- Home

- »

- Food Additives & Nutricosmetics

- »

-

Glycerol Monostearate Emulsifiers Market Size Report, 2030GVR Report cover

![Glycerol Monostearate Emulsifiers Market Size, Share & Trends Report]()

Glycerol Monostearate Emulsifiers Market (2024 - 2030) Size, Share & Trends Analysis Report By End-Use (Food & Beverages, Personal Care & Cosmetics, Others End-Uses), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-192-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

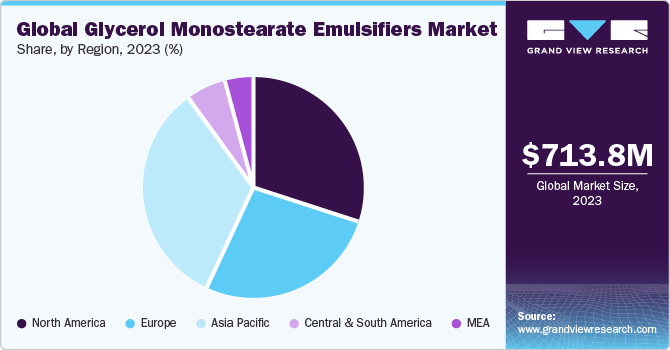

The global glycerol monostearate emulsifiers market size was estimated at USD 713.8 million in 2023 and is projected to grow at a CAGR of 6.3% from 2024 to 2030. The growing utilization of the product as an emulsifier in food & beverages, personal care & cosmetics, and pharmaceutical industries is anticipated to contribute to the market growth during the forecast period.

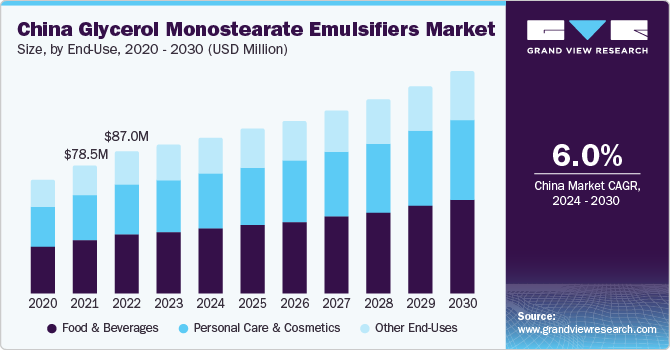

China has emerged as a major food processing market in recent times, maintaining a significant growth rate throughout the last 3 decades. According to the China Ministry of Agricultural and Rural Affairs (MARA), there has been a steady growth in the dairy industry of China, with the production rising from 40.3 million metric tons (Mmt) in 2022 to 42.3 Mmt in 2023. This growth still leaves scope for keeping up pace with the local consumption levels, which stood at 70.18 Mmt in 2023. The production capacity of the dairy industry in China is expected to show remarkable growth from 2022 to 2027. Hence, this industry is expected to become a major driver for the GMS market in the country.

Glycerol monostearate (GMS) is a widely used emulsifier in numerous industries due to its versatile properties. As an ester of stearic acid and glycerol, GMS exhibits both hydrophilic and lipophilic characteristics, making it an effective emulsifying agent. Its ability to form stable oil-in-water emulsions is attributed to its molecular structure, which includes a hydrophilic head and a lipophilic tail that dissolves in oily organic compounds. This allows GMS to effectively stabilize oil and water mixtures, preventing phase separation.

Glycerol monostearate with purity of less than 90% contains impurities or lower levels of the desired compound. They are extensively utilized in large-scale industrial operations, where their emulsifying and stabilizing properties are required, but the specific purity level is not critical. GM above 90% purity finds various applications in the food industry and helps improve the texture, consistency, and shelf life of food products. In the baked goods segment, GMS is used in the production of baked goods such as bread, cakes, and pastries.

The regulatory environment surrounding the use of GMS as an emulsifier in various industries can pose a restraint to its market growth. Regulatory bodies such as the Food and Drug Administration (FDA) in the United States and the European Food Safety Authority (EFSA) in the European Union impose strict regulations on the use of food additives, including emulsifiers like GMS. Compliance with these regulations requires extensive testing and documentation to ensure the safety and efficacy of GMS in different applications. Any changes in regulatory requirements or the introduction of new regulations can impact the market for GMS, as manufacturers may need to invest in additional research and development to meet the updated standards.

The competition from alternative emulsifiers presents a challenge for the GMS market. With ongoing advancements in food science and technology, alternative emulsifiers with similar or enhanced functionalities are continually being developed. These alternatives may offer specific advantages such as improved stability, texture, or sensory attributes in comparison to GMS.

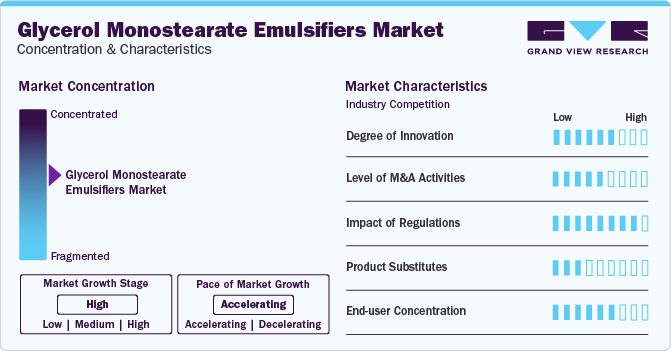

Market Concentration & Characteristics

The market exhibits a mildly concentrated nature, primarily due to the dominance of a few major players in the industry. These key players hold a significant market share and have established strong brand recognition and distribution networks. As a result, they have a competitive advantage over smaller and newer players entering the market. This concentration is influenced by factors such as economies of scale, extensive research and development capabilities, and long-standing customer relationships.

For instance, companies like Croda International plc, Evonik Industries AG and Kao Corporation are major players in the GMS emulsifiers market. They have a wide range of GMS-based products, catering to various industries such as food, cosmetics, and pharmaceuticals. These companies have the resources and expertise to develop innovative solutions, meet diverse customer requirements, and maintain a strong market presence.

Several factors affect the mildly concentrated nature of the GMS emulsifiers market. Firstly, the high initial investment required for research and development, manufacturing facilities, and distribution networks creates barriers to entry for new players. The established companies have already made substantial investments, giving them a competitive edge.

Major food manufacturers often have long-term contracts with established GMS emulsifier suppliers. These suppliers have invested in research and development to create specialized products that meet the specific needs of food formulations. As a result, they hold a significant portion of the market share.

Regulations play a significant role in shaping the GMS emulsifiers market. Government regulations are designed to protect consumers and ensure the safety and quality of food and cosmetic products. For instance, the European Union's Regulation (EC) No 1333/2008 on food additives. This regulation sets maximum permitted levels for emulsifiers, including GMS, in various food products. It ensures that the use of emulsifiers remains within safe limits and prevents excessive consumption that could potentially harm consumers.

End-Use Insights

Based on end-use, the food & beverages led the market with the largest revenue share of 38.9% in 2023. This high percentage can be attributed to the extensive usage of GMS emulsifiers due to their ability to blend ingredients that would otherwise separate, such as oil and water, in products such as salad dressings, margarine, and ice cream. Its stabilizing properties contribute to the texture and consistency of products like yogurt, preventing separation and providing a smooth feel.

GMS is also widely used in the confectionery industry as it aids in the production of chocolate, toffee, and caramel. In chocolate manufacturing, GMS helps to prevent the cocoa and cocoa butter from separating, ensuring a smooth and glossy appearance in the final product. Furthermore, in the production of toffee and caramel, GMS assists in controlling crystallization, resulting in a desirable texture and mouthfeel. Its multifunctional properties make GMS an essential ingredient in the confectionery sector.

The personal care and cosmetics industry is another major end-user of GMS emulsifiers. As an emulsifier, GMS helps to stabilize products and prevent separation, making it a valuable ingredient in moisturizers, eye creams, sunscreens, makeup, and hand creams. The multifunctional nature of GMS makes it a widely used ingredient in the personal care and cosmetics industry, where it contributes to the stability, texture, and performance of a wide range of products. The growing awareness towards organic and natural products has also had its effect on the GMS end user segments such as emulsifiers used in skin care products.

Regional Insights

Asia Pacific dominated the market with the largest revenue share of 36.2% in 2023. This high share is attributable to the presence of some of the largest manufacturers of agricultural products in the world such as China, India, Thailand, Vietnam, and others. This along with the presence of a large population has enabled these countries to have large-scale food producing and processing industries. The steady growth of the middle-class population in these countries has altered food consumption patterns, driving them toward processed food and beverages, thereby further increasing the demand for GMS in food & beverages industry.

North America is anticipated to witness the significant CAGR over the forecast period. The expansion of the North American cosmetics & personal care industry is driving the GMS market as an emulsifier. For instance, in February 2023, Unilever announced to build a manufacturing facility in Nuevo Leon, Mexico. The company plans to invest USD 400 million in enhancing its manufacturing capacity to produce beauty and personal care products in the country. This development is expected to increase the consumption of GMS as an emulsifier in the production of cosmetics & personal care.

The European pharmaceutical industry uses Glycerol Monostearate to stabilize emulsions, improve drug delivery systems, and enhance the overall performance of pharmaceutical formulations. GMS allows the incorporation of oil-based active pharmaceutical ingredients into water-based formulations. According to the European Federation of Pharmaceutical Industries and Associations (EFPIA), the value of production in Europe increased from USD 140.25 billion in 2000 to USD 330 billion in 2021. The European nations also invested USD 45.7 billion on a research and development activities, indicating the scope for further expansion of the industry.

Key Glycerol Monostearate Emulsifiers Company Insights

The market exhibits a competitive landscape with a significant number of companies vying for a share of the growing demand for bio-based products. The market is characterized by various initiatives undertaken by companies to enhance their competitiveness and increase market share. Notable companies operating in this market include Croda International Plc, Oleon NV, Kao Corporation, Evonik Industries AG and others. These companies are actively engaged in strategic initiatives such as mergers & acquisitions, product developments, regional expansion, and innovations to strengthen their market position.

Some of the key players operating in the market include Croda International plc, Oleon NV and Wilmar International Limited.

-

Croda International plc primarily deals in specialty chemicals meant for two markets, namely consumer care and life sciences. It also offers biotechnology solutions, segmented into fragrances, home care, personal care, and specialist solutions

-

Oleon NV is an international company that specializes in the production and distribution of oleochemicals. The company is part of the Avril group, a recognized player in the bio-based chemistry sector. Oleon offers a wide range of products, including fatty acids, glycerin, esters, dimers, technical oils, and specialty oleo chemicals

-

Alfa Chemistry, Estelle Chemicals and acm chemicals are some of the emerging market participants in the glycerol monostearate market.

-

Alfa Chemistry is a manufacturer, supplier, and contract research organization (CRO) that specializes in the fields of material chemistry, organic chemistry, and medicinal chemistry. The company provides research chemicals, building blocks, reagents, catalysts, and reference materials

-

Estelle Chemicals Pvt. Ltd. is a prominent manufacturer of food emulsifiers and specialty surfactants. It is a privately owned company that deals in the production of additives for use in the food & beverage industry

Key Glycerol Monostearate Emulsifiers Companies:

The following are the leading companies in the glycerol monostearate emulsifiers market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these glycerol monostearate emulsifiers companies are analyzed to map the supply network.

- Croda International Plc

- Oleon NV

- Alpha Chemicals Private Limited

- Kao Corporation

- Evonik Industries AG

- Estelle Chemicals Pvt. Ltd.

- acm chemicals

- BASF SE

- Alfa Chemistry

- LobaChemie Pvt. Ltd.

- Spectrum Chemical

- Wilmar International Ltd

Recent Developments

-

In December 2023, Croda International Plc inaugurated a new production facility, Pastillator 4 (PSO4) located in Jurong Island, Singapore. The facility is expected to help the company meet growing demand for esters and pastille format alkoxylates. It is investing a total sum of USD 16.4 million to increase the site’s total capacity to 15,000 metric tons

-

In January 2023, Oleon N.V. announced the decision to double the capacity of its isostearic acid and dimer acid production plant based in Ertvelde, Belgium by 2024. The production unit is expected to have a capacity of 14,125 tons, once the expansion work is completed

Glycerol Monostearate Emulsifiers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 749.03 million

Revenue forecast in 2030

USD 1,081.8 million

Growth rate

CAGR of 6.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Volume in kilotons, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End-use, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Argentina; Colombia; Saudi Arabia; and South Africa

Key companies profiled

Croda International Plc; Oleon NV; Alpha Chemicals Private Limited; Kao Corporation; Evonik Industries AG; Estelle Chemicals Pvt. Ltd.; acm chemicals; BASF SE; Alfa Chemistry; LobaChemie Pvt. Ltd.; Spectrum Chemical; Wilmar International Ltd

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Glycerol Monostearate Emulsifiers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global glycerol monostearate emulsifiers market report based on end-use, and region.

-

End-Use Outlook (Volume, Kilotons, Revenue, USD Billion, 2018 - 2030)

-

Food & Beverages

-

Personal Care & Cosmetics

-

Other End-Uses

-

-

Regional Outlook (Volume, Kilotons, Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global glycerol monostearate emulsifiers market size was estimated at USD 713.8 million in 2023 and is expected to reach USD 749.0 million in 2024

b. The global glycerol monostearate emulsifiers market is expected to grow at a compound annual growth rate of 6.3% from 2024 to 2030 to reach USD 1,081.8 million by 2030

b. Asia Pacific dominated the glycerol monostearate emulsifiers market with a share of 32.6% in 2023. This is attributable to the presence of some of the largest manufacturers of agricultural products in the world such as China, India, Thailand, Vietnam, and others.

b. Some key players operating in the glycerol monostearate emulsifiers market include Croda International Plc, Oleon NV, Alpha Chemicals Private Limited, Kao Corporation, Evonik Industries AG, Estelle Chemicals Pvt. Ltd., acm chemicals, BASF SE, Alfa Chemistry, LobaChemie Pvt. Ltd., Spectrum Chemical and Wilmar International Ltd

b. Key factors that are driving the market growth include the growing utilization of the product as an emulsifier in food & beverages, personal care & cosmetics as well as pharmaceutical industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.