- Home

- »

- Display Technologies

- »

-

Golf Simulator Market Size And Share, Industry Report, 2030GVR Report cover

![Golf Simulator Market Size, Share, & Trends Report]()

Golf Simulator Market (2025 - 2030) Size, Share, & Trends Analysis Report By Offering (Hardware, Software, Services), By Type, By Simulator Type, By Installation Type, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-535-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Golf Simulator Market Summary

The global golf simulator market size was estimated at USD 1.74 billion in 2024 and is projected to reach USD 2.90 billion by 2030, growing at a CAGR of 9.4% from 2025 to 2030. The rising popularity of indoor and home-based sports experiences is driving the golf simulator industry growth. Golf simulators provide a convenient alternative, allowing players to practice and play the sport from the comfort of their homes or in commercial indoor facilities.

Key Market Trends & Insights

- North America held the significant share of over 46.0% of the golf simulator industry in 2024.

- The golf simulator industry in Europe is expected to register a CAGR of 9.3% from 2025 to 2030.

- Based on offering, the hardware segment dominated the market and accounted for a revenue share of over 59.0% in 2024.

- In terms of type, the portable segment accounted for the largest revenue share of the market in 2024.

- Based on simulator type, the full swing simulator segment accounted for the largest revenue share of over 70% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.74 billion

- 2030 Projected Market Size: USD 2.90 billion

- CAGR (2025-2030): 9.4%

- North America: Largest market in 2024

The increasing demand for home entertainment Hardware, coupled with technological advancements that make golf simulators more user-friendly and interactive, is contributing to sustained market growth. Technological advancements have revolutionized the golf simulator industry, enhancing realism, accuracy, and user experience. Artificial Intelligence (AI) plays a key role by analyzing swing mechanics, ball trajectory, and player performance in real time, providing personalized feedback and coaching insights. AI-powered simulators can track minute details such as club speed, ball spin, launch angle, and shot dispersion, helping golfers refine their skills with precision. 4K graphics and high-definition projectors have significantly improved the visual experience, making virtual golf courses more immersive and lifelike.

Players can experience famous real-world courses with stunning detail, from terrain textures to weather effects, creating a near-authentic golfing environment. Motion tracking technology has also advanced, using high-speed cameras and infrared sensors to capture player movements with extreme accuracy. This ensures precise simulation of swings, putting strokes, and ball impact, making the experience more realistic.

The commercial sector is increasingly adopting golf simulators as businesses recognize their potential to attract customers and enhance engagement. Golf academies leverage simulators for professional training, offering advanced swing analysis and virtual course play. Sports bars and entertainment centers integrate them to create interactive experiences, drawing in patrons looking for social and competitive gaming options. Luxury hotels and resorts use simulators as premium amenities, catering to high-end clientele seeking indoor recreation. Additionally, corporate spaces install golf simulators for employee wellness programs and team-building activities. In cold-weather regions like Canada, Northern Europe, and parts of Asia, where outdoor golfing is restricted during winter, simulators provide a year-round alternative, boosting their demand in both residential and commercial settings.

The high initial cost of golf simulators is a major challenge, especially for individuals and small businesses. Premium models with advanced sensors, high-definition projectors, and sophisticated tracking systems can cost tens of thousands of dollars, making them unaffordable for budget-conscious consumers. These high-end simulators offer superior accuracy, realistic ball physics, and detailed performance analysis, which are essential for professional training. While mid-range and entry-level models provide a more affordable option, they often lack precision, realistic graphics, and advanced swing analysis, limiting their appeal to serious golfers. The significant upfront investment required for premium systems remains a key restraint, preventing wider adoption in the residential and commercial markets.

Offering Insights

The hardware segment dominated the market and accounted for a revenue share of over 59.0% in 2024. With the rising popularity of indoor golf facilities, sports bars, and entertainment venues, businesses are investing in high-end simulator hardware to attract customers. High-resolution screens, realistic turf mats, and advanced swing analysis systems provide an immersive experience, making golf simulators a profitable investment for businesses in the hospitality and leisure industries. This trend is further supported by the increasing appeal of recreational golf among younger demographics, who prefer social and tech-driven experiences over traditional outdoor golf.

The software segment is anticipated to grow at a significant CAGR during the forecast period. The rising popularity of multiplayer and online gaming features is also propelling the software segment growth. Many simulator platforms offer online connectivity, allowing users to compete in virtual tournaments, challenge friends remotely, and join global leaderboards. This social gaming element has expanded the appeal of golf simulators beyond traditional golf enthusiasts to include younger players and competitive e-sports participants. Cloud-based software solutions enable seamless multiplayer game play with minimal lag, enhancing the interactive and competitive aspects of virtual golf. As the demand for social and connected gaming experiences continues to grow, software developers are focusing on improving network stability, matchmaking algorithms, and real-time data synchronization.

Type Insights

The portable segment accounted for the largest revenue share of the market in 2024. The rise of eSports and virtual golf tournaments is playing a crucial role in the expansion of the portable golf simulator market. Many portable systems allow players to participate in online golf competitions, where they can compete against others from around the world. These tournaments often feature leaderboards, skill-based rankings, and rewards, creating an engaging experience for players. As virtual sports gain popularity, golf simulator manufacturers are enhancing their software capabilities to support competitive gameplay, further driving demand for portable systems that enable users to participate in these events from anywhere.

The built-in segment is expected to grow at a notable CAGR during the forecast period. Commercial establishments such as sports clubs, fitness centers, and corporate entertainment venues are installing built-in golf simulators to attract customers and enhance their service offerings. These systems provide year-round golfing experiences in controlled environments, making them ideal for regions with extreme weather conditions or limited access to outdoor courses. Built-in simulators are often integrated into larger entertainment spaces, offering a premium experience that combines golf with social and competitive gaming elements. This trend is particularly strong in urban areas, where space constraints make traditional golf courses less accessible.

Simulator Type Insights

The full swing simulator segment accounted for the largest revenue share of over 70% in 2024. The influence of celebrity endorsements and professional golfer partnerships is fueling growth in full swing simulators. Leading golf simulator brands are collaborating with top-tier PGA Tour professionals, influencers, and celebrities to showcase the benefits of simulator-based training. High-profile endorsements help build credibility and generate excitement around full swing simulators, catering to both aspiring golfers and recreational players. Some brands even offer signature models co-developed with professional golfers, featuring specialized swing analysis tools tailored to mimic real-world tour conditions.

The virtual reality simulator segment is expected to grow at a significant CAGR during the forecast period. The expanding presence of VR arcades, entertainment venues, and eSports competitions is further accelerating the adoption of VR golf simulators. Many entertainment centers are incorporating VR golf experiences as part of their offerings to attract customers looking for unique and engaging activities. Additionally, the rise of eSports and competitive gaming has opened new opportunities for VR golf tournaments, where players can compete in high-stakes competitions from anywhere in the world. These developments are increasing the exposure of VR golf simulators and driving demand across different segments of the market.

Installation Type Insights

The indoor segment accounted for the largest revenue share in 2024. The growing adoption of subscription-based and pay-per-use business models is driving the expansion of the indoor golf simulator market. Many companies are now offering flexible pricing models, allowing users to access high-end golf simulation experiences without the need for a large upfront investment. Golf enthusiasts can subscribe to simulator services, paying monthly or per session, instead of purchasing expensive equipment outright. This model is particularly attractive to casual golfers, beginners, and businesses looking to add golf simulators to their entertainment offerings without a significant capital expenditure. As the demand for on-demand and flexible gaming experiences grows, subscription-based golf simulation services are expected to become increasingly popular.

The outdoor segment is expected to grow at a CAGR of over 9.0% during the forecast period. The expansion of outdoor golf simulator tournaments and eSports competitions is a major factor driving market growth. With advancements in internet connectivity and cloud-based leaderboards, outdoor simulators allow players to compete in real-time tournaments, whether at local driving ranges or across different locations worldwide. These virtual competitions provide an opportunity for golfers of all skill levels to engage in structured gameplay without the need to travel to physical golf courses.

End Use Insights

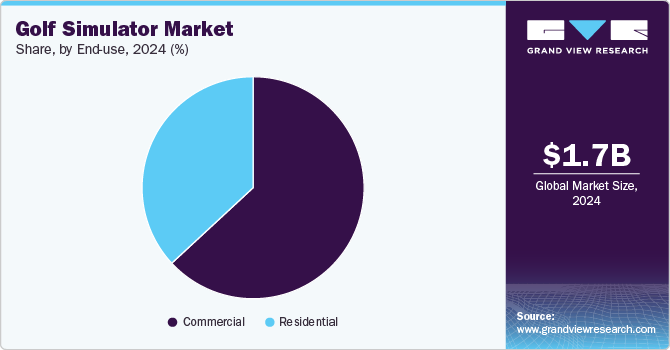

The commercial segment dominated the market and accounted for a revenue share of over 63% in 2024. The increasing popularity of indoor golf entertainment venues propels market expansion. Businesses such as golf lounges and simulator-based entertainment centers are leveraging golf simulation technology to cater to customers and enhance their service offerings. These venues provide a social and competitive golfing experience in an indoor environment, allowing patrons to play, practice, and compete regardless of weather conditions. As consumer demand for interactive and tech-driven entertainment experiences grows, more commercial establishments are integrating golf simulators to differentiate themselves from traditional entertainment options.

The residential segment is expected to grow at a significant CAGR during the forecast period. The rise of family-oriented recreational activities and multi-user gaming experiences is driving the segment growth. Unlike traditional golf, which requires traveling to a course and spending long hours on the greens, residential golf simulators offer a fun and engaging alternative that family members of all ages can enjoy. Many simulators now feature multiplayer modes, mini-games, and virtual challenges that make them suitable for casual players and non-golfers. Families looking for interactive indoor entertainment options are increasingly turning to golf simulators, as they provide a versatile and social gaming experience that can be played year-round.

Regional Insights

North America held the significant share of over 46.0% of the golf simulator industry in 2024. The North America market is witnessing significant growth due to its increasing adoption in corporate and hospitality sectors. Hotels, resorts, and corporate spaces are integrating golf simulators as luxury amenities, enhancing guest experiences and providing interactive entertainment options. Businesses are also using simulators for team-building activities, networking events, and executive leisure, making them a valuable investment.

U.S. Golf Simulator Market Trends

The golf simulator industry in the U.S. is expected to grow significantly from 2025 to 2030. the expansion of indoor golf centers and entertainment venues, such as Five Iron Golf, X-Golf, and Topgolf Swing Suites, has significantly contributed to market growth. These venues attract both dedicated golfers and social entertainment seekers, making simulators more mainstream. For instance, in September 2024, X-Golf America has announced the grand opening of X-Golf Nationals Park, bringing its advanced indoor golf simulation experience to Washington, D.C. The venue features cutting-edge technology, realistic gameplay, and social entertainment, catering to golfers of all levels. This expansion enhances urban golf accessibility and immersive sports entertainment. With continued technological advancements and rising consumer interest, the U.S. market is poised for sustained expansion in both residential and commercial sectors.

Europe Golf Simulator Market Trends

The golf simulator industry in Europe is expected to register a CAGR of 9.3% from 2025 to 2030. Advancements in golf simulator technology have significantly improved the realism and accuracy of indoor golfing experiences. Innovations in launch monitors, 3D course visualization, AI-driven analytics, and VR technology allow players to receive precise data on their swings, ball trajectory, and course conditions. Many Northern and Central European countries experience unpredictable weather, making year-round play difficult. Golf simulators provide an indoor alternative, enabling golfers to practice, train, and compete regardless of external conditions, further driving market growth.

The UK golf simulator market is expected to grow rapidly in the coming years. With increasing urbanization in major UK cities like London, Manchester, and Birmingham, access to outdoor golf courses is becoming more limited due to space constraints and rising land costs. As a result, indoor golf facilities are gaining popularity, offering a convenient and immersive golfing experience without the need for large outdoor spaces. Golf simulators provide realistic course play, swing analysis, and AI-driven performance tracking, making them appealing to both casual and professional players.

The golf simulator market in Germany held a notable market share in 2024. The expansion of indoor golf centers and entertainment venues is further fueling market growth. The rise of sports bars and simulator-based golf clubs has made indoor golf more social and appealing to a wider audience. Leading brands like TrackMan, Golfzon, and Foresight Sports are partnering with golf academies, coaching centers, and entertainment venues, enhancing training capabilities and making simulators more accessible to both professionals and casual players.

Asia Pacific Golf Simulator Market Trends

The golf simulator industryin the Asia Pacific is expected to grow significantly from 2025 to 2030. The rising popularity of golf as a recreational and professional sport in Asia-Pacific is driving the market growth. Countries such as Japan, South Korea, China, and India have seen a significant increase in golf participation, driven by expanding middle-class wealth, government support for sports development, and global exposure through international tournaments.

The China golf simulator market held a substantial market share in 2024. The growing trend of sports-themed entertainment venues and high-end leisure centers is contributing to the expansion of the market. Upscale entertainment hubs, sports bars, and luxury fitness clubs are incorporating golf simulators to cater to an affluent clientele seeking premium recreational experiences. These venues offer a blend of socializing, competition, and high-tech sports entertainment, making them attractive to business executives, corporate teams, and social groups.

The golf simulator market in Japan held a substantial market share in 2024. The rising interest in home-based entertainment and private golfing experiences is boosting the demand for residential golf simulators in Japan. With the impact of lifestyle changes brought about by remote work and the COVID-19 pandemic, more individuals are investing in premium home entertainment solutions. Affluent homeowners and golf enthusiasts who previously played on outdoor courses are now opting to install golf simulators in their residences to play the sport at their convenience.

India golf simulator market is growing due to the trend of experiential entertainment and premium leisure activities. As India's urban population expands and lifestyle preferences shift toward exclusive, high-end experiences, there is a greater demand for interactive entertainment solutions that blend sports, technology, and social engagement. The younger generation, particularly millennials and Gen Z, are increasingly looking for recreational options beyond conventional activities such as cinemas and dining out. High-end entertainment zones, luxury malls, and private clubs are incorporating golf simulators as part of their premium offerings, allowing individuals to play the game in an immersive and technologically advanced environment.

Key Golf Simulator Company Insights

The key market players in the global golf simulator market include aboutGOLF; BenQ; Bushnell Golf; ErnestSports; Foresight Sports; Full Swing Golf; GOLFZON; Optishot Golf; SKYTRAK; GOLFJOY LIMITED; X-GOLF AMERICA; Garmin Ltd.; Toptracer; FlightScope Golf; and Rapsodo Inc. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In February 2025, Rapsodo Inc. partnered with TruGolf’s E6 APEX, bringing expanded simulation capabilities to its Mobile Launch Monitor 2 Pro (MLM2PRO) for premium members. This integration enhances Rapsodo’s product offerings, allowing athletes of all skill levels to experience realistic playing conditions and refine their abilities through practice rounds and skill-based games. The collaboration follows a recent update to the MLM2PRO, which improved graphic quality and introduced junior tee locations to Rapsodo’s simulated courses, enhancing the overall gaming experience and making it more family-friendly. These advancements reflect Rapsodo’s ongoing commitment to enhancing and evolving its golf technology.

-

In February 2025, BenQ launched the AK700ST, the latest addition to its ACE Series and its most advanced golf simulator projector to date. Featuring a 4,000-lumen 4K laser light source, the AK700ST enhances golf simulation with lifelike detail, vibrant colors, and superior texture richness. Designed for seamless installation, it minimizes ambient light interference to deliver an immersive, play-like-you’re-there experience. As the first brand to develop a dedicated projector lineup for golf simulation, BenQ continues to expand its portfolio with models ranging from 1080p to 4K, catering to golf enthusiasts seeking high-quality, realistic gameplay.

-

In January 2025, Bushnell Golf launched the Bushnell Launch Pro Indoor (LPi), a cutting-edge indoor golf simulation system developed in collaboration with Foresight Sports. Designed to deliver professional-grade ball and club tracking, the LPi enhances accessibility, bringing Tour-level technology to everyday golfers. Building on the success of Bushnell Golf’s previous Launch Pro devices, this new model is optimized for indoor use, offering superior accuracy, advanced features, and an improved user experience, all at a more affordable price.

Key Golf Simulator Companies:

The following are the leading companies in the golf simulator market. These companies collectively hold the largest market share and dictate industry trends.

- aboutGOLF

- BenQ

- Bushnell Golf

- ErnestSports

- Foresight Sports

- Full Swing Golf

- GOLFZON

- Optishot Golf

- SKYTRAK

- GOLFJOY LIMITED

- X-GOLF AMERICA

- Garmin Ltd.

- Toptracer

- FlightScope Golf

- Rapsodo Inc.

Golf Simulator Market Report Scope

Report Attribute

Details

Market size in 2025

USD 1.85 billion

Market Size forecast in 2030

USD 2.90 billion

Growth rate

CAGR of 9.4% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Market Size in USD million/billion and CAGR from 2025 to 2030

Report coverage

Market Size forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Offering, type, simulator type, installation type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S,; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

aboutGOLF; BenQ; Bushnell Golf; ErnestSports; Foresight Sports; Full Swing Golf; GOLFZON; Optishot Golf; SKYTRAK; GOLFJOY LIMITED; X-GOLF AMERICA; Garmin Ltd.; Toptracer; FlightScope Golf; Rapsodo Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Golf Simulator Market Report Segmentation

This report forecasts market Size growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the golf simulator market report based on offering, type, simulator type, installation type, end use, and region:

-

Offering Outlook (Market Size, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Type Outlook (Market Size, USD Million, 2018 - 2030)

-

Built-in

-

Portable

-

Free Standing

-

-

Simulator Type Outlook (Market Size, USD Million, 2018 - 2030)

-

Full Swing Simulator

-

Virtual Reality (VR) Simulator

-

-

Installation Type Outlook (Market Size, USD Million, 2018 - 2030)

-

Indoor

-

Outdoor

-

-

End Use Outlook (Market Size, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Regional Outlook (Market Size, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global golf simulator market size was estimated at USD 1.74 billion in 2024 and is expected to reach USD 1.85 billion in 2025.

b. The global golf simulator market is expected to grow at a compound annual growth rate of 9.4% from 2025 to 2030 to reach USD 2.90 billion by 2030.

b. The full swing simulator segment accounted for the largest market share of over 70% in 2024. The influence of celebrity endorsements and professional golfer partnerships is fueling growth in full swing simulators. Leading golf simulator brands are collaborating with top-tier PGA Tour professionals, influencers, and celebrities to showcase the benefits of simulator-based training. High-profile endorsements help build credibility and generate excitement around full swing simulators, catering to both aspiring golfers and recreational players.

b. The key market players in the global golf simulator market include aboutGOLF, BenQ, Bushnell Golf, ErnestSports, Foresight Sports, Full Swing Golf, GOLFZON, Optishot Golf, SKYTRAK, GOLFJOY LIMITED, X-GOLF AMERICA, Garmin Ltd., Toptracer, FlightScope Golf, and Rapsodo Inc.

b. The rising popularity of indoor and home-based sports experiences is driving the golf simulator market growth. Golf simulators provide a convenient alternative, allowing players to practice and play the sport from the comfort of their homes or in commercial indoor facilities. The increasing demand for home entertainment Hardware, coupled with technological advancements that make golf simulators more user-friendly and interactive, is contributing to sustained market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.