Grease Market Size, Share & Trends Analysis Report By Product (Mineral, Synthetic, Bio-Based), By End-use (Construction, Metal & Mining, Power Generation, Food Processing, Agriculture, Manufacturing), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-302-4

- Number of Report Pages: 137

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Grease Market Size & Trends

The global grease market size was estimated at USD 5.84 billion in 2023 and is projected to grow at a CAGR of 4.1% from 2024 to 2030. Increasing demand for automotive grease across the world owing to the surging demand for vehicles and their spare parts is expected to contribute to the growth of the market in the coming years.

The construction industry is one of the major consumers of the product across the world. The product is used in this industry to lubricate and protect the moving parts of heavy construction equipment and machinery, including excavators, bulldozers, cranes, loaders, and dump trucks. It reduces friction, wear, and corrosion in components such as bearings, gears, bushings, pins, and hydraulic cylinders, thereby extending the lifespan of different equipment and improving their performance.

There are three major types of products including bio-based, mineral, and synthetic. The product is majorly classified based on the raw material used in their manufacturing process. Bio-based product include raw materials such as vegetable oil. Vegetable oils such as soybean oil, rapeseed oil, sunflower oil, and palm oil are among the most commonly used feedstocks for bio-based product. Among these, soybean oil is widely utilized due to its availability, low cost, and suitable viscosity characteristics for lubricant applications.

Formulation development involves designing of the product composition by blending synthetic base oils, thickeners, and additives in specific proportions. The formulation is optimized to achieve the desired viscosity, temperature stability, load-carrying capacity, corrosion protection, and other performance attributes required for the intended application.

The global market is changing, in terms of raw materials, owing to the rising demand for bio-based products. APAC has emerged as one of the largest consumers of the product owing to the rapidly growing manufacturing, construction, and metal & mining industries along with industrial development in the region. Asia Pacific product market has started mirroring the American and European regulatory systems, and thus, countries like Japan and South Korea are emphasizing eco-labeled product.

The global greases and lubricants industry is governed by stringent regulations, ranging from their production to use & disposal. Furthermore, the additives used in manufacturing grease are checked for their toxicity and potential to harm the environment. Some of the regulatory bodies that influence market dynamics include the Occupational Safety & Health Administration (OSHA), Environmental Protection Agency (EPA), and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) standards.

Market Concentration & Characteristics

The greases market is moderately fragmented and players aim to achieve optimum business growth and strong market positioning through production capacity expansions, new product development, research & development. For instance, in 2024, Shell Lubricants (a subsidiary of Shell plc), has finalized the acquisition of MIDEL and MIVOLT, both United Kingdom-based companies, from Manchester's M&I Materials Ltd. This acquisition marks Shell's commitment to produce, distribute, and promote the MIDEL and MIVOLT product ranges, enhancing its worldwide lubricants portfolio.

Manufacturers have anticipated a huge gap in product and technology development, thus, are investing in research & development to add new products to their portfolios and develop better technology for various end-use industries of product.

For instance, in 2024, GB Lubricants introduced its latest innovation, GB Super Universal Tractor Oil 15W-30. This multifunctional oil, designed for farm machinery, is formulated with top-grade virgin mineral base oils and advanced additive systems. It ensures optimal lubrication for various tractor components. In addition, Canoil Canada Ltd. in 2022-23 launched different products including lubricants, greases, and metalworking oils.

Shell plc, Exxon Mobil Corporation, Chevron Corporation, FUCHS, and TotalEnergies among others, are the key manufacturers operating in the product market. These companies have a stronghold in the emerging markets while exporting their products to various end-use applications.

Manufacturers are majorly adopting strategies such as partnership to increase their market footprint. For instance, in 2022, NYCO declared the renewal of its partnership agreement with easyJet, ensuring the continued provision of TURBONYCOIL 600 for the airline's fleet of Airbus A320 CEO and NEO family aircraft

Product Insights

Mineral based product dominated the market with a revenue share of 62.3% in 2023 owing to their better solubility with additives and cost-effectiveness. Mineral-based product are considered to be inherently biodegradable (degrading > 20 percent to < 60 percent within 28 days) if exposed to the natural environment.

Mineral-based product is a type of lubricating grease that utilizes mineral oil as their fluid component. These products are widely used in various industrial applications due to their satisfactory performance and versatility. Mineral-based products consist of three main components: a base oil, a thickener, and additives. The base oil in mineral-based products is typically a mineral oil, which provides lubrication and reduces friction between moving parts.

Synthetic products consist of synthetic oils containing a mixture of synthetic thickeners, or bases, in petroleum oils. Synthetic products are available in water-soluble and water-resistant forms and may be used over a wide temperature range. For example, AMSOIL INC., a grease manufacturer, offers water- resistant synthetic greases for various end-use industries, including manufacturing and mining. Compared with mineral-oil-based lubricants, synthetic lubricants provide better resistance to extreme temperatures and environments. They tend to resist oxidation better, allowing for a longer fluid of the fluid.

Bio-based products are defined as the ones that are formulated utilizing biodegradable and renewable feedstock or base stock. In order to be termed bio-based, the products don’t have to be entirely composed of unadulterated vegetable oil; rather only the base materials need to be renewable. Different companies manufacturing bio-based products use different feedstock; for instance, BIOBLEND SUATAINABLE PERFORMANCE, a U.S.-based manufacturer of bio-based greases, uses natural plant esters as their base oils, which makes them readily biodegradable.

End-use Insights

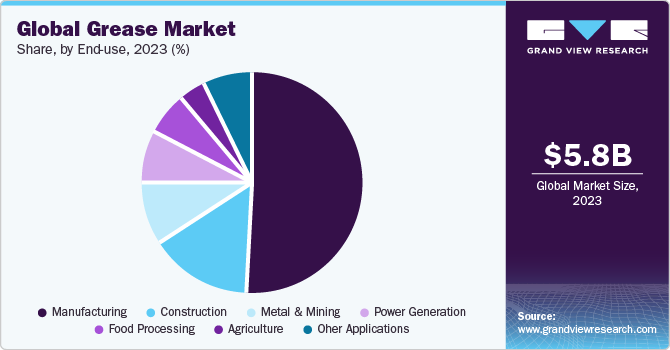

Manufacturing segment dominated the market with a revenue share of 51.3% in 2023. Grease plays a crucial role in the manufacturing of heavy machinery by providing lubrication to moving parts, reducing friction, preventing wear and tear, and ensuring smooth operation. Proper lubrication with grease prevents the components of heavy machinery from grinding against each other, which can cause damage and release harmful contaminants into the system.

Greases form a protective film between moving parts, reducing friction and minimizing wear and tear. High-quality products can lubricate isolated or relatively inaccessible components for extended periods of time without frequent replenishment. This is especially beneficial in heavy machinery that operates under extreme conditions such as high temperatures, pressures, shock loads, or slow speeds under heavy loads.

Greases play a crucial role in the construction industry, as they provide lubrication and protection to various mechanical components and equipment. Greases are extensively used in the maintenance of construction equipment, such as excavators, cranes, bulldozers, and loaders. These heavy machineries require regular lubrication to ensure smooth operation and prevent wear & tear. The products are applied to the moving parts, such as bearings, gears, and joints, to reduce friction and extend the lifespan of the equipment.

Regional Insights

The construction industry in North America is expected to witness significant growth over the coming years, owing to the high demand for non-residential construction projects, such as hospitals, commercial buildings, and colleges. The "Affordable Healthcare Act" in 2023 is expected to stimulate the construction of a greater number of healthcare units and hospitals, which, in turn, is expected to boost the demand for product in the region over the forecast period.

National policies promoting the recovery of the housing sector are expected to positively impact future construction trends. Reconstruction activities in the U.S., coupled with infrastructure development in Canada and Mexico as a result of rapid industrialization, are expected to provide immense market potential in North America over the forecast period, thus, increasing the demand for product in the region.

U.S. Grease Market Trends

In the U.S., the construction industry is growing rapidly owing to positive market fundamentals for commercial real estate and the country’s strong economy. The government is providing more funding for building schools, hospitals, and other public projects.

Few of the upcoming construction projects in the U.S. include the construction of the South San Francisco Civic Center campus, the Second Avenue Subway Construction Project, the O’Hare Airport Construction Project, and the LaGuardia Airport Construction Project. This is expected to further propel construction working hours leading to an increase in the operation time of the machinery used in construction activities further leading to increasing consumption of product in the coming years.

Asia Pacific Grease Market Trends

Asia Pacific dominated the market with a revenue share of 39.7% in 2023 owing to construction activities and growing demand for products from automotive sector in emerging countries, such as India, Japan, and South Korea, are expected to drive the market over the forecast period.

According to the data published by the International Organization of Motor Vehicle Manufacturers, Asia Pacific is the largest transportation market in the world, with the presence of numerous automobile manufacturers, thus ensuring a steady growth in automobile production in the region. Asia Pacific witnessed a growth of 10% in vehicle production in 2023 compared to 2022, and the region’s automotive production reached 55.1 million units in 2023, establishing it as a major driver for the product market in the region.

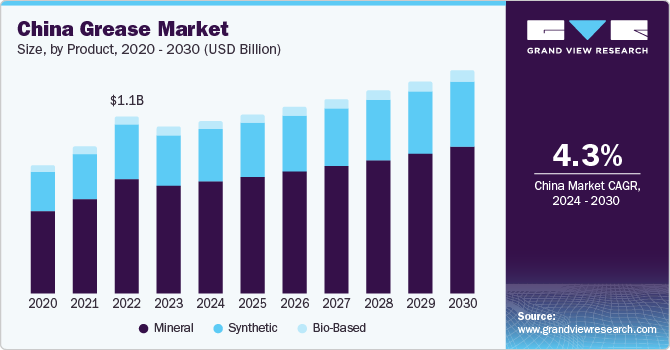

The China grease market is expected to be one of the promising product markets in the region on account of the government’s support to promote investments in manufacturing sector. Several companies are expanding or setting up new manufacturing facilities owing to low labor costs and ease of raw material procurement in the country. The growing manufacturing sector is expected to propel the demand for product in automotive, construction, electrical & electronics, and other industries.

The Grease market in India is expected to witness a substantial growth rate. The country is one of the prominent automotive manufacturers globally with a total production of three-wheelers, passenger vehicles, quadricycles, and two-wheelers accounting for 38,59,030 units in 2023, according to India Brand Equity Foundation, The automotive sector of the country received a cumulative equity FDI inflow of around USD 33.77 billion between April 2000 and September 2022. This positive outlook for the automotive industry in the country is likely to propel product demand in the coming years.

Europe Grease Market Trends

The Europe is a major hub for automotive production and therefore, the demand for automotive and consequently, greases is expected to be substantial. As grease is mainly used as a lubricant for machinery used in automotive manufacturing.

Surging automobile production in Germany, Hungary, Romania, Austria, and the UK, along with strong OEM automotive manufacturing bases, in the region is expected to drive the demand for grease. A few top automotive OEMs in Europe include Mercedes-Benz Group AG Volkswagen AG, Stellantis NV, Bayerische Motoren Werke AG, and Renault SA.

The Germany grease market is experiencing lucrative demand growth. The German automotive industry is one of the largest in the world. According to the KBA federal transport authority, new car sales in Germany was accounted for a 7.3% share in 2023 and reached a total of 2.8 million vehicles. Germany sold over 524,000 full-electric cars in 2023. According to trading economics, car production in Germany increased to 312,100 units in January from 258,254 units in December 2023. Thus, the rising automotive production, import, and export of vehicles positively impact the automotive manufacturing industry in Germany, in turn, propelling the demand for greases and related products. This is expected to be a significant contributor to the demand for greases in the country over the forecast period.

The demand for greases in the UK is influenced by various factors, including its application in tire manufacturing. Greases is widely used as a curing agent in tire manufacturing. Factors such as increasing number of on-road vehicles globally and the need for tire replacements are expected to drive UK’s demand for greases.

Central & South America Grease Market Trends

The Central & South American market is expected to witness substantial growth over the forecast period owing to the region’s high economic growth in the past few years. Increasing disposable income of consumers has surged the demand for automobiles, which is expected to augment the demand for automotive parts and their manufacturing, further leading to a positive impact on the product over the forecast period.

Significant new investments in housing and public works are expected to boost infrastructure growth in Colombia, thereby, augmenting the product demand over the next seven years. Thus, the increasing number of infrastructure development projects is expected to drive the demand for greases, which are heavily used in the small and large machinery operating on construction sites.

The Brazil grease market growth is projected to surge in the upcoming years. Brazil is the leading producer of automobiles in Central & South America and has emerged as the ninth-largest automobile producer in the world. According to the International Organization of Motor Vehicle Manufacturers, automotive production in Brazil witnessed an increase of 3.27% in 2023 compared to 2021. Thus, the rising production of vehicles is further expected to increase the demand for more manufacturing facilities, further leading to a high demand for greases in the country.

Middle East & Africa Grease Market Trends

The MEA region is expected to witness a substantial growth rate over the forecast period owing to the improvement in oil pricing as per IMF. The market is likely to be driven by the expanding oil & gas industry and increasing construction expenditure in the region. Greases find application in heavy machinery used in metal miming, gas exploration, and oil extraction activities. Thus, the growing demand for oil and gas is expected to increase the consumption of greases in the Middle East.

The Grease market in Saudi Arabia is experiencing a significant rise in product demand. The country's construction sector has witnessed substantial growth, driven by mega projects such as the Red Sea Project and the Qiddiya entertainment city. These developments have increased the need for greases used in construction machinery. Mega construction projects and oil refining facilities are major end-users of greases in the country. Several infrastructure projects have been sanctioned by the Saudi government, further developing the infrastructure sector in the country.

Key Grease Company Insights

Some of the key players operating in the market include Shell plc, Exxon Mobil Corporation, Chevron Corporation, FUCHS, and TotalEnergies among others.

-

Established players compete and outplay the regional players by strategically integrating across the value chain to ensure seamless supply chain activities and reducing the production & operating costs. In addition, companies involved in manufacturing greases develop new products and production technologies. Companies are also backwardly integrating in order to save the operations cost involved in raw material procurement.

-

For instance,Companies such as Chevron Corporation, ExxonMobil Corporation, INEOS, and Shell Plc are backward integrated in the value chain of the market and hence, are involved in the manufacture of different raw materials.

Key Grease Companies:

The following are the leading companies in the grease market. These companies collectively hold the largest market share and dictate industry trends.

- NYCO

- Battenfeld-Grease & Oil Corporation of New York

- RichardsApex, Inc.

- Lubriplate Lubricants Company

- GB Lubricants

- Canoil Canada Ltd.

- Eastern Oil Company

- JAX Incorporated

- Daubert Chemical Company

- D-A Lubricant Company

- Xaerus Performance Fluids, Inc.

- MorOil Technologies

- Royal High Performance Oil & Greases

- Industrial Oils Unlimited

- Primrose Oil Company, Inc.

- Environmental Lubricants Manufacturing, Inc. (ELM)

- Cadillac Oil

- CONDAT

- LUBRITA Europe B.V.

- COGELSA Efficient Lubrication

- Interflon

Recent Developments

-

In May 2024, GB Lubricants introduced its latest innovation, GB Super Universal Tractor Oil 15W-30. This multifunctional oil, designed for farm machinery, is formulated with top-grade virgin mineral base oils and advanced additive systems. It ensures optimal lubrication for various tractor components.

-

In November 2023, NYCO revealed that Pegasus Airlines, a prominent low-cost carrier in Turkey, opted for TURBONYCOIL 600 to provide engine lubrication across its entire fleet. Pegasus, recognized as one of the rapidly expanding airlines in the region, now boasts a fleet of 100+ aircraft.

-

In January 2024, Shell Lubricants (a subsidiary of Shell plc) finalized the acquisition of MIDEL and MIVOLT, both United Kingdom-based companies, from Manchester's M&I Materials Ltd. This acquisition marked Shell's commitment to produce, distribute, and promote the MIDEL and MIVOLT product ranges, enhancing its worldwide lubricants portfolio.

-

In 2023, ENSO Oils & Lubricants entered a strategic partnership with Gazpromneft-Lubricants, a subsidiary of Gazprom Neft PJSC, aimed at broadening the reach of lubricant resources in South Asia. Under this collaboration, ENSO is expected to distribute the comprehensive range of oils and lubricants offered by Gazpromneft-Lubricants, catering to the diverse requirements of industries across India.

Grease Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 6.05 billion |

|

Revenue forecast in 2030 |

USD 7.68 billion |

|

Growth rate |

CAGR of 4.1% from 2024 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; U.K.; Itay; France; Spain; China; India; Japan, South Korea; Brazil; Argentina; South Africa, Saudi Arabia |

|

Key companies profiled |

NYCO; Battenfeld-Grease & Oil Corporation of New York; RichardsApex; Inc.; Lubriplate Lubricants Company; GB Lubricants; Canoil Canada Ltd.; Eastern Oil Company; JAX Incorporated; Daubert Chemical Company; D-A Lubricant Company; Xaerus Performance Fluids; Inc.; MorOil Technologies; Royal High-Performance Oil & Greases; Industrial Oils Unlimited; Primrose Oil Company, Inc.; Environmental Lubricants Manufacturing, Inc. (ELM); Cadillac Oil; CONDAT; LUBRITA Europe B.V.; COGELSA Efficient Lubrication; Interflon |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Grease Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global grease market report based on product, end-use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Mineral

-

Synthetic

-

Bio-Based

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Construction

-

Metal & Mining

-

Power Generation

-

Food Processing

-

Agriculture

-

Manufacturing

-

Oher Applications

-

-

Regional Outlook (Volume, Kilotons, Revenue; USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global grease market size was estimated at USD 5.84 billion in 2023 and is expected to reach USD 6.05 billion in 2024

b. The global grease market is expected to grow at a compound annual growth rate of 4.1% from 2024 to 2030 to reach USD 7.68 billion by 2030.

b. Asia Pacific dominated the market segment with a revenue share of 39.7% in 2023 owing to construction activities and growing demand for products from automotive sector in emerging countries, such as India, Japan, and South Korea, are expected to drive the market over the forecast period.

b. Some key players operating in the greases market include NYCO, Battenfeld-Grease & Oil Corporation of New York, RichardsApex, Inc., Lubriplate Lubricants Company, GB Lubricants, Canoil Canada Ltd., Eastern Oil Company, JAX Incorporated, Daubert Chemical Company, D-A Lubricant Company, Xaerus Performance Fluids, Inc., MorOil Technologies, Royal High- Performance Oil & Greases, Industrial Oils Unlimited, Primrose Oil Company, Inc., Environmental Lubricants Manufacturing, Inc. (ELM), Cadillac Oil, CONDAT, LUBRITA Europe B.V., COGELSA Efficient Lubrication, Interflon

b. Key factors that are driving the greases market growth include surging growth of vehicles and their spare parts.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."