GPU As A Service Market Size, Share & Trends Analysis Report By Component (Solution, Services), By Pricing Model (Pay-per-use, Subscription-based Plans), By Organization Size, By Vertical, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-110-2

- Number of Report Pages: 124

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

GPU As A Service Market Size & Trends

The global GPU as a service market size was estimated at USD 3.80 billion in 2024 and is projected to grow at a CAGR of 22.9% from 2025 to 2030. The increasing volume of data and the demand for advanced data analytics have been major drivers behind the growing demand for GPU acceleration, especially in GPU-as-a-Service. GPUs excel at parallel processing, making them highly efficient at handling the computational demands of large-scale data processing and analysis tasks. Data-driven businesses often need to perform complex data analytics, such as running machine learning algorithms, deep learning models, and statistical analyses. GPUs can accelerate these computations, reducing the time required to derive meaningful insights.

Subscription-based plans gaming platforms have become increasingly popular. GPU as a Service is crucial in delivering high-quality gaming experiences to players without powerful gaming hardware. The powerful GPUs in the cloud can handle resource-intensive gaming tasks and render high-quality graphics, ensuring that players enjoy immersive and visually stunning gaming experiences. For instance, NVIDIA GeForce NOW is a cloud gaming platform developed by NVIDIA Corporation, a U.S.-based graphics processing unit (GPU) manufacturer. GeForce NOW allows users to stream and play games from the cloud on various devices, including laptops, desktops, smartphones, and NVIDIA SHIELD devices.

GPU as a Service is extensively utilized in artificial intelligence (AI) and machine learning (ML) applications due to its ability to accelerate computations and handle the complex processing demands of AI/ML algorithms. GPUaaS is important in the AI and ML landscape, expediting the development, training, and deployment of intricate models and facilitating the integration of AI-driven solutions in diverse industries. For instance, Amazon SageMaker, a service provided by Amazon Web Services, Inc., is a fully managed platform for building, training, and deploying machine learning models. SageMaker leverages GPUaaS to deliver high-performance and scalable ML solutions to businesses and developers.

Component Insights

The solution segment led the market and accounted for over 55% of the global revenue in 2024. The increasing popularity of GPU cloud computing solutions is a notable trend in the GPUaaS market. These solutions offer on-demand access to GPU resources for Artificial Intelligence (AI), Machine Learning (ML), and High-performance Computing (HPC) workloads. Businesses are turning to GPU cloud services for their scalability, cost-effectiveness, and ability to handle complex computational tasks efficiently. This trend is expected to continue as more industries embrace cloud-based GPU solutions to accelerate innovation and streamline their operations.

The services segment is anticipated to grow at a significant CAGR during the forecast period, driven by the rising demand for high-performance computing across various industries. This market includes several service segments, such as cloud-based GPU services, on-premises GPU solutions, and hybrid models that combine both. A notable trend in the GPUaaS market is the shift towards more flexible, scalable, and cost-effective pay-per-use pricing models. These models allow businesses to optimize their computing costs by scaling GPU resources up or down based on immediate needs, avoiding the expense of idle resources. This trend is particularly beneficial for industries with fluctuating computing demands, such as financial services, media & entertainment, and scientific research.

Pricing Model Insights

The subscription-based plans segment accounted for the largest market revenue share in 2024. Cloud providers such as Amazon Web Services, Inc., Microsoft Azure, and Google Cloud Platform (GCP) offer various GPUaaS subscription plans. These plans are priced based on factors such as GPU type, usage duration, and data transfer. Subscription plans are the dominant pricing model in GPUaaS. They provide users with flexibility and cost savings compared to pay-as-you-go options. Businesses can commit to a plan that meets their specific needs and budget, ensuring predictable costs and avoiding the upfront investment required for purchasing physical GPUs.

The pay-per-use segment is anticipated to grow at the fastest CAGR over the forecast period. Pay-per-use pricing models allow organizations to manage their computing expenses efficiently by enabling them to adjust GPU resources according to their current needs requirements. This model is particularly advantageous for users with intermittent or on-demand workloads, as it eliminates the cost of idle GPU resources when they are inactive. Cost optimization is especially critical for industries with variable computing demands, such as financial services, media & entertainment, and scientific research. By utilizing pay-per-use GPU-as-a-Service (GPUaaS), these organizations ensure they only incur costs for the resources they use, resulting in substantial savings and enhanced resource utilization.

Vertical Insights

The gaming segment accounted for the largest market revenue share in 2024, due to the increasing demand for high-performance graphics processing capabilities required for immersive gaming experiences. The adoption of cloud-based GPU services has enabled gamers to access advanced hardware without significant upfront investments, driving growth in this segment. In addition, the rise of esports, Virtual Reality (VR), and Augmented Reality (AR) gaming has further amplified the need for scalable and efficient GPU solutions, positioning gaming as a dominant application within the GPU as a service market.

The IT & telecom segment is anticipated to grow at the fastest CAGR during the forecast period due to its increasing reliance on high-performance computing (HPC) for managing complex data-intensive tasks. The adoption of GPUaaS enables IT and telecom companies to efficiently process large volumes of data generated by cloud computing, AI, and real-time analytics applications. This capability is essential for optimizing operations, improving network performance, and delivering seamless services in a data-driven environment. The deployment of advanced technologies such as 5G and edge computing also drives growth by requiring real-time data processing and low latency, which GPU acceleration can provide.

Organization Size Insights

The large enterprises segment dominated the market in 2024. The large enterprise segment showed the scalability and flexibility of GPUaaS to accommodate large enterprises' fluctuating computational demands. The GPU as a Service (GPUaaS) market caters to organizations of varying sizes, with the large-size organization segment playing a significant role in driving the adoption of GPUaaS services. Large organizations often have complex and resource-intensive computing requirements, making GPUaaS an attractive solution for optimizing their operations and enhancing their computational capabilities. The trend toward large organizations embracing GPUaaS reflects the growing demand for powerful computing resources to support critical decision-making processes in dynamic environments such as finance, logistics, and supply chain management.

The small & medium enterprises (SMEs) segment is expected to grow at the fastest CAGR during the forecast period. Small- and medium-sized organizations often face budget constraints and limited access to high-performance computing resources. However, the pay-per-use pricing models in the GPUaaS market have made GPU resources more accessible to these organizations. Pay-per-use pricing reduces the need for upfront commitments or long-term contracts, allowing small- and medium-sized businesses to access GPU resources without substantial initial investments. This trend has opened new opportunities for SMEs to leverage GPU computing for their AI, ML, and data analytics applications to compete on a level playing field with larger enterprises.

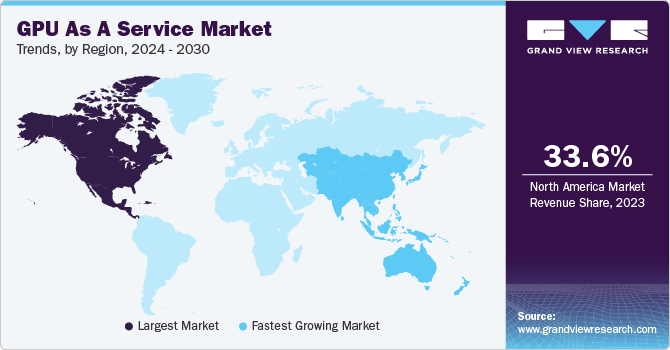

Regional Insights

North America GPU as a service market dominated the global market in 2024, accounting for over 32% share of the global revenue. The adoption of advanced solutions based on the latest technologies, such as cloud computing, analytics, Artificial Intelligence (AI), Machine Learning (ML), and High-Performance Computing (HPC), across diverse industries and verticals can be considered a significant highlight of the regional market. Governments in North America are investing heavily in rolling out a strong technological infrastructure and focusing on innovation and technological advancements, driving the demand for GPU resources for data-intensive tasks.

U.S. GPU As A Service Market Trends

The GPUaaS market in the U.S. is expected to grow substantially over the forecast period due to the increasing adoption of cloud-based solutions across industries such as gaming, artificial intelligence (AI), and data analytics. The demand for high-performance computing capabilities has surged, particularly in sectors such as healthcare, finance, and autonomous driving, where complex computations are essential. Additionally, the presence of leading tech companies and cloud service providers in the U.S. has accelerated the deployment of GPUaaS platforms, enabling businesses to scale their operations efficiently without significant hardware investments.

Europe GPU As A Service Market Trends

The GPUaaS industry in Europe is expected to witness significant growth over the forecast period. The demand for accelerated computing powered by GPUs is rising rapidly across Europe, driven by the continued implementation of applications based on AI, ML, and data analytics, among other modern technologies. Businesses in Europe prefer locally hosted cloud services to ensure adequate compliance with data protection regulations, such as the GDPR. The interest in environmentally friendly cloud solutions is also growing as sustainability is becoming a key consideration for organizations when selecting technology partners.

Asia Pacific GPU As A Service Market Trends

The GPUaaS industry in the Asia Pacific region is anticipated to register the highest CAGR over the forecast period, driven by rapid digital transformation and the growing adoption of AI and machine learning technologies across industries. Countries such as China, India, and Japan are witnessing increased demand for GPU-powered cloud solutions in sectors such as gaming, e-commerce, and smart city development. Furthermore, the region's expanding IT infrastructure and government initiatives promoting digitalization are leading to the growth of GPUaaS services.

Key GPU As A Service Company Insights

Some key companies in the GPUaaS industry are IBM Corporation, Amazon Web Services, Inc., Oracle, and NVIDIA Corporation.

-

NVIDIA Corporation is a technology company that designs and develops Graphics Processing Units (GPUs), Central Processing Units (CPUs), and system-on-a-chip units. The company’s products serve diverse applications across sectors such as professional visualization, gaming, data centers, and automotive. The company provides solutions for AI, data science, cloud computing, and self-driving vehicles.

-

Oracle is a technology corporation known for its database software, cloud computing systems, and enterprise software solutions. In the GPU as a Service (GPUaaS) market, Oracle provides cloud infrastructure that supports GPU-intensive workloads, catering to industries such as artificial intelligence, machine learning, data analytics, and scientific computing. Oracle Cloud Infrastructure (OCI) offers virtual machines and bare metal instances equipped with high-performance GPUs, enabling users to run demanding applications without the capital expenditure and operational overhead associated with on-premises GPU deployments.

Key GPU As A Service Companies:

The following are the leading companies in the GPU-as-a-Service market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services, Inc.

- Arm Limited

- Fujitsu

- HCL Technologies Limited

- IBM Corporation

- Intel Corporation

- Microsoft

- NVIDIA Corporation

- Oracle

- Qualcomm Technologies, Inc.

Recent Developments

-

In April 2025, NexGen Cloud Ltd., a U.K.-based GPU cloud company, raised USD 45 million in Series A funding, backed by high-net-worth individuals and family trusts. The funding is to support the expansion of its AI infrastructure in Europe and further development of its Hyperstack platform, which provides enterprise-grade AI compute services to over 10,000 users. NexGen Cloud Ltd. also plans to introduce new AI products, including Fine-Tuning-as-a-Service, to enhance the efficiency of pre-trained models and meet growing demand for AI solutions across the region.

-

In February 2025, powered by NVIDIA GB200 NVL72 systems, Google Cloud announced the preview of its A4X VMs. These systems consist of 36 Arm-based NVIDIA Grace CPUs and 72 NVIDIA Blackwell GPUs, interconnected via NVIDIA NVLink. These VMs are specifically designed to address the memory and computational demands of advanced AI workloads, including reasoning models and large language models with long context windows.

-

In February 2025, ST Digital, a cloud services provider, introduced GPU Cloud Africa, a pioneering GPU-as-a-service (GPUaaS) platform. This initiative provides African businesses and institutions with access to NVIDIA GPUs, enabling them to develop AI applications efficiently. The service aims to support the development of sustainable AI in Africa by offering a secure, locally-hosted environment for deep learning, big data analysis, and advanced simulations, thereby enhancing Africa's digital capabilities and AI innovation.

GPU As A Service Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 4.37 billion |

|

Revenue forecast in 2030 |

USD 12.26 billion |

|

Growth rate |

CAGR of 22.9% from 2025 to 2030 |

|

Historical data |

2017 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, pricing model, organization size, vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; U.K.; France; China; India; Japan; Brazil; KSA; UAE; South Africa |

|

Key companies profiled

|

Amazon Web Services, Inc.; Arm Limited; Fujitsu; HCL Technologies Limited; IBM Corporation; Intel Corporation; Microsoft; NVIDIA Corporation; Oracle; Qualcomm Technologies, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global GPU As A Service Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global GPU-as-a-service market report based on the component, pricing model, organization size, vertical, and region.

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Solution

-

Services

-

-

Pricing Model Outlook (Revenue, USD Million, 2017 - 2030)

-

Pay-per-use

-

Subscription-based plans

-

-

Organization Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Small & Medium Enterprises (SMEs)

-

Large Enterprises

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

IT & telecom

-

BFSI

-

Media and Entertainment

-

Gaming

-

Automotive

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Singapore

-

Malaysia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global GPU as a service market size was estimated at USD 3,353.9 million in 2023 and is expected to reach USD 3,797.8 million in 2024.

b. The global GPU as a service market is expected to grow at a compound annual growth rate of 21.6% from 2024 to 2030 to reach USD 12.26 billion by 2030.

b. North America dominated the GPUaaS market with a share of 33.6% in 2023. This is attributable to its robust technological infrastructure, presence of top-tier cloud service providers, and a flourishing ecosystem of tech companies and startups centered around AI and ML applications.

b. .Some key players operating in the GPU as a service market include Amazon Web Services (AWS), Arm Holding PLC, Fujitsu Ltd, HCL Technologies, IBM Corporation, Intel Corporation, Microsoft Corporation, NVIDIA Corporation, Oracle Corporation, and Qualcomm Technologies, Inc.

b. Key factors that are driving the market growth include the growing adoption of cloud computing, the increasing need for processing power at the edge of networks due to the growth of IoT and edge computing, ongoing advancements in GPU technology, and widespread adoption of the technology across various industries.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."