- Home

- »

- Beauty & Personal Care

- »

-

Glycolic Acid Beauty Products Market Size Report, 2030GVR Report cover

![Glycolic Acid Beauty Products Market Size, Share & Trends Report]()

Glycolic Acid Beauty Products Market Size, Share & Trends Analysis Report By Product (Skincare, Haircare), By Distribution Channel (Hypermarkets & Supermarkets, Online), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-370-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Glycolic Acid Beauty Products Market Trends

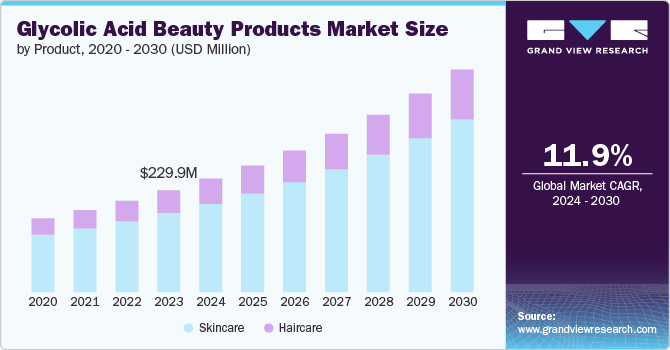

The global glycolic acid beauty products market size was estimated at USD 229.9 million in 2023 and is expected to grow at a CAGR of 11.9% from 2024 to 2030. This can be attributed to the growing demand for skin and hair care products, increasing consumer preference for minimal & non-Invasive solutions, technological advancements in production, and rising popularity of natural cosmetics, and increasing sales through online channels.

A significant factor contributing to the growth of glycolic acid beauty products market is the increasing demand for skincare and hair care solutions. Consumers are becoming more conscious about their personal grooming and are willing to invest in products that offer visible results. Glycolic acid, known for its exfoliating and rejuvenating properties, has gained popularity as an effective ingredient in various beauty formulations.

The market is being driven by the increasing demand for non-invasive and minimally invasive treatments. Consumers are seeking effective skincare solutions that do not require extensive procedures or downtime, leading to a surge in the popularity of products containing glycolic acid. In September 2023, Lacura, Aldi’s health and beauty brand, introduced a new product to its cruelty-free line-up - the Glycolic Body Lotion. This addition expands Lacura’s range of skincare products, offering consumers a new option for body care that includes glycolic acid as a key ingredient.

Moreover, advancements in technology have played a crucial role in the development and production of glycolic acid beauty products. Manufacturers are constantly innovating to create formulations that are more effective, stable, and safe for consumers. These technological advancements have led to the introduction of new product variants that cater to specific skin concerns and preferences.

The trend towards organic and natural cosmetics is also contributing to the growth of the glycolic acid beauty products market. Consumers are increasingly opting for products that contain natural ingredients, such as glycolic acid derived from fruits such as sugarcane or grapes. This shift towards natural formulations aligns with the growing preference for clean beauty products that are free from harsh chemicals. According to an article by ESW published in July 2022, millennials and gen Z are leading the clean beauty trend, showing a stronger preference for organic and natural beauty products compared to the average consumer. 43% of consumers in these age groups favor natural skincare, while only 31% of overall U.S. consumers share this preference.

The proliferation of e-commerce platforms has provided a significant boost to the sales of glycolic acid beauty products. Online channels offer convenience, accessibility, and a wide range of product options to consumers worldwide. Beauty brands leverage digital marketing strategies to reach a broader audience and promote their glycolic acid formulations effectively. The ease of online shopping coupled with targeted advertising campaigns has contributed to the market expansion. An article published by ETBrandEquity.com in December 2022 states that, According to Unicommerce data, the Indian e-commerce industry reported that beauty and personal care have shown significant growth, with order volumes increasing by 143% and order value increasing by 132% in 2022.

The glycolic acid beauty products market has been experiencing significant growth driven by the introduction of innovative product variants that cater to evolving consumer preferences and tastes. Manufacturers in the glycolic acid beauty products industry have been focusing on creating unique and differentiated offerings such as low-calorie and gluten-free glycolic acid beauty products to capture market share and meet the demands of a diverse consumer base. For instance, in March 2024, Hormel Black Label launched a new limited-time flavor offering called Hormel Black Label Ranch Bacon, combining the savory smokiness of glycolic acid beauty products with the rich taste of ranch in a single bite.

Numerous brands in the beauty market are continuously enhancing their product offerings to meet consumer needs. New product releases with improved formulations and efficacy contribute to market expansion. These brands are focused on attracting consumers through strategic marketing initiatives and competitive pricing strategies. For instance, In October 2023, Goop launched a skincare line at Target called Good.Clean.Goop, where all products are priced under USD 40. This new line aims to provide quality skincare at a more accessible price point for consumers. The range also includes an Illuminator 10% Glycolic Toner.

Product Insights

Glycolic acid skincare products accounted for a revenue share of 77.9% % in 2023. The surging popularity of glycolic acid in skincare beauty products is propelled by its potent exfoliating properties, which effectively remove dead skin cells, revealing brighter, smoother skin. Consumer awareness of its benefits, coupled with advancements in dermatological science, has led to a proliferation of glycolic acid-infused products tailored to various skin types and concerns. In addition, the growing trend of 'active' ingredients in skincare regimens and the endorsement by skincare professionals have further fueled the demand for glycolic acid-based beauty items. Moreover, increasing availability of such products through e-commerce platforms and the influence of social media skincare communities have made glycolic acid a household name in the beauty industry.

Glycolic acid haircare products are expected to witness a CAGR of 12.0 % during 2024 to 2030. The adoption of glycolic acid in haircare beauty products is driven by its unique ability to cleanse and exfoliate the scalp, promoting a healthy scalp environment. The increasing consumer focus on holistic hair health, encompassing not just the hair strands but also the scalp, has elevated the demand for glycolic acid-infused products.

In addition, the trend towards multifunctional beauty products that can deliver multiple benefits has led manufacturers to incorporate glycolic acid into their formulations to address issues such dandruff and dryness, while also offering a clarifying effect. The growing awareness through beauty influencers and dermatological research, highlighting the benefits of glycolic acid for scalp health, further catalyzes its integration into hair care routines for a more comprehensive hair wellness approach.

In June 2023, Living Proof introduced the Scalp Care Exfoliator, a skin care-inspired product designed to gently exfoliate the scalp, addressing issues such as dry scalp flaking, excess oil, and buildup in just five minutes. The product is formulated with key benefits such as gentle exfoliation, reduction of dry scalp flaking, removal of buildup and excess oil, and includes a prebiotic to boost hydration and reduce sebum over time. One of the active ingredients in the formulation is Glycolic Acid.

Distribution Channel Insights

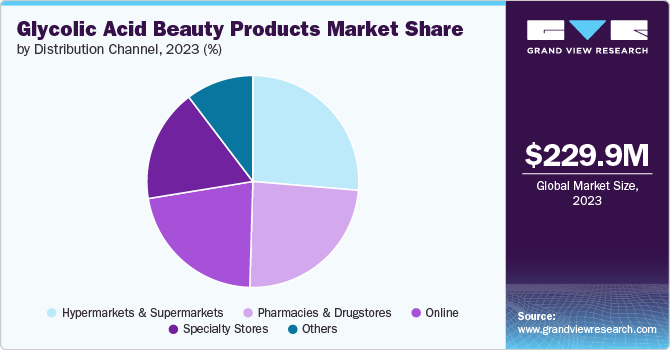

The distribution of glycolic acid beauty products through hypermarkets & supermarkets accounted for revenue share of 26.3% in 2023. This can be attributed to the convenience offered by hypermarkets and supermarkets to consumers. Consumers can easily access a wide range of beauty products, including glycolic acid-based ones, during their routine shopping trips.

The distribution of glycolic acid beauty products through online channels is expected to grow at a CAGR of 14.2% from 2024 to 2030, owing to the convenience and accessibility they offer to consumers. Online platforms provide a vast selection, allowing customers to easily compare products and reviews from the comfort of their homes. The rise of e-commerce has also facilitated global reach, enabling consumers to access niche and international brands that might not be available in local stores. Various players are increasingly trying to expand into the online marketspace. In June 2023, Amazon Beauty introduced the Global Beauty Store, a dedicated section on Amazon’s main ecommerce platform that showcases over 60 international beauty brands and more than 5,000 curated beauty products. The store will feature renowned brands such as Anomaly, Caudalie, Paula’s Choice, Farmacy and others

Regional Insights

In 2023, the glycolic acid beauty products market in North America captured a revenue share of 33.9%. The market in North America is propelled by high consumer awareness regarding skin health and the benefits of alpha-hydroxy acids. A strong presence of leading skincare brands and a culture that values innovative beauty solutions further fuels market growth. In addition, the region's robust e-commerce sector and high internet penetration make it easier for consumers to access a wide range of glycolic acid products, driving sales and market expansion.

U.S. Glycolic Acid Beauty Products Market Trends

The glycolic acid beauty products market in the U.S. accounted for a notable revenue share in 2023, due to a strong consumer demand for products containing ingredients such as glycolic acid that specifically target anti-aging & skin rejuvenation treatments. According to an article by the Global Cosmetic Industry, 95% of women in U.S. seek specific ingredients in their skincare products to address their primary concerns.

Europe Glycolic Acid Beauty Products Market Trends

In 2023, glycolic acid beauty products market in Europe is anticipated to grow with a CAGR of 12.1% during 2024 to 2030. The glycolic acid beauty products market in Europe is primarily fueled by a high awareness and preference for skincare routines that include chemical defoliants for their skin-renewing benefits. Furthermore, the region's stringent regulations on beauty products have encouraged the development and adoption of safer, more effective glycolic acid formulations.

Asia Pacific Glycolic Acid Beauty Products Market Trends

Asia Pacific glycolic acid beauty products market is expected to grow with a CAGR of 3.2% during 2024 to 2030. The growth in the region is closely tied to increasing trend of skincare and the growing preference for products that address skin concerns such as pigmentation and texture. The expanding middle class and rising disposable incomes in countries such China and India are boosting the demand for premium and effective skin care solutions, including those containing glycolic acid.

Key Glycolic Acid Beauty Products Company Insights

Key market players such as The Ordinary; Neutrogena; Alpha-H; Murad and Sunday Riley among others contribute significantly to the innovation and growth of the market through research and development efforts, product formulation advancements, strategic marketing strategies, consumer education initiatives, and strategic partnerships with industry experts.

Key Glycolic Acid Beauty Products Companies:

The following are the leading companies in the glycolic acid beauty products market. These companies collectively hold the largest market share and dictate industry trends.

- The Ordinary

- Neutrogena

- Alpha-H

- Murad

- Sunday Riley

- Kiehl’s

- La Roche-Posay

- Dermalogica

- Glytone

- Clinique

Recent Developments

-

In April 2024, The Inkey List launched the Glycolic Acid Exfoliating Body Stick, a new exfoliating product under the INKEY Body umbrella. The product aims to address various body skin concerns through chemical exfoliation, and targets issues such as ingrown hairs, KP bumps, breakouts and rough skin.

-

In February 2024, House of Lakmē unveiled its latest skincare line called the Glycolic Illuminate Collection. This new collection is endorsed by the popular actress Ananya Panday, who serves as the brand ambassador for House of Lakmē. The Glycolic Illuminate Collection is designed to cater to various skincare needs and aims to provide users with radiant and glowing skin.

-

In February 2024, L’Oréal Paris introduced a new product called the Glycolic Bright Dark Circle Eye Serum. This serum is specifically designed to target under eye puffiness and hyperpigmentation.

Glycolic Acid Beauty Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 256.4 million

Revenue forecast in 2030

USD 502.9 million

Growth rate

CAGR of 11.9% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

The Ordinary; Neutrogena; Alpha-H; Murad; Sunday Riley; Kiehl’s; La Roche-Posay; Dermalogica; Glytone; Clinique

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Glycolic Acid Beauty Products Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global glycolic acid beauty products market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Skincare

-

Serum

-

Cleanser

-

Toner

-

Exfoliant

-

Face masks

-

Others

-

-

Haircare

-

Shampoo

-

Conditioner

-

Hair serum

-

Others

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & supermarkets

-

Pharmacies & drugstores

-

Specialty stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global glycolic acid beauty products market size was estimated at USD 229.9 million in 2023 and is expected to reach USD 256.4 billion in 2024.

b. The global glycolic acid beauty products market is expected to grow at a compounded growth rate of 11.9% from 2024 to 2030 to reach USD 502.9 billion by 2030.

b. The glycolic acid beauty products market in North America captured a revenue share of 33.9% in 2023.Growing consumer preference for natural and organic beauty products, coupled with the rising demand for effective anti-aging and skin rejuvenation treatments, significantly propels the glycolic acid beauty products market in the region.

b. Some key players operating in the market include The Ordinary ; Neutrogena ; Alpha-H ; Murad ; Sunday Riley ; Kiehl’s ; La Roche-Posay ; Dermalogica; Glytone ; and Clinique

b. The growth can be attributed to the growing demand for skin and hair care products, increasing consumer preference for minimal & non-Invasive solutions, technological advancements in production, and rising popularity of natural cosmetics and increasing sales through online channel.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."