GNSS Simulators Market Size, Share & Trends Analysis Report By Component (Hardware, Software), By Type (Single Channel, Multichannel), By GNSS Receiver (GPS, Galileo), By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-262-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

GNSS Simulators Market Size & Trends

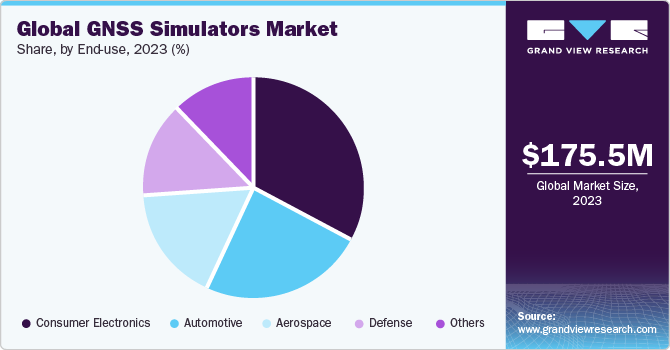

The global GNSS simulators market size was estimated at USD 175.5 million in 2023 and is projected to grow at a CAGR of 9.7% from 2024 to 2030. The market for GNSS (Global Navigation Satellite System) simulators is growing due to the increasing need for accurate positioning solutions in various sectors such as aerospace, defense, and transportation. Advancements in simulation technology, expanding applications of GNSS in emerging industries, and the need for cost-effective testing and training solutions are boosting the product adoption.

GNSS technology's rapid advancement and proliferation is characterized by the development of new satellite constellations, enhanced receiver capabilities, and improved positioning accuracy, thereby driving the market. As GNSS technology continues to evolve, the demand for reliable simulation tools grows, driven by the need to test and validate increasingly complex navigation systems, train operators in diverse scenarios, and ensure performance in diverse environments.

The expansion of satellite networks resulted in a more complex interplay between signals and systems. This increased complexity necessitates using comprehensive testing environments simulators provide to ensure seamless integration and reliable performance. The evolution of GNSS technology towards higher accuracy, resilience to interference, and support for diverse applications such as autonomous vehicles, precision agriculture, and geolocation services requires improved simulation capabilities. These capabilities are essential to accurately replicate real-world scenarios for validation and training purposes.

Simulators play an integral role in testing and validating GNSS technology, enabling businesses and academics to implement and develop new applications. For instance, in January 2024, Sabanto integrated the Dual Antenna GNSS Receiver and real-time positioning service offered by Trimble into its autonomous tractors. The integration provides high-accuracy positioning, which can help farmers increase productivity, reduce downtime and input costs, and overcome workforce shortages.

Market Concentration & Characteristics

The market growth stage is high and the pace of the market growth is accelerating. The market is characterized by a high degree of innovation due to rapid technological advancements driven by factors such as the increasing demand for accurate and reliable positioning, navigation, and timing solutions across various industries.

Ongoing innovation and R&D activities also characterize the GNSS simulators market to address evolving customer requirements and industry trends. Key areas of innovation include the development of advanced signal processing algorithms, support for emerging navigation technologies (e.g., PPP, RTK, SBAS), and integration with other sensor systems (e.g., inertial navigation, LiDAR). Market players are also exploring opportunities to leverage artificial intelligence (AI) and machine learning (ML) technologies to enhance simulation realism, optimize testing procedures, and improve overall system performance. For instance, in March of 2023, Orolia, a Safran Electronics and Defense company, announced GNSS simulation engine software, Skydel, which can generate over 500 signals from a single platform. Due to its software-defined architecture, Skydel can also be scaled upwards using robust hardware components.

Regulatory scrutiny in the market drives manufacturers to ensure compliance with navigation standards, certification requirements, and security protocols. This scrutiny necessitates investment in research, development, and testing procedures to meet regulatory mandates, impacting product development timelines and costs.

There are limited direct product substitutes for GNSS simulators due to their specialized functionality in simulating satellite signals and complex navigation environments. However, alternative solutions such as hardware-in-the-loop (HIL) simulators or radio frequency (RF) signal generators partially replicate some aspects of GNSS simulation but need more comprehensive constellation emulation and scenario customization capabilities offered by dedicated GNSS simulators.

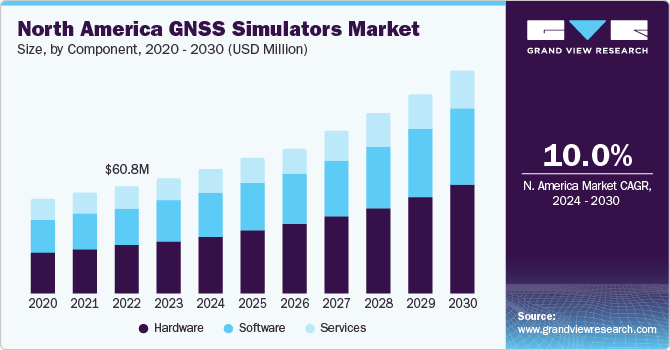

Component Insights

The hardware segment accounted for the largest revenue share of 46.4% in 2023 and is anticipated to witness the fastest growth during the forecast period. Advancements in semiconductor and RF (Radio Frequency) technology play a significant role in driving the growth of the hardware segment. The development of high-performance, low-power radio frequency (RF) components enables the creation of improved GNSS simulator hardware capable of simulating multiple satellite constellations, signals, and environmental conditions with increased accuracy and reliability. For instance, in January 2024, Qualinx, a producer of semiconductors for ultra-low-power wireless tracking and connectivity, collaborated with the European Union Agency for the Space Programme (EUSPA) to develop a low-power GNSS receiver tailored for consumer applications. This collaboration addresses the rising concern over spoofing incidents affecting GNSS services by leveraging the Galileo Open Service Navigation Message Authentication service, which offers users data from Galileo satellites.

The software segment is anticipated to witness significant growth during the forecast period due to technological advancements in software algorithms and signal-processing techniques. Software-based simulators offer flexibility and scalability, enabling users to customize simulation parameters, simulate complex scenarios, and analyze test results more precisely. For instance, in January 2024, Exwayz launched Exwayz 3D Mapping, a software that creates centimeter-accurate georeferenced maps of ports, cities, industrial sites, and other outdoor areas. The software is versatile and can work with any GNSS system and LiDAR. Its innovations in optimization and 3D vision achieve unprecedented levels of precision.

End-use Insights

The consumer electronics segment accounted for the largest revenue share in 2023 due to the increasing demand for precise positioning and navigation capabilities in portable devices. Accurate GNSS functionality is crucial as people increasingly use smartphones and wearables for navigation, location-based services, and fitness tracking. According to the State of Mobile Internet Connectivity Report 2023, over 4.3 billion people, or 54% of the global population, own a smartphone. GNSS simulators enable manufacturers to authorize and modify the performance of their devices under various real-world scenarios, ensuring smooth operation and optimal user experience.

The automotive segment is anticipated to witness the fastest growth during the forecast period due to the increasing integration of advanced navigation and driver assistance systems in modern vehicles. The rise of self-driving technologies and the growing demand for advanced in-car navigation experiences led car manufacturers to provide precise and dependable GNSS functionality. GNSS simulators enable automotive manufacturers to validate the performance of their navigation systems under diverse scenarios, including urban environments, tunnels, and challenging weather conditions, ensuring seamless operation and precision in real-world driving situations. In January 2024, Spirent Communications partnered with dSPACE. This collaboration integrates Spirent's GNSS simulator into the dSPACE AD-HIL framework, enabling developers to validate vehicle performance in location-sensitive scenarios with precise satellite signals. By leveraging this technology, developers can expedite development timelines and accelerate time-to-market for autonomous driving solutions.

Type Insights

The multichannel segment accounted for the largest revenue share in 2023 due to the increasing use of IoT (Internet of Things) devices and the subsequent growth in consumer applications. Consumer products such as smart wearables, asset tracking systems, smart home devices, and IoT's increasing integration in various industries contribute to the growth of dependable and precise positioning solutions. The State of IoT report in 2023 indicated an 18% rise in global IoT connections during 2022, with 14.3 billion active endpoints. Projections from the report anticipate a further 16% increase in connected IoT devices in 2023, bringing the total to 16.7 billion active endpoints.

The single-channel segment is anticipated to witness the fastest growth during the forecast period. The increasing adoption of advanced navigation systems and emphasis on safety standards serve as a growth driver for the market. The aviation industry is moving towards performance-based and satellite-based navigation systems, which has increased demand for high-fidelity single-channel GNSS simulators. These simulators are essential for aviation authorities, airlines, and aircraft manufacturers to test and validate the performance of GNSS receivers, ensuring compliance with strict regulatory requirements.

GNSS Receiver Insights

The GPS segment accounted for the largest revenue share in 2023 and is anticipated to witness the fastest growth during the forecast period. The growth is attributed to the integration of GPS technology across various industries and applications, including automotive, aviation, agriculture, and telecommunications. The demand for precise positioning and navigation solutions continues to surge, driven by the rise of location-based services, IoT devices, and autonomous technologies. For instance, in August 2023, Bad Elf, a designer of high-performance GNSS receivers, launched the Bad Elf Flex Mini for geospatial professionals, offering a combination of location accuracy, deployability, reliability, usability, design, and value. The company develops GPS receivers that enhance iOS, Android, and Windows mobile platforms.

The Galileo segment is anticipated to witness substantial growth during the forecast period. The adoption of Galileo extends beyond traditional navigation applications and includes a wide range of emerging use cases such as precision agriculture, unmanned aerial vehicles (UAVs), and location-based services. These diverse applications demand specialized testing environments that accurately replicate Galileo signals and operational scenarios. According to the DJI Agriculture's Drone Insight Report, more than 200,000 agricultural drones were deployed worldwide, spanning approximately 200 million hectares. These drones aimed to bolster efficiency in farmland management via digital solutions.

Application Insights

The navigation & mapping segment accounted for the largest revenue share in 2023 and is anticipated to witness the fastest growth during the forecast period. The growth is attributed to the rapid expansion of location-based services and digital mapping applications in transportation, logistics, urban planning, and outdoor recreation sectors. Navigation and mapping technologies are becoming increasingly essential for consumers and businesses, making rigorous testing and validation of GNSS crucial for optimal route optimization, asset tracking, and spatial analysis. For instance, in December 2023, Furuno Electric Co. launched its advanced eRideOPUS 9, a dual-band GNSS receiver chip. The chip is designed to provide accurate position information with a precision of up to 50cm without the need for any correction data.

The surveying segment is anticipated to witness lucrative growth during the forecast period, driven by the expanding adoption of high-precision GNSS technology in land surveying applications. The demand for accurate positioning solutions in surveying, mapping, and geospatial data collection continues to soar, driven by infrastructure development, urban planning, and natural resource management projects worldwide. GNSS simulators tailored for surveying applications offer crucial benefits such as replicating real-world conditions, including challenging environments and signal obstructions, enabling surveyors to validate and optimize the performance of GNSS receivers and antennas. In October 2023, Harxon launched two antennas, the HX-CSX600A and the HX-CUX615A helix antenna, tailored for high-precision positioning needs in the geospatial sector. Equipped with a filtered low-noise amplifier, the HX-CSX600A ensures robust anti-interference capabilities in demanding conditions. This antenna is ideal for precise GNSS applications like agricultural machinery, robotics, and surveying.

Regional Insights

North America dominated the market with a share of 37.3% in 2023 due to the widespread use of GNSS technology in various industries, such as aerospace, defense, transportation, and telecommunications. The global positioning system (GPS) was created in the U.S. and is a widely used GNSS system worldwide, which constantly requires GNSS simulators to test and improve navigation systems, satellite communication networks, and location-based services. The region's regulatory environment is supportive, and significant investment in research and development promotes the development of advanced GNSS simulation solutions to meet the requirements of different industries and applications.

U.S. GNSS Simulators Market Trends

The U.S. accounted for 23.3% of the global market in 2023. The U.S. Government's continuous investment in GNSS infrastructure and modernization programs is boosting the market's growth. The U.S. operates the GPS, one of the most widely used GNSS systems globally, and is committed to enhancing its capabilities to meet evolving user needs and technological advancements. Initiatives such as GPS III, the Next-Generation Operational Control System (OCX), and the National Timing Resilience and Security Act highlight the government's commitment to maintaining the GPS infrastructure's integrity, resilience, and security.

Europe GNSS Simulators Market Trends

The market in Europe is expected to grow at a lucrative pace over the forecast period due to the presence and development of the Galileo satellite navigation system. Galileo, Europe's satellite constellation, is steadily expanding its reach and capabilities, offering enhanced accuracy and reliability compared to other GNSS systems. This expansion of Galileo drives the demand for GNSS simulators in Europe as manufacturers and developers seek comprehensive testing solutions to ensure compatibility and optimize performance with the Galileo system. For instance, in January 2024, Qualinx partnered with the European Union Agency for the Space Programme (EUSPA) to create a low-power GNSS receiver tailored for EUSPA's GNSS authentication service. The project aims to ensure users accurately receive data from Galileo satellites while also tackling spoofing incidents.

The GNSS simulators market in the UK is expected to grow at a substantial rate over the forecast period due to the increasing demand for precise navigation and positioning solutions across various industries, such as automotive and manufacturing. Automotive companies heavily rely on GNSS technology for applications such as vehicle navigation, fleet management, and logistics optimization. GNSS simulators play a crucial role in testing and validating the performance of these systems under different environmental conditions, ensuring accuracy and reliability, which is vital for the country's industrial competitiveness and efficiency.

Asia Pacific GNSS Simulators Market Trends

The market in the Asia Pacific region is expected to witness significant growth during the forecast period. The rapid advancements in GNSS technology of satellite constellations such as Galileo, BeiDou, and the Indian Regional Navigation Satellite System (IRNSS) have transformed the capabilities of GNSS simulators across the Asia Pacific region. Government initiatives to support infrastructure development, smart city projects, and digitalization efforts fuel the demand for GNSS technologies in the region.

The China GNSS simulators market is expected to grow lucratively over the forecast period due to the rapid expansion of China's satellite navigation infrastructure with the BeiDou Navigation Satellite System (BDS). There is a growing demand for GNSS simulators to support the development, testing, and validation of BeiDou-enabled devices and applications as China aims to establish BeiDou as a global navigation system. This initiative aims to invest in the GNSS ecosystem in China by developing advanced simulation technologies personalized to the BeiDou constellation.

The GNSS simulators market in India is driven by the increasing adoption of GNSS technology across various sectors. Various sectors such as transportation, agriculture, telecommunications, and defense are utilizing GNSS systems for applications ranging from vehicle tracking and fleet management to precision farming and military operations. For instance, in July 2023, the Ministry of Ports, Shipping, and Waterways launched a new SAGAR SAMPARK satellite system. An indigenous differential global navigation satellite system (DGNSS) serves as a terrestrial enhancement system. This system corrects errors and inaccuracies in the GNSS, which results in more precise positioning information.

Key GNSS Simulators Company Insights

Some of the key players operating in the market include Accord Software & Systems Private Limited, SAFRAN, VIAVI Solutions Inc.

-

Accord Software & Systems Private Limited specializes in GNSS technology, avionics, and real-time embedded systems. The company offers a range of products and solutions, including GNSS receivers, GNSS simulators, and software simulation tools. The company also develops space-grade GPS receivers successfully launched in Indian remote sensing satellites and vehicles such as IRS-P4, SRE, IRS-P5, IRS-P6, 'Cartosat,' and PSLV. Accord modified its GNSS technology for small satellites by creating small receivers for LEO orbits.

-

SAFRAN offers advanced GNSS simulators for testing GPS-based applications and receivers. Their GNSS simulators are scenario-based instruments that combine with industry requirements and affordability. Safran's simulators support multi-constellation, multi-frequency, and hundreds of signals with a 1000 Hz iteration rate.

-

VIAVI Solutions Inc. offers GPS signal simulators that provide GPS-enabled devices. Their GPSG-1000 GNSS simulator supports multi-satellite simulations, including GPS, Galileo, and SBAS capabilities for the U.S. WAAS and EU EGNOS systems. The simulator allows for the programming of unlimited navigation plans using 3D waypoints and offers record and playback functionalities for live simulation and RAIM testing. VIAVI's GPS signal simulators support modernized GPS bands and improve interoperability among GNSS standards.

Key GNSS Simulators Companies:

The following are the leading companies in the GNSS simulators market. These companies collectively hold the largest market share and dictate industry trends.

- Accord Software & Systems Private Limited.

- Averna

- CAST Navigation, LLC

- Hexagon AB

- IP SOLUTIONS

- Keysight Technologies

- Rohde & Schwarz

- SAFRAN

- Spirent Communications

- SYNTONY

- Tersus GNSS Inc

- u-blox

- VIAVI Solutions Inc.

Recent Developments

-

In August 2023, IFEN launched NCS NOVA, the company's latest RF signal generator technology based on a modular and flexible software-defined radio platform. This device offers flexible RF SDR hardware and easy-to-use operating software, capable of multi-frequency simulations and multi-constellation for a wide range of GNSS applications, including space, aviation, and automotive testing.

-

In April 2023, Orolia, a subsidiary of Safran Electronics & Defense, collaborated with Xona Space Systems to provide GNSS simulation solutions tailored for low earth orbit constellations and navigation. This collaboration empowered Orolia to create a solution for enhancing Xona's PNT service, which is dedicated to elevating PNT security, precision, and resilience capabilities.

-

In January 2022, Hexagon's Autonomy & Positioning division partnered with Dayou to launch TerraStar X technology to the Chinese market. This collaboration aimed to offer accurate point positioning (PPP) corrections for various devices, including smartphones and autonomous vehicles. The partnership facilitates the provision of consistent positioning solutions on a global scale, allowing Original Equipment Manufacturers (OEMs) to implement uniform designs worldwide.

GNSS Simulators Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 189.1 million |

|

Revenue forecast in 2030 |

USD 329.7 million |

|

Growth Rate |

CAGR of 9.7% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2017 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, type, GNSS receiver, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; U.K.; Germany; France; Italy; China; India; Japan; South Korea; Australia; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Accord Software & Systems Private Limited.; Averna, CAST Navigation, LLC; Hexagon AB; IP SOLUTIONS; Keysight Technologies; Rohde & Schwarz; SAFRAN; Spirent Communications; SYNTONY; Tersus GNSS Inc; u-blox, VIAVI Solutions Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global GNSS Simulators Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global GNSS simulators market report based on component, type, GNSS receiver, application, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Single Channel

-

Multichannel

-

-

GNSS Receiver Outlook (Revenue, USD Million, 2017 - 2030)

-

GPS

-

Galileo

-

GLONASS

-

BeiDou

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Navigation & Mapping

-

Surveying

-

Vehicle Assistance System

-

Location-based Services

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Automotive

-

Aerospace

-

Defense

-

Consumer Electronics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Factors such as an increase in the use of consumer IoT devices, wearable devices utilizing location information, and growing demand of GNSS technology are driving the market growth

b. The global GNSS simulator market size was estimated at USD 175.5 million in 2023 and is expected to reach USD 189.1 million in 2024

b. The global GNSS simulator market is expected to grow at a compound annual growth rate of 9.7% from 2024 to 2030 to reach USD 329.7 million by 2030

b. North America dominated the GNSS simulator market with a share of 37.3% in 2023 due to the widespread use of GNSS technology in various industries, such as aerospace, defense, transportation, and telecommunications

b. Some key players operating in the GNSS simulator market are Accord Software & Systems Private Limited., Averna, CAST Navigation, LLC, Hexagon AB, IP SOLUTIONS, Keysight Technologies, Rohde & Schwarz, SAFRAN, Spirent Communications, SYNTONY, Tersus GNSS Inc, u-blox, VIAVI Solutions Inc.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."