- Home

- »

- Homecare & Decor

- »

-

Golf Tourism Market Size, Share And Trends Report, 2030GVR Report cover

![Golf Tourism Market Size, Share & Trends Report]()

Golf Tourism Market (2025 - 2030) Size, Share & Trends Analysis Report By Tourist Type (Domestic, International), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68040-006-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Golf Tourism Market Summary

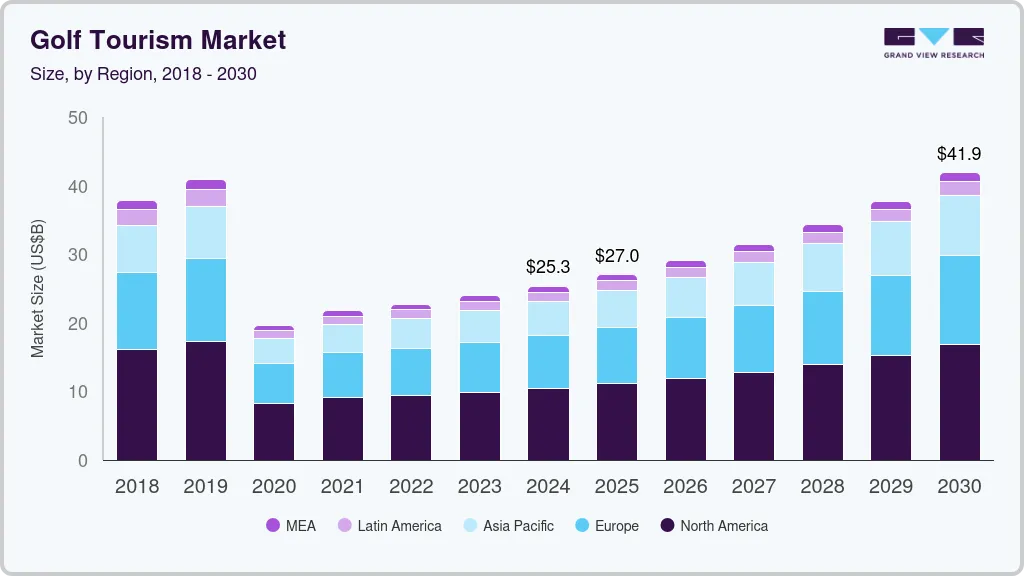

The global golf tourism market size was estimated at USD 25.34 billion in 2024 and is projected to reach USD 41.87 billion by 2030, growing at a CAGR of 9.1% from 2025 to 2030. Golf sport has emerged as a professional, amateur, & leisure activity in recent years involving considerable traveling.

Key Market Trends & Insights

- The golf tourism market in North America accounted for a market share of around 41% in 2024 in the global market.

- The golf tourism market in the U.S. accounted for a market share of around 71% in 2024.

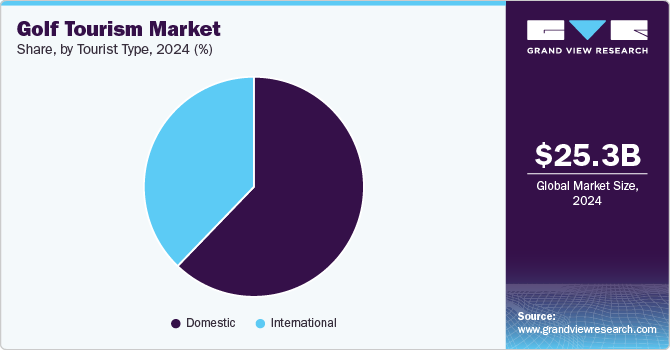

- Based on tourist type, the domestic tourism type segment captured the largest share and accounted for more than 62% of the total revenue in 2024.

Market Size & Forecast

- 2024 Market Size: USD 25.34 Billion

- 2030 Projected Market Size: USD 41.87 Billion

- CAGR (2025-2030): 9.1%

- North America: Largest market in 2024

The growth of the global market is primarily driven by the rising number of international and domestic tournaments across the globe, considerable spending on the set-up of enhanced sporting infrastructure, and an enormous rise in the number of professional and amateur golf players across the globe. In addition, sports authorities and governments across the globe are arranging domestic and international golf tournaments and making heavy investments to attract golfers and boost the local economy. For instance, in August 2022, Canadian Federal Government announced USD 4.4 million investment in Golf Canada’s two professional tournaments named the RBC Canadian Open and CP Women’s Open to promote golf participation, create important economic benefits, and attract tourists across the region. The pandemic impacted the industry and resulted in a significant decline in the number of golf travellers. The pandemic affected sports tourism and all international travel & global tourism. According to the statistics published by The World Tourism Organization (UNWTO) World Tourism Barometer, the pandemic caused an estimated loss of USD 1.3 trillion in export revenues and Asia Pacific suffered the highest level of impact due to the stringent travel restrictions.However, golf tourism continued to regain its lost ground after the relaxation of COVID-19 restrictions in several countries in Asia and Africa. In addition, a focus on sports tourism is anticipated to provide the struggling tourism industry a much-needed boost after being battered for almost two years by COVID-19 limitations as APAC countries tentatively welcomed international visitors. To increase their visibility to sports tourists seeking comprehensive services as well as enrichment, businesses in the golf tourism sector should put a high priority on creating holistic, integrated experiences

Rising interest in outdoor sporting events, government funding & measures to promote sports tourism, and growth in the number of young golfers are expected to make a profound impact on the global industry and offer tour operators an opportunity to enter untapped markets. The growth is also anticipated to be fuelled by the growing government backing for the industry. Various governments are marketing sports vacation spots to local and foreign travelers to increase their foreign exchange earnings through the growth of the specialty market and consequently support economic expansion. Governments across the globe are now keen to exploit the industry’s true potential given the popularity and future growth possibilities of this sport.

For instance, in August 2022, in Scotland, a new Golfing Tourism Development was launched, directed by the Scottish Golf Tourism Development Group (SGTDG). With a major focus on community engagement and improving health and well-being, and developing opportunities for young people, this initiative is expected to help support and shape the future of the industry in the coming years. Such initiatives are expected to create growth opportunities for a variety of industries, including lodging, tour operators, and travel agencies. A rise in professional female golfers has emerged as one of the major trends across the globe. This trend is expected to significantly impact the global market and consequently drive its growth. To cater to this trend, sports companies and government authorities across the globe are launching female tours to increase the participation of women in golf.

For instance, in September 2021, Golf Saudi and Aramco Team Series introduced ladies’ European tour golfing tournaments in Jeddah. The top female golfers in the world returned to Saudi Arabia for the greatest week of competitive women’s sport in the Kingdom, including 108 players competing for back-to-back events on the Ladies European Tour. Such initiatives are further expected to boost industry growth. Increased interest in outdoor activities and sports due to health advantages would provide favorable chances for market development. Innovation in the golfing sector and technological improvements are some other aspects that enable manufacturers to produce advanced golfing products, and as a result, the sport is expected to gain immense popularity across many countries.

Tourist Type Insights

The domestic tourism type segment captured the largest share and accounted for more than 62% of the total revenue in 2024. It is expected to maintain its dominance in the coming years. The pandemic continued to be a concern to the business. Thus, marketing campaigns and target market strategies have moved their attention largely to the phenomena of domestic travel. The segment's growth has been greatly supported by government development programs and considerable sports infrastructure expenditures, such as stadiums, sports clubs, playing fields, and the availability of athletic items for golfers. The international segment is expected to grow at a CAGR of 9.7% over the forecast period from 2025 to 2030.

International tourist type in the golf tourism market is anticipated to grow at a CAGR of 9.7% from 2025 to 2030. Various governments are promoting international tours to attract new golfers. For instance, in June 2022, DP World Tour and The British Junior Golf Tour (BJGT) launched a golfing development initiative that announced the launch of the World Junior Golfing Championship. The first competition will be held from February 14-16, 2023, at the Amendoeira Golf Resort in Portugal, providing young golfers with the chance to start their session with a high-quality international tournament. Such initiatives are expected to boost international tourism, making a significant impact on the global economy.

Regional Insights

The golf tourism market in North America accounted for a market share of around 41% in 2024 in the global market, on account of the rising number of professional golfing tours & tournaments and the ever-grown number of international and domestic golfers visiting golf courses in the U.S. According to the International Association of Golf Tour Operators (IAGTO), the U.S. market has significant capacity for growth and is expected to develop as an attractive market for international visitors across the globe. To attract golfers from across the globe, U.S. sports authorities & associations are taking major initiatives and consider sports as a key opportunity to rejuvenate the country’s tourism industry. This is further expected to boost the regional market in the coming years.

U.S. Golf Tourism Market Trends

The golf tourism market in the U.S. accounted for a market share of around 71% in 2024 in the North American market. Golf tourism in the U.S. thrives due to the country’s diverse landscapes, prestigious courses, and year-round golfing opportunities. The U.S. offers over 15,000 golf courses, from iconic destinations like Pebble Beach in California to the famous Augusta National in Georgia, each providing unique experiences that cater to golfers of all skill levels. Furthermore, golf's deep cultural roots in the U.S., bolstered by high-profile tournaments like the Masters and the U.S. Open, attract domestic and international tourists who view these events as bucket-list experiences.

Europe Golf Tourism Market Trends

The golf tourism market in Europe accounted for a revenue share of around 30% of global revenue in 2024. Europe's golf tourism is driven by its historic ties to the sport and the distinctive appeal of its famous courses, particularly in the UK, Scotland, and Ireland. Scotland is considered the birthplace of golf, with iconic courses like St. Andrews and Gleneagles, which draw golf enthusiasts from around the world. Countries like Spain and Portugal contribute with warm-weather resorts along the Mediterranean, while the UK and Ireland offer a mix of links courses that are often part of travelers’ itineraries due to their scenic, rugged landscapes.

Asia Pacific Golf Tourism Market Trends

The Asia Pacific golf tourism market is expected to grow at a CAGR of 10.3% from 2025 to 2030. Golf tourism is projected to grow significantly, driven by rising disposable incomes, a growing middle class, and an increasing interest in the sport across countries like Japan, South Korea, Thailand, and Australia. APAC also benefits from its variety of landscapes and climates, making it ideal for year-round golf tourism, with countries such as Thailand, Indonesia, and Vietnam offering tropical settings, while Japan and South Korea provide mountainous backdrops.

Key Golf Tourism Company Insights

The golf tourism market is highly competitive. Market players in golf tourism are investing in luxury resorts, exclusive golf packages, and high-profile tournaments to attract tourists, while enhancing course designs and facilities to cater to diverse preferences. They are also leveraging digital marketing and collaborations with travel agencies to reach a broader audience globally.

Key Golf Tourism Companies:

The following are the leading companies in the golf tourism market. These companies collectively hold the largest market share and dictate industry trends.

- Golfasian Co., Ltd.

- Premier Golf Tours

- The Haversham and Baker Co.

- PerryGolf

- Carr Golf

- Celtic Golf

- SGH Golf

- Golfbreaks Ltd.

- Golf Tours International

- travelOsports

Recent Developments

-

In September 2024, Elevate Golf, organized by industry veteran Tom Lovering, brought together up to 50 international tour operators and over 100 suppliers for bespoke appointments at the Old Course Hotel in St. Andrews in October. Notable suppliers included prestigious Open Championship venues like Royal Birkdale and Royal Troon.

-

In November 2023, ZEST.GOLF partnered with La Rioja, Spain, to launch a digital golf passport that offered bookings for the region's four golf courses: Logroño GC, Sojuela, Rioja Alta, and Izki Golf, designed by Seve Ballesteros. Recognized as an ‘Undiscovered Golf Destination’ by IAGTO, La Rioja aimed to attract golfers interested in its rich gastronomy, wine, and culture. The passport gained popularity among regional tourism boards, enhancing promotion efforts for golf offerings.

Golf Tourism Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 27.04 billion

Revenue forecast in 2030

USD 41.87 billion

Growth rate (Revenue)

CAGR of 9.1% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Billion/Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Tourist type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; and Middle East & Africa

Country scope

U.S; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; and South Africa

Key companies profiled

Golfasian Co., Ltd.; Premier Golf Tours; The Haversham and Baker Co.; PerryGolf; Carr Golf; Celtic Golf; SGH Golf; Golfbreaks Ltd; Golf Tours International; travelOsports

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Golf Tourism Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the golf tourism market report based on tourist type and region.

-

Tourist Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Domestic

-

International

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global golf tourism market was estimated at USD 25.34 billion in 2024 and is expected to reach USD 27.04 billion in 2025.

b. The global golf tourism market is expected to grow at a compound annual growth rate of 9.1% from 2025 to 2030 to reach USD 41.87 billion by 2030.

b. North America dominated the golf tourism market with a share of around 41% in 2023. The growth is mainly driven on account of well-developed economies, the availability of several golf courses, and widespread coverage of sports across the region.

b. Some of the key players operating in the golf tourism market include Golfasian Co., Ltd., Premier Golf Tours, The Haversham and Baker Co., PerryGolf, Carr Golf, Celtic Golf, SGH Golf, Golfbreaks Ltd, Golf Tours International, and travelOsports.

b. Key factors that are driving the golf tourism market growth include the rising number of international and domestic tournaments across the globe, considerable spending on the set-up of enhanced sporting infrastructure, and an enormous rise in the number of professional and amateur golf players across the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.