- Home

- »

- Organic Chemicals

- »

-

Glycol Ethers Market Size, Share & Trends Report, 2025GVR Report cover

![Glycol Ethers Market Size, Share & Trends Report]()

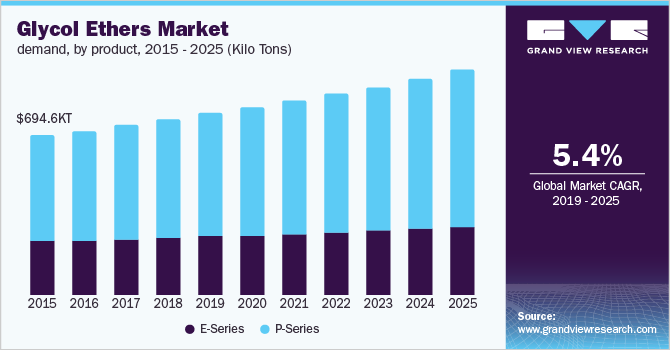

Glycol Ethers Market Size, Share & Trends Analysis Report By Product (E-Series, P-Series), By Application (Paints & Coatings, Printing, Pharmaceuticals, Electronics), And Regional Forecasts, 2019 - 2025

- Report ID: GVR-3-68038-002-6

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2017

- Forecast Period: 2018 - 2025

- Industry: Bulk Chemicals

Report Overview

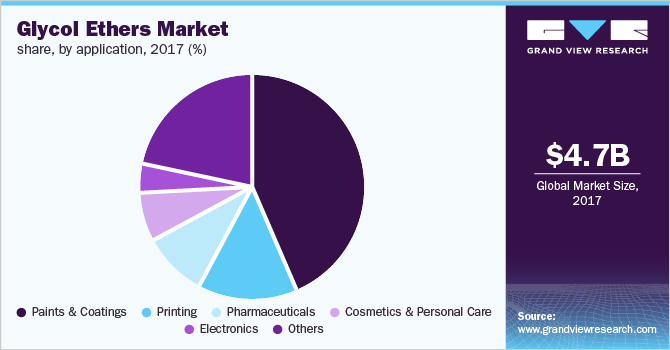

The global glycol ethers market size was estimated at USD 4.66 billion in 2017. It is projected to expand at a CAGR of 5.4% over the forecast period. High demand for water-soluble active ingredients across end-use industries, such as printing and personal care industries is expected to boost market growth. Increasing consumption of water-based coatings that comprise of glycol ether as a coalescing agent has been the major reason for growth across printing and personal care sectors.

The waterborne coating market has witnessed substantial growth in the past few years due regulatory policies favoring the use of environment-friendly coating in the architectural and industrial sectors. Demand from other end-use sectors, such as woodworking, aerospace and defense, and marine shall further augment the demand in the medium-term.

U.S. is a significant part of the paints and coatings industry, with the country employing around 278,000 people in 2017. The paints and coatings industry in U.S. is worth nearly USD 30 billion, wherein nearly 1,000 companies are competing for greater market share. Although U.S. is expected to remain the largest market in North America, the toxicological studies reflecting on human health hazard caused by lower molecular weight glycol ethers shall play a vital role in future developments. The product usage is now restricted in consumer goods due to strict regulations from associations such as European Union (EU) and the U.S. Food and Drug Administration (FDA) across Europe and North America, respectively.

Propylene Glycol Ether Acetates (PGEAs) are industrial solvents used for manufacturing paints, coatings, inks, and cleaners. These products have found widespread acceptance as solvents for new product development and reformulations in various end-uses. One such example would be that of P-series PMA-Electronic, which has replaced ethylene acrylates in photoresist formulations that find application in the semiconductor industry. It can also be used as a solvent for removing solder flux and degreasing and cleaning of circuit boards.

The REACH regulations concerning the toxic nature of ethylene oxide-based derivatives, have a constraining effect on the industry. This has led to manufacturers focusing on propylene oxide as a starting material. Volatility in raw materials and utilities severely constrain profitability of manufacturers, and consequently act as a negative stimulus on the global pricing scenario.

Glycol Ethers Market Trends

The rising use of glycol ethers in the paint and coatings sector is one of the primary factors driving the market's growth. Rising urbanization and construction activity are increasing the demand for paints and coatings resulting in increased usage of glycol ethers thereby, driving the growth of this market during the forecast period.

The compound's high boiling point and excellent solvent characteristics make glycol ether a useful solution in the manufacturing of several personal care products. As a result, there is a considerable demand for glycol ether as a raw ingredient due to the widespread use of personal care products. This is expected to drive industry growth over the forecast period.

The primary challenge limiting themarket growth is strict regulations imposed by various organizations on the usage of glycol ether in consumer goods. Additionally, individuals may also experience effects such as conjunctivitis, upper respiratory tract irritation, headache, transient corneal clouding, and nausea as a result of low level and direct exposure to the product. The rising concern regarding these side effects is expected to hamper the market growth.

Product Insights

Glycol ethers product family is made up of more than 30 different types of solvents which can be categorized into two major groups, namely, E-series and P-series, depending upon the starting material used (ethylene or propylene). E-series comprises of ethylene glycol butyl ether, ethylene glycol propyl ether, and ethylene glycol butyl ether acetate as key products are used extensively as they have a strong compatibility with diverse organic solvents and water. They also have low volatility and strong solvent properties which diversifies their applications in cosmetics, pharmaceuticals, electronics, personal care and many more.

The demand for P-series is higher than the counterpart as they are preferred for their lower toxicity level. Propylene glycol butyl ether, whose demand exceeded 400 kilo tons globally, held the largest market share in 2017. It is majorly used in products that are used in treating metal and non-metal surfaces, laboratory products, and in water treatment formulation. Methyl ether acetate is used extensively in inks and coating applications, with its major formulators including DowDuPont and Shell Chemicals.

Application Insights

Glycol ethers and acetates are used to improve the flow and leveling characteristics of paints and to lengthen the wet edge, which provide for smoother lapping while eliminating brush marks. Recent uptick in construction starts across the world and positive infrastructure investment scenario has uplifted the demand for glycol ethers in paints. With promising outlook on automotive production and construction starts, demand for architectural and industrial coatings is projected to rise, further giving impetus for the glycol ethers market over the forecast period.

In the printing industry, multiple substances such as hydrocarbons, alcohols, acetates, and ketones are used as the major solvent. Glycol ether is highly preferred as a tailing solvent that controls evaporation rates. Propylene methyl and Di-propylene methyl acetates are the major compounds used in silkscreen inks.

Whereas in cosmetic formulations, glycol ether is an effective mutual solvent which can also be used as a low-cost replacement for fatty acid isopropyl esters. The compound currently finds use in some personal care products as a preservative and may be used at levels up to an overall concentration of 1.0% by volume.

Regional Insights

Steady growth outlook across end-use industries in North America, partly creditable to the signing of a renewed trilateral treaty, USMCA, shall be a key factor while assessing future opportunities for glycol ethers in the region. While U.S. and Canada exhibit the characteristics of a highly advanced industrial landscape governed by the policies of regulatory agencies; Mexico is touted as an emerging manufacturing hub. Currently accounting for 20% of the global consumption levels, North America is projected to register a CAGR of 3.8% in terms of volume until 2025.

Europe, which accounted for 28% of the global consumption in 2017, is one of the largest markets for cosmetics and personal care products. Fluctuating seasonal demand is expected to impede growth in the short-term across the region. However, with supply levels expected to recover and multinationals demanding for high-quality glycol ethers, demand augmentation is plausible over the long-term, with a projected CAGR of 4.7% until 2025.

Key Companies & Market Share Insights

Presence of numerous manufacturers reasons for intensive competition amongst companies. The market is characterized by multinationals dominating the marketspace, while regional companies vying to excel in terms of product innovation and implementation of next-gen technologies across the operational sphere. The presence of a broad product portfolio that caters to a number of end-use industries has led to these companies cementing their top position in the market. One of the critical aspects covered by these multinationals apart from product innovation is strong market positing of their products to capture a wider potential customer base.

Some of the prominent players include:

-

BASF SE

-

LyondellBasell

-

Eastman

-

DowDuPont

Recent Developments

- In April 2022, BASF and SINOPEC, a petroleum refineries company, expanded their Verbund site in Nanjing, China. This expansion will increase the production capacity of cleaning agents, glycol ethers, and ethanolamines.

Glycol Ethers Market Report Scope

Report Attribute

Details

Market size value in 2019

USD 5.13 billion

Revenue forecast in 2025

USD 5.40 billion

Growth Rate

CAGR of 5.4% from 2019 to 2025

Base year for estimation

2018

Historical data

2014 - 2017

Forecast period

2019 - 2025

Quantitative units

Revenue in USD billion and CAGR from 2019 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, France, U.K., China, India, Japan, Thailand, Indonesia, Malaysia

Key companies profiled

BASF, LyondellBasell, Eastman, and Dow Chemicals.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Glycol Ethers Market SegmentationThis report forecasts revenue growth at global, regional, and country level and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global glycol ethers market report on the basis of product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

E-Series

-

E-series Glycol Ether

-

Ethylene Glycol Propyl Ether

-

Ethylene Glycol Butyl Ether Acetate

-

Others

-

-

P-Series

-

Methyl Ether

-

Butyl Ether

-

Methyl Ether Acetate

-

Others

-

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Paints & Coatings

-

Printing

-

Pharmaceuticals

-

Cosmetics & Personal Care

-

Electronics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

North America

-

U.S

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Malaysia

-

Thailand

-

Indonesia

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global glycol ethers market size was estimated at USD 5.13 billion in 2019 and is expected to reach USD 5.40 billion in 2020.

b. The global glycol ethers market is expected to grow at a compound annual growth rate of 5.4% from 2018 to 2025 to reach USD 7.10 billion by 2025.

b. P-series dominated the glycol ethers market with a share of 63.5% in 2019. This is attributable to rising utilization in treating metal &non-metal surfaces, laboratory products, and water treatment formulations.

b. Some key players operating in the glycol ethers market include BASF, LyondellBasell, Eastman, and Dow Chemicals.

b. Key factors that are driving the market growth include rising use of water-based surface coatings as replacement for solvent-based coatings.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."