- Home

- »

- Power Generation & Storage

- »

-

Graphene Battery Market Size, Share & Trends Report, 2030GVR Report cover

![Graphene Battery Market Size, Share & Trends Report]()

Graphene Battery Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Lithium-ion Graphene Battery, Lithium Sulphur Graphene Battery, Graphene Supercapacitor), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-256-0

- Number of Report Pages: 220

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Graphene Battery Market Summary

The global graphene battery market size was estimated at USD 170.86 million in 2023 and is projected to reach USD 848.27 million by 2030, growing at a CAGR of 26.3% from 2024 to 2030. Advancements in electric vehicle industry and the ever-growing demand for high-performance electronics is expected to augment market growth.

Key Market Trends & Insights

- The Asia Pacific is poised for a significant CAGR of over 26.0% between 2024 and 2030.

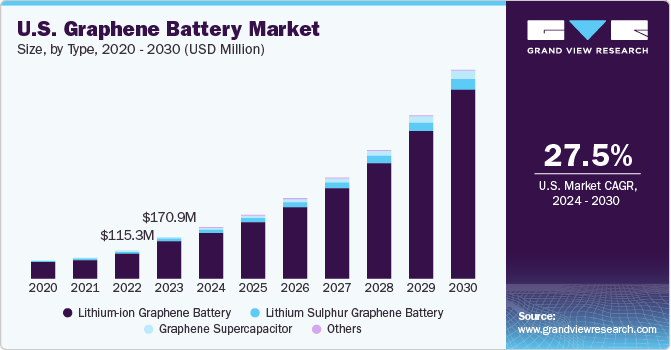

- The U.S. is expected to grow at a CAGR of 27.5% from 2024 to 2030.

- By type, lithium-ion graphene battery emerged as the largest segment with a market share of about 89% in 2023.

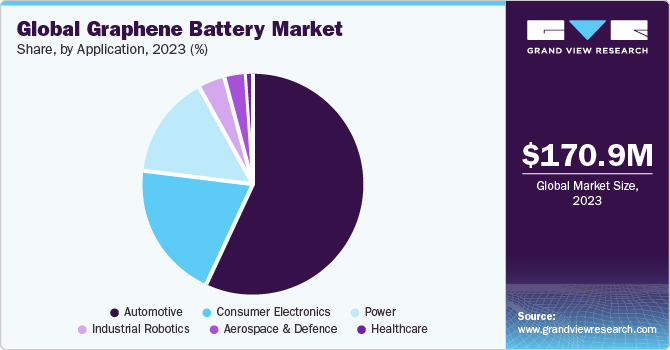

- By application, the automotive segment dominated global market, accounting for a revenue share of more than 56% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 170.86 Million

- 2030 Projected Market Size: USD 848.27 Million

- CAGR (2024-2030): 26.3%

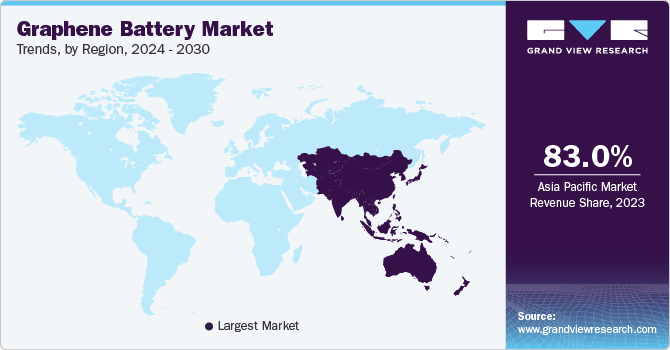

- Asia Pacific: Largest market in 2023

The U.S. is a leader in electric vehicle (EV) production and consumer electronics. As these industries prioritize longer range, faster charging times, and improved efficiency, graphene batteries become increasingly attractive. Their potential for higher energy density and faster charging cycles aligns perfectly with these demands. Additionally, the U.S. has a strong focus on renewable energy storage solutions, and graphene batteries could play a significant role in grid storage and backup power due to their potential for faster charging and discharging cycles. Funding from universities, research institutions, and private companies is accelerating innovation and is expected to lead breakthroughs that pave the way for mass production and commercialization of graphene batteries in the U.S. Also, the U.S. is increasingly focused on sustainable energy solutions and reducing dependence on fossil fuels. Graphene batteries boast faster charging and discharging cycles, potentially improving grid storage capabilities for renewable energy sources like solar and wind. Additionally, their lighter weight is expected to benefit the aerospace industry for more efficient and sustainable aircraft.

Market Concentration & Characteristics

Graphene battery technology is still in its early stages of development. This means there are no established players dominating the market share. The market consists of a mix of established battery manufacturers, research institutions, startups, and universities. Leading companies like Toray Industries, LG Chem, PPG Industries, Sekisui Chemical, and Fraunhofer-Gesellschaft are leading patent filer in the graphene battery industry. Startups and smaller companies are entering fray with innovative technologies and disruptive business models.

Companies are increasingly focusing on launching innovative product in order to increase their foothold in market. For instance, in February 2024, Ipower Batteries, an Indian based battery manufacturer launched graphene series lead-acid batteries. The new battery will contribute to growth of the EV industry in India and shall be used as an alternative against lithium batteries.

Type Insights

Lithium-ion graphene battery emerged as the largest segment with a market share of about 89% in 2023. It is expected to witness robust growth over forecast period. This technology combines the established strengths of Lithium-ion batteries with the remarkable properties of graphene. Graphene enhances traditional Lithium-ion batteries by offering faster charging times, increased energy density, and potentially longer lifespans. These improvements hold immense appeal for industries like electric vehicles, consumer electronics, and renewable energy storage.

Lithium Sulphur Graphene Battery segment is anticipated to grow at the fastest rate over forecast period. A key driver for the lithium sulphur graphene battery market is its potential to significantly surpass traditional Lithium-ion batteries in terms of energy density. Lithium Sulphur batteries boast a theoretical energy density several times higher, allowing them to store much more power in the same volume.

Application Insights

The automotive segment dominated global market, accounting for a revenue share of more than 56% in 2023. The quest for longer driving ranges, faster charging times, and lighter weight vehicles has made lithium-ion graphene batteries prominence in the competitive market.

Graphene's remarkable properties offer significant advantages over traditional Lithium-ion batteries. It enhances conductivity, enabling faster charging and discharging cycles. Additionally, graphene's potential to increase energy density translates to a longer driving range on a single charge—a critical factor for consumer adoption of electric vehicles. Furthermore, graphene's lighter weight could contribute to the overall weight reduction of electric vehicles, improving efficiency and potentially extending range even further. These combined benefits position Graphene Batteries as a game-changer for the automotive industry, paving the way for a future of more efficient, sustainable, and long-range electric vehicles.

The industrial robotics segment is anticipated to exhibit the highest growth over the forecast period. As Industry 4.0 advances, robots are becoming more sophisticated and require higher levels of power and data processing. Graphene battery’s superior power density could be a potential, allowing robots to handle more demanding tasks and integrate seamlessly with future industrial automation trends. These factors are expected to spur graphene battery market value in the future.

Regional Insights

The North America market for graphene batteries is poised for growth during the forecast period, driven by the growing electric vehicle (EV) market and demand for efficient energy storage. Major players in both graphene and EV manufacturing are collaborating to develop graphene-based anode materials for lithium-ion batteries, aiming for faster charging, longer range, and environmentally friendly solutions. This trend is expected to be further fueled by rising investments in graphene battery research and development. However, the high production costs of graphene remain a challenge in the challenging environment.

U.S. Graphene Battery Market Trends

The graphene battery market in the U.S. is expected to grow at a CAGR of 27.5% from 2024 to 2030. It is poised for significant growth, driven by two key trends. Firstly, there's a growing demand for longer-lasting and faster-charging batteries, particularly in electric vehicles and consumer electronics. Graphene's unique properties hold immense promise for achieving these goals. Secondly, rising environmental concerns are pushing for a shift towards sustainable technologies. Graphene batteries are seen as a cleaner alternative to traditional batteries, further fueling market expansion.

Europe Graphene Battery Market Trends

Graphene battery market in Europe is expected to witness moderate growth over the forecast period. The growth in this region is fueled by stringent environmental regulations and a strong electric vehicle industry. Europe is expected to witness a CAGR of over 29% by 2030.

Germany graphene battery market held over 40.0% share of the Europe market due to various factors such as the thriving German automotive industry, particularly electric vehicles (EVs).

The graphene battery market in the UK is anticipated to grow at a CAGR of over 29.5% from 2024 to 2030. This growth can be attributed to government initiatives promoting clean technologies and research grants specifically for graphene battery development are providing a significant tailwind for the market.

France graphene battery market is growing at a significant CAGR of 34.0% over the forecast period. Growth can be attributed to the increasing focus on electric vehicles. For instance, new registrations of electric vehicles in France are expected to reach nearly 240,000 by 2026. With graphene batteries, French EV manufacturers could offer vehicles that compete more effectively with gasoline-powered cars.

Asia Pacific Graphene Battery Market Trends

Asia Pacific is poised for a significant CAGR of over 26.0% between 2024 and 2030. This boom is driven by factors like rising demand for electric vehicle production in countries such as China, Japan, South Korea, and India. The region accounted for the largest revenue share of about 83.0% in 2023. Governments in China, Japan, and South Korea, among others are at the forefront of this growth, driven by supportive policies, increasing disposable incomes, and growing environmental concerns. Government initiatives are promoting eco-friendly solutions. This includes policies that encourage electric vehicles and curb air pollution. As a result, there's a growing demand for high-performance batteries like graphene to power these sustainable technologies.

China graphene battery market held a dominant share of about 67.0% in the Asia Pacific region in 2023China's strong position in both graphene research and EV manufacturing positions it to be a global leader. Government support and a booming domestic EV market create a fertile ground for the rapid development and commercialization of graphene batteries. This could solidify China's dominance in the future of electric transportation.

The graphene Battery market in South Korea is anticipated to register a CAGR of about 29.0% from 2024 to 2030. South Korea boasts a powerhouse tech industry with giants like Samsung and LG Chem at the helm. These companies are heavily invested in battery research and development, and graphene is a major focus. Their expertise and resources position them perfectly to capitalize on this new technology.

Key Graphene Battery Company Insights

The market is moderately fragmented with the presence of a sizable number of medium and large-sized companies. The graphene battery industry is a dynamic landscape with established players in the battery space and innovative startups. Key companies are adopting several organic and inorganic growth strategies, such as facility expansion, new product development, research & development, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In December 2023, Nanotech Energy announced to inaugurate its 150 MW graphene battery production plant by early 2024 in California, U.S. The strategy shall help the company increase its market share in graphene battery market.

-

In November 2023, a conglomerate of 11 partners from six European nations officially launched the GRAPHERGIA project. The project aims to develop graphene-based materials into energy harvesting and storage devices.

Key Graphene Battery Companies:

The following are the leading companies in the graphene battery market. These companies collectively hold the largest market share and dictate industry trends.

- Samsung SDI

- Huawei Technologies Co., Ltd.

- Log 9 Materials Scientific Private Limited

- Cabot Corporation

- Grabat Graphenano Energy

- Nanotech Energy

- Nanotek Instruments, Inc.

- XG Sciences, Inc.

- ZEN Graphene Solutions Ltd.

- Graphene NanoChem

- Global Graphene Group

- Vorbeck Materials Corp.

- Graphenea Group

- Hybrid Kinetic Group Ltd.

- Targray Group

Graphene Battery Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 208.95 million

Revenue forecast in 2030

USD 848.27 million

Growth rate

CAGR of 26.3% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Samsung SDI;Huawei Technologies Co., Ltd.; Log 9 Materials Scientific Private Limited; Cabot Corporation; Grabat Graphenano Energy; Nanotech Energy; Nanotek Instruments, Inc.; XG Sciences, Inc.; ZEN Graphene Solutions Ltd.; Graphene NanoChem, Global Graphene Group; Vorbeck Materials Corp.; Graphenea Group; Hybrid Kinetic Group Ltd.; Targray Group

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Graphene Battery Market Report Segmentation

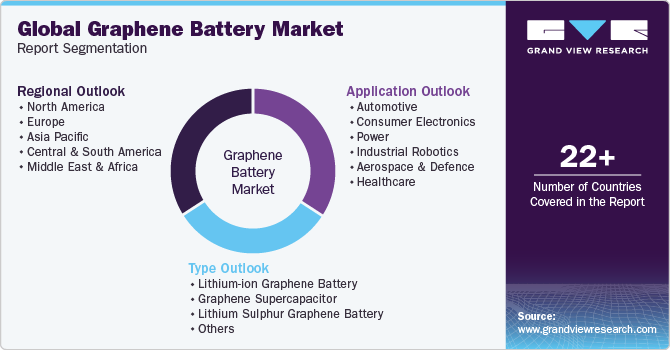

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the graphene battery market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Lithium-ion Graphene Battery

-

Graphene Supercapacitor

-

Lithium Sulphur Graphene Battery

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Consumer Electronics

-

Power

-

Industrial Robotics

-

Aerospace & Defence

-

Healthcare

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

- South Africa

-

-

Frequently Asked Questions About This Report

b. The global graphene battery market size was estimated at USD 170.86 million in 2023 and is expected to reach USD 208.95 million in 2024.

b. The global graphene battery market is expected to grow at a compounded annual growth rate of 26.3% from 2024 to 2030 to reach USD 848.27 million by 2030.

b. Based on application, automotive was the dominant segment in 2023 with a share of about 56.0% in 2023. This is attributable to the quest for longer driving ranges, faster charging times, and lighter weight vehicles has made lithium-ion graphene batteries prominence in the competitive market.

b. Some of the key players operating in this industry include Samsung SDI, Huawei Technologies Co., Ltd., Log 9 Materials Scientific Private Limited, Cabot Corporation, Grabat Graphenano Energy, Nanotech Energy, Nanotek Instruments, Inc., XG Sciences, Inc., ZEN Graphene Solutions Ltd., Graphene NanoChem, Global Graphene Group, Vorbeck Materials Corp., Graphenea Group, Hybrid Kinetic Group Ltd. and Targray Group.

b. Advancements in electric vehicle industry and the ever-growing demand for high-performance electronics is expected to augment market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.