and accessible for consumers. The availability of lactose-free Greek yogurt options has further encouraged demand among lactose-sensitive consumers in the economy who want to enjoy dairy products without risking their health.

North America Greek Yogurt Market Trends

North America accounted for a substantial revenue share in the global market in 2024, aided by the rising consumption of health- and wellness-focused food items in the U.S. and Canada. For instance, in recent years, Canadian consumers have adopted higher-protein eating patterns, particularly in response to fitness goals, weight management, or a need for more satiating meals. Moreover, Greek yogurt’s rich and creamy texture, which offers a satisfying and indulgent experience while remaining relatively healthy, has also appealed to the country’s population. As a result, companies frequently introduce new and improved products to address customer demands. For instance, in February 2024, Danone Canada’s Silk brand announced the launch of a plant-based Greek-style yogurt incorporating Canadian pea protein. Similar launches by other brands aiming to expand their presence in North American economies are expected to aid market growth.

The U.S. accounted for the largest revenue share in the North American market in 2024, owing to the positive perception of Greek yogurt among American citizens and the frequent launch of innovative promotional campaigns. Several new brands selling specialized dairy and non-dairy products have emerged in recent years to compete with existing major companies to take advantage of the rising consumer demand. Furthermore, brands focus on launching limited edition products during holidays and seasonal changes to increase product awareness and boost short-term sales. For instance, in October 2024, Chobani, a leading global food manufacturer and the coffee roasting company La Colombe, unveiled a seasonal product range in the U.S. suited for the winter months. This assortment included the Chobani Apple Pie Dairy Coffee Creamer, the Chobani Greek Yogurt Spiced Holiday Nog, the Chobani Flip Peppermint Perfection, and the Chobani Oatmilk Oat Nog, among other items.

Asia Pacific Greek Yogurt Market Trends

The Asia Pacific Greek yogurt industry is expected to witness the highest CAGR from 2025 to 2030. The increasing pace of urbanization and rising disposable income levels among consumers in regional economies such as India and China have resulted in the launch of several health-oriented premium food items, including Greek yogurt. The growing awareness of gut health and probiotics and the rising interest in functional foods have contributed to Greek yogurt’s appeal among regional consumers. Its probiotic benefits, which aid digestion, have made it a viable option in economies where digestive health is a key concern. In India, Epigamia is a notable Greek yogurt brand that has witnessed substantial popularity among consumers through the launch of innovative flavors. In February 2024, the brand introduced ‘Greek Yogurt with Oats & Seed Mix,’ which is premixed with oats, flax, amaranth seeds, and chia and uses honey and date syrup as sweeteners. The product was made available at major online delivery platforms such as Zepto, Swiggy, and Epigamia’s online store.

China accounted for the largest revenue share in the regional market and is expected to advance at the fastest CAGR from 2025 to 2030. The demand for Greek yogurt in the economy is driven by evolving dietary preferences, health trends, and cultural shifts. Greek yogurt is seen as a nutritious, high-protein, and low-fat option that addresses the increasing focus on healthier diets, especially among urban consumers. Additionally, as the country’s urban population becomes more fast-paced and busy, consumers are looking for convenient and nutritious snacking options. Greek yogurt, which is often available in ready-to-eat, single-serve formats, fits the need for healthy, on-the-go options that do not require preparation. The rapid expansion of the e-commerce industry has further made it easier for Chinese consumers to purchase products from international brands, boosting their popularity in the economy.

Key Greek Yogurt Company Insights

Some major companies involved in the global Greek yogurt industry include Chobani, Fage International, and Danone, among others.

-

Chobani is an American food manufacturer specializing in developing and manufacturing Greek yogurt products and various non-dairy products, drinks, snacks, and creamers. The company is known for its greek yogurt, flip, high protein, less sugar, zero sugar, and creations offerings in the yogurt section. Chobani's Greek yogurts are available in multi-serve, impact batch, fruit-on-bottom, blended, and seasonal formats, using well-known flavors such as strawberry, peach, vanilla, mango, blackberry, and others.

-

Fage International is a dairy company based in Greece that is extensively involved in the manufacturing and sales of Greek yogurt offerings. The company employs a unique straining process that removes excess whey from yogurt, resulting in a thicker consistency that distinguishes its products. In addition to a range of plain, flavored, and strained options, Fage also produces cheese and other dairy items. Notable products include FAGE Total, FAGE BeFree, FAGE Fruits, FAGE Fruyo, FAGE TruBlend Lactose-Free, and FAGE Total Split Cup.

Key Greek Yogurt Companies:

The following are the leading companies in the greek yogurt market. These companies collectively hold the largest market share and dictate industry trends.

- Chobani, LLC

- Danone

- Fage International S.A.

- Nestlé

- General Mills Inc.

- Parmalat S.p.A.

- The Kroger Co.

- Horizon Organic Dairy, LLC

- The Hain Celestial Group

- Stonyfield Farm, Inc.

Recent Developments

-

In October 2024, Chobani announced the launch of the Chobani High Protein line of nutritional Greek yogurt cups and drinks made of real fruits and natural ingredients containing no added sugar. The newly introduced cups offer 20 grams of protein, while the drinks are available in 15, 20, and 30 grams variants. They are lactose-free and contain no protein powders, preservatives, or concentrates. The yogurt cups were made available across U.S. retailers in November, with the drinks options being launched for sale in January 2025.

-

In September 2024, Hain Celestial Group introduced a new line of seasonal, better-for-you snacks and beverages for U.S. consumers for the fall months. These included the Garden Veggie Snacks Apple Straws, Earth's Best Sunny Days Snack Bars, and Greek Gods Honey Yogurt, among various other offerings. The products were made available at major grocery retailers such as Walmart, Amazon, Target, and local specialty shops.

Greek Yogurt Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 37.18 billion

Revenue forecast in 2030

USD 55.14 billion

Growth rate

CAGR of 8.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

January 2025

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Flavor, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Denmark, Spain, Russia, China, Japan, India, Brazil, Argentina, South Africa

Key companies profiled

Chobani, LLC; Danone; Fage International S.A.; Nestlé; General Mills Inc.; Parmalat S.p.A.; Müller UK & Ireland; The Kroger Co.; Horizon Organic Dairy, LLC; The Hain Celestial Group; Stonyfield Farm, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Greek Yogurt Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global greek yogurt market report based on flavor, distribution channel, and region:

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Strawberry

-

Vanilla

-

Blueberry

-

Peach

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Denmark

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.