- Home

- »

- Consumer F&B

- »

-

Gluten-Free Bakery Premixes Market, Industry Report, 2030GVR Report cover

![Gluten-Free Bakery Premixes Market Size, Share & Trends Report]()

Gluten-Free Bakery Premixes Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Application (Bakery & Confectionary Shops, Restaurants & Cafes, Households), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-918-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Gluten-Free Bakery Premixes Market Trends

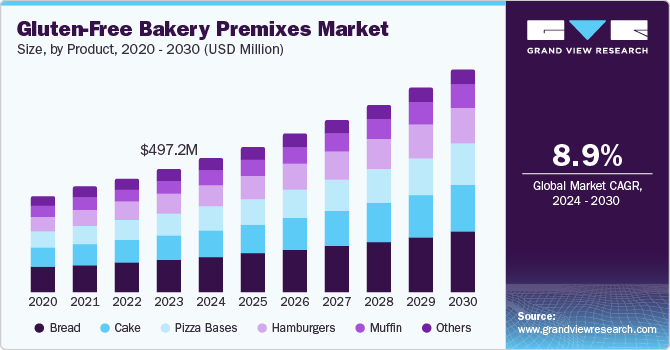

The global gluten-free bakery premixes market size was valued at USD 497.2 million in 2023 and is projected to grow at a CAGR of 8.9% from 2024 to 2030 owing to the increasing prevalence of celiac disease and gluten intolerance among consumers. In America, 1 in every 133 people has celiac disease. As awareness of these conditions grows, consumers increasingly seek gluten-free alternatives to traditional bakery products. This shift in consumer behavior has led to a surge in demand for gluten-free bakery premixes, which offer a convenient and reliable solution for producing gluten-free baked goods.

Another crucial factor contributing to the market’s growth is the rising health consciousness among consumers. Consumers have increasingly adopted gluten-free diets due to medical conditions and as a lifestyle choice to improve their overall health and well-being. This trend is particularly prominent among millennials and health-conscious individuals who prioritize clean and natural ingredients in their food. A report by NIH reveals that 70% of survey participants voluntarily try gluten-free diets without any medical diagnosis. Gluten-free bakery premixes, often made with wholesome and nutritious ingredients, align with modern consumer preferences. These premixes contain a small amount of wheat flour, and some of them do not contain wheat flour at all.

Furthermore, technological advancements in manufacturing processes and ingredient formulations have led to the development of high-quality gluten-free bakery premixes that closely mimic the taste and texture of traditional baked goods. For instance, using hydrocolloids such as xanthan gum, guar gum, and locust bean gum has been instrumental in replicating the viscoelastic properties of gluten. These ingredients help bind water, improve dough elasticity, and provide a better crumb structure. Enzymes, including transglutaminase, are used to enhance the protein network, resulting in improved dough stability and texture. These advancements have made gluten-free products more appealing to a broader audience.

Expanding distribution channels have made gluten-free bakery premixes more accessible to consumers worldwide. E-commerce platforms, specialty stores, and supermarkets now offer a wide range of gluten-free products, making it easier for consumers to find and purchase them. The increased availability of gluten-free bakery premixes has contributed to their growing popularity and market penetration.

Product Insights

Breads led the market with the dominant share of 25.7% in 2023 owing to the increasing prevalence of celiac disease and gluten intolerance, which has led to a growing demand for gluten-free bread options. Consumers with these conditions require safe and reliable alternatives to traditional bread, and gluten-free bakery premixes provide a convenient solution. In addition, health consciousness among consumers has been a major market driver. They have increasingly adopted gluten-free diets as part of a broader trend towards healthier eating habits. Gluten-free bread premixes, often made with nutritious ingredients including whole grains and seeds, have been a preferred choice for these consumers.

Hamburgers are expected to emerge as the fastest-growing segment over the forecast period. Increasing preference for ready-to-eat food due to busy working schedules is anticipated to propel the segment growth. Moreover, manufacturers have focused on using gluten-free premixes in the burgers to keep them fresh and healthy, which in turn has fueled the market growth. For instance, Schär is a European brand that is well-known for its extensive range of gluten-free products, including bread and buns that are perfect for gluten-free burgers.

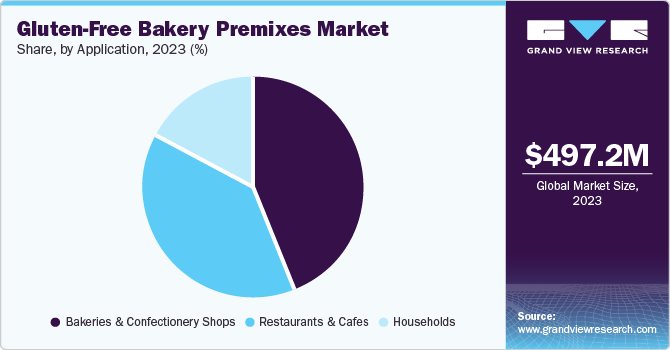

Application Insights

The bakery and confectionary shops segment dominated the market in 2023 owing to the rise in consumer demand for specialty and artisanal baked goods. These outlets have increasingly focused on offering unique and high-quality gluten-free products to differentiate themselves from competitors. Gluten-free bakery premixes allow these establishments to experiment with new flavors and product varieties, attracting a broader customer base. North America and Europe are projected to have the maximum number of bakery stores and manufacturers in the world. Moreover, the presence of leading bakery product manufacturers such as Flowers Foods, McKee Foods, and Grupo Bimbo is expected to fuel the growth of the segment over the forecast period.

Restaurants and cafes are expected to emerge at a CAGR of 9.1% over the forecast period. Increasing traveling and tourism is anticipated to propel the growth. The high number of tourist attraction spots in Asia Pacific, mainly in countries including India, China, Thailand, and Singapore is expected to propel the consumption of breads and related products in the region.

Regional Insights

The North America gluten-free bakery premixes market registered a 26.1% share in 2023 with the rising adoption of these premixes that align with growing consumer health consciousness. Consumers have increasingly adopted gluten-free diets due to medical conditions and as a lifestyle choice to improve their overall health and well-being. This trend is particularly prominent among millennials and health-conscious individuals who prioritize clean and natural ingredients in their food.

U.S. Gluten-Free Bakery Premixes Market Trends

The U.S. gluten-free bakery premixes market is anticipated to grow over the forecast period due to the increasing number of individuals opting for a gluten-free diet, for medical reasons and personal lifestyle choices. This group includes people with celiac disease, gluten sensitivity, or wheat allergies. Additionally, the rising popularity of diets including paleo and keto, which focus on low-carbohydrate and gluten-free options, is expected to further fuel the demand for gluten-free bakery premixes.

Asia Pacific Gluten-Free Bakery Premixes Market Trends

The Asia Pacific (APAC) gluten-free bakery premixes market dominated the global revenue with a 34.7% share in 2023 owing to the increasing prevalence of celiac disease and gluten intolerance. The market witnessed a notable shift in consumer preferences towards healthier and allergen-free food options, which has fueled the demand for gluten-free bakery premixes. Furthermore, the increasing popularity of western foods, such as pizzas, burgers, sandwiches, and hamburgers, is projected to fuel the regional demand for gluten-free bakery premixes.

The Australia gluten-free bakery premixes market dominated the APAC gluten-free bakery premixes market in 2023. The market was stimulated by a growing awareness of gluten-related health issues, leading to an increased demand for gluten-free products. Additionally, advancements in gluten-free product offerings have significantly improved the taste and texture of gluten-free bakery items, making them more appealing to a broader audience.

Europe Gluten-Free Bakery Premixes Market Trends

The gluten-free bakery premixes market in Europe held a 28.8% share in 2023. The market growth can be credited to the growing popularity of home baking, especially during the pandemic that has further fueled the demand for gluten-free bakery premixes. With more people spending time at home and experimenting with baking, the convenience and ease of use offered by premixes have become highly attractive. Consumers appreciate the ability to create delicious gluten-free baked goods without the need for extensive ingredient sourcing and preparation.

The Germany gluten-free bakery premixes market in 2023 was majorly driven by the rising prevalence of celiac disease and gluten intolerance among consumers. This has led to an increased demand for gluten-free products as more people seek to avoid gluten for health reasons. Moreover, the trend towards clean-label and natural ingredients positively impacted the market, as consumers prefer products with fewer additives and preservatives.

Key Gluten-Free Bakery Premixes Company Insights

The global gluten-free bakery premixes market is intensely competitive. Some of the key players are Myosyn Industries, MELINDA'S GLUTEN FREE GOODIES, Choices Gluten-free, and others. Manufacturers have continuously developed new flavors, formulations, and product types to cater to diverse consumer preferences. The wide range of options available has attracted a larger customer base and boosted market growth.

-

Myosyn Industries is a Brisbane-based company specializing in the manufacture and supply of innovative ingredient solutions for the food industry. The company boasts rich experience in developing high-quality ingredients, including processed meats, poultry products, seafood products, and bakery premixes.

-

Melinda’s Gluten-Free Goodies is a company dedicated to creating delicious and innovative gluten-free and allergy-friendly products. The company offers a wide range of products that cater to the needs of those with dietary restrictions, including vegan, dairy-free, and egg-free options.

Key Gluten-free Bakery Premixes Companies:

The following are the leading companies in the gluten-free bakery premixes market. These companies collectively hold the largest market share and dictate industry trends.

- Myosyn Industries

- MELINDA'S GLUTEN FREE GOODIES

- Choices Gluten-free

- Lesaffre Australia Pacific Pty Ltd

- Naturally Organic

- Theodor Rietmann Gmbh

- Caremoli

- Bakels Worldwide

- Watson Inc.

- SwissBake

Recent Developments

-

In June 2024, Lesaffre announced an agreement with dsm-firmenich for a multi-faceted collaboration in yeast derivatives for the savory ingredients market. Lesaffre is expected to acquire the latter company’s yeast extract GTM expertise and organization.

-

In March 2023, Bakels Worldwide announced the acquisition of Orley Foods, a company specializing in producing bakery ingredients. This acquisition aimed to enhance Bakels' product offerings and expand its market presence. The integration of Orley Foods was expected to bring additional expertise and innovation to Bakels' operations.

Gluten-Free Bakery Premixes Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 540.5 million

Revenue forecast in 2030

USD 903.1 million

Growth Rate

CAGR of 8.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Application, and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Mexico, Canada, UK, France, Germany, Italy, Spain, China, India, Japan, Australia, South Korea, Brazil, Saudi Arabia

Key companies profiled

Myosyn Industries; MELINDA'S GLUTEN FREE GOODIES; Choices Gluten-free; Lesaffre Australia Pacific Pty Ltd; Naturally Organic; Theodor Rietmann Gmbh; Caremoli; Bakels Worldwide; Watson Inc.; SwissBake

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gluten-Free Bakery Premixes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the gluten-free bakery premixes market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Bread

-

Cake

-

Pizza Bases

-

Muffin

-

Hamburgers

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bakeries & Confectionery Shops

-

Restaurants & Cafes

-

Households

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Mexico

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.