Graph Database Market Size, Share & Trends Analysis Report, By Component (Solution, Service), By Type (SQL, and Non-SQL) By End-Use (BFSI, Retail & e-commerce), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-141-5

- Number of Report Pages: 82

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Graph Database Market Size & Share

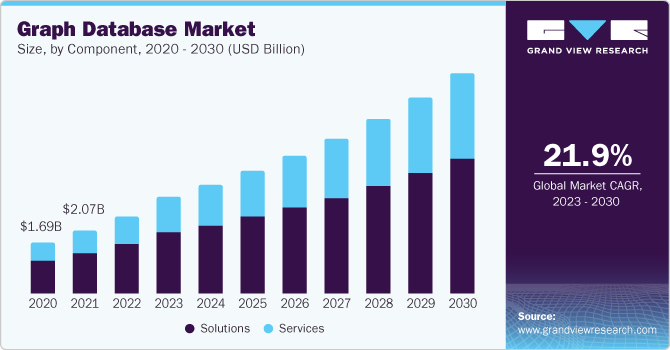

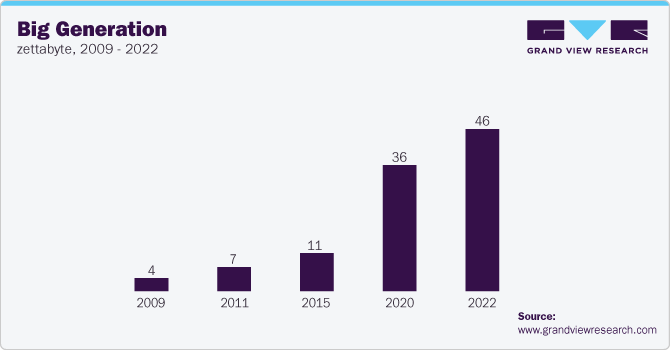

The global graph database market size was estimated at USD 2.57 billion in 2022 and is expected to grow at a CAGR of 21.9% from 2023 to 2030. The graph DB market is propelled by a surge in demand for solutions adept at handling complex relationships in data, with applications spanning social networks, fraud detection, and recommendation systems. As businesses increasingly recognize the limitations of traditional relational DBs in managing intricate connections, the rise of big data and the need for real-time analytics further fuel the adoption of graph databases. Their ability to represent and query relationships efficiently positions them as a pivotal technology in the evolving landscape of data management. Major players like Neo4j, Amazon Neptune, and others continue to innovate, expanding the market's growth, while industries such as finance, healthcare, and logistics leverage graph DBs to collect actionable insights from interconnected datasets.

In healthcare, graph databases play a pivotal role in transforming data management by capturing and leveraging complex relationships within medical information. These DBs prove invaluable in patient care coordination, offering a holistic view of a patient's journey through the healthcare system by modeling connections between medical records, treatments, and outcomes. Additionally, graph databases contribute to disease surveillance through network analysis, aiding in the identification and containment of outbreaks by visualizing connections between individuals, locations, and the spread of illnesses.

Graph databases revolutionize data management by effectively capturing and utilizing intricate relationships within supply chain networks. These databases play a pivotal role in route optimization, warehouse management, and supply chain visibility. By modeling and analyzing the complex web of connections between suppliers, distribution centers, transportation routes, and inventory levels, graph databases enable logistics professionals to make data-driven decisions that enhance efficiency and reduce costs. Real-time tracking of shipments, identifying bottlenecks, and optimizing delivery routes are made more effective through the relationship-centric approach of graph databases. The adoption of graph DBs in logistics underscores their ability to provide a dynamic and interconnected view of supply chain operations, ultimately improving responsiveness and resilience in the face of the ever-changing demands of the logistics landscape.

Component Insights

Based on the component, the graph database market is segmented into solutions and services. The solution segment held the largest market share in 2022, driven by the growing demand for advanced data modeling and analytics tools to manage complex relationships, particularly in industries such as healthcare, logistics, finance, and social networking, where efficient representation and querying of interconnected data are crucial for informed decision-making and improved operational efficiency.

The services segment in the graph database market is experiencing robust growth due to the complexity of implementing and managing graph databases, which forces organizations to seek specialized expertise. Additionally, as graph databases gain broader acceptance and adoption across various industries, the demand for training, support, and maintenance services has surged. Service providers also play a pivotal role in assisting companies in integrating graph databases with other technologies, ensuring a seamless data ecosystem. Furthermore, the dynamic nature of the technology and the evolving requirements of organizations call for continuous services, making it a thriving market segment in the graph database industry.

Type Insights

On the basis of type, the market is segmented into SQL and non-SQL. SQL dominated the market in 2022, asserting its prominence as a preferred choice for businesses and organizations seeking robust and structured query capabilities. The widespread use of SQL databases is attributed to their reliability, well-established standards, and compatibility with existing systems, making them instrumental in managing and retrieving data in various industries, including finance, e-commerce, and enterprise applications.

End Use Insights

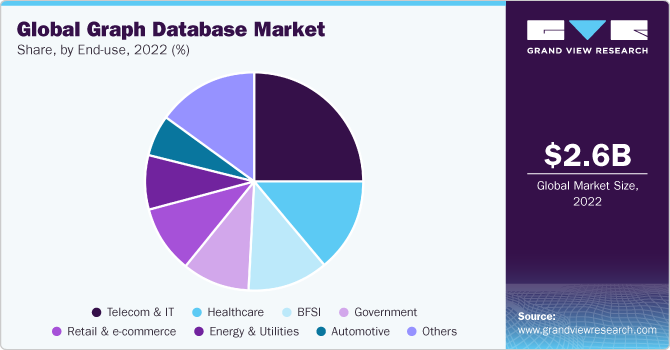

Based on end use, the graph database market is segmented into BFSI, Retail & e-commerce, Telecom & IT, Healthcare, Government, Automotive, Energy & Utilities, and Others. The Telecom & IT segment dominated the market in 2022, driven by the industry's increasing reliance on advanced data modeling for network optimization, predictive analytics, and personalized customer experiences. The intricate relationships between telecommunications and IT data make graph DBs a vital tool for enhancing operational efficiency, network management, and decision-making processes within this dynamic and rapidly evolving sector.

The healthcare industry has embraced graph database solutions as a versatile tool to address a variety of challenges and enhance patient care, research endeavors, and operational efficiency. The graph databases are instrumental in disease mapping & surveillance, tracking disease outbreaks, and monitoring infectious disease spread. Furthermore, pharmaceutical companies employ graph databases for drug discovery & development, streamlining chemical compound analysis and accelerating research. Additionally, these databases aid in clinical trials by matching patients with suitable studies, combating healthcare fraud, ensuring interoperability and health information exchange, and enhancing population health management.

Regional Insights

North America dominated the market in 2022, highlighting the region's leadership in the adoption and utilization of graph database technologies. This dominance is attributed to the robust presence of tech-driven industries, a mature ecosystem for data management solutions, and a growing recognition among enterprises of the importance of relationship-centric data modeling in various applications such as healthcare, finance, and logistics. The proactive integration of graph DBs into business operations has propelled North America to the forefront of the evolving landscape of data management.

Competitive Insights

Key players operating in the graph DB market are driving innovation and shaping the industry landscape. Prominent companies such as Neo4j, Amazon Neptune, Microsoft Azure Cosmos DB, and ArangoDB are at the forefront of advancing graph database technologies. Their continuous investment in research and development, coupled with a commitment to enhancing the capabilities of graph databases, positions these industry leaders as catalysts for the widespread adoption of graph DB solutions across various sectors.

In April 2021, MANTA, the data lineage platform, unveiled a fresh collaboration with Neo4j, a prominent figure in the graph technology realm. This partnership entails the integration of Neo4j's graph database technology directly into the MANTA platform, bolstering its capabilities for pipeline analysis.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."