- Home

- »

- Homecare & Decor

- »

-

Golf Club Market Size, Share & Trends, Industry Report 2030GVR Report cover

![Golf Club Market Size, Share & Trends Report]()

Golf Club Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Leisure, Professional), By Distribution Channel (Sporting Goods Retailers, Online, Department & Discount Stores), By Region (North America, Europe), And Segment Forecasts

- Report ID: GVR-4-68038-809-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Golf Club Market Summary

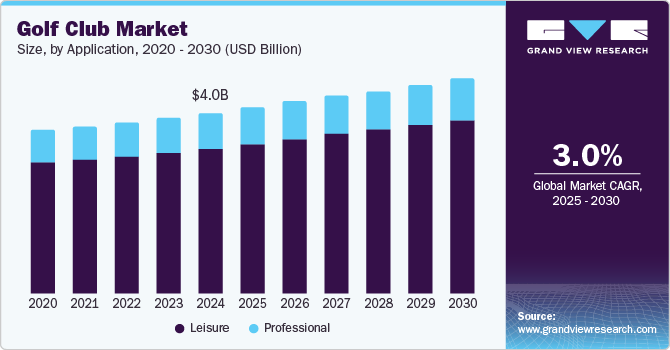

The global golf club market size was valued at USD 4.05 billion in 2024 and is projected to reach USD 4.83 billion by 2030, growing at a CAGR of 3.0% from 2025 to 2030. The market is majorly driven by the growing popularity and adoption of golf as an active sport.

Key Market Trends & Insights

- North America golf club market dominated the global market with a revenue share of 45.1% in 2024.

- U.S. golf club market held the largest share of the regional market.

- Based on applications, the leisure segment dominated the global golf club market with a revenue share of 80.1% in 2024.

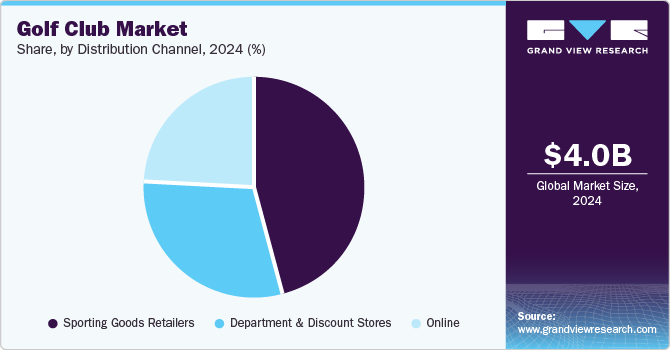

- By distribution channel, the sporting goods retailers segment held the largest revenue share of the golf club market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.05 Billion

- 2030 Projected Market Size: USD 4.83 Billion

- CAGR (2025-2030): 3.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Moreover, premium resorts and hotels are incorporating sporting activities into their hospitality facilities, and golf is one of them. According to an article published in 2024 by CiMSO, a hotel management software company, more than 100 million people globally engage in golf in various forms. The article also states that more than 62.3 million people play golf in the region overseen by The Royal & Ancient Golf Club of St Andrews, an increase of 1.1 million from the previous year. Such instances evidently support the growing sales of golf clubs. Additionally, establishment of several new miniature golf courses worldwide has increased the inflow of patrons and endorsing the game as a healthy leisure activity and thus, contributing to the rising sales of golf clubs.

The number of golf enthusiasts has been growing significantly, including individuals whose favorite sport or one of their many recreational pursuits is golf. In addition to traditional on-course golf, technology has facilitated the evolution of various forms of golf, including indoor golf and simulators. This has attracted a new breed of leisure golfers who traditionally considered golf a game for the elite. Several companies, such as the sports entertainment company Topgolf, have made innovative strides and introduced platforms to attract numerous consumers by making golf more fun and engaging. This has encouraged the golf club industry to develop and promote advanced golf clubs tailored to the game's requirements.

The selection of the right golf clubs has always been crucial for players to elevate their game. Traditionally, golfers had limited options to choose from. However, golf manufacturers are investing significantly in designing and developing new lines of golf clubs. The golf club industry manufactures clubs with composite materials that help to overcome the shortcomings of conventional wood or iron clubs. The latest golf clubs offer superior features, including adjustable hosels, high-speed face inserts, and technological sensors, such as accelerometers and smart computers that record and analyze players' performance. Young consumers prefer to buy trendy equipment, and experienced ones seek the technical specifications of the equipment. However, the consistently rising demand for better golf clubs is driving market growth in both cases.

Application Insights

Based on applications, the leisure segment dominated the global golf club market with a revenue share of 80.1% in 2024. The expansion of golf courses in key urban areas across the globe has played a major role in the sport's rising popularity. According to GolfLux, there are 38,081 golf courses across 206 countries, with consistent growth, particularly in countries with less established golf cultures. With increased access to golf courses, more individuals are exploring their interest in sport, leading to a rise in the sales of golf clubs for leisure applications. Additionally, the popularity of miniature golf among younger generations and kids and the growing use of indoor golf simulators for casual and practice sessions have also promoted the demand for golf clubs for leisure applications.

The professional segment is expected to experience a significant CAGR from 2025 to 2030. An increasing number of professional golfers, along with the rising interest of amateur golfers and their efforts to become professionals, is a major factor driving the segment. As per the data published by the bunkered, there are more than 8.2 million registered golfers which is a 10% increase compared to 2020. Registered women golfers have grown from 1.5 million in 2020 to 1.6 million in 2023. The trend is similar across all major golf-playing nations. A consistently growing number of professional players supports the demand for professional golf clubs. The golf club industry is also making significant investments in the design and manufacturing of professional golf clubs.

Distribution Channel Insights

The sporting goods retailers segment held the largest revenue share of the golf club market in 2024. Consumer preference has increasingly shifted toward high-end golf clubs, typically sold at sporting goods retail stores. These stores offer a comprehensive shopping experience, facilitating consumer understanding of golf club specifications and quality. Strategically located at golf courses, these retail stores benefit from high visibility and maximize revenue potential. Additionally, membership discounts often incentivize consumer purchases. Regarding brand preference, Callaway Golf, Titleist, Wilson, TaylorMade, and other established brands have garnered increased consumer favor.

The online distribution segment is expected to experience the fastest market growth during the forecast period. The increasing popularity of e-commerce and the dependence of Generation X, millennials, and Generation Z on the internet has boosted the demand for online platforms for buying golf clubs. Consumers prefer online portals and official websites to purchase premium golf clubs due to the availability of a wide range of products from various manufacturers. In addition, numerous value-added services are provided by online retailers, such as cash on delivery, convenient return policies, and integrated and centralized customer services

Regional Insights

North America golf club market dominated the global market with a revenue share of 45.1% in 2024. North America has been the global leader in terms of the number of golf courses and the number of professional & leisure players. The region has a rich heritage of hosting various golf majors (tournaments), including the Masters Tournament, PGA Championship, the U.S. Open, and The Open Championship. Such competition helps build enthusiasm among local players and boosts the sales of golf clubs in the region.

U.S. Golf Club Market Trends

The U.S. golf club market held the largest share of the regional market. According to the data published by the National Golf Foundation (NGF), in 2023, there were approximately 16,000 golf courses in nearly 14,000 golf facilities in the U.S. NGF also states that 45 million players in the U.S. played on-course and off-course in 2023. Players in the country actively participate in on-course and off-course golfing, including indoor simulators and miniature golfing activities. In addition to adults, a sizable number of kids (below the age of 14) are also actively involved in playing golf. This has been driving the demand for golf clubs in the country. The U.S. is also at the center of the innovation in golf clubs and other equipment. Golf club industry leaders, including Callaway, Ping, TaylorMade, and Cobra Golf, are consistently involved in developing advanced golf clubs. This allows consumers to get their hands on the latest and most advanced golf clubs, thus boosting the market growth.

Asia Pacific Golf Club Market Trends

The Asia Pacific golf club market is projected to experience the fastest CAGR from 2025 to 2030. Asia Pacific offers strong growth potential for golf clubs owing to the rising golf-playing population and increasing disposable income of the middle-class population. The sales of golf equipment are mainly driven by the increasing number of golf tournaments and the growing number of participants. In 2022, as per the Global Golf Participation Report 2023, there were 22.5 million adult golfers across all formats in the region. Countries in the region, including Japan, China, the Republic of Korea, and India, are making themselves noticed on the global golf map. For instance, the total number of golf courses in China tripled within last decade. Additionally, The R&A is continuing its commitment to invest approximately USD 250 million over 10 years by 2026 in developing golf in Asia Pacific. The development includes sustained work to encourage participation through various initiatives. While the sport is more commonly played by men, the number of women golfers has increased over the past few years. As per the HSBC Golf Report, Asia holds the highest number of female golfers globally, wherein 6 out of the top 10 players hail from Asia. All such factors contribute to the growth of the golf clubs market in the region.

Japan golf club market held the largest revenue share of the regional industry in 2024. Japan has the largest number of golf courses across Asia Pacific and the second largest number after the U.S. The country has also been home to some of the major global tournament winners. Players such as Hideki Matsuyama won major tournaments on the international stage and became the major inspiration for rising players.

Europe Golf Club Market Trends

The European golf club market is anticipated to experience significant growth during the forecast period. Europe has approximately 8,800 courses, with more than 56% of the courses in the U.K., Germany, and France. Better availability of golf courses has helped the region, which has more than 4.5 million registered professional golfers and approximately 9.5 million unregistered golfers. This has boosted the golf club industry in the region.

The UK golf club market dominated the regional golf club market in 2024. The U.K. is home to the largest community of golfers, and the numbers are consistently growing. Golf courses are earning considerable profits after suffering major losses in COVID-19 pandemic. For instance, St Andrews Links Trust announced that it earned record-breaking revenue in 2023. The profits earned by the club were more than the combined losses during 2020 & 2021. In addition to the on-course golfing, indoor golfing and simulators are equally contributing to the growth of golfing communities in the country.

Key Golf Club Company Insights

Some of the key companies operating in the global golf club market are Callaway Golf Company, Acushnet Holdings Corp., PING; Sumitomo Rubber Industries, Ltd., TAYLORMADE GOLF COMPANY, INC., MIZUNO Corporation, Amer Sports, Bridgestone Corporation, Studio B, Ben Hogan Golf Equipment Company, and others. These players account for a significant market share, diverse product portfolios, and a strong global presence. The market also comprises small to mid-sized players that offer a selected range of golf clubs and mostly serve regional customers.

-

Callaway Golf is one of the global leaders in golf club manufacturing. The company is renowned among professional players for innovative designs and high-performance clubs. Some of the products offered by Callaway Golf includes Paradym Drivers, Rogue ST Irons, Odyssey Putters, Mavrik Hybrids, and Epic Max Fairway Woods among others.

-

Ping is another pioneer in golf club manufacturing offering fitting technology and customizable clubs. The company focuses on providing golfers with equipment perfectly matching an individual’s swing characteristics. Some of the golf clubs offered by the company include G430 drivers, G710 & i525 irons, Sigma 2 putters, hybrids, and wedges among others.

Key Golf Club Companies:

The following are the leading companies in the golf club market. These companies collectively hold the largest market share and dictate industry trends.

- Callaway Golf Company

- Acushnet Holdings Corp

- PING

- Sumitomo Rubber Industries, Ltd.

- TAYLORMADE GOLF COMPANY, INC.

- MIZUNO Corporation

- Amer Sports

- Bridgestone Corporation

- Studio B

- Ben Hogan Golf Equipment Company

Recent Developments

-

In January 2024, Callaway, one of the prominent companies in the golf club industry, introduced a line of golf drivers using AI technology. The Ai Smoke Driver Family is designed by using AI and promises unparalleled precision and power. The sleek design and advanced aerodynamics helped the drivers to increase ball speed and driving distance.

-

In February 2024, Yonex Co., Ltd., a major sports equipment manufacturer, launched a brand-new 4th Generation EZONE GT Series driver. These drivers are manufactured using proprietary 2G-Namd Speed, an advanced graphite composite that assists the club head compressing and provides superior rebound on impact.

Golf Club Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.17 billion

Revenue forecast in 2030

USD 4.83 billion

Growth rate

CAGR of 3.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; ANZ; Brazil; Argentina; South Africa; UAE

Key companies profiled

Callaway Golf Company, Acushnet Holdings Corp., PING, Sumitomo Rubber Industries, Ltd., TAYLORMADE GOLF COMPANY, INC., MIZUNO Corporation, Amer Sports, Bridgestone Corporation, Studio B, Ben Hogan Golf Equipment Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Golf Club Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, grand view research has segmented the global golf club market report based on application, distribution channel, and region:

-

Application (Revenue, USD Billion, 2018 - 2030)

-

Leisure

-

Professional

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Sporting Goods Retailers

-

Online

-

Department and Discount Stores

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.