- Home

- »

- Advanced Interior Materials

- »

-

Graphene Reinforced Polymer Composites Market Report 2030GVR Report cover

![Graphene Reinforced Polymer Composites Market Size, Share & Trends Report]()

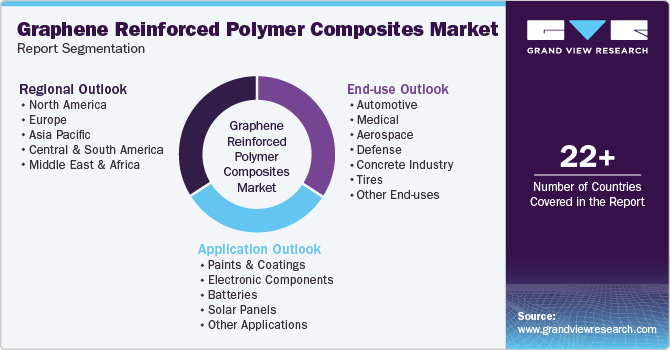

Graphene Reinforced Polymer Composites Market Size, Share & Trends Analysis Report By Application (Paints & Coatings, Electronic Components) By End-use (Automotive, Medical, Aerospace), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-472-4

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

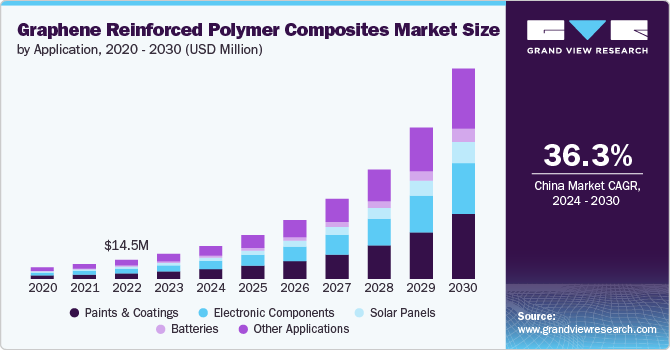

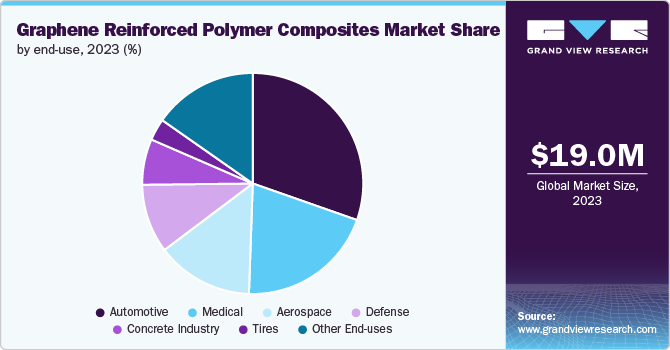

The global graphene reinforced polymer composites market size was estimated at USD 19.02 million in 2023 and expected to grow at a CAGR of 36.3% from 2024 to 2030. Rising concerns about global warming and climate change are augmenting the market for alternative sustainable sources of energy leading to an increase in demand for renewable energy such as solar and wind. This is expected to spur the graphene reinforced polymer composites market.

A key trend in the graphene-reinforced polymer composites market is their rising use in high-performance electronics. As consumer electronics evolve, there's a growing demand for materials that offer better durability, flexibility, and conductivity. Graphene's unique properties such as its excellent electrical conductivity and lightweight nature make it ideal for applications in flexible displays, wearable devices, and other cutting-edge electronic products. In addition, the rise of the internet of things (IoT) and miniaturized electronic devices is further driving the use of graphene composites, as these require materials that can handle higher data processing speeds without overheating or losing efficiency.

Drivers, Opportunities & Restraints

Increasing need for lightweight yet durable materials in the automotive and aerospace industries is promoting the graphene reinforced polymer composites market. Manufacturers are under constant pressure to produce more fuel-efficient vehicles and aircraft, which can only be achieved by reducing the overall weight of the components. Graphene-reinforced composites provide a high strength-to-weight ratio, allowing manufacturers to replace traditional heavy materials like steel and aluminum. The result is reduced fuel consumption and lower emissions, aligning with global environmental regulations. This shift is pushing the demand for graphene composites across these sectors.

The expansion of renewable energy infrastructure presents a significant opportunity for the graphene-reinforced polymer composites market. Wind turbine blades, solar panels, and other renewable energy equipment require materials that can withstand harsh environmental conditions, such as extreme temperatures and corrosion. Graphene-enhanced composites, with their superior mechanical strength and weather resistance, are well-suited for such applications. As governments and private sectors invest heavily in clean energy projects, the demand for advanced materials such as graphene composites is expected to increase, creating a lucrative market opportunity, particularly in wind and solar energy applications.

Despite its potential, the market faces challenges that could hinder its growth. One of the key restraints limiting the growth of the graphene-reinforced polymer composites market is the high cost of production. While graphene offers exceptional properties, the process of integrating it into polymers at a commercial scale is expensive and technically challenging. This is primarily due to the complex manufacturing techniques required to produce high-quality graphene in large quantities and evenly disperse it within polymer matrices. These high costs often translate into higher prices for end products, making it difficult for manufacturers to justify the switch from traditional materials, especially in cost-sensitive industries such as consumer goods and construction.

Application Insights

Based on application, the paints & coatings segment led the market with a revenue share of 29.8% in 2023. The expansion of infrastructure projects in emerging economies is promoting the graphene-reinforced polymer composites market in the segment. Countries in regions such as Asia Pacific, the Middle East, and Latin America are investing heavily in large-scale construction projects, such as highways, bridges, and commercial buildings. These projects require advanced materials that can withstand harsh environmental conditions and extend the lifespan of structures. Graphene-reinforced paints and coatings offer superior durability, corrosion resistance, and anti-fouling properties, making them ideal for protecting infrastructure from weathering and wear. As infrastructure development accelerates in these regions, demand for high-performance coatings is rising, boosting the use of graphene composites in this sector.

The batteries segment is expected to grow at a significant rate over the forecast period. The segment is driven by the rapid advancements in IoT and smart technologies. As IoT devices, smart wearables, and connected technologies become more prevalent, there is a growing need for smaller, more efficient batteries that can power these devices for longer periods without frequent recharging. Graphene-reinforced composites enhance the performance of batteries by improving energy density, charge retention, and thermal conductivity, allowing batteries to store more power while remaining lightweight and compact. With the rise of IoT ecosystems and smart cities, the demand for high-performance batteries is accelerating, pushing the adoption of graphene-reinforced materials in battery technologies to meet the increasing energy needs of these connected systems.

End-use Insights

Based on end-use, the automotive segment dominated the market with the largest revenue share of 30.4% in 2023. The increasing adoption of electric vehicles (EVs) is driving the demand for graphene-reinforced polymer composites in the automotive sector. To improve battery efficiency and extend driving range, automakers are turning to lightweight materials such as graphene composites for EV components such as battery casings and body panels. These materials reduce vehicle weight while enhancing strength and thermal stability, key factors in improving EV performance. As the shift towards electric mobility gains momentum, the use of graphene-reinforced composites in automotive manufacturing is expected to rise significantly.

The medical segment is poised to grow at a substantial rate from 2024 to 2030. This can be attributed to the growing global geriatric population. As the elderly population increases, there is a rising demand for advanced medical devices and implants that offer durability, biocompatibility, and strength to support aging bodies. Graphene-reinforced composites are being used to develop lightweight, flexible, and strong materials for implants, prosthetics, and medical equipment, which are crucial for improving the quality of life for older individuals. These composites provide superior mechanical properties, allowing for longer-lasting, more reliable medical solutions that reduce the need for frequent replacements or adjustments. As the healthcare industry shifts to meet the needs of an aging population, the use of graphene-reinforced materials in medical applications is expected to expand.

Regional Insights

In North America, the graphene-reinforced polymer composites market is primarily driven by advancements in defense and aerospace applications. The region’s strong focus on developing high-performance military equipment, drones, and space exploration technologies requires lightweight, durable materials. Graphene composites offer significant advantages in terms of strength-to-weight ratio, corrosion resistance, and thermal stability, making them ideal for aircraft, satellite components, and protective gear. The ongoing investments in defense and the expansion of aerospace projects in North America are boosting the demand for graphene-reinforced materials in these high-tech sectors.

U.S. Graphene Reinforced Polymer Composites Market Trends

In the U.S., the adoption of EVs and the push for sustainable manufacturing are key drivers for the graphene-reinforced polymer composites market. As the country intensifies its efforts to reduce carbon emissions, automakers and battery manufacturers are increasingly turning to lightweight graphene composites to improve EV performance. These composites help reduce vehicle weight, enhance battery efficiency, and support the drive toward greener, more energy-efficient transportation. With government incentives and consumer demand for EVs on the rise, the U.S. is seeing significant growth in the use of graphene-reinforced materials in automotive and battery applications.

Asia Pacific Graphene Reinforced Polymer Composites Market Trends

Asia Pacific dominated the global graphene reinforced polymer composites market and accounted for largest revenue share of 32.9% in 2023. The market is driven by the growing demand for consumer electronics and smart devices. With countries such as South Korea, Japan, and Taiwan leading in electronics manufacturing, the need for advanced materials that provide flexibility, conductivity, and durability is increasing. Graphene composites are being used in the production of flexible screens, batteries, and sensors, which are essential for next-generation electronics, including wearables and IoT devices. As consumer demand for smart technology grows, the region is experiencing a surge in the adoption of graphene-reinforced composites in the electronics sector.

The graphene-reinforced polymer composites market in China is driven by the rapid expansion of the construction and infrastructure sectors. With large-scale urbanization and infrastructure projects, China requires materials that offer longevity, corrosion resistance, and strength, especially for bridges, buildings, and transportation systems. Graphene composites provide enhanced durability and weather resistance, making them suitable for high-performance coatings, construction materials, and structural components. The Chinese government's continued investments in infrastructure development are fueling the demand for graphene-enhanced materials in the construction industry.

Europe Graphene Reinforced Polymer Composites Market Trends

In Europe, the focus on renewable energy and stringent environmental regulations are major drivers for the graphene-reinforced polymer composites market. European countries are heavily investing in wind and solar energy infrastructure, requiring materials that can withstand extreme environmental conditions. Graphene-reinforced composites are ideal for wind turbine blades, solar panel components, and other renewable energy systems due to their superior strength, corrosion resistance, and durability. As Europe pushes for decarbonization and cleaner energy, the demand for graphene-enhanced materials in renewable energy applications is expected to rise.

Key Graphene Reinforced Polymer Composites Market Company Insights

The graphene reinforced polymer composites market is highly competitive, with several key players dominating the landscape. The graphene reinforced polymer composites market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Graphene Reinforced Polymer Composites Companies:

The following are the leading companies in the graphene reinforced polymer composites market. These companies collectively hold the largest market share and dictate industry trends.

- Mito Materials Solutions

- Integran Technologies, Inc.

- TLC Products, Inc.

- Asahi Kasei Corporation

- Haydale Graphene Industries plc

- Graphenano Group

- NanoXplore Inc

- PMG 3D Technologies Company Limited

- Directa Plus Plc Company

- Dyson

- Procter & Gamble

Recent Developments

-

In January 2024, Black Swan Graphene Inc. announced a significant advancement in polymer composites through its new Graphene Enhanced Masterbatch (GEM) products. These innovations, developed in collaboration with Hubron International Ltd., aim to improve the performance of various polymers, particularly polypropylene, by enhancing its impact resistance by 30% with just a 1% addition of graphene. This improvement opens up new applications across industries, including packaging and transportation, where lightweight materials are crucial for efficiency.

-

In February 2022, Scientists improved wood-plastic composites by incorporating graphene, a material known for its strength and conductivity. This enhancement aims to increase the durability and performance of these composites, making them more suitable for various applications in construction and manufacturing. The research highlights the potential of graphene to revolutionize traditional materials, offering better mechanical properties and sustainability benefits.

Graphene Reinforced Polymer Composites Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 25.04 million

Revenue forecast in 2030

USD 160.56 million

Growth rate

CAGR of 36.3% from 2024 to 2030

Historical data

2018 - 2022

Base year

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Brazil; Saudi Arabia

Key companies profiled

Mito Materials Solutions; Integran Technologies; Inc.; TLC Products; Inc.; Asahi Kasei Corporation; Haydale Graphene Industries plc; Graphenano Group; NanoXplore Inc; PMG 3D Technologies Company Limited; Directa Plus Plc Company; Dyson; Procter & Gamble

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Graphene Reinforced Polymer Composites Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented graphene reinforced polymer composites market report on the basis of application, end-use, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Paints & Coatings

-

Electronic Components

-

Batteries

-

Solar Panels

-

Other Applications

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Medical

-

Aerospace

-

Defense

-

Concrete Industry

-

Tires

-

Other End-uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global graphene reinforced polymer composites market was estimated at USD 19.02 million in 2023 and is expected to reach USD 25.04 million in 2024.

b. The global graphene reinforced polymer composites market is expected to grow at a compound annual growth rate of 36.30% from 2024 to 2030 to reach USD 160.56 million by 2030

b. Based on end use, the automotive segment dominated the market with the largest revenue share of 30.42% in 2023. The increasing adoption of electric vehicles (EVs) is driving the demand for graphene-reinforced polymer composites in the automotive sector.

b. Some key players are Mito Materials Solutions, Integran Technologies, Inc., TLC Products, Inc., Asahi Kasei Corporation, Haydale Graphene Industries plc, Graphenano Group, NanoXplore Inc, PMG 3D Technologies Company Limited, Directa Plus Plc Company, Dyson, and Procter & Gamble.

b. Rising concerns about global warming and climate change are augmenting the market for alternative sustainable energy sources, leading to an increase in demand for renewable energy such as solar and wind. This is expected to spur the graphene reinforced polymer composites market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."