- Home

- »

- Consumer F&B

- »

-

Gluten Free Sugar Syrup Market Size & Share Report, 2030GVR Report cover

![Gluten Free Sugar Syrup Market Size, Share & Trends Report]()

Gluten Free Sugar Syrup Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Application (Industrial, Direct Human Consumption), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-895-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Gluten Free Sugar Syrup Market Summary

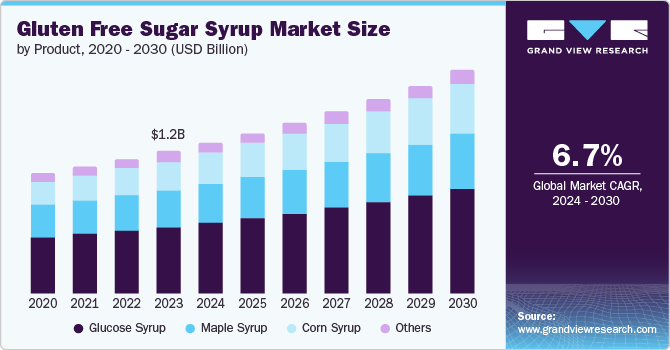

The global gluten free sugar syrup market size was valued at USD 1.17 billion in 2023 and is expected to reach USD 1.82 billion by 2030, growing at a CAGR of 6.7% from 2024 to 2030. The increasing prevalence of celiac diseases, more people's awareness of gluten intolerance, and the adoption of healthier lifestyles are contributing to the growth of the gluten-free sugar syrup market.

Key Market Trends & Insights

- The North America region dominated the market in 2023 with a revenue share of 35.2%.

- The U.S. gluten free sugar syrup market is expected to witness significant growth over the forecast period.

- In terms of product, glucose syrup segment dominated the market and accounted for a share of 47.3% in 2023.

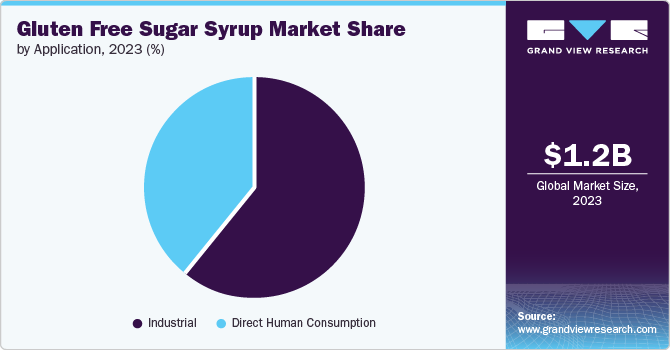

- In terms of application, the industrial segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.17 Billion

- 2030 Projected Market Size: USD 1.82 Billion

- CAGR (2024-2030): 6.7%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Moreover, the expanding range of gluten-free products available in retail and online stores makes it easier for consumers to incorporate them into their daily diets. With the growing awareness of celiac disease and gluten intolerance, more people are pursuing gluten-free alternatives to conventional food products. Approximately 1 in 133 people in the United States have celiac disease, affecting 1% of the population or 2 million people, but over 80% remain undiagnosed or misdiagnosed, especially among socioeconomically deprived individuals. The number of people with celiac disease is increasing and varies by location and demographic group. Additionally, many individuals without diagnosed gluten-related disorders choose gluten-free products as part of a healthier lifestyle, accepting that such products are better for digestion and overall well-being. This rising health consciousness fuels the demand for gluten-free sugar syrups as consumers adopt safe and healthy sweetening options.

Innovations in extraction and purification processes have increased the production of high-quality gluten-free sugar syrups that retain their natural flavors and nutritional properties. These technological improvements ensure that gluten-free sugar syrups are produced at scale, maintaining consistency and quality and meet growing consumer demand. Additionally, advancements in packaging and preservation methods have extended the shelf life of these products, making them more accessible and convenient for consumers.

Restaurants and the food service industry are increasingly adopting gluten-free sugar syrups to meet their customer's dietary requirements. As awareness of gluten intolerance and celiac disease grows, more restaurants request gluten-free options. Additionally, soft drink manufacturers are increasingly incorporating gluten-free sugar syrups into their products to cater to the rising demand for gluten-free beverages. By using gluten-free sugar syrups, soft drink producers fulfill the demand of the wider audience, including health-conscious consumers. For instance, in April 2024, Pepsi launched a limited-edition Maple Syrup soda in collaboration with IHOP, the International House of Pancakes. Instead of cans, the cola is available at IHOP as a fountain soda option. Customers order the flavor as a soft drink or in a Pepsi Maple Syrup Cola Float, including vanilla ice cream.

Product Insights

Glucose syrup segment dominated the market and accounted for a share of 47.3% in 2023. Gluten-free bakery and confectionery products are increasingly popular among consumers with gluten intolerance or those avoiding gluten for health reasons. Glucose syrup is a crucial ingredient in these sectors due to its ability to improve the texture, sweetness, and shelf-life of products such as cakes, cookies, candies, and pastries. The rising demand for gluten-free confectionery and bakery items increases the demand for gluten-free glucose syrup.

The corn syrup segment is expected to witness the fastest CAGR over the forecast period. As consumers become more aware of gluten's health implications and pursue gluten-free alternatives, they actively choose products that meet their dietary needs. Manufacturers and retailers play a crucial role in educating consumers about the availability and benefits of gluten-free corn syrup, thereby expanding its market reach and driving demand. Moreover, as the prevalence of gluten-related disorders such as celiac disease increases, more consumers are opting for gluten-free alternatives in their diets. Food manufacturers are responding by reformulating existing products and introducing new gluten-free options, including corn syrup as a key ingredient. For instance, in March 2023, Torani introduced Kettle Corn Syrup, which includes the flavor of popped kettle corn, combining salty and sweet notes with hot oil flavor. It is part of Torani's Original Syrup line, crafted with natural flavors and cold-filtered water.

Application Insights

The industrial segment accounted for the largest market revenue share in 2023. In the industrial sector, gluten free sugar syrups are essential ingredients in food and beverage manufacturing, providing sweetness, texture, and stability to products such as baked goods, confectionery, beverages, and sauces. These products offer additional health benefits beyond essential nutrition and are gaining popularity among consumers. Gluten-free sugar syrups are used as sweeteners and functional ingredients in these products to enhance their nutritional profiles while ensuring gluten-free. The growth of this sector creates new opportunities for applying gluten-free sugar syrups in products such as energy bars, sports drinks, probiotic beverages, and snacks, driving demand in the industrial application segment.

The direct human consumption segment is expected to witness the fastest CAGR over the forecast period. Consumers needing to avoid gluten for medical reasons actively pursue products that replace traditional gluten-containing foods. Gluten-free sugar syrups provide a safe and convenient option for health-conscious individuals, driving demand in this segment. Additionally, as companies aim to cater to the growing market of gluten-sensitive and health-conscious consumers, they are increasingly incorporating gluten-free sugar syrups into their product formulations. This includes a wide range of products such as breakfast cereals, granola bars, beverages, desserts, and snacks. Including gluten-free sugar syrups in these products ensures meeting the dietary needs of consumers while maintaining quality and taste.

Regional Insights

The North America region dominated the market in 2023 with a revenue share of 35.2%. The rising population of people intolerant to gluten is the primary factor influencing the market's growth in this region. Manufacturers are introducing innovative products to meet the growing demand for gluten free sugar syrup products. Additionally, the region's retail and distribution networks play a crucial role in driving the gluten-free sugar syrup market. Supermarkets, health food stores, specialty retailers, and e-commerce platforms offer a wide variety of gluten-free products, making them easily accessible to consumers. The convenience of purchasing gluten-free sugar syrups through these diverse channels supports their widespread adoption.

U.S. Gluten Free Sugar Syrup Market Trends

The U.S. gluten free sugar syrup market is expected to witness significant growth over the forecast period. Health organizations, advocacy groups, and manufacturers have successfully conducted consumer awareness campaigns to educate consumers about the benefits of gluten-free diets and the availability of gluten-free products. These efforts have increased consumer awareness and understanding of gluten-related disorders and the importance of gluten-free alternatives. Influential marketing strategies, including celebrity endorsements and social media campaigns, significantly impact the U.S. market. Celebrities and influencers promoting gluten-free diets and lifestyles influence consumer behavior. Effective marketing strategies enhance consumer interest and drive the demand for gluten-free sugar syrups.

The Canada gluten free sugar syrup market is expected to witness significant growth over the forecast period. Manufacturers in Canada are launching dedicated distribution platforms for gluten-free sugar syrups to enhance market reach and consumer access. These platforms leverage traditional retail channels and modern e-commerce solutions, ensuring widespread product availability. For instance, in November 2023, Canadian Maple Co. launched a global platform to export maple syrup. With an initial budget under USD 5,000 and powered by Shopify, the company streamlines operations and optimizes advertising.

Asia Pacific Gluten Free Sugar Syrup Market Trends

The Asia Pacific gluten free sugar syrup market is expected to witness the fastest CAGR over the forecast period. Many regional food manufacturers are expanding their portfolios to include gluten-free products in response to growing consumer demand. This includes a wide range of baked goods, snacks, beverages, and others incorporating gluten-free sugar syrups. Integrating these syrups into various food products ensures consistent demand from manufacturers and consumers, supporting market growth.

The China gluten free sugar syrup market is anticipated to witness significant growth. Cultural shifts and changing consumer preferences in China influence the demand for gluten-free sugar syrups. As urbanization and globalization change lifestyles and dietary habits, there is an increasing inclination towards healthier and more diverse food choices. Chinese consumers, particularly younger generations, pursue products that match their health, wellness, and sustainability values. Gluten-free sugar syrups, as natural and beneficial alternatives to traditional sweeteners, match these evolving consumer preferences, driving their adoption and market expansion.

The India gluten free sugar syrup market is anticipated to witness significant growth. Expanding retail channels and e-commerce platforms increase the accessibility and availability of gluten-free sugar syrups in India. Major supermarkets, health food stores, and specialty retailers increasingly stock up on various gluten-free products to meet consumer demand. The growth of online retail has also increased access to gluten-free sugar syrups, making them available to consumers across urban and rural areas. E-commerce platforms provide convenience and a wide range of product choices, enhancing India's market reach of gluten-free products.

Europe Gluten Free Sugar Syrup Market Trends

Europe gluten free sugar syrup market is anticipated to witness significant growth over the forecast period. Awareness and diagnosis of gluten intolerance and celiac disease have significantly improved over the years, leading to a growing number of individuals adopting gluten-free diets. This rising awareness has created a substantial demand for gluten-free products, including sugar syrups, as more consumers pursue to manage their health conditions effectively. Moreover, consumers increasingly prioritize healthy eating habits and are more conscious of the nutritional content of the foods they consume. The shift towards healthier lifestyles includes a preference for products perceived as more natural and beneficial, such as gluten-free sugar syrups. These factors combine to drive the market's demand for gluten-free sugar syrup.

The UK gluten free sugar syrup market is expected to witness significant growth over the forecast period. The growth of specialty and health food retail in the UK drives the accessibility and availability of gluten-free sugar syrups. Dedicated health food stores, supermarkets, and online retailers increasingly offer a wide range of gluten-free products, catering to the growing demand from health-conscious consumers. Additionally, the influence of dietary trends and globalization changed consumer preferences for gluten-free products in the UK. As consumers become more exposed to international food trends through media, travel, and online platforms, there is growing interest in adopting diets that align with global health standards, including gluten-free diets.

Key Gluten Free Sugar Syrup Company Insights

Some of the key companies in the gluten free sugar syrup market include B&G Foods, Inc, MONIN, Wholesome Sweeteners, Inc., CANADIAN ORGANIC MAPLE, Skinny Mixes., Blue Ocean Biotech, and others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. The key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

B&G Foods, Inc. produces markets and delivers a range of frozen and non-perishable household items. They include a variety of products, from spices to snacks. B&G offers products such as pickles, maple syrup, salsa, liquid smoke, baked beans, vinegar, and meat spreads under its brand.

-

Wholesome Sweeteners, Inc. is a prominent supplier of organic, natural, and unrefined sweeteners. The company provides nectars, sugars, honey, and syrups to the wholesale food ingredient and service sectors. It is dedicated to organic practices and innovation in environmentally friendly farming.

Key Gluten Free Sugar Syrup Companies:

The following are the leading companies in the gluten free sugar syrup market. These companies collectively hold the largest market share and dictate industry trends.

- B&G Foods, Inc

- Blue Ocean Biotech

- CANADIAN ORGANIC MAPLE CO. LTD

- Cargill, Incorporated

- Gulshan Polyols Ltd.

- MONIN

- Skinny Mixes.

- Tereos

- Torani

- Whole Earth Brands (Wholesome Sweeteners, Inc.)

Recent Developments

-

In March 2023, Jordan's Skinny Mixes launched four new flavors to its Naturally Sweetened Skinny Syrups line. These syrups contain natural zero-calorie sweeteners and do not have any artificial flavors or colors but still have a rich and taste. The new varieties include Caramel, French Vanilla, Peppermint Mocha, and Pumpkin Spice.

-

In January 2024, Valeo Foods launched Maple Crest Pancake Syrup in UK. The syrup is prepared using premium syrup produced by Les Industries Bernard & Fils, a Quebec-based fifth-generation syrup maker owned by Valeo Foods. The pancake syrup is available in jugs, as found in Canadian and US pancake houses.

Gluten Free Sugar Syrup Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.24 billion

Revenue forecast in 2030

USD 1.82 billion

Growth Rate

CAGR of 6.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Brazil, Argentina, Saudi Arabia, South Africa

Key companies profiled

B&G Foods, Inc; MONIN; Whole Earth Brands (Wholesome Sweeteners, Inc.); CANADIAN ORGANIC MAPLE CO. LTD; Cargill, Incorporated; Torani; Blue Ocean Biotech; Skinny Mixes.; Tereos; Gulshan Polyols Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gluten Free Sugar Syrup Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global gluten free sugar syrup market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Glucose Syrup

-

Maple Syrup

-

Corn Syrup

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Bakery Products

-

Beverages

-

Prepared Foods

-

Others

-

-

Direct Human Consumption

-

Grocery Store

-

Independent Health Stores

-

Club And Drugstores

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.