Graphite Market Size, Share & Trends Analysis Report By Form (Natural Graphite, Synthetic Graphite), By End-use (Electrodes, Refractories, Lubricants, Foundries, Battery Production), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-142-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Graphite Market Size & Trends

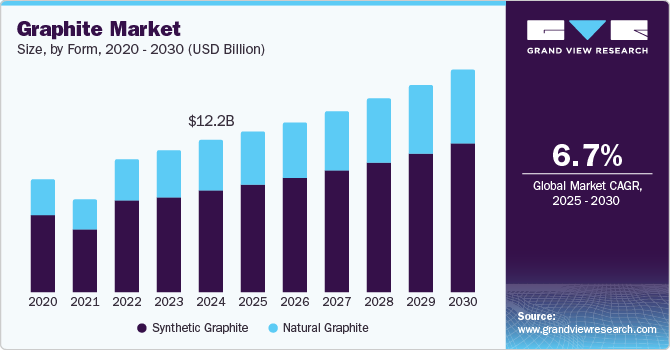

The global graphite market size was estimated at USD 12.2 billion in 2024 and is projected to grow at a CAGR of 6.7% from 2025 to 2030. The demand for graphite is anticipated to be driven by its usage in electrodes and refractories. The rise in the usage of electric arc furnaces (EAFs) owing to the global transition towards green steel is the main contributor to market growth. Moreover, graphite is consumed in producing crucibles, molds, and ladles to pour molten metal into the steel-making process.

The increasing investments in electric vehicle battery manufacturing worldwide are identified as a key opportunity for the global market. Graphite is used as the anodic material in EV batteries. Graphite's outstanding electrical conductivity makes it a crucial material in the electronics and electrical sectors. It is extensively used in batteries, particularly in lithium-ion batteries, where graphite is the primary material for the anode. As demand for energy storage and EVs grows, so does the need for graphite in battery anodes due to its ability to intercalate lithium ions without degradation.

Additionally, graphite is used in various other applications, such as electronics, fuel cells, and manufacturing, further boosting its market demand. Graphite plays a key role in steel production, lubricants, and as a refractory material, all essential in various industries. It is also widely used in electronic devices such as smartphones, laptops, and electric vehicles due to its excellent conductivity and heat resistance. Graphite exists in natural and synthetic forms. Graphite is mined from metamorphic rocks in areas with high temperature and pressure. Supply chain issues and trade policies may prompt interest in securing local graphite sources, affecting market demand.

Form Insights

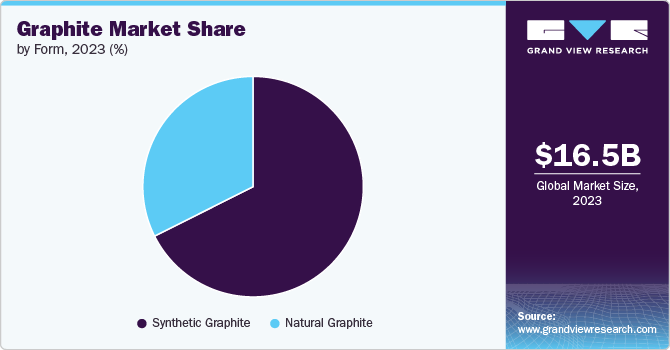

Synthetic graphite dominated the graphite market, with the highest revenue share of 67.1% in 2024, as it is commercially produced and has higher purity. Due to its conductivity and stability, synthetic graphite is primarily used in lithium-ion batteries, especially for anodes. It’s essential in EV batteries for efficient energy storage and release. It’s found in semiconductors, capacitors, and resistors in electronics for its heat resistance and conductivity. Additionally, synthetic graphite is used in electric arc furnaces for steel production, as it can endure high temperatures. It also serves as a dry lubricant in various industrial applications due to its slippery properties.

The natural graphite segment in the graphite market is expected to grow significantly at a CAGR of 6.7% over the forecast period. Natural graphite, especially from high-quality sources, offers high purity, making it suitable for specialized applications. It is more cost-effective to produce than synthetic graphite, making it ideal for large-scale use. Natural graphite is widely used in lithium-ion batteries for anodes, providing an affordable alternative. Its excellent thermal stability makes it perfect for durable, heat-resistant brake linings in vehicles. Additionally, it is commonly found in pencil leads and coatings for electrical conductors due to its ease of processing and versatility.

End-use Insights

Electrodes dominated the graphite market, with the highest revenue share of 35.2% in 2024. Graphite is a crucial material in lithium-ion batteries, particularly for electric vehicles (EVs) and renewable energy storage, where it plays a key role in reducing charging times and enhancing energy storage density. Additionally, graphite is utilized in the production of electrodes and refractories, both of which are vital in the steel industry. As steel is a fundamental component of the economy and widely used in industries such as construction and automotive, the market for graphite is closely linked to the growth of the steel sector.

The battery production segment is a major driver of the graphite market and is estimated to grow at the fastest CAGR of 7.4% over the forecast period. The battery production segment drives significant graphite demand, primarily for lithium-ion battery anodes due to its conductivity, stability, and energy storage capabilities. With the rising demand for electric vehicles (EVs), renewable energy storage, and electronics, the need for graphite in battery production grows. This segment is expected to expand further as battery technology advances, boosting graphite consumption for energy storage and efficient energy transfer applications.

Regional Insights

The North America graphite market held a substantial market share in 2024. It is fueled by factors such as rising demand for electric vehicles (EVs), expanding use in aerospace and defense, and the growing adoption of renewable energy technologies such as fuel cells and lithium-ion batteries. Graphite plays a vital role as a key component in the lithium-ion batteries powering EVs. Ongoing innovations in battery technologies, including higher energy densities and faster charging capabilities, are spurring increased graphite demand for next-generation lithium-ion batteries.

U.S.Graphite Market Trends

The graphite market in U.S. dominated the North America market, with the highest revenue share of 81.7% in 2024. The U.S. has a well-established industrial sector, including manufacturing, electronics, and steel production, all of which rely on graphite for a variety of applications, further strengthening its market dominance. The U.S. is working to diversify its graphite supply chain to mitigate risks associated with geopolitical tensions and trade disputes, especially with China, which dominates global graphite production. This includes exploring alternative sources and investing in domestic mining and processing capabilities.

Asia PacificGraphite Market Trends

The Asia Pacific graphite market dominated the global market and accounted for the largest revenue share of 44.3% in 2024, owing to the larger scale of crude steel production volumes. China, India, and Japan are key steel producers in the region. In addition, there has been a significant boost to EV battery production in the Southeast, mostly in South Korea. Asia Pacific's well-established supply chain infrastructure and cost-effective production processes make it a hub for graphite production, driving down costs and ensuring competitive pricing in global markets.

The graphite market in China led the Asia Pacific market with the highest revenue share in 2024. China is the largest producer and consumer of graphite in the global market, making it the dominant supplier in the region. China’s efficient and well-integrated supply chain enables cost-effective graphite production and timely delivery, meeting both domestic and global demand. The country’s established manufacturing sector, especially in electric vehicle (EV) production, renewable energy, and electronics, drives significant demand for graphite in batteries, components, and various industrial applications.

Latin America Graphite Market Trends

The Latin America graphite market is expected to grow significantly, with a CAGR of 6.0% over the forecast period. Countries such as Brazil, Argentina, and Venezuela, with their abundant natural graphite reserves, are seeing a rise in mining and exploration activities. As the global electric vehicle (EV) industry expands, Latin America is experiencing a surge in demand for graphite, particularly for lithium-ion batteries essential to EVs. Additionally, Latin American nations are emerging as key exporters of natural graphite, taking advantage of the growing global demand for graphite in energy storage and industrial applications.

Brazil graphite market led the Latin America market with the highest revenue share in 2024. With its abundant natural graphite reserves, Brazil is a leading producer and a key player in the global supply chain. As electric vehicle demand rises, the need for graphite, particularly for lithium-ion batteries, is growing. Brazil is becoming a major exporter, with increasing demand for its high-quality, competitively priced graphite in both regional and international markets. This positions Brazil as a significant contributor to global graphite supply.

Key Graphite Company Insights

Key global graphite market companies include AMG Graphite (Graphit Kropfmühl GmbH), Focus Graphite, GrafTech International, and Graphite India Limited, among others. Companies with vertically integrated operations covering mining, processing, and manufacturing are able to exercise greater control over their supply chains, minimize costs, and maintain consistent product quality. Strategic collaborations with other industry stakeholders facilitate access to new markets, innovative technologies, and additional resources. Moreover, companies can effectively capitalize on new revenue opportunities by focusing on emerging markets and sectors, such as the expanding demand for electric vehicles (EVs) and renewable energy technologies.

-

AMG Graphite (Graphit Kropfmühl GmbH) manages its own mining operations and vertically integrated production facilities, ensuring control over the supply chain and consistent product quality. It provides Natural Graphite, Synthetic Graphite, Graphite dispersion, and Pastes to multiple industries for battery manufacturing, steel production, lubricants, ceramics, and refractories.

-

Focus Graphite is involved in the development of flake graphite deposits. The company supplies battery-grade graphite, essential for the green energy revolution. It holds the Lac Tétépisca Graphite Project, situated in the Southwest Manicouagan reservoir area of Quebec, one of North America's emerging flake graphite districts.

Key Graphite Companies:

The following are the leading companies in the graphite market. These companies collectively hold the largest market share and dictate industry trends.

- AMG Graphite (Graphit Kropfmühl GmbH)

- Focus Graphite

- GrafTech International

- Graphite India Limited

- Mason Resources Inc.

- Nippon Carbon Co Ltd.

- Northern Graphite Corp.

- NOVONIX Limited

- Resonac Holdings Corporation

- SGL Carbon

Recent Developments

-

In October 2024, Hazer Group and Mitsui extended their strategic collaboration on Hazer Graphite, focusing on advancing sustainable graphite production. Hazer’s proprietary technology, which converts natural gas into hydrogen and graphite, plays a critical role in creating a more sustainable supply chain for graphite, used in electric vehicles and batteries. The collaboration has enhanced the development of Hazer Graphite for energy storage and other high-demand industries, further boosting the transition to a low-carbon economy.

-

In July 2024, BASF and Graphit Kropfmühl, a subsidiary of AMG Critical Materials, partnered to reduce the carbon footprint of graphite production. BASF provides renewable energy certificates to Graphit Kropfmühl’s Hauzenberg site, cutting its product carbon footprint by at least 25%. This graphite is used in BASF’s Neopor insulation materials, enhancing sustainability. The collaboration aligns with BASF’s net-zero goals by 2050 and AMG's CO2 reduction targets for 2030.

Graphite Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 12.9 billion |

|

Revenue forecast in 2030 |

USD 17.8 billion |

|

Growth rate |

CAGR of 6.7% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Form, end-use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, Germany, France, Italy, Spain, China, India, Japan, Brazil |

|

Key companies profiled |

AMG Graphite (Graphit Kropfmühl GmbH), Focus Graphite, GrafTech International, Graphite India Limited, Mason Resources Inc., Nippon Carbon Co Ltd., Northern Graphite Corp., NOVONIX Limited, Resonac Holdings Corporation, SGL Carbon |

|

Customization scope |

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Graphite Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global graphite market report based on form, end-use, and region:

-

Form Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Natural Graphite

-

Synthetic Graphite

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Electrodes

-

Refractories

-

Lubricants

-

Foundries

-

Battery Production

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."