Grant Management Software Market Size, Share, & Trends Analysis Report By Component (Solution, Services), By Deployment Mode (Cloud, On-premise), By Function, By Platform, By Organization, By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-542-9

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Grant Management Software Market Trends

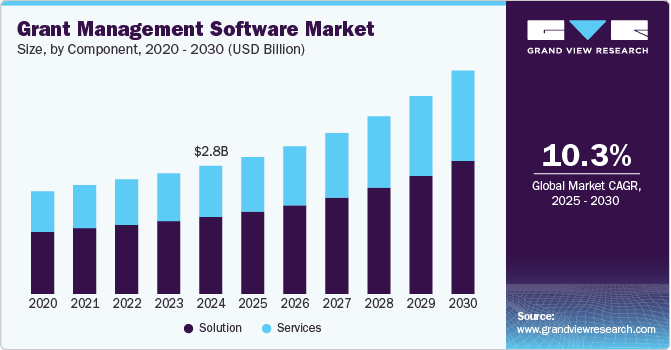

The global grant management software market size was estimated at USD 2,750.0 million in 2024 and is projected to grow at a CAGR of 10.3% from 2025 to 2030. The market is witnessing significant growth as organizations across government, education, healthcare, philanthropy, and corporations increasingly adopt digital solutions to streamline grant application, tracking, and reporting processes. This market encompasses software platforms designed to manage the entire grant lifecycle, including application submission, review, approval, fund disbursement, compliance monitoring, and performance evaluation. The demand for grant management software is rising due to the increasing complexity of grant administration, growing funding opportunities from government agencies and private entities, and the need for transparent financial management.

The increasing volume of grant applications and funding opportunities across industries is driving organizations to adopt automated grant management solutions to handle growing workloads efficiently. Governments, nonprofits, and corporations are allocating substantial resources to funding programs, necessitating advanced tools for tracking applications, managing disbursements, and ensuring compliance.

As funding mechanisms become more complex, manual processes are proving inefficient, leading to delays, errors, and lack of transparency. Automated grant management software streamlines workflows by digitizing application reviews, fund allocation, reporting, and compliance monitoring, reducing administrative burdens. In addition, real-time tracking and analytics improve decision-making by providing insights into fund utilization and program impact. Cloud-based and AI-driven solutions further enhance efficiency by enabling collaboration among multiple stakeholders, automating repetitive tasks, and detecting potential fraud. As grant funding continues to grow across sectors such as education, healthcare, and social services, the demand for scalable and efficient grant management systems is expected to rise.

The shift toward AI-driven automation and predictive analytics will significantly enhance grant management efficiency by automating repetitive tasks, improving decision-making, and offering real-time insights into funding impact. AI-powered chatbots and virtual assistants will streamline applicant interactions, reducing administrative burdens. In addition, blockchain technology is expected to play a crucial role in ensuring transparency and security in grant distribution by providing immutable records of transactions, minimizing fraud, and enhancing accountability. Cloud-based and mobile-first solutions will continue gaining momentum, enabling seamless collaboration and accessibility across devices, catering to an increasingly remote workforce.

High implementation and integration costs remain a major challenge for small and medium-sized enterprises (SMEs) and nonprofits with limited budgets. Many organizations still depend on legacy systems or manual processes due to concerns over the expenses associated with software deployment, staff training, and ongoing maintenance. The initial investment in cloud-based or AI-driven grant management solutions can be prohibitive, making it difficult for smaller entities to transition from traditional methods. To overcome these barriers, vendors must offer cost-effective pricing models, user-friendly interfaces, and scalable solutions tailored to smaller organizations' needs.

Component Insights

The solution segment dominated the market with a revenue share of over 60% in 2024. The increasing demand for automation and efficiency is driving the adoption of grant management solutions, as organizations handling multiple grants require streamlined application processing, fund disbursement, and compliance tracking. Advanced workflow automation reduces manual errors, enhances transparency, and ensures timely allocation of funds, making the grant process more efficient. Simultaneously, expanding government and private sector funding in areas such as education, healthcare, social welfare, and research & development is creating a need for centralized and scalable solutions. As funding programs become more complex, organizations must adopt automated grant management software to handle large volumes of applications, maintain compliance, and optimize resource distribution. This shift toward digital transformation ensures accountability and maximizes the impact of funding initiatives.

The services segment is expected to grow at a significant CAGR during the forecast period. The rising demand for software implementation and integration services is driven by organizations seeking seamless deployment of grant management software with existing ERP, CRM, and financial systems. Expert installation, configuration, and integration services ensure smooth adoption, enhancing operational efficiency. In addition, the need for customized solutions tailored to specific workflows is fueling demand for professional implementation services, enabling organizations to optimize grant tracking, compliance, and fund management.

Function Insights

The application tracking segment held the largest market share in 2024. The rising volume of grant applications across various sectors is driving the need for efficient application tracking systems. As funding opportunities increase, organizations must manage, sort, and evaluate a growing number of submissions. Manual tracking is time-consuming and prone to errors, making automation essential for streamlining the process. Automated tracking solutions enable faster application reviews, ensuring that submissions meet eligibility criteria and deadlines. These systems also enhance transparency and accountability, allowing grant providers to maintain a clear audit trail. By reducing administrative burdens and improving efficiency, application tracking software helps organizations optimize resource allocation and ensure timely and fair distribution of grants.

The reporting segment is expected to grow at a significant CAGR during the forecast period. The adoption of Artificial Intelligence (AI) and automation in reporting enhances efficiency by streamlining data collection, visualization, and predictive analytics. AI-powered tools eliminate manual data entry errors, ensuring accuracy and consistency. Automation enables organizations to generate real-time, customized reports, improving decision-making and compliance. These advancements help grant providers track fund utilization, measure impact, and optimize resource allocation, making reporting more efficient, transparent, and data driven.

Deployment Mode Insights

The on-premise segment held the largest market share of over 56% in 2024. On-premise grant management solutions are increasingly preferred due to their flexibility in customization and compliance with local regulations. Many organizations, particularly government agencies, nonprofits, and large enterprises, have specific reporting, audit, and security requirements that require tailored solutions. On-premise deployments allow organizations to modify workflows, reporting structures, and security protocols to meet industry and regional compliance standards, such as GDPR, HIPAA, and financial auditing laws. In addition, universities and research institutions managing multiple grants and funding programs favor on-premise solutions for secure data storage, audit trails, and compliance tracking. These institutions require long-term data retention, seamless integration with legacy systems, and full control over sensitive research funding data, ensuring efficient and secure grant administration while maintaining regulatory adherence.

The cloud segment is expected to grow at a significant CAGR during the forecast period. Cloud-based grant management solutions offer real-time access from any location, enabling seamless collaboration among grant managers, funders, and applicants. This is especially beneficial for organizations with distributed teams and international funding programs, ensuring efficient communication and workflow management. In addition, cloud platforms provide automatic updates, security patches, and feature enhancements without requiring IT intervention. This ensures that organizations always operate with the latest technology and compliance standards, reducing downtime and improving overall efficiency in grant administration.

Platform Insights

The web segment held the largest market share in 2024. Web-based grant management software provides widespread accessibility, allowing users to access the platform from any device with an Internet connection. This flexibility is essential for grant administrators, applicants, and reviewers working across different locations and time zones, ensuring seamless collaboration and real-time updates. In addition, web-based solutions are cost-effective and scalable, making them an attractive option for organizations looking to optimize grant management processes without significant IT investments. Compared to on-premise deployments, cloud-hosted web platforms offer lower upfront costs and the ability to scale as grant programs grow. This adaptability, combined with improved efficiency and accessibility, is driving the adoption of web-based grant management software across industries.

The mobile segment is expected to grow at a significant CAGR during the forecast period. Mobile-friendly grant management solutions enhance user engagement by providing intuitive interfaces and push notifications that deliver real-time updates on application statuses, deadlines, and compliance requirements. This ensures timely actions, reducing delays in the grant lifecycle. In addition, the integration of mobile applications with cloud-based grant management platforms allows seamless synchronization across multiple devices. Organizations benefit from improved coordination, data security, and accessibility, enabling grant administrators and stakeholders to manage processes from anywhere efficiently, increasing overall operational efficiency and responsiveness.

Organization Insights

The large organization segment held the largest revenue share in 2024. Large organizations are increasingly investing in AI-powered grant management platforms to enhance fund allocation efficiency, application evaluation, and fraud detection. AI-driven automation reduces manual processing time, ensures data accuracy, and enables predictive analytics for better decision-making. In addition, enterprises require seamless integration with ERP, Customer Relationship Management (CRM), and financial systems to automate workflows, track funding cycles, and maintain financial accountability. This integration eliminates data silos, enhances real-time visibility into fund utilization, and ensures compliance with regulatory requirements. By leveraging AI and enterprise system integration, organizations can streamline grant processes, improve operational efficiency, and ensure transparent, data-driven fund management while minimizing risks associated with fraud and misallocation.

The SMEs segment is expected to register a significant CAGR during the forecast period. SMEs often operate with limited budgets, making cost-effective and scalable grant management essential. Cloud-based platforms with subscription pricing models help SMEs reduce upfront costs while providing flexibility as their funding needs grow. In addition, governments and private organizations are expanding grant programs to support startups, small businesses, and innovation-driven projects. SMEs require efficient grant management tools to track applications, ensure compliance, and secure funding, enabling them to streamline processes and improve their chances of receiving financial support.

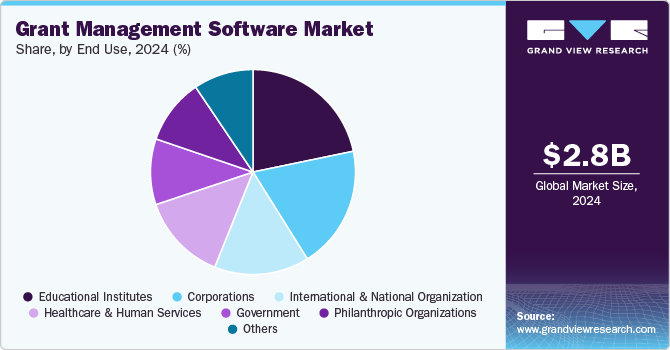

End Use Insights

The educational institutes segment dominated the market with a revenue share of over 21.0% in 2024. Universities and research institutions are receiving increasing grants from governments, private foundations, and corporations to support scientific research, innovation, and academic programs. Managing these diverse funding sources requires efficient grant management software to track applications, allocate funds, and ensure compliance with funding requirements. In addition, educational institutions must adhere to strict regulatory guidelines regarding fund usage, making compliance and audit readiness essential. Grant management software provides accurate financial tracking, automated reporting, and real-time audit trails, ensuring transparency and accountability. By streamlining funding workflows and compliance monitoring, institutions can optimize resource utilization, prevent financial mismanagement, and improve grant application success rates.

The corporations segment is expected to grow at a significant CAGR during the forecast period. Corporations are increasingly investing in Corporate Social Responsibility (CSR) initiatives, funding grants for education, sustainability, community development, and innovation. As CSR programs expand, companies require efficient grant management software to streamline application processing, automate fund allocation, and track impact. These solutions enhance transparency, compliance, and reporting, ensuring that funds are distributed effectively and aligned with corporate goals. By leveraging technology, corporations can optimize resource utilization, measure outcomes, and improve the overall efficiency of their CSR grant programs.

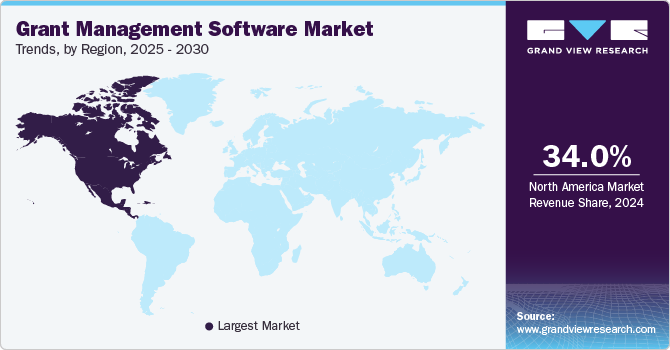

Regional Insights

North America grant management software industry held a significant global revenue share of over 34% in 2024. North America, particularly the U.S. and Canada, has a well-established grant ecosystem, with government agencies, private foundations, and corporations allocating significant funding for education, healthcare, social welfare, and research initiatives. The increasing volume of grants necessitates advanced grant management solutions for efficient tracking, allocation, and compliance.

U.S. Grant Management Software Market Trends

The grant management software industry in the U.S. is expected to grow significantly from 2025 to 2030. The U.S. government allocates billions of dollars annually in grants across sectors like education, healthcare, research, and social services. Agencies such as the National Institutes of Health (NIH), National Science Foundation (NSF), and Department of Education provide substantial funding, driving the need for efficient grant management solutions. Furthermore, U.S. organizations must comply with strict federal grant management regulations such as the Uniform Guidance (2 CFR 200) from the Office of Management and Budget (OMB). Automated grant management software ensures compliance, financial transparency, and audit readiness.

Europe Grant Management Software Market Trends

The grant management software industryin Europe is growing at a CAGR of 10.4% from 2025 to 2030. European organizations must adhere to complex financial reporting and transparency regulations, including the EU Financial Regulation and GDPR (General Data Protection Regulation). Grant management software helps institutions meet compliance standards through automated reporting, audit tracking, and secure data management. In addition, the presence of international NGOs, humanitarian organizations, and development agencies in Europe, such as the Red Cross and Oxfam, has led to an increasing need for efficient grant tracking, compliance management, and real-time reporting.

The UK grant management software industry is expected to grow rapidly in the coming years. The UK’s exit from the European Union has led to new funding structures, such as the UK Shared Prosperity Fund (UKSPF), replacing EU-based grant programs. This shift is driving the need for flexible, scalable grant management solutions that adapt to evolving policies. AI-driven grant management platforms are helping UK organizations automate application processing, detect fraudulent submissions, and optimize fund allocation, reducing manual errors and improving efficiency.

The Germany grant management software industry held a substantial market share in 2024. The German government is actively investing in digital transformation through initiatives like "Digital Strategy 2025", leading to increased adoption of cloud-based grant management solutions that improve transparency, efficiency, and real-time collaboration across multiple stakeholders.

Asia Pacific Grant Management Software Market Trends

The grant management software industry in the Asia Pacific is expected to grow significantly at a CAGR of 11.2% from 2025 to 2030. Governments across the Asia Pacific (APAC), including China, India, Japan, Australia, and Southeast Asia, are expanding public grant programs to support education, healthcare, infrastructure, and technology innovation. Initiatives such as India’s Startup India, China’s R&D grants, and Australia’s National Competitive Grants Program (NCGP) drive demand for automated grant management solutions to handle complex applications and fund disbursement processes.

The China grant management software industry held a substantial market share in 2024. As part of its Made in China 2025 and Five-Year Plans, China continues to increase R&D funding for industries such as biotechnology, artificial intelligence, green energy, and aerospace. The need for grant tracking and compliance tools in universities and research institutions like Tsinghua University, Chinese Academy of Sciences, and Peking University is fueling market growth.

The Japan grant management software industry held a notable market share in 2024. Japanese corporations are investing in CSR-driven grant programs focused on education, environmental sustainability, and social welfare. Companies like Toyota, Sony, and SoftBank allocate grants to startups, NGOs, and research institutions, driving the demand for grant management software to streamline application processing, fund disbursement, and impact measurement.

The grant management software industry in India is growing as the Indian government allocates significant funding for education, healthcare, rural development, and scientific research through agencies like the Department of Science & Technology (DST), Indian Council of Medical Research (ICMR), and University Grants Commission (UGC). The growing volume of grants requires automated solutions for efficient fund disbursement, application tracking, and compliance management.

Key Grant Management Software Company Insights

Some of the key market players in the global grant management software industry include Blackbaud, Benevity, Oracle, Salesforce, and The Funding Portal, among others. Companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In March 2025, Euna Solutions, a leading provider of SaaS solutions for the public sector, acquired AmpliFund, a prominent grant management platform. This strategic move enhances Euna's grant management offerings, combining expertise to better serve over 3,400 customers across North America. The acquisition adds more than 100 professionals to Euna's team, reinforcing its commitment to delivering innovative tools for government agencies and nonprofits.

-

In August 2024, Foundant Technologies and SmartSimple Software, leading providers of grants and philanthropic management software, merged to form a global leader in grant management solutions. This strategic partnership aims to enhance product offerings, expand support services, and accelerate innovation, including advancements in artificial intelligence, to serve the philanthropic and grants management communities better.

-

In July 2024, Blackbaud introduced new features to its Grantmaking platform, including an applicant-centric portal and an AI-powered form builder. The portal allows applicants to manage all their applications across funders using Blackbaud Grantmaking with a single login, enhancing accessibility and reducing administrative tasks. The AI-driven form builder enables dynamic form creation with conditional logic and supports translation into over 25 languages, streamlining the application process for both funders and applicants.

Key Grant Management Software Companies:

The following are the leading companies in the grant management software market. These companies collectively hold the largest market share and dictate industry trends.

- Blackbaud

- Benevity

- Oracle

- Salesforce

- The Funding Portal

- Goodstack

- Fluxx

- Foundant Technologies

- CyberGrants

- WizeHive

- Submittable

- AmpliFund

- eCivis

- GrantHub

Grant Management Software Market Report Scope

|

Report Attribute |

Details |

|

Market size in 2025 |

USD 2,937.0 million |

|

Market Size forecast in 2030 |

USD 4,791.8 million |

|

Growth Rate |

CAGR of 10.3% from 2025 to 2030 |

|

Actual data |

2018 - 2023 |

|

Base Year |

2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Market Size in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Market size forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, function, deployment mode, platform, organization, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, China, India, Japan, Australia, South Korea, Brazil, UAE, Saudi Arabia, and South Africa |

|

Key companies profiled |

Blackbaud; Benevity; Oracle; Salesforce; The Funding Portal; Goodstack; Fluxx; Foundant Technologies; CyberGrants; WizeHive; Submittable; AmpliFund; eCivis; GrantHub |

|

Customization scope |

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Grant Management Software Market Report Segmentation

This report forecasts market size growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global grant management software market report based on component, function, deployment mode, platform, organization, end use and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Services

-

-

Function Outlook (Revenue, USD Million, 2018 - 2030)

-

Performance and Outcomes Measurement

-

Application Tracking

-

Collaboration

-

Document Management

-

Reporting

-

Others

-

-

Deployment Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Web

-

Mobile

-

-

Organization Outlook (Revenue, USD Million, 2018 - 2030)

-

SMEs

-

Large enterprises

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Government

-

Healthcare and Human Services

-

Educational Institutes

-

Corporations

-

International and National Organization

-

Philanthropic Organizations

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global grant management software market size was estimated at USD 2,750.0 million in 2024 and is expected to reach USD 2,937.0 million in 2025.

b. The global grant management software market is expected to grow at a compound annual growth rate of 10.3% from 2024 to 2030 to reach USD 4,791.8 million by 2030.

b. The solution segment accounted for a market share of over 60% in 2024. The increasing demand for automation and efficiency is driving the adoption of grant management solutions, as organizations handling multiple grants require streamlined application processing, fund disbursement, and compliance tracking. Advanced workflow automation reduces manual errors, enhances transparency, and ensures timely allocation of funds, making the grant process more efficient. Simultaneously, expanding government and private sector funding in areas such as education, healthcare, social welfare, and research & development is creating a need for centralized and scalable solutions.

b. The key market players in the global grant management software market include Blackbaud, Benevity, Oracle, Salesforce, The Funding Portal, Goodstack, Fluxx, Foundant Technologies, CyberGrants, WizeHive, Submittable, AmpliFund, eCivis, and GrantHub.

b. The grant management software market is witnessing significant growth as organizations across government, education, healthcare, philanthropy, and corporations increasingly adopt digital solutions to streamline grant application, tracking, and reporting processes. The demand for grant management software is rising due to the increasing complexity of grant administration, growing funding opportunities from government agencies and private entities, and the need for transparent financial management.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."