- Home

- »

- Semiconductors

- »

-

Graphic Processor Market Size, Share & Growth Report 2030GVR Report cover

![Graphic Processor Market Size, Share & Trends Report]()

Graphic Processor Market (2023 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Type (Integrated, Hybrid), By Deployment, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-119-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Graphic Processor Market Summary

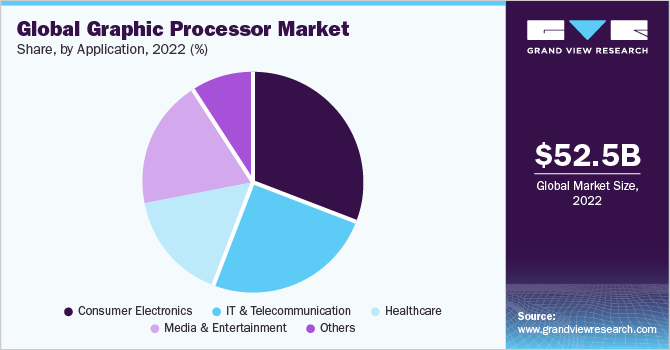

The global graphic processor market size was estimated at USD 52.52 billion in 2022 and is projected to reach USD 357.99 billion by 2030, growing at a CAGR of 27.7% from 2023 to 2030. Graphic processors have emerged as pivotal assets, driving innovation and reshaping business prospects across diverse sectors owing to the swiftly evolving technological landscape, often denoted as graphic processing units (GPUs).

Key Market Trends & Insights

- The Asia Pacific graphic processor market held the largest revenue share of 28.37% in 2022.

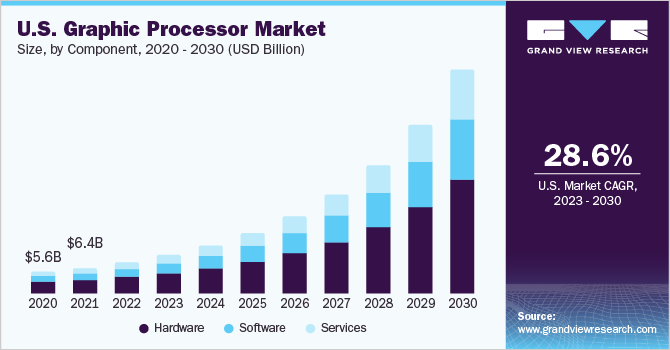

- By component, the hardware segment held the largest revenue share of over 55.0% in 2022.

- By deployment, the cloud segment held the largest revenue share of over 59.44% in 2022.

- By application, the consumer electronics segment held the largest revenue share of over 31.0% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 52.52 Billion

- 2030 Projected Market Size: USD 357.99 Billion

- CAGR (2023-2030): 27.7%

- Asia Pacific: Largest market in 2022

GPUs are specialized hardware units meticulously crafted to expedite and optimize graphical and visual data processing. The proliferation of artificial intelligence (AI) and machine learning (ML) applications, coupled with compelling demand for data visualization, virtual reality (VR), and augmented reality (AR) experiences, are significantly driving the market growth. These processors employ multiple cores, each capable of simultaneous task execution. This parallel processing capability empowers GPUs to efficiently manage substantial datasets by segmenting them into smaller components processed in unison.

These components are seamlessly integrated to produce the final images or videos. Consequently, this methodology accelerates the generation of intricate graphics and true-to-life animations, ensuring seamless real-time experiences. This streamlined approach affords users the luxury of immersing themselves in sophisticated visuals and lifelike animations, free from any perceptible delays.

Initially conceived to elevate the gaming experience, GPUs have outgrown their gaming origins to become essential instruments for consumer electronics, industrial, automotive, medical, communication, and aerospace & defense, aiming to harness the prowess of high-performance computing. These processors boast exceptional proficiency in managing intricate parallel computations, rendering them exceptionally to suit data-intensive processing, intricate simulations, artificial intelligence, and deep learning applications. Within the finance industry, GPUs find utility in expediting risk assessment, algorithmic trading, and portfolio management through swift data analysis. The medical domain capitalizes on GPUs for rapid analysis of medical images and expedites drug discovery, thereby enhancing precision in diagnostics and the advancement of treatments. Moreover, industries such as manufacturing and design reap the rewards of GPU-fueled simulations, streamlining the development lifecycle of products, by curbing expenses related to prototyping and stimulating inventive ingenuity.

COVID-19 Impact

The outbreak of the COVID-19 pandemic in early 2020 deeply impacted global economies and industries, and the market for graphic processors was no exception. As nations enforced lockdowns, restricted movements, and businesses embraced remote operations, there was a surge in demand for electronic devices, accompanied by disruptions in supply chains. The shutdown of factories and limitations on travel led to significant hitches in the supply chain and manufacturing processes. In addition, the need for more skilled labor and reduced workforce capacities further complicated matters, extending delivery timelines and lead times.

As businesses and individuals adapted to remote work setups and online engagement, the demand for enhanced digital experiences surged, amplifying the significance of graphic processors. The gaming sector bloomed exceptionally during the pandemic. With more people seeking entertainment options at home, the gaming industry witnessed a remarkable upswing. This translated to heightened demand for graphic processors, as gamers sought immersive visuals and seamless gameplay. Concurrently, the demand for powerful graphic processors was also fueled by the increased adoption of remote collaboration tools, virtual events, and streaming platforms, which rely heavily on high-quality graphics.

Component Insights

In terms of component, the hardware segment led the market in 2022 with a revenue share of more than 55.0%. Based on component, the market is bifurcated into hardware, software, and services segments. The hardware segment encompasses printed circuit boards (PCBs) that host and interconnect the GPUs; VRAM (video random access memory) modules for rapid data storage; cooling solutions that ensure optimal performance under varying workloads; an interface; outputs comprising HDMI, DisplayPort, DVI or VGA, power connectors; and BIOS, which holds initial setup and program information. Cutting-edge innovations such as ray tracing cores, tensor cores for AI acceleration, and dedicated hardware for real-time ray tracing further broaden the hardware spectrum, offering enhanced visual fidelity and computational capabilities. The persistent evolution of video games, marked by ever-increasing graphics complexity and realism, drives demand for robust hardware. Gamers seek high-performance GPUs to deliver immersive gaming environments and fluid gameplay, spurring innovation in the hardware domain.

The services segment is anticipated to grow at the fastest CAGR of 29.9% throughout the forecast period. The services segment encompasses a range of offerings that complement and enhance graphic processors' utilization, facilitating seamless integration into various applications and industries. The services generally include software development, system optimization, technical support, consulting, and training. The increasingly complex and diversified applications of graphics processors across sectors, such as gaming, AI, and data analytics, have led to an amplified demand for specialized services that can effectively harness the capabilities of these processors. Moreover, the rapid pace of technological innovation in the graphics processing domain necessitates continuous updates and optimizations, thereby driving the need for services to maintain peak performance.

Type Insights

Based on type, the integrated segment led the market in 2022 with a revenue share of more than 43.0%. Based on type, the market is bifurcated into integrated, discrete, and hybrid segments. An integrated graphics card leverages the system's available RAM for operational tasks. These cards are particularly tailored for entry-level laptops, prioritizing functionality over high graphical demands. Moreover, integrated cards entail a higher system memory utilization, potentially leading to decreased overall system performance during resource-intensive tasks like gaming or image editing. These cards offer economic advantages by curbing costs, conserving energy, and minimizing noise emissions associated with graphics solutions. Moreover, the demand for multimedia-rich applications, ranging from video streaming to graphic-intensive software, has necessitated capable graphics processing within compact devices. Integrated graphic processors cater to this demand by balancing performance and power efficiency, making them ideal for devices with limited space for separate GPU components.

The hybrid segment is anticipated to grow at the fastest CAGR of 29.7% throughout the forecast period. Hybrid graphics technology is designed to manage multiple GPUs effectively. This technology is a strategic solution for effectively managing GPU resources, catering to power-saving and performance augmentation objectives. These graphic cards can dynamically allocate resources to integrated or discrete graphics, depending on the computational requirements of a given task. This adaptability allows efficient processing power utilization, ensuring high performance during graphically intensive activities like gaming or multimedia editing while conserving energy during less demanding tasks. In addition, the increasing prevalence of compact yet capable gaming laptops and ultra-books has contributed to the popularity of hybrid graphic processors.

Deployment Insights

Based on deployment, the cloud segment led the market in 2022 with a revenue share of more than 59.44%. In terms of deployment, the market is bifurcated into on-premise and cloud segments. The introduction of cloud computing has exerted a significant influence on the utilization of GPUs throughout the industry, sparking the emergence of a noteworthy trend known as on-demand cloud-based GPUs. The innovative cloud GPU technology introduces a paradigm shift, offering the experience of a high-performance graphics card within the cloud environment, as opposed to conventional local hardware configurations. A paramount advantage of cloud GPUs is their capacity to circumvent direct competition with local graphics cards, presenting an efficient and economically viable solution for end-users. The ongoing advancements in GPU performance offer many possibilities for demanding applications such as computational graphics, computer vision, and a diverse spectrum of high-performance computing tasks.

Application Insights

In terms of application, the consumer electronics segment led the market in 2022 with a revenue share of more than 31.0%. Based on application, the market is bifurcated into consumer electronics, IT & telecommunication, healthcare, media & entertainment, and others segments. GPUs are paramount in the consumer electronics industry, serving as the cornerstone of enhanced visual experiences and computational capabilities. The integrated graphic cards capture an essential facet of consumer electronics encompassing GPUs intricately embedded within devices, such as smartphones, tablets, laptops, and smart TVs, to provide seamless and optimized graphical performance. The escalating demand for visually immersive content and applications, spanning from high-definition video streaming to mobile gaming, propels the growth of the market. In addition, the growing trend of multifunctional devices, such as 2-in-1 laptops and hybrid tablets, propels the integration of versatile graphics solutions. Consumers increasingly seek devices that seamlessly transition between productivity tasks and entertainment pursuits, necessitating GPUs that can fulfill both roles accurately.

The media & entertainment segment is anticipated to grow at the fastest CAGR of 31.2% throughout the forecast period. GPUs are the backbone for accelerated graphics rendering, real-time simulations, and advanced post-production tasks, vital for film production, animation studios, and gaming development. The increasing demand for high-quality, visually captivating content is a driving force. Moreover, the GPUs provide the processing power required to manipulate and render intricate visual elements swiftly, thus facilitating the creation of dynamic visual narratives and immersive experiences. Furthermore, the emergence of extended reality (XR) technologies, including augmented reality (AR) and virtual reality (VR), is reshaping the industry. GPUs play a vital role in enabling the creation of lifelike virtual environments, simulations, and interactive experiences, enhancing the appeal of XR content for consumers.

Regional Insights

Asia Pacific led the overall market in 2022, with a market share of 28.37%. The explosive growth of the gaming market in the Asia Pacific region is indeed a significant driver for market growth. The region is a hotspot for game development and consumption, with a massive audience expecting visually impressive and immersive gaming experiences. GPUs play a crucial role in enabling developers to create cutting-edge games and meet the demands of the discerning gaming community. Moreover, emphasizing emerging technologies like artificial intelligence, robotics, and autonomous vehicles in the Asia Pacific region further boosts the demand for GPUs. These technologies rely on complex computations that GPUs excel at, driving innovation across industries and advancing these transformative fields. The expanding demand for cloud services and data centers in the region is another factor propelling the need for GPUs. These facilities require powerful GPUs to handle resource-intensive applications, ranging from AI-driven analytics to high-performance computing tasks. This trend supports the region's technological progress and contributes significantly to its economic growth.

North America is anticipated to grow notably with a CAGR of 29.5%. The thriving technology and entertainment industries are primarily driving the market of GPUs in North America. With major tech hubs and entertainment centers in cities like Silicon Valley and Hollywood, there's a consistent demand for cutting-edge GPUs that power advanced visual effects, 3D modeling, and gaming experiences. In addition, the AI and machine learning revolution is a significant driver, as GPUs play a pivotal role in accelerating AI computations, driving innovation across industries from healthcare to finance. The prevalent emphasis on scientific research, especially in fields like climate modeling and drug discovery, also spurs the demand for high-performance GPUs. Lastly, North America's competitive nature fosters an environment where companies constantly seek to push boundaries, and GPUs enable them to achieve groundbreaking advancements in technology and creative endeavors.

Key Companies & Market Share Insights

The market is characterized by intense competition among prominent participants. These major players invest substantially in Research and Development (R&D) initiatives to propel innovation and maintain a competitive edge. Some prominent players in the market include NVIDIA Corporation, Advanced Micro Devices, Inc. (AMD), Intel Corporation, Qualcomm Incorporated, and Samsung Electronics Co., Ltd., among others. These key players are implementing diverse development strategies to strengthen their market presence and expand their share. These strategies encompass activities such as introducing new product offerings through launches, executing strategic mergers and acquisitions, and exploring innovative approaches to bolster their standing within the market. Along with key strategies, these players are introducing new features to improve the customer experience.

In August 2023, Advanced Micro Devices, Inc. (AMD) made a significant announcement concerning unveiling a fresh lineup of RX 7000 series GPUs during the event Gamescom 2023. The central focus of these newly unveiled RX 7000 series GPUs rests upon an advanced architecture, promising substantial strides in both performance and power efficiency. The newly launched GPUs aim to deliver cutting-edge performance and features, to cater to modern gaming and content creation demands. Within the RX 7000 series, each graphic card is tailored to different market segments, offering varied performance levels and features, allowing users to choose the GPU that best suits their needs and budget. Some prominent players in the global graphic processor market include:

-

NVIDIA Corporation

-

Advanced Micro Devices, Inc. (AMD)

-

Intel Corporation

-

Qualcomm Incorporated

-

Samsung Electronics Co., Ltd.

-

Imagination Technologies

-

VIA Technologies, Inc.

-

Matrox Electronic Systems Ltd.

-

IBM

Graphic Processor Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 64.60 billion

Revenue forecast in 2030

USD 357.99 billion

Growth rate

CAGR of 27.7% from 2023 to 2030

Historic year

2017 - 2021

Base year for estimation

2022

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, type, deployment, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

NVIDIA Corporation; Advanced Micro Devices Inc. (AMD); Intel Corporation; Qualcomm Incorporated; Samsung Electronics Co., Ltd.; Imagination Technologies; VIA Technologies Inc.; Matrox Electronic Systems Ltd.; IBM

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Graphic Processor Market Segmentation

This report forecasts revenue growth at global, regional, as well as at country levels and provides qualitative and quantitative analysis of the market trends for each of the segment and sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global graphic processor market report based on component, type, deployment, application, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Integrated

-

Discrete

-

Hybrid

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

On-premise

-

Cloud

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Consumer Electronics

-

IT & Telecommunication

-

Healthcare

-

Media & Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global graphic processor market size was estimated at USD 52.52 billion in 2022 and is expected to reach USD 64.60 billion in 2023.

b. The global graphic processor market is expected to grow at a compound annual growth rate of 27.7% from 2023 to 2030 to reach USD 357.99 billion by 2030.

b. Asia Pacific is expected to dominate the market and grow at a CAGR of 24.7%. The explosive growth of the gaming market in the Asia Pacific region is indeed a significant driver. The region is a game development and consumption hotspot, with a massive audience expecting visually impressive and immersive gaming experiences.

b. Some prominent players in the market include NVIDIA Corporation, Advanced Micro Devices, Inc. (AMD), Intel Corporation, Qualcomm Incorporated, Samsung Electronics Co., Ltd., Imagination Technologies, VIA Technologies, Inc., Matrox Electronic Systems Ltd., IBM

b. Key factors driving the graphic processor market growth include the the proliferation of artificial intelligence (AI) and machine learning (ML) applications, coupled with compelling demand for data visualization, virtual reality (VR), and augmented reality (AR) experiences, are significantly driving the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.