- Home

- »

- Advanced Interior Materials

- »

-

Graphene Quantum Dots Market Size, Industry Report, 2030GVR Report cover

![Graphene Quantum Dots Market Size, Share & Trends Report]()

Graphene Quantum Dots Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Paints & Coatings, Electronic Components, Composites, Batteries), By Region (North America, Asia Pacific, Central & South America), And Segment Forecasts

- Report ID: GVR-4-68040-543-3

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Graphene Quantum Dots Market Trends

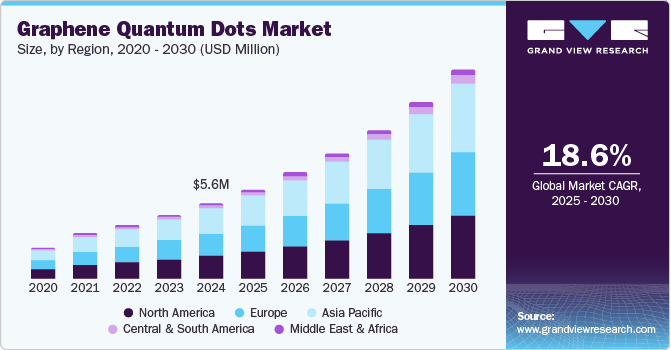

The global graphene quantum dots market size was estimated at USD 5.63 million in 2024 and is expected to expand at a CAGR of 18.6% from 2025 to 2030. The increasing demand for advanced nanomaterials in biomedical applications is driving the global GQD market. GQDs exhibit excellent biocompatibility, fluorescence properties, and low toxicity, making them ideal for bioimaging, drug delivery, and biosensing applications. As the healthcare and pharmaceutical industries continue to adopt nanotechnology for targeted therapies and early disease detection, the demand for GQDs is expected to rise. Furthermore, ongoing research in nanomedicine and collaborations between academic institutions and biotechnology firms are accelerating the development of graphene-based solutions, thereby driving market growth.

The rising adoption of graphene quantum dots in optoelectronics and display technologies is a key factor driving market expansion. GQDs possess superior optical and electrical properties, enabling their use in high-performance LEDs, solar cells, and flexible display panels. With the increasing penetration of OLED and quantum dot-based display technologies in consumer electronics, manufacturers are exploring GQDs as a sustainable and efficient alternative to conventional semiconductor quantum dots. Additionally, the need for energy-efficient and environmentally friendly lighting solutions further strengthens the demand for GQDs in optoelectronic applications.

Government support and investments in nanotechnology research and development also contribute to the growth of the GQDs market. Various governments and regulatory bodies worldwide are funding projects that focus on the commercial viability of graphene-based materials, including quantum dots. Policies promoting sustainable and green technologies encourage industries to adopt graphene derivatives due to their low environmental impact and high performance. The establishment of research hubs and innovation centers dedicated to nanomaterials, particularly in countries such as the United States, China, and Germany, further propels market growth by facilitating advancements in GQD synthesis, scalability, and commercialization.

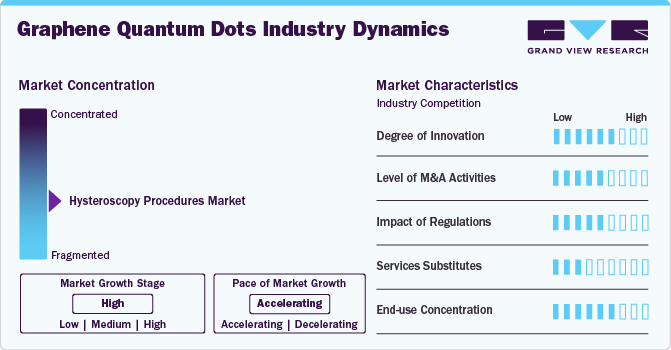

Market Concentration & Characteristics

The industry is characterized by moderate to high market concentration, with a few key players dominating research, development, and commercialization. The degree of innovation in the market is high, driven by continuous advancements in nanomaterials, photoluminescence properties, and biocompatibility enhancements. Companies are investing heavily in R&D to develop GQDs with superior quantum yields and functionalization for applications in bioimaging, optoelectronics, and energy storage. However, large-scale commercialization is still in its early stages, with innovation primarily concentrated in academic research institutions and specialized nanotechnology firms.

Mergers and acquisitions (M&A) levels remain moderate, with key players focusing on strategic collaborations rather than large-scale consolidations. The impact of regulations is significant, as graphene-based materials fall under stringent environmental and safety regulations, particularly in regions like the EU and the U.S., where nanomaterial handling and toxicity are closely monitored. Service substitutes remain limited, as traditional quantum dots made from heavy metals like cadmium pose environmental concerns, making graphene-based alternatives preferable in sustainable applications. The end-user concentration is relatively high, with major demand from sectors like biomedical imaging, display technologies, and energy storage, where only a few key industry players drive adoption.

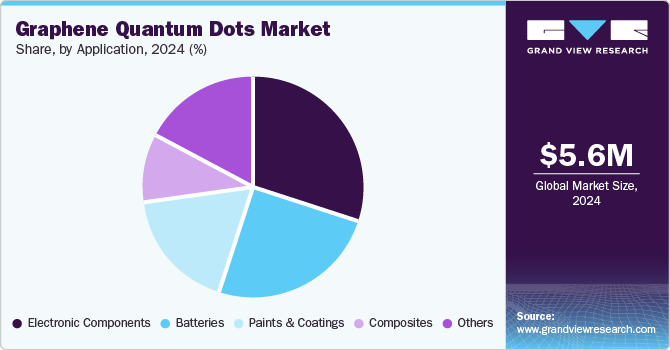

Application Insights

Electronic components dominated the market and accounted for the largest revenue share of 45.0% in 2024 driven by increasing demand for high-performance, energy-efficient, and miniaturized electronic devices. Graphene quantum dots offer exceptional electrical conductivity, high electron mobility, and superior thermal stability, making them ideal for use in transistors, sensors, photodetectors, and optoelectronic devices. With the rising adoption of 5G technology, the Internet of Things (IoT), and artificial intelligence (AI)-driven electronics, manufacturers are increasingly integrating GQDs to enhance signal processing speed, data transmission, and power efficiency in advanced electronic components.

The batteries segment is expected to grow at the fastest CAGR of 19.2% over the forecast period, driven by the increasing demand for high-performance energy storage solutions in consumer electronics, electric vehicles (EVs), and renewable energy systems. Graphene quantum dots offer superior conductivity, higher charge carrier mobility, and enhanced electrochemical stability, making them highly attractive for next-generation battery technologies. The growing push for longer-lasting, faster-charging, and more efficient batteries has accelerated research and development (R&D) in GQD-based anodes and cathodes, particularly in lithium-ion and sodium-ion batteries.

Regional Insights

North America graphene quantum dots market growing as government initiatives in the U.S. and Canada are playing a crucial role in accelerating the development and commercialization of graphene quantum dots. Programs such as the National Nanotechnology Initiative (NNI) in the U.S. and the Natural Sciences and Engineering Research Council of Canada (NSERC) are actively funding projects focused on graphene and nanomaterial advancements. These initiatives not only promote innovation but also help in overcoming commercialization barriers, making it easier for companies to scale production and develop commercial-grade GQD applications.

U.S. Graphene Quantum Dots Market Trends

The graphene quantum dots market in the U.S. is growing as the healthcare industry is increasingly leveraging nanomaterials for diagnostics, imaging, and therapeutics, fueling the demand for GQDs. Their fluorescence properties make them ideal for bioimaging applications, where high-resolution visualization of cells and tissues is required. Additionally, GQDs are being explored for targeted drug delivery, photodynamic therapy, and biosensing applications. With the growing prevalence of chronic diseases such as cancer and cardiovascular conditions, the adoption of GQDs in medical research and clinical diagnostics continues to rise.

Asia Pacific Graphene Quantum Dots Market Trends

The graphene quantum dots market in Asia Pacific dominated the market and accounted for the largest revenue share of about 32.55% in 2024, driven by government funding and private sector investments. Countries such as China, Japan, and South Korea are leading in graphene quantum dots (GQDs) research, focusing on enhancing their photoluminescence properties, biocompatibility, and energy efficiency for various applications. These advancements are accelerating the commercialization of GQDs across industries. The increasing use of GQDs in bioimaging, drug delivery, and cancer treatment is a key driver of market growth. Their superior fluorescence properties, lower toxicity compared to traditional quantum dots, and potential for targeted drug delivery make them highly desirable in the healthcare sector. Leading pharmaceutical and biotechnology firms in the region are exploring GQDs for diagnostic and therapeutic applications.

China graphene quantum dots market is driven by the rapidly expanding electronics and display industry. These materials exhibit excellent photoluminescence and tunable optical properties, making them ideal for high-performance display panels, LED lighting, and quantum dot-based photodetectors. As major Chinese electronics manufacturers, such as BOE Technology and TCL, invest in next-generation display technologies, the adoption of GQDs is expected to increase, enhancing their market penetration in optoelectronics.

Europe Graphene Quantum Dots Market Trends

The graphene quantum dots market in Europe is strengthening its semiconductor ecosystem, with increasing investments in advanced materials and fabrication processes. GQDs play a crucial role in next-generation semiconductor devices due to their exceptional electrical and optical properties. The European Chips Act, which aims to boost domestic semiconductor production, is expected to drive the incorporation of graphene-based materials in high-performance computing and optoelectronics.

Germany graphene quantum dots market is growing. As the country continues its transition to renewable energy, the demand for advanced energy storage solutions is on the rise. GQDs have shown significant potential in enhancing battery performance, supercapacitors, and solar cells due to their high conductivity and excellent charge transport capabilities. Research in quantum dot-enhanced perovskite solar cells and lithium-ion battery technologies is gaining momentum, making GQDs an attractive material for Germany’s sustainable energy initiatives.

Latin America Graphene Quantum Dots Market Trends

The graphene quantum dots market in Latin America is expected to grow. The shift toward renewable energy, particularly in solar power, is driving demand for innovative nanomaterials such as GQDs. These quantum dots enhance the efficiency of photovoltaic cells by improving light absorption and charge transfer mechanisms. With countries like Brazil and Chile leading in solar energy adoption, there is a rising need for materials that optimize energy conversion, positioning GQDs as a promising solution for sustainable energy applications.

Middle East & Africa Graphene Quantum Dots Market Trends

The demand for high-performance imaging technologies, particularly in defense, security, and healthcare, is a major driver of the GQDs market. The MEA region is witnessing increased investments in security and surveillance systems that rely on advanced imaging solutions. Additionally, the rise of artificial intelligence (AI) and machine learning in imaging applications is pushing the need for enhanced sensor technologies, where GQDs can play a crucial role. As imaging and sensing technologies continue to evolve, the adoption of GQDs in advanced imaging solutions is expected to accelerate.

Key Graphene Quantum Dots Company Insights

Some of the key players operating in the market include American Elements, AUO

-

American Elements is a global manufacturer and supplier of advanced materials, specializing in nanomaterials, rare earth elements, and high-purity chemicals. The company offers Graphene Quantum Dots (GQDs) designed for applications in bioimaging, optoelectronics, and energy storage, leveraging its expertise in high-performance nanotechnology solutions.

-

AUO is a Taiwan-based leader in display technology and electronic components, with a strong focus on innovation in optoelectronics. The company integrates Graphene Quantum Dots into its next-generation display panels to enhance color accuracy, energy efficiency, and brightness in consumer electronics, paving the way for advanced visual technologies.

Avantama, BOE Technology are some of the emerging market participants in Graphene Quantum Dots market.

-

Avantama, is a pioneer in nanomaterials and quantum dot development for electronic and optoelectronic applications. The company produces Graphene Quantum Dots tailored for high-performance display technology, organic electronics, and printed electronics, providing sustainable and efficient solutions for advanced material applications.

-

BOE Technology, a Chinese multinational specializing in semiconductor display solutions, is actively investing in Graphene Quantum Dots to revolutionize its next-generation display panels. The company integrates GQDs into OLED and micro-LED technologies to improve energy efficiency, enhance image quality, and support the development of flexible and transparent displays for high-end consumer electronics.

Key Graphene Quantum Dots Companies:

The following are the leading companies in the graphene quantum dots market. These companies collectively hold the largest market share and dictate industry trends.

- American Elements

- AUO

- Avantama

- BOE Technology

- HANSOLCHEMICAL

- LG

- Merck KGaA

- Microvision

- Nanoco

- NNCrystal

- Ocean Nanotech

- QDI Systems

Recent Developments

-

The new Wafer Device Facility (Fab) was unveiled by Nanoco in July 2024 to showcase the enhanced performance of its nanomaterials. The company can use this facility to show off its conductive layers and quantum dot materials on silicon wafers and test coupons.

-

TCL China Star debuted the newest QD-Mini LED TVs in June 2024. The corporation demonstrated its superior technological innovation to its South African clientele with this product introduction.

Graphene Quantum Dots Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.68 million

Revenue forecast in 2030

USD 15.67 million

Growth Rate

CAGR of 18.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan

Key companies profiled

American Elements; AUO; Avantama; BOE Technology; HANSOLCHEMICAL; LG; Merck KGaA; Microvision; Nanoco; NNCrystal; Ocean Nanotech; QDI Systems.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Graphene Quantum Dots Market Report Segmentation

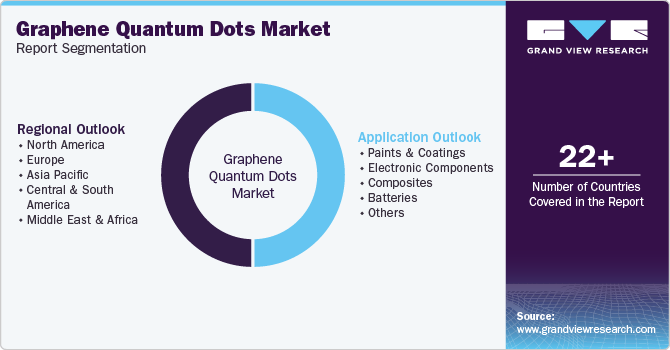

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global graphene quantum dots market report based on application and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Paints & Coatings

-

Electronic Components

-

Composites

-

Batteries

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global graphene quantum dots market size was estimated at USD 5.63 million in 2024 and is expected to reach USD 6.68 million in 2025.

b. The global graphene quantum dots market is expected to grow at a compound annual growth rate of 18.6% from 2025 to 2030 to reach USD 15.67 million by 2030.

b. The electronic components segment dominated the market and accounted for the largest revenue share of 30.0% in 2024 driven by increasing demand for high-performance, energy-efficient, and miniaturized electronic devices

b. Some of the key players operating in the graphene quantum dots market include American Elements, AUO, Avantama, BOE Technology, HANSOLCHEMICAL, LG, Merck KGaA, Microvision, Nanoco, NNCrystal, Ocean Nanotech, QDI Systems.

b. The key factors that are driving the graphene quantum dots market include rising demand for high-performance energy storage, advancements in biomedical imaging and drug delivery, increasing adoption in optoelectronics and display technologies, growing interest in sustainable nanomaterials, and ongoing research in quantum computing and sensing applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.