- Home

- »

- Plastics, Polymers & Resins

- »

-

Graphic Film Market Size, Share And Growth Report, 2030GVR Report cover

![Graphic Film Market Size, Share & Trends Report]()

Graphic Film Market Size, Share & Trends Analysis Report By Product (Polyethylene, Polypropylene, Polyvinyl Chloride), By Film, By Manufacturing Process, By Printing Technology, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-330-8

- Number of Report Pages: 180

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Graphic Film Market Size & Trends

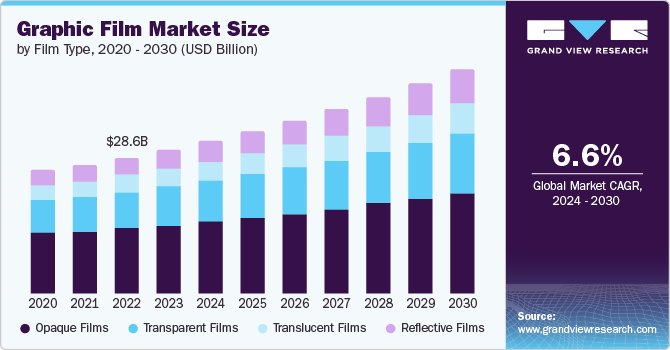

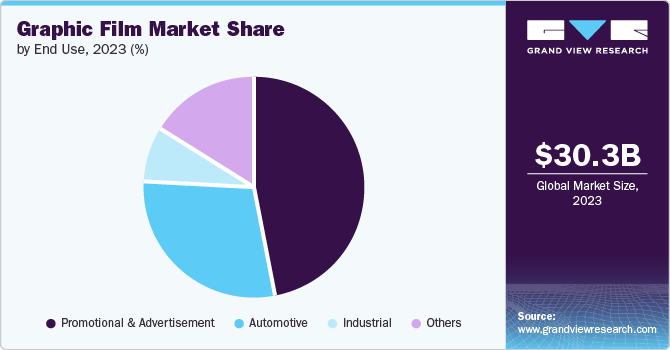

The global graphic film market size was estimated at USD 30.33 billion in 2023 and expected to grow at a CAGR of 6.61% from 2024 to 2030. Graphic films offer versatility in applications, ranging from vehicle wraps and window graphics to safety signs and decorative elements. These films are preferred due to their durability, high-quality printability, and ability to enhance visual appeal.

The growing trend of vehicle customization and the need for effective advertising solutions are major factors driving the market. In addition, advancements in printing technologies such as digital printing are enhancing the capabilities and applications of graphic films. The market is also seeing a shift towards environmentally friendly materials and processes, with increased adoption of recyclable and biodegradable films.

Drivers, Opportunities & Restraints

The automotive industry is a significant driver of the graphic film market, primarily due to the increasing trend of vehicle customization and branding. Graphic films are extensively used for vehicle wraps, decals, and window tinting, offering a cost-effective and versatile way to alter the appearance of vehicles. These films not only enhance aesthetic appeal but also provide protective benefits, such as shielding the vehicle's paint from damage and UV exposure.

The graphic film market faces challenges due to fluctuations in raw material prices, particularly those of polymers such as polyvinyl chloride (PVC), polyethylene (PE), and polypropylene (PP). These price variations can significantly impact the production costs and profit margins for manufacturers. In addition, the reliance on petroleum-based raw materials makes the market vulnerable to volatility in global oil prices.

The increasing focus on sustainability and environmental regulations presents significant opportunities for the graphic film market. There is a growing demand for eco-friendly and biodegradable films as consumers and industries seek to reduce their environmental footprint. Manufacturers are investing in the development of recyclable materials and sustainable production processes to meet this demand.

Film Type Insights

Based on film type, opaque films held the market with the largest revenue share of 47.73% in 2023. These films are highly favored for their ability to completely block light and view. This makes them ideal for a variety of applications including vehicle wraps, promotional banners, and decorative purposes. These films provide privacy, protect underlying surfaces, and ensure vibrant, non-fading colors which are crucial for both indoor and outdoor advertising.

Transparent films are also significant in the market due to their applications in window graphics, automotive window tinting, and packaging. These films allow visibility while providing UV protection and aesthetic appeal. Translucent films, which allow light to pass through but not detailed shapes, are commonly used in illuminated signage and backlit displays, ensuring uniform light diffusion. Reflective films, designed to reflect light, are essential for safety and security applications such as road signs, vehicle markings, and emergency exits, contributing to visibility and safety in low light conditions.

Product Type Insights

Based on product type, Polyvinyl Chloride (PVC) held the market with the largest revenue share of 48.33% in 2023. They are extensively used in various applications such as automotive wraps, signage, and decals. PVC films are preferred for their ease of installation and ability to conform to complex surfaces, making them suitable for a wide range of promotional and decorative uses.

Polyethylene films are known for their excellent resistance to chemicals and moisture, making them suitable for industrial applications and protective packaging. Polypropylene films, on the other hand, offer high clarity and strength, making them ideal for labeling, packaging, and graphic displays. The others category includes specialty films such as polyester and polycarbonate, which are used for their specific properties such as high heat resistance and enhanced durability, catering to niche markets.

Manufacturing Process Insights

Based on manufacturing process, calendered film held the market with the largest revenue share of 61.84% in 2023. Calendered films are produced by pressing the material through rollers, resulting in smooth and even films. This process is cost-effective and suitable for high-volume production, making calendered films popular in signage, decals, and general graphic applications.

Casting, a more premium process, involves pouring the material onto a casting sheet and curing it. Cast films are generally of higher quality, offering better conformability and durability compared to calendered films. They are preferred for high-end applications such as vehicle wraps and premium advertisements due to their superior performance and longer lifespan.

Printing Technology Insights

Based on printing technology, flexography held the market with the largest revenue share of 53.44% in 2023. Flexography is a widely used technology for printing large volumes of graphics on various substrates, including films used in packaging, labels, and promotional materials. It is favored for its high-speed and cost-effective nature.

Rotogravure printing is known for its high-quality output and ability to print fine details. This technology is often used for high-end packaging, decorative films, and applications where print quality is paramount. Offset printing offers excellent print quality and consistency, making it ideal for producing detailed graphics and images. It is commonly used in the production of labels, decals, and other printed materials requiring high-resolution output. Digital printing technology provides flexibility and quick turnaround times, making it suitable for short-run and customized printing needs.

End Use Insights

Based on end use, promotional & advertisement industry held the market with the largest revenue share of 51.26% in 2023. These films are widely used in creating eye-catching banners, posters, billboards, and point-of-sale displays. Their ability to deliver vibrant, high-resolution graphics makes them essential for effective marketing campaigns. In the industrial sector, graphic films are used for labeling, safety signage, and protective applications. Their durability and resistance to harsh environments make them suitable for industrial use. The others category includes applications in home décor, DIY projects, and architectural films for decorative purposes, providing a cost-effective solution for enhancing the visual appeal of interiors and exteriors.

The automotive sector extensively uses graphic films for vehicle wraps, decals, and window tinting. These films enhance the aesthetic appeal of vehicles, provide protection against environmental elements, and serve advertising purposes. The growing trend of vehicle customization is boosting the demand for graphic films in this sector.

Regional Insights

North America Film Market Trends

North America is a significant market for graphic films, driven by the high demand in the automotive and promotional sectors. The region's strong automotive industry, especially in the U.S., is a major contributor to the growth of the graphic film market. In addition, the presence of leading market players and the increasing adoption of advanced printing technologies further bolster market growth. The promotional and advertisement industry in North America also significantly contributes to the demand for high-quality graphic films.

U.S. Graphic Film Market Trends

The U.S., as a major player in the North American market, showcases substantial growth due to its robust automotive and advertising industries. The trend of vehicle customization and the high demand for visually appealing advertisements drive the market. In addition, stringent regulations regarding road safety boost the use of reflective and durable graphic films.

Europe Graphic Film Market Trends

Europe represents a mature market for graphic films with steady growth. The region's focus on sustainability and environmental regulations has led to the adoption of eco-friendly graphic films. Countries such as Germany, France, and the UK are major contributors to the market, driven by their automotive industries and the need for high-quality promotional materials. The European market is also witnessing a growing demand for digitally printed films due to their customization capabilities and quick turnaround times.

Asia Pacific Graphic Film Market Trends

Asia Pacific dominated global graphic film market and accounted for largest revenue share of over 46.12% in 2023. Advancements in printing technologies and the availability of cost-effective materials boost market growth in the region. The APAC market is characterized by significant investments in infrastructure and advertising, further propelling the demand for graphic films.

The Asia-Pacific region is expected to witness the highest growth rate in the graphic film market. Rapid industrialization, urbanization, and the expanding automotive industry in countries such as China, India, and Japan are key factors driving the market. The increasing popularity of vehicle wraps and promotional activities in emerging economies contributes to the demand for graphic films. In addition, advancements in printing technologies and the availability of cost-effective materials boost market growth in the region.

Key Graphic Film Company Insights

The graphic film market is a highly competitive industry with several key players operating globally.

Key Graphic Film Companies:

The following are the leading companies in the graphic film market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Avery Dennison Corporation

- Hexis S.A.S.

- Orafol Group

- Arlon Graphics LLC

- Ritrama S.p.A.

- Mactac, LLC

- Dunmore

- The Griff Network

- Spandex AG

- FDC Graphic Films Inc.

Recent Developments

-

In October 2023, DuPont de Nemours, Inc. publicized a partnership with United States Steel Corporation to introduce COASTALUME. This product merges the strength and self-healing properties of U. S. Steel’s GALVALUME material with DuPont Tedlar Polyvinyl Fluoride (PVF) film.

-

In October 2023, Drytac introduced Polar Blockout, a UV opaque printable block-out film designed specifically for applications such as two-sided window graphics and other block-out layer needs.

-

In July 2023, Innovia, which is a subsidiary of CCL Industries, made a significant investment in a new coating line at its Wigton site in Great Britain. This initiative aims to innovate and produce a new series of films tailored for the graphics sector, with a focus on being PVC-free.

Graphic Film Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 32.20 billion

Revenue forecast in 2030

USD 47.28 billion

Growth rate

CAGR of 6.61% from 2024 to 2030

Historical data

2018 - 2022

Base year

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, volume in million square meters, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors and trends

Segments covered

Product type, film type, manufacturing process, printing technology, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

3M; Avery Dennison Corporation; Hexis S.A.S.; Orafol Group; Arlon Graphics LLC; Ritrama S.p.A.; Mactac, LLC; Dunmore; The Griff Network; Spandex AG; FDC Graphic Films Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Graphic Film Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global graphic film market report on the basis of product type, film type, manufacturing process, printing technology, end use, and region:

-

Film Type Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Opaque Films

-

Transparent Films

-

Translucent Films

-

Reflective Films

-

-

Product Type Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Polyethylene

-

Polypropylene

-

Polyvinyl chloride

-

Others

-

-

Manufacturing Process Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Calendered

-

Casting

-

Others

-

-

Printing Technology Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Flexography

-

Rotogravure

-

Offset

-

Digital

-

-

End Use Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Promotional & Advertisement

-

Industrial

-

Others

-

-

Regional Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global graphic film market size was estimated at USD 30.33 billion in 2023 and is expected to reach USD 32.20 billion in 2024.

b. The global graphic film market is expected to grow at a compound annual rate of 6.61% from 2024 to 2030, reaching USD 42.76 billion by 2030.

b. The opaque film segment led the global graphic film market, accounting for more than 47.73% of the global revenue in 2023.

b. Some of the major companies in the global plastic antioxidants market include 3M; Avery Dennison Corporation; Hexis S.A.S.; Orafol Group; Arlon Graphics LLC; Ritrama S.p.A.; Mactac, LLC; Dunmore; The Griff Network; Spandex AG; FDC Graphic Films Inc., among others.

b. The growing trend of vehicle customization and the need for effective advertising solutions are major factors driving the market. Additionally, advancements in printing technologies, such as digital printing, are enhancing the capabilities and applications of graphic films.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."