Glutathione Resin Market Size, Share & Trends Analysis Report By Application (Protein Purification, IP, Research), By Region (Asia Pacific, North America, Europe, MEA, CSA), And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-505-9

- Number of Report Pages: 105

- Format: PDF

- Historical Range: 2017 - 2019

- Forecast Period: 2021 - 2028

- Industry: Specialty & Chemicals

Report Overview

The global glutathione resin market size was valued at USD 407.60 million in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 8.4% from 2021 to 2028. The market is anticipated to be driven by the growing demand for affinity chromatography techniques in research and development activities related to drug and vaccine development. The global product demand is fueled by increased production of vaccines & pharmaceutical drugs and increased research activities across medicine industries. The glutathione resin suppliers face numerous challenges, such as the high price of glutathione, the key raw material used in affinity chromatography technique, and increased government regulations concerning the health of the people, which vary by region considerably.

Reduced glutathione or oxidized glutathione are key raw materials used in manufacturing glutathione resins. Raw materials and processing are the two largest elements in the cost structure of the glutathione resins manufacturing process. Raw materials constitute a high share of the cost structure in glutathione resins production closely followed by processing cost, which accounts for a high share.

High raw material prices along with high processing costs are another major factor impacting the market. Thus, the manufacturers are investing in R&D to find an affordable alternative. Key suppliers of the raw materials have widespread facilities and a highly effective distribution network, thereby facilitating efficient and timely sourcing.

Rapidly increasing population, increasing awareness regarding health & safety, the continuous growth of custom affinity bioprocess resin, and expanding pharmaceutical sector are expected to drive the product demand over the forecast period. This, in turn, is expected to have a positive impact on the affinity chromatography market over the forecast period.

Extensive R&D in the global chromatography resin industry has driven the development of novel resin products, which have better productivity in comparison to conventional resins. Chromatography resin is a perfect example of evolving industry dynamics. Affinity chromatography has gained a significant market space in recent years across various end-use industries due to its ease of use and high accuracy. However, the presence of stringent safety standards across pharmaceutical industries may hamper the growth of the chromatography resin industry.

The market was moderately impacted by the COVID-19 pandemic in 2020 owing to the supply-demand restrain in key economies across the globe. Furthermore, the pandemic impacted several end-use industries, which, in turn, influenced the overall market growth. However, key end-use applications including pharmaceutical, biotechnology, and others are anticipated to fuel product demand on account of the stability of these industries.

Application Insights

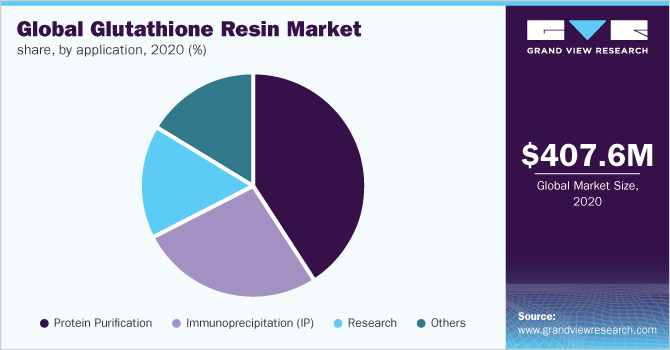

The protein purification application segment dominated the market with a revenue share of over 41% in 2020. This high share was attributed to the increased demand for protein extraction from complex mixtures and increased research in biotechnological & pharmaceutical fields. Companies have developed protein purification technologies to develop COVID-19 vaccines. Researchers can isolate and purify protein with higher yields using newer technologies, such as the novel CL7/Im7 system. Purified proteins are being successfully used in vaccine production, immunological studies, protein-DNA, and protein-protein interaction.

The rising demand for therapeutic antibodies for the treatment of patients is a major driver that is propelling the pharmaceutical industry's growth. A shift in the trend toward the replacement of conventional separation techniques, such as distillation and filtration, with chromatography, has also driven innovation for the chromatography application in numerous new segments.

Glutathione resin is highly used in research applications for protein extractions. Numerous branches of biomedical, pharmaceutical, laboratory research, academic research, etc. find the use of recombinant proteins for the study of molecules and pathways or direct applications. Over the years, protein technologies and recombinant proteins have taken a leading role in various forms of research. Researchers have been developing high-quality and highly-purified proteins for varied pharmaceuticals and biomedical applications.

With the rising population, the demand for vaccines, pharmaceutical drugs, and high-quality proteins is growing, resulting in a surge in market growth. It is expected that most of the demand will arise from applications, such as research labs, to study protein-protein interaction, immunological studies vaccine production, and other biochemical analysis. The GST can be removed by using re-chromatography on the glutathione column with protein of interest can be separated using other techniques, such as ion exchange or gel filtration.

Regional Insights

Asia Pacific accounted for the highest revenue share of more than 41% in 2020 and is anticipated to grow at the fastest CAGR of more than 9% over the forecast period. This share is attributed to the growing government support for domestic manufacturing, which is likely to boost the production levels and reduce the dependence on imports in the Asia Pacific region, thereby offering lucrative opportunities to global manufacturers.

The growing pharmaceutical R&D sector is also likely to drive the market over the forecast period. The research application segment was valued at 1.33 thousand liters in 2020. Major countries in APAC are expected to witness high economic growth over the coming years, despite slow growth in other developed regions like the U.S. and Europe.

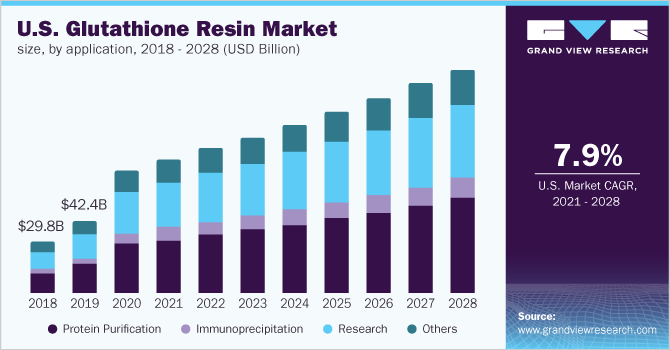

North America is the largest market, in terms of volume, and is estimated to grow at a notable CAGR over the forecast period. The major factors driving the regional market include the rising demand for biochemical research applications and vaccine discovery to combat diseases, such as the ongoing Coronavirus pandemic. Growing usage of purified proteins, antibodies in therapeutic areas is also expected to propel the product demand in North America.

The U.S. is the largest consumer of chromatography resin in North America, accounting for the largest share of the market. Government initiatives, such as funding to improve the productivity of affinity chromatography beads like magnetic beads and agarose beads, have benefited the U.S. economy over the last few decades resulting in improved economic competitiveness and technological capability.

Key Companies & Market Share Insights

The companies operating in the industry are constantly undertaking new initiatives to develop more productive and innovative products in an attempt to strengthen their position in the global market. Innovations in this field are likely to pave the way for the existing as well as new players in the industry over the forecast period. The huge demand for affinity resin is attracting new manufacturers to the market. The existing manufacturers are penetrating newer markets to gain higher shares. Significant product portfolio diversification gives the market leaders a competitive edge and enables them to meet the rising demand from new and existing customers. Some prominent players in the global glutathione resin market include:

-

Merck kGaA

-

Bio-Rad Laboratories, Inc.

-

Thermo Fisher Scientific, Inc.

-

Cytiva

-

Takara Bio, Inc.

-

Mitsubishi Corporation Life Sciences Ltd.

Glutathione Resin Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2021 |

USD 446.46 million |

|

Revenue forecast in 2028 |

USD 777.46 million |

|

Growth rate |

CAGR of 8.4% from 2021 to 2028 |

|

Base year for estimation |

2020 |

|

Historical data |

2017 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD thousand, volume in thousand liters, and CAGR from 2021 to 2028 |

|

Report coverage |

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; U.K.; Italy; France; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa |

|

Key companies profiled |

Merck KGaA; Thermo Fisher Scientific Inc.; Cytiva; Bio-Rad Laboratories, Inc.; Takara Bio Inc.; Mitsubishi Corporation Life Sciences Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the global glutathione resin market report on the basis of application and region:

-

Application Outlook (Volume, Thousand Liters; Revenue, USD Thousand, 2017 - 2028)

-

Protein Purification

-

Immunoprecipitation (IP)

-

Research

-

Others

-

-

Regional Outlook (Volume, Thousand Liters; Revenue, USD Thousand, 2017 - 2028)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global glutathione resin market size was valued at USD 407.60 million in 2020 and is expected to reach USD 446.46 million by 2021.

b. The global glutathione resin market is anticipated to grow at a compound annual growth rate (CAGR) of 8.4% from 2021 to 2028 to reach USD 777.46 million by 2028.

b. Protein purification dominated the glutathione resin market with a share of 41.27% in 2020. This high share is attributable to the rising demand for protein extraction from complex mixtures, increased research in biotechnological and pharmaceutical fields.

b. Some prominent players in the glutathione resin market include Merck kGaA, Thermo Fisher Scientific Inc., Cytiva, Bio-Rad Laboratories, Inc., Takara Bio Inc., and Mitsubishi Corporation Life Sciences Limited.

b. The glutathione resin market is majorly driven by the rapid expansion of pharmaceutical industries, vaccine production, and others in emerging economies is projected to drive the product demand over the forecast period.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."