- Home

- »

- Food Additives & Nutricosmetics

- »

-

Glutamic Acid Market Size, Share & Trends Report, 2030GVR Report cover

![Glutamic Acid Market Size, Share & Trends Report]()

Glutamic Acid Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Food & Beverage, Animal Feed, Pharmaceuticals), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-4-68039-561-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Glutamic Acid Market Size & Trends

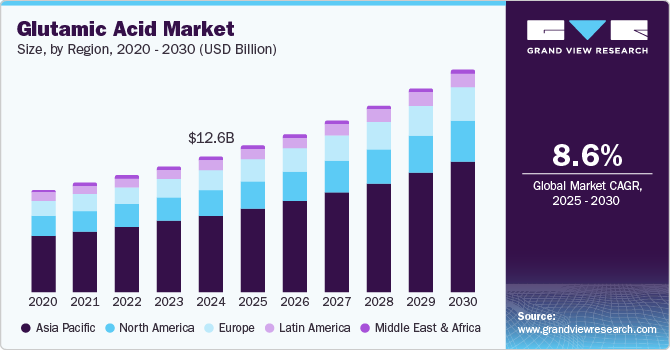

The global glutamic acid market size was valued at USD 12.55 billion in 2024 and is projected to grow at a CAGR of 8.6% from 2025 to 2030. This growth is driven by the increasing demand for glutamic acid in the food and beverage industry, where it is used as a flavor enhancer and stabilizer, a major growth driver. In addition, the rising health consciousness among consumers is boosting the use of glutamic acid in nutritional supplements and protein powders. The expanding pharmaceutical industry, which utilizes glutamic acid in drug formulations, further contributes to market growth. The increasing consumption of processed foods and the growing demand for animal feed additives drive the glutamic acid market.

Key technological advancements significantly influence the glutamic acid market, enhancing production efficiency and expanding applications. Advanced fermentation technologies are at the forefront, allowing for more efficient and sustainable production processes. These methods improve yield and reduce the environmental impact of glutamic acid manufacturing by optimizing the fermentation conditions and utilizing renewable resources. In addition, biotechnology innovations, such as genetically modified organisms (GMOs) and synthetic biology, enable the development of high-yield strains that can produce glutamic acid more effectively, lowering production costs and increasing availability.

Moreover, automation and process optimization in industrial synthesis have streamlined operations, reducing labor costs and minimizing human error during production. These advancements contribute to a more consistent product quality, which is crucial for applications in pharmaceuticals and food additives. The integration of AI and machine learning in monitoring and controlling fermentation processes further enhances efficiency by predicting optimal conditions for maximum output. Together, these technological developments drive growth in the glutamic acid market by meeting rising demand across various sectors while promoting sustainability.

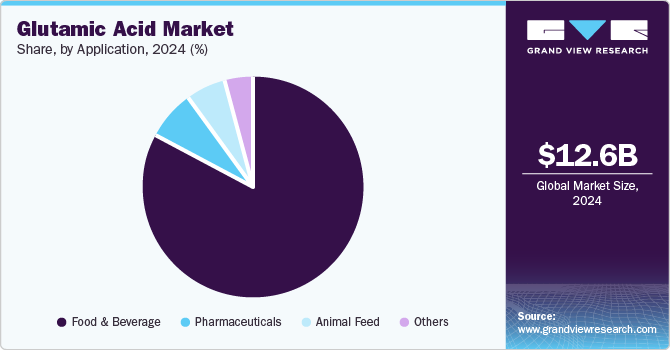

Application Insights

The food & beverages segment accounted for the largest share of 57.7% in the global glutamic acid market in 2024 due to the extensive use of glutamic acid as a flavor enhancer, particularly in the form of monosodium glutamate (MSG). Widely employed in various cuisines, especially in Asian dishes, MSG is known for enhancing the umami taste, making food more palatable. The increasing consumer demand for savory and processed foods, coupled with the growing popularity of convenience foods, has significantly bolstered the demand for glutamic acid in this segment. In addition, glutamic acid's role as a stabilizer and pH adjuster in beverages further adds to its widespread application in the food and beverage industry. The rising trend of clean-label products has also spurred the demand for natural flavor enhancers, thereby contributing to the segment's substantial market share.

The pharmaceuticals segment is expected to grow at a CAGR of 9.1% from 2025 to 2030. This robust growth can be attributed to the increasing use of glutamic acid in drug formulations, which is an essential component in various medications. Glutamic acid is used as an excipient in tablet formulations, acting as a binder and disintegrant to ensure proper drug delivery and efficacy. Its role in the synthesis of active pharmaceutical ingredients (APIs) and as a precursor to neurotransmitters like glutamate and GABA (gamma-aminobutyric acid) makes it invaluable in the treatment of neurological disorders. The rising prevalence of chronic diseases, coupled with the growing demand for effective and safe pharmaceuticals, is driving the expansion of this segment. Furthermore, ongoing research and development activities to explore new therapeutic applications of glutamic acid are expected to contribute significantly to the segment's growth over the forecast period.

Regional Insights

North America accounted for a significant share of the global glutamic acid market in 2024. This substantial share can be attributed to the region's well-established food and beverage industry, which is one of the largest consumers of glutamic acid, particularly in the form of monosodium glutamate (MSG). The increasing health consciousness among consumers has also driven the demand for glutamic acid in dietary supplements and protein powders. In addition, the presence of major pharmaceutical companies and ongoing research and development activities in the region contribute to the market's growth. The use of glutamic acid in animal feed additives is another factor supporting the market's expansion in North America.

U.S. Glutamic Acid Market Trends

The U.S. held the largest revenue share of the North American glutamic acid market in 2024 driven by the country's advanced food processing industry and the widespread use of glutamic acid as a flavor enhancer and stabilizer in various food products. The U.S. also has a significant pharmaceutical sector that utilizes glutamic acid in drug formulations, further contributing to the market's revenue. The increasing trend towards healthy eating and the demand for natural flavor enhancers have boosted the use of glutamic acid in the U.S.

Europe Glutamic Acid Market Trends

The glutamic acid market in Europe is anticipated to grow at a CAGR of 8.6% over the forecast period, driven by the region's focus on sustainable and natural food ingredients, which has led to an increased demand for glutamic acid as a flavor enhancer. European consumers are increasingly seeking clean-label products, boosting the use of natural ingredients like glutamic acid. The region's robust pharmaceutical industry also contributes to market growth, with glutamic acid being used in various drug formulations. Moreover, the expanding use of glutamic acid in animal feed to improve livestock health and productivity is driving market expansion in Europe.

Asia Pacific Glutamic Acid Market Trends

Asia Pacific dominated the global glutamic acid market with a revenue share of 57.1% in 2024 due to the extensive use of glutamic acid in the food and beverage industry, particularly in countries like China and Japan, where MSG is a staple ingredient. The region's large population and increasing disposable incomes drive the demand for processed and convenience foods, further supporting market growth. In addition, the expanding pharmaceutical and nutraceutical industries in Asia Pacific contribute to the high demand for glutamic acid. The presence of major manufacturers and ongoing investments in production capacities also enhance the market's growth prospects in the region.

Key Glutamic Acid Company Insights

Some of the key companies in the Glutamic acid market include Ajinomoto Co., Inc., Akzo Nobel N.V., Evonik Industries AG, Sichuan Tongsheng Amino acid Co., Ltd., and others.

-

Ajinomoto Co., Inc. develops and offers innovative amino acid-based surfactants for the personal care industry. Their high-quality ingredients are used by over 3,000 companies in nearly 50 countries worldwide.

-

Evonik Industries AG provides glutamic acid for various applications, including food additives, pharmaceuticals, and animal feed.

Key Glutamic Acid Companies:

The following are the leading companies in the glutamic acid market. These companies collectively hold the largest market share and dictate industry trends.

- Ajinomoto Co., Inc.

- Akzo Nobel N.V.

- Evonik Industries AG

- Sichuan Tongsheng Amino acid Co., Ltd.

- KYOWA HAKKO BIO CO., LTD.

- Ottokemi; Hefei TNJ Chemical Industry Co., Ltd.

- Suzhou Yuanfang Chemical Co., Ltd.

- Global Bio-chem Technology Group Company Limited

- Ningxia Yipin Biological Technology Co., Ltd.

Recent Developments

-

In July 2024, GRO Biosciences Inc. recently secured USD 60.3 million in Series B funding to accelerate its drug development pipeline. The funds will be allocated to advancing its lead gout treatment into clinical trials, expanding its therapeutic portfolio, and enhancing its GRO platform for producing innovative, multiple non-standard amino acids (NSAAs).

-

In March 2024, Pearl Bio announced a strategic partnership with Merck (MSD). This collaboration aims to leverage synthetic biology to discover and develop innovative biological therapies that incorporate non-standard amino acids. The agreement covers territories outside the U.S. and Canada.

Glutamic Acid Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13.52 billion

Revenue forecast in 2030

USD 20.46 billion

Growth Rate

CAGR of 8.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, volume in metric tons and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, China, Japan, India, Brazil, Argentina, Saudi Arabia, South Africa

Key companies profiled

Ajinomoto Co., Inc.; Akzo Nobel N.V.; Evonik Industries AG; Sichuan Tongsheng Amino acid Co., Ltd.; KYOWA HAKKO BIO CO., LTD.; Ottokemi; Hefei TNJ Chemical Industry Co., Ltd.; Suzhou Yuanfang Chemical Co., Ltd.; Global Bio-chem Technology Group Company Limited; Ningxia Yipin Biological Technology Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Glutamic Acid Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global glutamic acid market report based on application, source, product, and region.

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Pharmaceuticals

-

Animal Feed

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.