- Home

- »

- Food Safety & Processing

- »

-

Grain Processing Equipment Market, Industry Report, 2030GVR Report cover

![Grain Processing Equipment Market Size, Share & Trends Report]()

Grain Processing Equipment Market (2025 - 2030) Size, Share & Trends Analysis Report By Mode of Operation (Semi-automatic, Automatic), By Machine (Pre Processing, Processing), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-477-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Grain Processing Equipment Market Trends

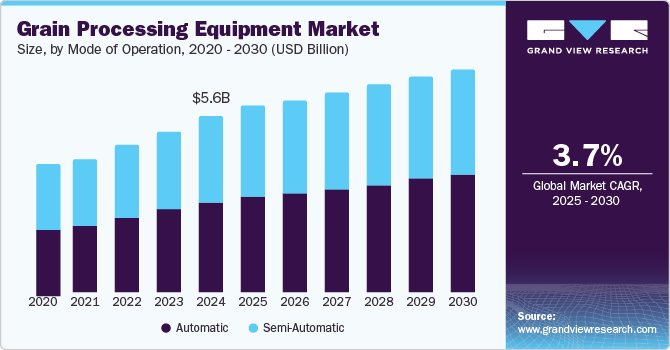

The global grain processing equipment market size was valued at USD 5.57 billion in 2024 and is expected to grow at a CAGR of 3.7% from 2025 to 2030. This growth is attributed to the increasing population, and food demand significantly boosts the need for efficient grain processing solutions. In addition, the rise in ready-to-eat food consumption, lifestyle changes, and higher family incomes further accelerates market growth. Furthermore, advancements in automation and robotics and integrating IoT technologies enhance operational efficiency and are expected to drive the market’s growth. Moreover, expanding the food and beverage industry and focusing on sustainable practices also contribute to the growing demand for grain processing equipment.

Grain processing equipment refers to machinery utilized for processing various grains, involving procedures such as cleaning, adjusting moisture content, and sizing to produce products for human and animal consumption. The growth of the global grain processing machinery market is significantly influenced by rising demand and technological advancements, particularly in urban areas. As populations increase and more people migrate from rural to urban settings, a growing market for processed and convenience foods is growing. This trend notably boosts the demand for grain-processing machinery.

In addition, advancements in technology such as automation, IoT integration, and energy-efficient designs enhance the efficiency and productivity of grain processing operations. These innovations allow manufacturers to streamline their processes and meet consumers' evolving needs. Furthermore, government support plays a crucial role in expanding this market. Various initiatives and subsidies to modernize agriculture and food processing encourage the adoption of advanced grain processing equipment.

Moreover, an increasing awareness of health and nutrition among consumers drives demand for high-quality processed grains. This heightened focus on fitness and dietary needs necessitates superior processing solutions to meet these requirements effectively. Consequently, the combination of growing consumer demand for convenience foods, technological innovations, supportive government policies, and a heightened emphasis on health collectively contribute to the robust expansion of the grain processing machinery market globally.

Mode of Operation Insights

The automatic mode of operation dominated the market and accounted for the largest revenue share of 50.8% in 2024. This growth is attributed to technological advancements and the demand for increased efficiency. Automation minimizes human intervention, leading to enhanced precision and consistency in processing. In addition, the rising focus on productivity and the need for high-quality grain products further propel this segment. Furthermore, integrating IoT technologies allows for real-time monitoring and control, making automatic systems more appealing to manufacturers seeking to optimize their operations.

The semi-automatic mode of operation is expected to grow at a CAGR of 3.0% over the forecast period, owing to its cost-effectiveness and ease of use. In addition, this segment benefits from the availability of labor, making it a practical choice for many producers. Semi-automatic systems require less capital investment than fully automated solutions, appealing to smaller operations. Furthermore, the adaptability of semi-automatic equipment allows for flexibility in processing various grain types, catering to diverse market needs while ensuring efficient production processes.

Machine Insights

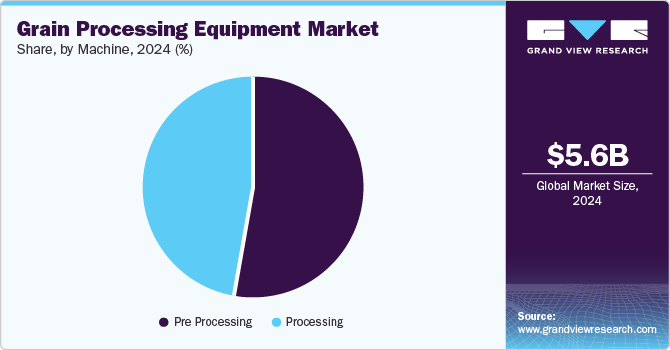

The pre-processing machine segment led the market and accounted for the largest revenue share of 53.2% in 2024, driven by the increasing demand for efficient grain cleaning and sorting. In addition, as the food and beverage industry expands, there is a growing need to remove impurities such as stones, straw, and other unwanted materials from harvested grains. Furthermore, rising awareness among farmers about modern grain processing technologies and the need for high-quality raw materials further propel the demand for pre-processing equipment, enhancing overall productivity.

The processing machine segment is expected to grow at a CAGR of 3.4% from 2025 to 2030, owing to the rising demand for processed grain products in various food applications. As consumer preferences shift towards convenience foods and ready-to-eat meals, manufacturers require advanced processing equipment to meet these needs efficiently. Furthermore, technological advancements in processing machinery, such as automation and IoT integration, enhance operational efficiency and product quality. This trend is supported by the expansion of commercial bakeries and flour mills, driving significant investments in processing machines.

Regional Insights

Asia Pacific grain processing equipment market dominated the global market and accounted for the largest revenue share of 43.9% in 2024 attributed to the increasing urbanization and rising disposable incomes, leading to higher demand for processed food. In addition, the rapid expansion of the food and beverage industry and changing consumer preferences for convenience foods significantly boost market growth. Furthermore, technological advancements and government initiatives promoting modern agricultural practices further enhance the adoption of grain processing equipment across developing countries such as India and China.

The grain processing equipment market in China dominated the Asia Pacific market and accounted for the largest revenue share in 2024, driven by the country's large population and the corresponding demand for food security. In addition, the government's focus on enhancing agricultural productivity through modernization and technological innovation plays a crucial role. Furthermore, urbanization trends are shifting consumer habits toward processed and convenience foods, which increases the need for efficient grain processing solutions. Investments in research and development by local manufacturers also contribute to market growth.

Latin America Grain Processing Equipment Market Trends

The Latin America grain processing equipment market is expected to grow at a CAGR of 2.4% over the forecast period, owing to rising agricultural production and a growing middle class demanding processed food products. Furthermore, increased investments in infrastructure and technology to improve food processing capabilities are significant drivers. Moreover, government policies to enhance food security and promote sustainable agricultural practices foster an environment conducive to adopting advanced grain processing equipment across countries such as Brazil and Argentina.

North America Grain Processing Equipment Market Trends

The grain processing equipment market in North America is expected to grow significantly over the forecast period, driven by high consumer awareness regarding food safety and quality. In addition, the region's established food and beverage industry demands advanced processing technologies to meet stringent regulations and consumer expectations. Furthermore, increasing investments in automation and robotics enhance operational efficiency within processing facilities. Moreover, the growing trend toward organic and specialty grains further stimulates demand for innovative grain processing solutions.

The U.S. grain processing equipment market dominated the North American market and accounted for the largest revenue share in 2024, owing to its position as one of the largest producers of grains such as maize, wheat, and sorghum. The government's supportive policies for agriculture and substantial investments in research and development promote advancements in processing technologies. Furthermore, a strong focus on sustainability and eco-friendly practices among U.S. consumers drives the demand for efficient grain processing equipment that meets modern standards.

Europe Grain Processing Equipment Market Trends

The Europe grain processing equipment market is expected to experience substantial growth over the forecast period, driven by stringent food safety regulations and a strong emphasis on quality assurance in food production. In addition, the region's advanced agricultural practices and high levels of mechanization contribute to increased efficiency in grain processing operations. Furthermore, consumer demand for organic and locally sourced products encourages manufacturers to adopt innovative technologies that enhance product quality while maintaining sustainability.

The growth of the grain processing equipment market in Germany is driven by its robust industrial base and emphasis on technological innovation. The country's commitment to sustainability drives investments in energy-efficient machinery that meets environmental standards. Furthermore, Germany's strong export orientation in processed food products necessitates high-quality grain processing solutions to maintain competitiveness in international markets. Moreover, the combination of advanced engineering capabilities and a focus on research further drives growth in this sector.

Key Grain Processing Equipment Company Insights

Some key global grain processing equipment industry companies include Bühler Group, WESTRUP A/S, Golfetto Sangati S.r.l., and others. These companies adopt various strategies, such as new product launches, forming strategic partnerships for enhanced distribution, investing in research and development to innovate products, focusing on sustainability and energy efficiency, and expanding their presence in emerging markets to capture growth opportunities and gain a competitive edge.

-

Osaw Agro Industries Private Limited manufactures a wide range of grain processing equipment, focusing on solutions that enhance efficiency and productivity in the agricultural sector. The company produces machinery for various applications, including grain cleaning, grading, and milling. Operating primarily in the grain processing segment, Osaw Agro is known for its innovative designs and robust equipment tailored to meet the diverse needs of grain processors, ensuring high-quality output and operational reliability.

-

Lewis M. Carter Manufacturing, LLC manufactures various equipment, including air/screen cleaners, designers, gravity separators, and packaging systems. Operating in the grain processing segment, the company focuses on delivering tailored solutions that maximize product purity and efficiency throughout the cleaning and separation processes, catering to each customer's unique requirements.

Key Grain Processing Equipment Companies:

The following are the leading companies in the grain processing equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Bühler Group

- Alvan Blanch Development Company Limited

- Osaw Agro Industries Private Limited

- WESTRUP A/S

- Golfetto Sangati S.r.l.

- PETKUS Technologie GmbH

- Lewis M. Carter Manufacturing, LLC

- Satake USA, Inc.

- Forsberg Agritech (India) Pvt. Ltd.

- Lianyungang Huantai Machinery Co., Ltd.

Recent Developments

-

In October 2024, Bühler Group unveiled its Grain Innovation Center, a state-of-the-art facility for advancing grain processing equipment and technologies. This center is a hub for innovation, focusing on developing sustainable solutions for the grain industry. It aims to enhance efficiency and productivity in grain handling and processing, fostering collaboration with industry partners. The initiative underscores Bühler's commitment to driving progress in grain processing, ultimately benefiting global food production and supply chains.

-

In March 2023, Mathews Company announced the launch of a new line of grain handling products designed to enhance efficiency in grain processing equipment. This innovative product line aims to address the evolving needs of the grain industry, providing advanced solutions for handling and processing grain. The company's commitment to quality and performance is evident in these new offerings, which are expected to improve operational productivity for grain processors and operators across various sectors.

Grain Processing Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.87 billion

Revenue forecast in 2030

USD 7.05 billion

Growth Rate

CAGR of 3.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Billion/Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Mode of operation, machine, region

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, Germany, Russia, UK, Italy, China, India, Japan, South Korea, Australia, Brazil, Argentina, South Africa, Saudi Arabia

Key companies profiled

Bühler Group; Alvan Blanch Development Company Limited; Osaw Agro Industries Private Limited; WESTRUP A/S; Golfetto Sangati S.r.l.; PETKUS Technologie GmbH; Lewis M. Carter Manufacturing, LLC; Satake USA, Inc.; Forsberg Agritech (India) Pvt. Ltd.; Lianyungang Huantai Machinery Co., Ltd.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Grain Processing Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global grain processing equipment market report based on mode of operation, machine, and region.

-

Mode of Operation Outlook (Revenue, USD Million, 2018 - 2030)

-

Automatic

-

Semi-Automatic

-

-

Machine Outlook (Revenue, USD Million, 2018 - 2030)

-

Pre Processing

-

Processing

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Russia

-

UK

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.