- Home

- »

- Next Generation Technologies

- »

-

Grain Silos And Ancillary Equipment Market Size Report 2030GVR Report cover

![Grain Silos And Ancillary Equipment Market Size, Share & Trends Report]()

Grain Silos And Ancillary Equipment Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Grain Silos, Ancillary Equipment), By Application (Grain Transportation, Grain Storage), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-398-6

- Number of Report Pages: 250

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

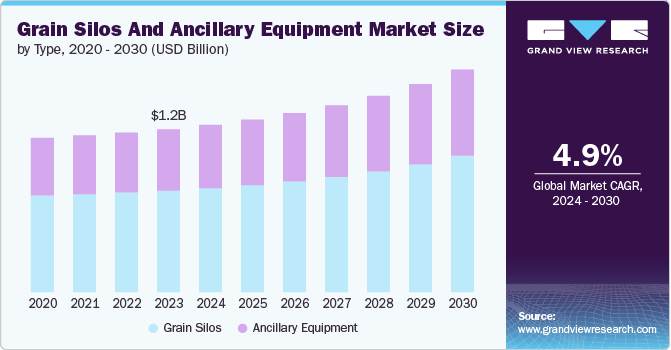

The global grain silos and ancillary equipment market size was estimated at USD 1.18 billion in 2023 and is expected to register a CAGR of 4.9% from 2024 to 2030. The growth of the market for grain silos and ancillary equipment is driven by factors such as increasing agricultural production, food security concerns, technological advancements, government initiatives and subsidies, and growing demand for efficient grain transportation. Increasing agricultural production is also a significant market growth driver. With the global population rising, there is a continuous need to produce more food to meet demand.

Advanced agricultural practices, including the use of high-yield crop varieties and precision farming, have led to substantial increases in crop production. This surge in output necessitates enhanced storage solutions to prevent post-harvest losses. Grain silos provide the capacity and conditions needed to store large quantities of grain safely. Efficient storage systems are critical to maintaining the quality of harvested grain until it is processed or sold. Countries worldwide are focusing on improving their agricultural output to ensure food security and economic growth. As a result, the demand for modern, efficient storage solutions like grain silos and ancillary equipment is on the rise.

Food security is a major concern for nations globally, driving the need for robust grain storage solutions. Efficient storage systems like grain silos are essential in maintaining the quality and safety of grain stocks, thereby ensuring a stable food supply. In regions prone to climate variability and natural disasters, having reliable storage infrastructure mitigates the risk of food shortages. Governments and international organizations are investing in modern storage facilities to safeguard food supplies against potential disruptions. Grain silos help in reducing post-harvest losses caused by pests, spoilage, and adverse weather conditions. Secure storage also supports stable market prices by preventing gluts and shortages. By preserving the nutritional value of stored grains, these facilities contribute to better food quality and public health. Consequently, the emphasis on food security directly fuels the demand for advanced grain silos and ancillary equipment.

Technological advancements are revolutionizing the grain silos and ancillary equipment market. Innovations such as automation, IoT (Internet of Things) sensors, and real-time monitoring systems are enhancing the efficiency and reliability of grain storage. Automated systems reduce labor costs and improve the precision of grain handling and storage processes. IoT sensors enable continuous monitoring of temperature, humidity, and other critical parameters, ensuring optimal storage conditions. These technologies help in the early detection of potential issues like pest infestations or spoilage, allowing for timely interventions. Improved materials and construction techniques are making silos more durable and resistant to environmental factors. The integration of smart technology in silos is also providing valuable data for better inventory management and logistical planning. As these advancements make grain storage more efficient and cost-effective, they drive market growth by attracting more investments in modern storage solutions.

Type Insights

The grain silos segment held the largest market share of 62.3% in 2023, due to their essential role in storing large quantities of grain safely and efficiently. Their ability to prevent spoilage and contamination makes them crucial for maintaining grain quality over extended periods. Additionally, increasing global grain production and the need for secure storage solutions drive the demand for grain silos. The segment benefits from technological advancements, such as automated systems and improved materials, enhancing storage capacity and durability. Lastly, government initiatives and subsidies supporting agricultural infrastructure further boost the adoption of grain silos, solidifying their dominant market position.

The ancillary equipment segment is expected to grow at the fastest CAGR of 5.3% from 2024 to 2030, due to the rising need for efficient handling, monitoring, and transportation of stored grain. Technological advancements in equipment such as conveyors, dryers, and automated control systems improve operational efficiency and reduce labor costs, driving adoption. The growing focus on precision agriculture and the integration of IoT and AI in farming practices enhance the functionality and appeal of ancillary equipment. Increasing awareness of post-harvest losses and the need to minimize them also fuel the demand for advanced ancillary solutions. Additionally, investments in agricultural infrastructure and modernization projects in emerging markets contribute to the rapid growth of this segment.

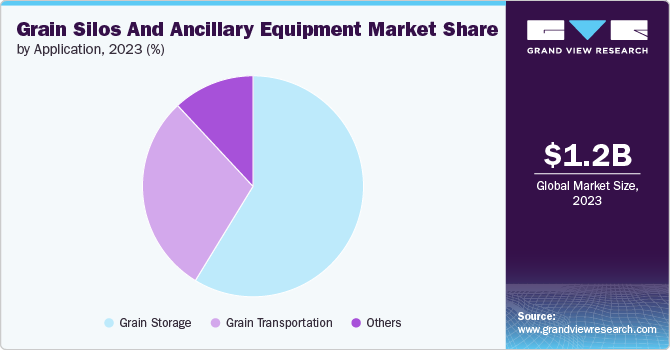

Application Insights

The grain storage segment held the largest market share of 58.7% in 2023, due to its critical role in preserving the quality and safety of harvested grain over extended periods. The need to prevent spoilage, contamination, and post-harvest losses has made efficient storage solutions essential for farmers and agricultural businesses. Technological advancements in storage systems, such as temperature and humidity control, further enhance their effectiveness and appeal. The increasing global grain production necessitates significant storage capacity, driving demand for advanced silos and storage equipment. Additionally, supportive government policies and subsidies for agricultural infrastructure development encourage the adoption of modern grain storage solutions, solidifying this segment's market dominance.

The grain transportation segment is expected to grow at the fastest CAGR over the forecast period, due to the increasing global demand for efficient and timely movement of grain from farms to storage and processing facilities. Advances in transportation technologies, such as automated conveyors and high-capacity grain handling systems, have improved efficiency and reduced transit times. The growth in international trade of agricultural products has also heightened the need for reliable grain transportation infrastructure. Furthermore, investments in logistics and supply chain improvements, particularly in emerging markets, have significantly contributed to the rapid growth of this segment.

Regional Insights

North America dominated the grain silos and ancillary equipment market in 2023 with a revenue share of 35.1%, primarily driven by extensive agricultural activities and high grain production in the region. The adoption of advanced storage and handling technologies to improve efficiency and reduce losses further fueled market growth. Additionally, strong government support and substantial investments in agricultural infrastructure contributed to North America's leading market position.

U.S. Grain Silos And Ancillary Equipment Market Trends

The growth of the grain silos and ancillary equipment market in the U.S. is propelled by the increasing need for efficient grain storage solutions to manage large-scale agricultural production. Technological advancements and innovations in grain handling and storage equipment enhance operational efficiency and reduce post-harvest losses, driving market demand.

Asia Pacific Grain Silos And Ancillary Equipment Market Trends

Asia Pacific is expected to grow at the fastest CAGR of 5.3% from 2024 to 2030, due to rapid agricultural modernization and infrastructure development in countries like China and India. The region's growing population and increasing food demand drive the demand for efficient grain storage and handling solutions. Additionally, rising investments in technology and automation in the agricultural sector contribute to the market's growth. Supportive government policies and initiatives aimed at enhancing food security and reducing post-harvest losses further propel the adoption of advanced grain storage equipment.

Europe Grain Silos And Ancillary Equipment Market Trends

Europe is expected to record a significant CAGR of 4.6% over the forecast period, due to increasing investments in modernizing agricultural infrastructure and storage solutions. The region's emphasis on reducing post-harvest losses and improving grain quality through advanced storage technologies also contributed to the growth. Additionally, supportive government policies and subsidies for agricultural development further bolstered the adoption of innovative storage and handling equipment.

Key Grain Silos And Ancillary Equipment Company Insights

Some of the key companies operating in the market include AGCO Corporation and Ag Growth International (AGI).

-

AGCO Corporation is a global leader in the design, manufacture, and distribution of agricultural equipment and solutions, including grain silos and ancillary equipment. The company offers a comprehensive range of products such as GSI grain storage systems, dryers, and material handling equipment, which are known for their durability and advanced technology.

Kepler Weber SA and Silos Cordoba SL are some of the emerging market participants.

-

Kepler Weber SA is a leading player in the grain silos and ancillary equipment market, specializing in post-harvest solutions. The company has established a strong presence in Latin America, providing a wide range of products and services, including grain storage systems, handling equipment, and industrial warehouses. The company emphasizes operational efficiency, expanding service capabilities, and leveraging strategic locations to gain a competitive edge in the market and better serve its customers.

Key Grain Silos And Ancillary Equipment Companies:

The following are the leading companies in the grain silos and ancillary equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Ag Growth International (AGI)

- AGCO Corporation

- Berkshire Hathaway Inc.

- Chief Industries Inc.

- CST Industries Inc.

- Satake Corp.

- Sioux Steel Co.

- Sukup Manufacturing Co.

- Superior Manufacturing LLC

- Symaga SA

- Silos Cordoba SL

- Kepler Weber SA

Recent Developments

-

In January 2024, AG Growth International Inc. (AGI) partnered with Cooperativa Agrária Agroindustrial and other cooperatives to commission the Maltaria Campos Gerais, a barley malting plant in Brazil, capable of producing 240,000 tons of brewer’s malt per year. AGI provided a complete grain handling and storage solution for the facility, enhancing local barley demand and fostering socio-economic growth in the region.

-

In July 2023, Kepler Weber SA announced the inauguration of its eighth distribution center in Brazil, located in Sorriso, Mato Grosso. The expansion represented an important milestone for the company, which now has eight centers in full operation in different regions across the country. The location in Mato Grosso, which is a significant grain production area, was chosen to enable better service distribution throughout the region and neighboring areas.

Grain Silos And Ancillary Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.21 billion

Revenue forecast in 2030

USD 1.62 billion

Growth rate

CAGR of 4.9% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Ag Growth International (AGI); AGCO Corporation; Berkshire Hathaway Inc.; Chief Industries Inc.; CST Industries Inc.; Satake Corp.; Sioux Steel Co.; Sukup Manufacturing Co.; Superior Manufacturing LLC; Symaga SA; Silos Cordoba SL, Kepler Weber SA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Grain Silos And Ancillary Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global grain silos and ancillary equipment market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Grain Silos

-

Ancillary Equipment

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Grain Transportation

-

Grain Storage

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global grain silos and ancillary equipment market size was valued at USD 1.18 billion in 2023 and is expected to reach USD 1.21 billion in 2024.

b. The global grain silos and ancillary equipment market is expected to witness a compound annual growth rate of 4.9% from 2024 to 2030 to reach USD 1.62 billion by 2030.

b. The grain storage segment held the largest market share of 58.7% in the grain silos and ancillary equipment market due to its critical role in preserving the quality and safety of harvested grain over extended periods.

b. Key players in the grain silos and ancillary equipment market include Ag Growth International (AGI), AGCO Corporation, Berkshire Hathaway Inc., Chief Industries Inc., CST Industries Inc., Satake Corp., Sioux Steel Co., Sukup Manufacturing Co., Superior Manufacturing LLC, Symaga SA, Silos Cordoba SL, Kepler Weber SA.

b. The grain silos and ancillary equipment market is driven by factors such as increasing agricultural production, food security concerns, technological advancements, government initiatives and subsidies, and growing demand for efficient grain transportation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.