- Home

- »

- Clothing, Footwear & Accessories

- »

-

Golf Apparel Market Size, Share And Growth Report, 2030GVR Report cover

![Golf Apparel Market Size, Share & Trends Report]()

Golf Apparel Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Topwear, Bottomwear), By End-use, By Distribution, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-480-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Golf Apparel Market Summary

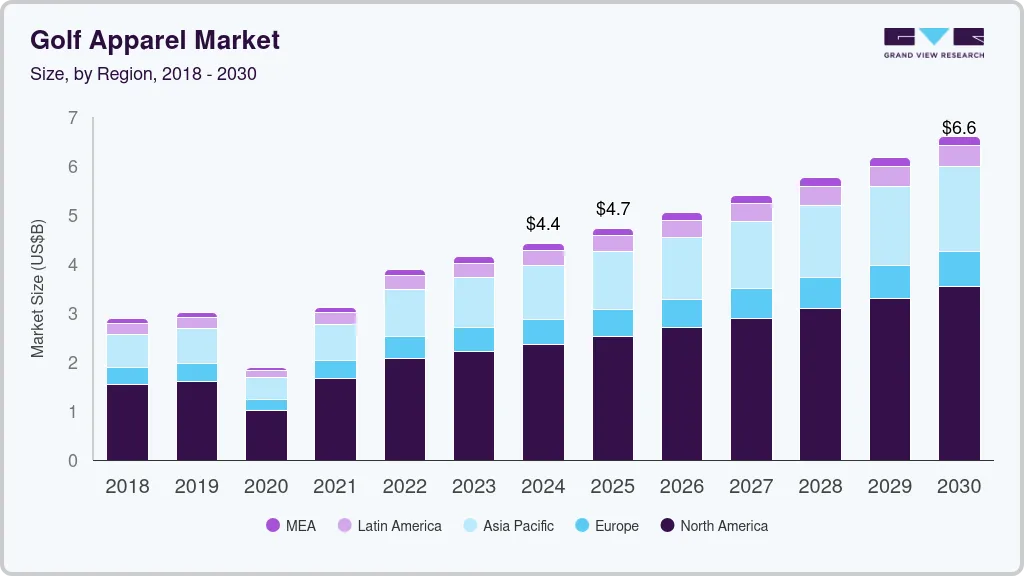

The global golf apparel market size was estimated at USD 4.42 billion in 2024 and is projected to reach USD 6.61 billion by 2030, growing at a CAGR of 6.9% from 2025 to 2030. This significant growth is driven by various factors that reflect changing consumer preferences, technological advancements, and broader societal trends.

Key Market Trends & Insights

- North America golf apparel market was the largest global market for golf apparel in 2023, with revenue of USD 2.2 billion. It is expected to grow at a CAGR of 7% over the forecast period.

- The U.S. golf apparel market was estimated at USD 1.55 billion in 2023 and is expected to grow at a CAGR of 6.9% over the forecast period.

- Based on product, Topwear, including T-shirts and jackets, was the most bought product in the market, with revenue over USD 1.5 billion in 2023.

- Based on distribution channel, the retail sale of golf apparel was estimated at USD 1.1 billion in 2023 and is expected to grow at a CAGR of 6.8% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 4.42 Billion

- 2030 Projected Market Size: USD 6.61 Billion

- CAGR (2025-2030): 6.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The global interest in golf is on the rise, fueled by increased disposable income and a growing focus on health and wellness. As more individuals take up the sport, the demand for golf apparel naturally expands. This trend is particularly noticeable among younger demographics, including Generation Z, who increasingly participate in golf and seek apparel that aligns with their values and lifestyle choices.Technological advancements in fabric design are revolutionizing golf apparel. Modern materials are engineered to enhance performance with features like moisture-wicking, UV protection, and breathability. These innovations cater not only to professional golfers but also to amateurs seeking high-performance clothing. The market's focus on functionality, meeting consumers' demands for comfort and performance, is a key driver of its growth.

Nowadays, golfers are increasingly style-conscious, moving away from traditional baggy attire to more fashionable and tailored options. Brands are responding by integrating contemporary fashion trends into their collections, which helps attract a broader audience beyond just avid golfers. The blending of athletic wear with everyday fashion-often referred to as athleisure-has further blurred the lines between sportswear and casual wear, making golf apparel more versatile.

The increasing participation of women in golf is driving demand for female-specific apparel that combines style with functionality. This segment is experiencing rapid growth as brands recognize the need to cater to women golfers' unique preferences and requirements. This, coupled with high-profile golfing events significantly impact consumer behavior by increasing visibility for brands associated with these tournaments. The media coverage surrounding these events not only elevates the sport's profile but also stimulates interest in related merchandise, including apparel.

The cost of golf apparel can be prohibitive, particularly for high-end brands that utilize premium materials and technologies. This price sensitivity deters budget-conscious consumers, limiting the market size and forcing brands to balance quality and affordability. As consumers seek value-driven options, brands must innovate without significantly raising prices. In addition, the market is highly competitive, with numerous established brands and new entrants vying for market share. This saturation leads to price wars and margin compression, making it difficult for brands to differentiate themselves. The rise of non-specialized sportswear brands offering versatile athletic apparel further intensifies this competition.

Product Insights

Topwear, including T-shirts and jackets, was the most bought product in the market, with revenue over USD 1.5 billion in 2023. Modern golf apparel emphasizes performance-enhancing features. Moisture-wicking fabrics that help players stay cool and dry are in high demand. In addition, garments often incorporate UV protection, breathability, and flexibility to enhance comfort and movement during play.

The trend towards more fashion-forward designs is evident, as traditional monotone styles give way to bold patterns and vibrant colors. Golfers are increasingly looking for apparel that allows them to express their style on the course. Brands are responding by offering striking prints and trendy designs that appeal to a younger audience. Sustainability is becoming a significant focus within the market. Consumers increasingly seek eco-friendly options made from sustainable materials, reflecting a growing awareness of environmental issues among golfers, particularly younger generations like Gen Z.

Versatility in apparel is a crucial element of modern-day golf apparel. Lightweight jackets, vests, and pullovers designed for layering are essential, allowing golfers to adjust to changing weather.

Waterproof and wind-resistant outerwear continues to be essential for year-round play. Though still emerging, innovative golf apparel with technology for tracking performance, swing analysis, and fitness metrics is on the horizon. Wearable tech integration, such as sensors embedded in clothing, will likely grow in the coming years.

Gloves are an essential part of a golfer's attire. Like other golf apparel, gloves are seeing a shift toward eco-friendly materials. Manufacturers are incorporating recycled or biodegradable materials such as synthetic leather alternatives. Brands also focus on reducing environmental impact during production by using more sustainable practices. Advanced grip technology continues to be a key trend, with textured palms and finger pads for improved traction in all weather conditions. Gloves now feature materials that maintain grip even when wet, such as tacky, moisture-resistant compounds for better performance in rain or humidity. Lightweight, breathable gloves are becoming more popular, designed with perforated leather or synthetic materials for better ventilation. Moisture-wicking fabrics are increasingly used to keep hands dry, improving comfort, especially in warmer climates.

Distribution Insights

The retail sale of golf apparel was estimated at USD 1.1 billion in 2023 and is expected to grow at a CAGR of 6.8% over the forecast period. Traditional retail channels, including hypermarkets and big-box stores, also contribute to market sales. These stores often carry a wide array of golf apparel, appealing to budget-conscious consumers looking for affordable options. Retail stores serve as a critical distribution channel for golf clothing, combining expert service with customers' opportunity to physically evaluate products. As trends like athleisure and sustainability gain momentum, retailers must adapt their strategies to meet evolving consumer demands while understanding the competitive landscape shaped by online shopping alternatives.

Specialty stores and franchise outlets remain significant players in the market. They provide a curated selection of golf apparel, allowing consumers to examine products before purchasing physically. Many customers value this tactile experience, preferring to assess fit and quality in person.

Sports variety stores are trendy due to their extensive range of brands and products, offering professional assistance and high-quality customer service. The online segment is projected to grow due to consumers' increasing preference for e-commerce. This channel allows for easy product comparison and often features competitive pricing and discounts, making it attractive for buyers. The COVID-19 pandemic further accelerated the shift towards online shopping, as restrictions limited in-store visits. Many brands have established online presence, enhancing customer engagement through digital marketing strategies.

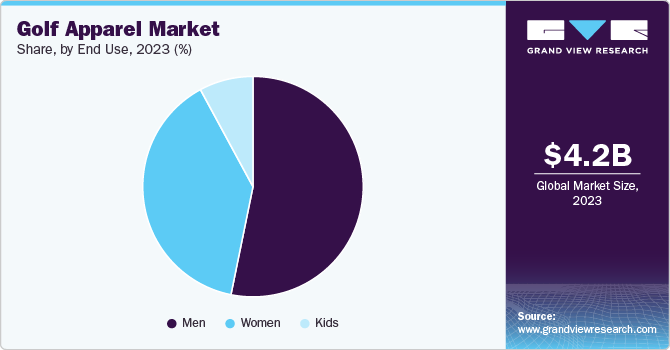

End-use Insights

Men's golf apparel was valued at USD 2.2 billion in 2023 and is expected to grow at a CAGR of 7% over the forecast period. Golf as a sport has higher male participation, with men representing 70% of the overall participants. The total number of golfers in the U.S. has surpassed 45 million, with significant growth noted, particularly among younger and more diverse demographics.

Female golf apparel sales are expected to stay robust with increasing female participation in the sport. The number of female golfers has been growing by double digits in the past few years, and the trend is expected to continue. Kids' golf apparel is a developing market, particularly in the U.S., China, and India. There is an enormous scope for companies to develop apparel catering to these younger golfers' dynamic demands.

Regional Insights

North America golf apparel market was the largest global market for golf apparel in 2023, with revenue of USD 2.2 billion. It is expected to grow at a CAGR of 7% over the forecast period. The demand for golf apparel in the U.S. will remain a key driver for market growth. The golf apparel landscape in the United States is undergoing a significant transformation driven by cultural shifts, demographic changes, and evolving consumer preferences.

U.S. Golf Apparel Market Trends

The U.S. golf apparel market was estimated at USD 1.55 billion in 2023 and is expected to grow at a CAGR of 6.9% over the forecast period. Brands focus on creating stylish yet functional golf apparel that merges performance with contemporary fashion. Companies like Under Armour emphasize the importance of balancing style and functionality to attract a wider audience. This includes incorporating lifestyle elements into golf clothing, appealing to serious players and casual fans.

Golf is increasingly viewed as a lifestyle choice rather than just a sport. The pandemic has accelerated this trend, with over 45 million Americans participating in golf activities, including a notable rise in younger and more diverse demographics. This shift has led to a crossover appeal between traditional golfers and those who appreciate golf fashion for its aesthetic value, creating a wider acceptance of golf apparel in everyday wear.

Europe Golf Apparel Market Trends

The golf apparel market in Europe is expected to observe strong growth over the forecast period owing to the increasing expenditure of the middle-class population on sports. The presence of numerous public golf facilities in the region drives the popularity of the sport, subsequently increasing the number of participants, ultimately leading to an increased demand for golf apparel.

The Germany golf apparel market is the most significant one in Europe and it is expected to grow at a CAGR of 7% over the forecast period. Golf apparel trends in Germany reflect a link between fashion, functionality, and sustainability. As the sport continues to grow in popularity among diverse demographics, brands are adapting their offerings to meet consumers' evolving preferences, positioning themselves for success in this expanding market.

Asia Pacific Golf Apparel Market Trends

Asia Pacific golf apparel market is expected to remain the fastest-growing market for golf apparel over the forecast period, with a CAGR of 7.9%. Increasing golf participation in countries such as India, China and Japan is a crucial driver for market growth. There is a noticeable rise in youth participation in golf, which is influencing preferences for modern and stylish golf outfits. Younger consumers are driving demand for apparel that combines functionality with contemporary fashion, reflecting their lifestyle choices.

The athleisure trend has permeated the market, blurring the lines between sportswear and casual clothing. Modern golfers seek versatile clothing seamlessly transitioning from the course to everyday activities. This has resulted in tailored polo shirts and hybrid pants that offer comfort and style for various settings. There is a growing awareness of sustainability within the golf apparel sector. Brands increasingly adopt eco-friendly materials such as recycled fabrics and organic cotton, reflecting consumers' desires for environmentally responsible products. This trend aligns with broader societal shifts towards sustainability across various industries.

Key Golf Apparel Company Insights

The golf apparel industry is consolidated in nature and categorized by the presence of large players such as Callaway Golf Company, Under Armour, Nike, and Adidas. Companies try to gain a competitive advantage through product innovation and strategic collaboration. Some smaller incumbents operate in regional markets but have a fairly smaller market share as compared to the global giants.

Key Golf Apparel Companies:

The following are the leading companies in the golf apparel market. These companies collectively hold the largest market share and dictate industry trends.

- Nike, Inc. (U.S.)

- Adidas AG (Germany)

- Under Armour, Inc. (U.S.)

- Callaway Golf Company (U.S.)

- PUMA SE (Germany)

- Amer Sports Corporation (Finland)

- TaylorMade Golf Company, Inc. (U.S.)

- Mizuno Corporation (Japan)

- Ralph Lauren Corporation (U.S.)

- PING (U.S.)

- Acushnet Holdings Corp. (U.S.)

- Fila (South Korea)

- Greg Norman Collection (U.S.)

- Fairway and Greene (U.S.)

Golf Apparel Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.72 billion

Revenue forecast in 2030

USD 6.61 billion

Growth rate (Revenue)

CAGR of 6.9% from 2025 to 2030

Actuals

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, distribution, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Nike, Inc. (U.S.); Adidas AG (Germany); Under Armour, Inc. (U.S.); Callaway Golf Company (U.S.); PUMA SE (Germany); Amer Sports Corporation (Finland); TaylorMade Golf Company, Inc. (U.S.); Mizuno Corporation (Japan); Ralph Lauren Corporation (U.S.); PING (U.S.); Acushnet Holdings Corp. (U.S); Fila (South Korea); Greg Norman Collection (U.S.); Fairway and Greene (U.S.)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Golf Apparel Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global golf apparel market report based on product, end use, distribution, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Topwear

-

Bottomwear

-

Gloves

-

Cap

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Men

-

Women

-

Kids

-

-

Distribution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Retail

-

Specialty Stores

-

Sports Store

-

Online Retailers

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global golf apparel market was valued at USD 4.15 billion in 2023 and is expected to reach USD 4.42 billion in 2024

b. The global golf apparel market is expected to grow at a compounded growth rate of 6.9% from 2024 to 2030 to reach USD 6.61 billion by 2030

b. The top wear segment accounted for a revenue share of around 38.3% in 2023. Modern golf apparel emphasizes performance-enhancing features. Moisture-wicking topwear that helps players stay cool and dry is in high demand. Additionally, topwear often incorporates UV protection, breathability, and flexibility to enhance comfort and movement during play.

b. Some key players operating in the global golf apparel market include Nike, Inc., Adidas AG, Under Armour, Inc., Callaway Golf Company, PUMA SE, Amer Sports Corporation (Finland), TaylorMade Golf Company, Inc., Mizuno Corporation , Ralph Lauren Corporation , PING, Acushnet Holdings Corp., Fila, Greg Norman Collection, Fairway and Greene

b. Key factors that are driving the global golf apparel market growth are increased disposable income and a growing focus on health and wellness. Additionally, factors such as personal preferences, availability of choices, and technological innovation in apparel manufacturing is driving the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.