GPU Database Market Size, Share & Trends Analysis Report By Component (Tools, Service), By Deployment (On Premise, Cloud), By Application, By Vertical, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-385-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

GPU Database Market Size & Trends

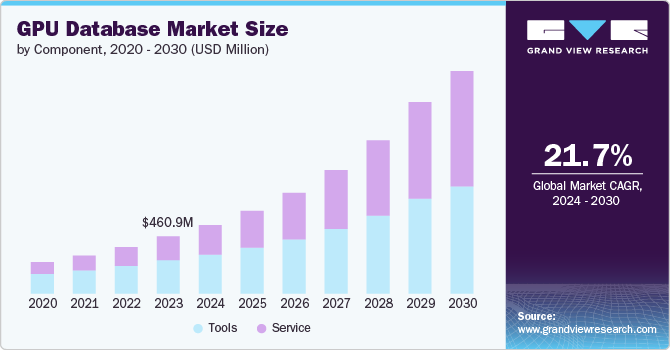

The global GPU database market size was estimated at USD 460.91 million in 2023 and is projected to grow at a CAGR of 21.7% from 2024 to 2030. Artificial intelligence (AI) and Machine Learning (ML) applications are heavily reliant on high computational power for tasks such as image and speech recognition. GPU databases offer the necessary processing capabilities to handle the vast amounts of data these applications generate. This has led to widespread adoption in healthcare, automotive, and finance industries. For instance, GPUs are crucial in training deep learning models that require intensive computational resources. As AI and ML evolve, the demand for GPU databases is expected to grow exponentially.

The era of big data has made real-time analytics a necessity for many businesses. Traditional databases often struggle with the volume, velocity, and variety of data generated today. With their parallel processing capabilities, GPU databases can handle these challenges effectively. They enable companies to analyze large datasets quickly, facilitating real-time decision-making. This is particularly valuable in sectors like retail, finance, and telecommunications, where timely insights can lead to competitive advantages.

The Internet of Things (IoT) and edge computing generate vast amounts of data that need to be processed in real time. GPU databases are well-suited for these applications due to their high processing power and efficiency. Edge computing, in particular, benefits from GPU databases as they enable data processing closer to the source, reducing latency and bandwidth usage. This is crucial for applications such as smart cities, industrial automation, and connected devices. As IoT and edge computing technologies advance, integrating GPU databases will become more prevalent, driving market growth.

Component Insights

The tools segment led the market, accounting for 58.64% of the global revenue in 2023. Tools that integrate GPU databases with popular data science and ML frameworks are becoming increasingly essential. These integrations enable data scientists to perform advanced analytics, model training, and inference tasks directly on GPU-accelerated databases. Frameworks such as TensorFlow, PyTorch, and Apache Spark have introduced GPU support, allowing seamless integration with GPU databases for scalable and high-performance analytics. As AI and machine learning applications continue to grow, so does the demand for tools that facilitate their integration with GPU databases.

The adoption of GPU databases necessitates specialized knowledge and skills. Training services are crucial to educating IT staff and data scientists on effectively using and managing GPU databases. This includes training on performance optimization, query writing, and leveraging GPU-specific features for data processing and analytics. In addition, ongoing support services ensure that users have access to expert assistance for troubleshooting and optimizing database performance. The need for continuous education and support is driving growth in this segment.

Application Insights

The governance, risk, and compliance segments hold the highest global revenue market share in 2023. The Governance, Risk, and Compliance (GRC) segment increasingly leverages GPU databases to enhance real-time risk management capabilities. GPU-accelerated databases enable organizations to process vast amounts of data quickly, allowing for immediate identification and mitigation of potential risks. This real-time analysis is crucial for financial institutions and other regulated industries that must adhere to stringent risk management protocols. By utilizing GPU databases, companies can detect anomalies, fraud, and compliance breaches in near real-time, significantly reducing the likelihood of costly incidents.

GPU databases are increasingly used in customer experience management (CEM) to provide real-time analytics and personalized experiences. The ability to process and analyze large volumes of customer data quickly allows businesses to offer tailored recommendations, personalized marketing campaigns, and individualized customer interactions. This level of personalization enhances customer satisfaction and loyalty by making customers feel valued and understood. As consumers expect more personalized experiences, the demand for GPU-accelerated databases in CEM continues to rise.

Deployment Insights

The on premises segment has the highest revenue share in 2023. Industries increasingly favor on-premises deployments in the market with stringent data sovereignty and compliance requirements. Finance, healthcare, and government sectors prioritize maintaining full control over their data to ensure adherence to local and international regulations. By keeping sensitive data within their own physical or virtual environments, organizations mitigate risks associated with data governance and sovereignty concerns. This approach enables them to implement specific security protocols, encryption standards, and access controls tailored to their regulatory obligations. On-premises solutions provide peace of mind regarding data residency, particularly in regions with strict data protection laws like GDPR in Europe or HIPAA in the United States. As regulatory scrutiny intensifies globally, the demand for on-premises GPU databases continues to grow among organizations seeking to safeguard sensitive information and maintain compliance.

Cloud deployments are increasingly favored in the market for their scalability and elasticity, allowing organizations to adjust computing resources based on workload demands dynamically. This flexibility enables businesses to scale up or down quickly in response to fluctuating data processing needs, optimizing resource utilization and cost efficiency. Industries with seasonal or unpredictable data workloads, such as retail during peak shopping seasons or healthcare during outbreaks, benefit from the ability to scale GPU-accelerated databases seamlessly without upfront hardware investments. This scalability also supports innovation and growth initiatives, enabling organizations to experiment with new applications and expand computational capabilities without infrastructure constraints.

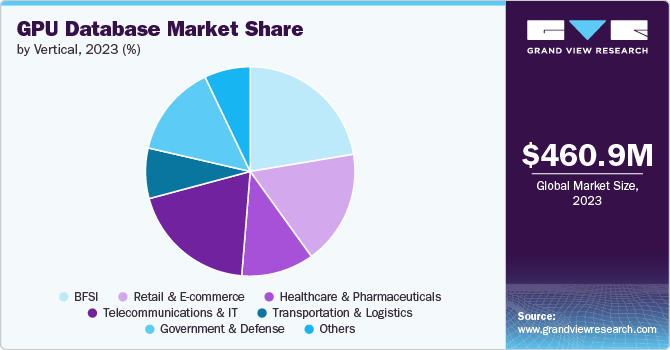

Vertical Insights

The BFSI segment holds the highest global revenue market share in 2023. Data security and privacy are paramount in the BFSI sector, given the sensitive nature of financial data. GPU databases offer robust encryption and faster processing of security algorithms, ensuring that data is protected during storage and transmission. Financial institutions can leverage GPU databases to implement advanced security measures, such as real-time monitoring and anomaly detection, to safeguard against data breaches and cyber-attacks. As data security regulations tighten and cyber threats become more complex, the reliance on GPU databases for enhanced security measures is expected to increase.

GPU databases are revolutionizing the drug discovery and development process by enabling the rapid analysis of vast datasets from genomic studies, clinical trials, and molecular simulations. This acceleration helps identify potential drug candidates more quickly and efficiently. Pharmaceutical companies can simulate complex biological processes and interactions, significantly reducing the time and cost associated with bringing new drugs to market. Integrating AI and machine learning with GPU databases further enhances predictive capabilities, leading to more targeted and effective treatments.

Regional Insights

North America dominated the market and accounted for a 34.07% share in 2023. North America is witnessing significant market growth, driven by the rapid adoption of advanced analytics, AI, and machine learning technologies across various industries. The region's strong presence of tech giants and startups, particularly in the U.S., fuels innovation and investment in GPU-accelerated solutions. In addition, increasing demand for real-time data processing and analytics in sectors like finance, healthcare, and retail further propels the market.

U.S. GPU Database Market Trends

The GPU database market in U.S. thrives due to the strong emphasis on AI and machine learning applications in finance, healthcare, and technology industries. The presence of major tech companies and research institutions fosters a robust ecosystem for GPU-accelerated innovation. Furthermore, the growing need for high-performance data processing and real-time analytics in the digital economy is fueling market growth.

Europe GPU Database Market Trends

The GPU database market in Europe is expanding due to stringent data protection regulations, such as GDPR, which drive the demand for secure and efficient data processing solutions. The region's focus on digital transformation and smart city initiatives also contributes to the growth of GPU-accelerated databases. Moreover, industries such as automotive, manufacturing, and telecommunications are leveraging GPU databases for advanced simulations and real-time analytics.

Asia Pacific GPU Database Trends

The GPU database market in Asia Pacific is anticipated to register the fastest CAGR over the forecast period. The Asia Pacific region is experiencing rapid market growth, fueled by the increasing adoption of AI, IoT, and big data analytics across various sectors. Countries like China, Japan, and India lead the charge with significant investments in technology infrastructure and innovation. The region's booming e-commerce industry and the need for real-time customer insights drive the demand for GPU-accelerated databases.

Key GPU Database Company Insights

The market is highly competitive, with a concentrated landscape dominated by key players such as Nvidia Corporation, OMNISCI, INC., and SQream. To maintain market dominance, these industry leaders aggressively expand their customer base through strategic initiatives, including partnerships, mergers, acquisitions, collaborations, and product innovation. For instance, In September 2023, SQream, a data analytics firm, secured a $45 million investment to expand its GPU-powered platform for handling large datasets. The company caters to enterprises in sectors such as manufacturing, semiconductors, finance, telecom, and healthcare, with a client base including industry giants like Alibaba, Samsung, LG, Orange, and PubMatic. SQream's platform leverages GPU processing to enable faster and more efficient data queries for business intelligence, machine learning, and other applications. The company plans to use the new funding to continue its growth, particularly in the North American market, and explore advancements in processor technologies like quantum and optical processors to build the next generations of its service.

Key GPU Database Companies:

The following are the leading companies in the GPU database market. These companies collectively hold the largest market share and dictate industry trends.

- Anaconda Inc.

- Brytlyt

- Fuzzy Logix

- Graphistry

- HeteroDB, Inc

- Jedox

- Kinetica DB Inc.

- Neo4j, Inc.

- NVIDIA Corporation

- OMNISCI, INC.

- SQream

- Zilliz

Recent Developments

-

In March 2024, NVIDIA partnered with Google Cloud to offer GPU-accelerated databases and analytics on the Google Cloud Platform. By combining NVIDIA's GPU technology with Google Cloud's infrastructure, the partnership aims to enhance data processing and analysis capabilities for developers and enterprises. This partnership is expected to accelerate AI development, drive innovation, and position both companies as leaders in the market.

-

In March 2023, NVIDIA partnered with Microsoft Azure to bring GPU-accelerated databases and analytics to Azure. This partnership harnesses NVIDIA's GPU technology to enhance Azure's capabilities, enabling efficient handling of complex data workloads and boosting AI development. By integrating NVIDIA's AI Enterprise software with Azure Machine Learning, the partnership provides a robust platform for enterprises to build and manage AI applications. This strategic move solidifies NVIDIA and Microsoft's positions as leaders in the market.

GPU Database Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 552.1 million |

|

Revenue forecast in 2030 |

USD 1.80 billion |

|

Growth rate |

CAGR of 21.7% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

|

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; UAE; Saudi Arabia (KSA); South Africa |

|

Key companies profiled |

Anaconda Inc.; Brytlyt; Fuzzy Logix; Graphistry; HeteroDB, Inc.; Jedox; Kinetica DB Inc.; Neo4j, Inc.; NVIDIA Corporation; OMNISCI, INC.; SQream; Zilliz |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global GPS Database Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global GPU database market report based on component, application, deployment, vertical and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Tools

-

Service

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Governance, Risk, And Compliance

-

Customer Experience Management

-

Threat Intelligence

-

Fraud Detection And Prevention

-

Predictive Maintenance

-

Supply Chain Management

-

Others(Network management, Campaign Management)

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On premise

-

Cloud

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Retail and Ecommerce

-

Healthcare and Pharmaceuticals

-

Telecommunications and IT

-

Transportation and Logistics

-

Government and Defense

-

Others (Manufacturing, Oil and Gas, media and entertainment, energy and utilities)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global GPU database market size was estimated at USD 460.9 million in 2023 and is expected to reach USD 552.1 million in 2024.

b. The global GPU database market is expected to grow at a compound annual growth rate of 21.7% from 2024 to 2030, reaching USD 1.80 billion by 2030.

b. North America dominated the GPU database market with a share of 34.1% in 2023. The region is witnessing significant growth in the market, driven by the rapid adoption of advanced analytics, AI, and machine learning technologies across various industries.

b. Some key players operating in the GPU database market include Anaconda Inc., Brytlyt, Fuzzy Logix, Graphistry, HeteroDB, Inc, Jedox, Kinetica DB Inc., Neo4j, Inc., NVIDIA Corporation, OMNISCI, INC., SQream, and Zilliz.

b. Key factors driving market growth include an Exponential Increase in Data Generation Across Industries and Growing Demand for AI and Machine Learning Applications.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."