Glycerol Derivatives Market Size, Share & Trends Analysis By Grade (Bio-based), By Product (4-(hydroxymethyl)-1 3-dioxolan-2-one, Polyglycerol) By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-036-6

- Number of Report Pages: 105

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

Report Overview

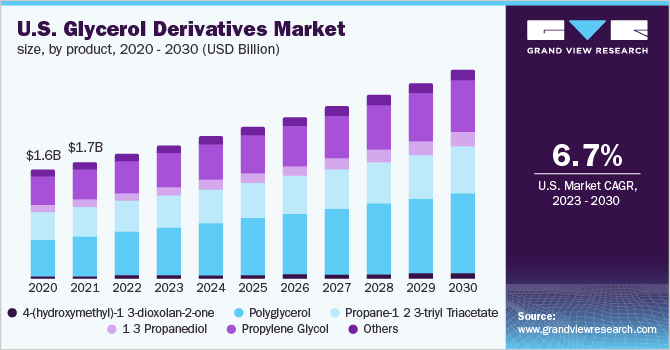

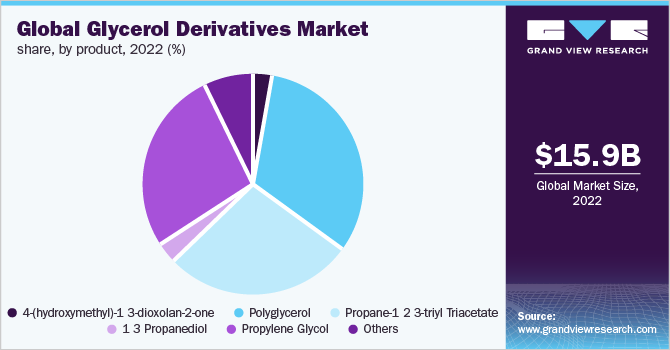

The global glycerol derivatives market size was valued at USD 15.94 billion in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 6.5% from 2023 to 2030. The demand for glycerol derivatives is driven by increasing demand from growing end-use industries such as construction, transportation, pharmaceutical, food & beverages, and cosmetics They are used as an emulsifier in the production of low-fat spreads such as frozen desserts and peanut butter. Increasing consumption of emulsifiers in food & beverage application is anticipated to boost the demand for market

Glycerol derivatives are a class of chemicals derived from glycerol, a naturally occurring alcohol commonly found in fats and oils. These derivatives include a range of products, such as glycerol esters, glycerol ethers, polyglycerol esters, and propylene glycol, among others. The increasing use of propylene glycol in various industries, including construction and transportation, is expected to drive demand for these derivatives in the near future as glycerol-based plasticizers can be added to concrete to improve its workability and reduce water content. This can result in stronger, more durable concrete with reduced shrinkage and cracking.

Polyglycerol is a derivative of glycerol and plays a significant role in the growth of the glycerol derivatives market. Its unique properties such as high viscosity, low toxicity, and excellent emulsifying and moisturizing abilities make it a popular choice for a variety of applications. In the food and beverage industry, it is used as a substitute for other emulsifiers due to its lower calorie content and improved stability, while in cosmetics and personal care products, it acts as a moisturizing ingredient.

Additionally, in the pharmaceutical industry, polyglycerol is utilized as a solubilizer and emulsifier in the production of drugs, and vaccines and also as a carrier. Its ability to improve the stability and efficacy of vaccines and drugs makes it a preferred choice in the pharmaceutical industry. The increasing demand for polyglycerol in these industries, along with the potential for new applications in the future, is contributing to the industry growth.

The COVID-19 pandemic had a mixed impact on the market growth. On one hand, the lockdowns and restrictions on transportation and trade disrupted the supply chain and led to temporary disruptions in production and distribution. This resulted in a shortage of raw materials and an increase in prices. On the other hand, the pandemic also led to a surge in demand for certain glycerol derivatives, particularly in the pharmaceutical and personal care industries.

The increased demand for hand sanitizers and other personal care products boosted the demand for glycerol derivatives as they are used as ingredients in these products. In the pharmaceutical industry, the demand for vaccines and drugs also increased as a result of the pandemic, further driving the demand for glycerol derivatives in the production of these products.

Grade Insights

Bio-based grade segment dominated the market with the highest revenue share of 55.8 % in 2022. This is attributable to the increasing demand for sustainable and eco-friendly products. Bio-based glycerol derivatives are produced from renewable resources, such as vegetable oils, and are considered to be more sustainable and environmentally friendly.

The use of bio-based glycerol derivatives is growing in various industries, such as cosmetics, personal care, food and beverage, pharmaceuticals, and others, due to their properties such as high viscosity, moisturizing effects, and emulsifying properties. Additionally, the increasing awareness of the harmful effects of petrochemicals and the growing trend towards natural and organic products are driving the growth of the bio-based glycerol derivatives market.

Petroleum based grade segment is growing significantly due to the growing concern over the environmental impact of petroleum-based products and the increasing demand for sustainable and eco-friendly products has led to a shift towards bio-based glycerol derivatives. Despite this, the market for petroleum-based glycerol derivatives is still expected to remain significant, driven by the demand from existing applications and the development of new applications in various industries.

Product Insights

Polyglycerol segment dominated the market with the highest revenue share of 32.3 % in 2022. This is attributable to growing use of the product as emulsifiers, solubilizing agents, and moisturizing agents. They are considered to be more sustainable and environmentally friendly compared to traditional petroleum-based emulsifiers and are considered to be a safer alternative to ingredients like propylene glycol.

Moreover, the food and beverage industry is a major end-user of polyglycerols, and their use as emulsifiers and solubilizing agents is growing in the industry. They are used in products such as baked goods, dairy products, and sauces to improve texture and stability. Additionally, the increasing demand for natural and organic cosmetics and personal care products is driving the growth of the product market in the cosmetics and personal care industry.

1, 3-propanediol (PDO) product segment is growing significantly due to the growing personal care and cosmetics industry, where it is used as a moisturizing agent, solubilizer, and carrier in various skin care and hair care products. The food and beverage industry also uses PDO as a humectant and emulsifier to improve the texture and stability of various products. As the demand for (PDO) continues to grow, the demand for the product is expected to increase, thereby driving the growth of the market

Regional Insights

Asia Pacific dominated the market with the highest revenue share of 39.3% in 2022. This is attributable to the growing demand for bio-based products, as well as the increasing demand for personal care and pharmaceutical products in countries such as China and India. Asia-Pacific is a major producer and consumer of glycerol, with countries such as China, India, and Indonesia among the largest producers of biodiesel and glycerol.

The food & beverage industry has also been a major driver for the market as the food processing industry is expected to expand at a lucrative rate in China. Market in China is expected to witness profitable growth in the food manufacturing sector, which has over 35,000 processing and manufacturing facilities in the country. The growing need for food production can be attributed to the changing consumer lifestyles, increasing purchasing power, and the expanding middle-class population of the country, which is expected to further contribute to food additives demand. This, in turn, is anticipated to drive the demand for the product in the country over the forecast period.

Europe is a key producer of glycerol and biodiesel in the world and accounts for the second-largest share of the global market. Germany, Italy, France, and the Netherlands are the major producers of glycerol derivatives in Europe. Countries in Europe have a significant need for biofuels. Thus, biodiesel production is expected to rise over the forecast period which, in turn, will have a positive impact on the market. The supply of glycerol derivatives improved in the first quarter of 2022 owing to the availability of feedstock and large-scale biodiesel production.

Key Companies & Market Share Insights

The market is highly competitive, with a large number of companies operating in this market and competing for a share of the growing demand for bio-based products. Companies in this market are focusing on various initiatives to enhance their competitiveness and increase their market share.

One of the initiatives taken by manufacturers in the market is the development of new and innovative products. For example, AkzoNobel, a producer of the product, has developed a new range of bio-based surfactants using glycerol as a raw material. This new range of products has been well received by the market, as it provides a more sustainable and environmentally friendly alternative to traditional surfactants.

In addition, market players are also focusing on improving their supply chain management and distribution network. This includes establishing partnerships and collaborations with suppliers, distributors, and customers to enhance their competitiveness and increase their market share.

The key players in glycerol derivatives market are

-

Zhangjiagang Glory Biomaterial Co., Ltd.

-

Shell Chemical Lp

-

Tokyo Chemical Industry Co., Ltd.

-

DuPont

-

Solvay

-

Croda International Plc

-

Cargill, Incorporated

-

Primient Covation LLC

-

Haihang Industry Co., Ltd

-

Sakamoto Yakuhin kogyo Co., Ltd.

-

Spiga Nord S.p.A.

-

Stepan Company

-

thyssenkrupp AG

-

Acuro Organics Limited

-

Repsol

Glycerol Derivatives Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 16.9 billion |

|

Revenue forecast in 2030 |

USD 26.5 billion |

|

Growth Rate |

CAGR of 6.5% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD Million, Volume in Kilotons, and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Grade, product, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Columbia; South Africa; Saudi Arabia |

|

Key companies profiled |

Zhangjiagang Glory Biomaterial Co.; Ltd.; Shell Chemical Lp; Tokyo Chemical Industry Co.; Ltd.; DuPont; Solvay; Croda International Plc; Cargill; Incorporated; Primient Covation LLC; Haihang Industry Co.; Ltd; Sakamoto Yakuhin kogyo Co.; Ltd.; Spiga Nord S.p.A.; Stepan Company; thyssenkrupp AG; Acuro Organics Limited; Repsol. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Glycerol Derivatives Market Segmentation

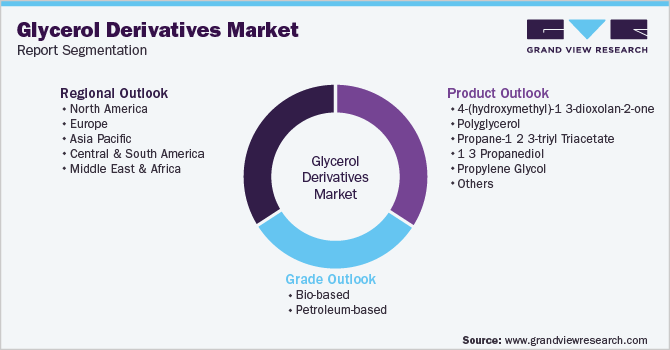

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global glycerol derivatives market report based on grade, application, and region:

-

Grade Outlook (Volume, Kilotons, Revenue, USD Million; 2018 - 2030)

-

Bio-based

-

Petroleum-based

-

-

Product Outlook (Volume, Kilotons, Revenue, USD Million; 2018 - 2030)

-

4-(hydroxymethyl)-1 3-dioxolan-2-one

-

Pharmaceutical

-

Solvents

-

Polymers

-

Others

-

-

Polyglycerol

-

Food & Beverage

-

Pharmaceuticals

-

Personal care

-

Others

-

-

Propane-1 2 3-triyl triacetate

-

Personal Care & Cosmetics

-

Pharmaceutical

-

Dyes

-

Others

-

-

1 3 propanediol

-

Polytrimethylene Terephthalate (PTT)

-

Polyurethane (PU)

-

Personal Care & Detergents

-

Others

-

-

Propylene Glycol

-

Food & Beverage

-

Pharmaceutical

-

Cosmetics & Personal Care

-

Construction

-

Transportation

-

Others

-

-

Others

-

-

Regional Outlook (Volume, Kilotons, Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

Columbia

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global glycerol derivatives market size was estimated at USD 15.94 billion in 2022 and is expected to reach USD 16.99 billion in 2023.

b. The global glycerol derivatives market is expected to grow at a compound annual growth rate of 6.5% from 2023 to 2030 to reach USD 26.48 billion by 2030.

b. Asia Pacific dominated the glycerol derivatives market with a share of 36.9% in 2022. This is attributable to rising healthcare awareness coupled with constant research and development initiatives.

b. Some key players operating in the glycerol derivatives market include Shell Chemicals Plc, Solvay, DuPont, Croda International Plc, Cargill Incorporated, Stepan Company, and Repsol

b. Key factors that are driving the market growth include increasing demand from growing end-use industries such as construction, transportation, pharmaceutical, food & beverages, and cosmetics along with rising demand from various end-use industries for environmentally friendly alternatives

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."