- Home

- »

- Electronic & Electrical

- »

-

Retail Vending Machine Market Size, Industry Report, 2033GVR Report cover

![Retail Vending Machine Market Size, Share & Trends Report]()

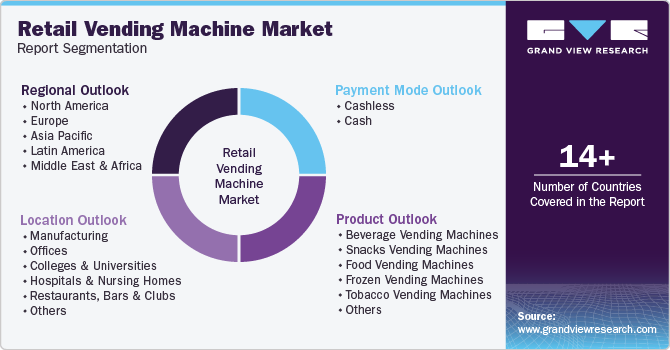

Retail Vending Machine Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Beverage Vending Machines, Snacks Vending Machines, Food Vending Machines), By Location, By Payment Mode, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-465-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Retail Vending Machine Market Summary

The global retail vending machine market size was estimated at USD 72.33 billion in 2024 and is projected to reach USD 98.75 billion by 2033, growing at a CAGR of 3.5% from 2025 to 2033. The rising demand for on-the-go snacks and beverages, driven by consumers' hectic lifestyles, is fueling the growth of vending machine sales.

Key Market Trends & Insights

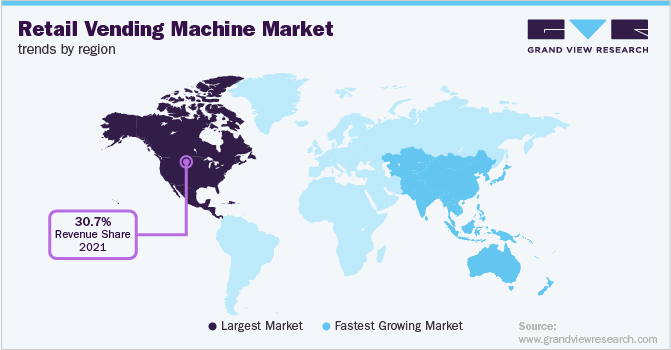

- Asia Pacific dominated the retail vending machine market with the largest revenue share of 56.78% in 2024.

- By product, the beverage segment led the market with the largest revenue share of 44.78% in 2024.

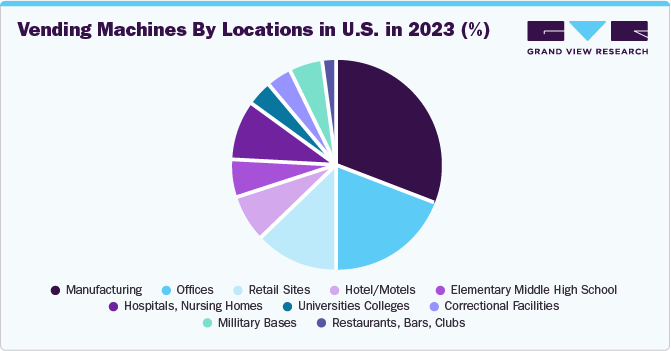

- Based on location, the manufacturing segment led the market with the largest revenue share of 35.47% in 2024.

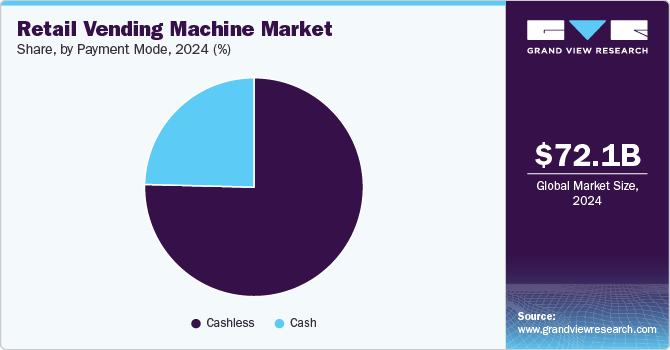

- Based on payment mode, the cashless segment led the market with the largest revenue share of 75.41% in 2024..

- Based on payment mode, the cash segment is projected to grow at the fastest CAGR of 1.9% from 2025 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 72.33 Billion

- 2033 Projected Market Size: USD 98.75 Billion

- CAGR (2025-2033): 3.5%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

This expansion is further supported by the speed and convenience these machines offer, allowing quick access to products without the need for traditional retail interactions. The growing demand for functional beverages positions retail vending machine as a health-focused drink that offers both hydration and wellness benefits, driving its market growth.The retail vending machine industry has undergone significant transformation driven by technological advancements and evolving consumer preferences. These machines have become essential retail solutions in urban settings, offering convenient access to a wide range of product, including beverages, packaged foods, and daily essentials. As modern lifestyles become increasingly fast-paced, the demand for quick and accessible purchasing solutions has surged, solidifying vending machines as crucial retail touchpoints in commercial complexes, corporate offices, amusement parks, and healthcare facilities. In addition, the growing preference for contactless and cashless transactions has further reinforced their relevance in today's digital-first consumer landscape.

Technological innovations have elevated vending machines beyond simple product dispensers, transforming them into sophisticated, automated retail solutions. Advanced vending machines now integrate interactive digital interfaces and multiple payment options, including cashless and mobile transactions. The emergence of touchless vending technology has further increased consumer confidence, particularly in hygiene-conscious environments. In addition, smart vending machines equipped with real-time inventory tracking and data analytics optimize operations, ensuring efficient restocking and enhanced customer experience.

The increasing consumer demand for convenience has led to the widespread adoption of vending machines offering quick access to packaged foods and beverages. Positioned in high-traffic locations such as transport hubs, office spaces, and educational institutions, these machines provide on-the-go consumers with an efficient alternative to traditional retail outlets. The growing popularity of ready-to-eat meals and snacks further drives demand, as vending machines cater to individuals seeking fast yet satisfying food options in their daily routines.

The retail vending machine industry has evolved and steadily grown over the years. As consumers’ lives get busier and people seek convenience and time-saving options while on the go, vending machine operators are presented with many opportunities. As consumer preferences shift toward health-conscious and organic products, vending machine operators have the opportunity to introduce healthier snack and beverage options. Machines offering protein bars, fresh juices, organic snacks, and meal replacements can cater to the rising demand for nutritional convenience. In addition, vending machines selling gluten-free, keto, and plant-based foods can attract health-conscious consumers in urban areas, gyms, and workplaces, expanding the market potential for specialty vending.

Product Insights

The beverage segment led the market with the largest revenue share of 44.78% in 2024, owing to the rising consumer preference for convenient, on-the-go refreshment options and advancements in vending technology. In addition, the demand for healthier beverage choices, such as cold-pressed juices, functional drinks, and premium coffee, has led to the expansion of vending machines beyond traditional soft drinks. Businesses are also leveraging them as a cost-effective, 24/7 retail solution, further driving market growth. Technological advancements are further fueling the expansion of the beverage vending machine market. Smart vending machines equipped with AI, IoT, and mobile payment systems allow for a more seamless shopping experience. Consumers can now purchase drinks using contactless cards, QR codes, and mobile wallets, reducing the need for physical cash transactions

The snacks segment is expected to grow at the fastest CAGR of 3.8% from 2025 to 2030. The demand for snack vending machines is growing as consumers seek quick and convenient food options. Modern consumers lead fast-paced lifestyles, making vending machines an attractive option for quick snacking without the need to visit a store or restaurant. As snack consumption grows, vending machines serve as a key distribution channel, leading to their rising demand in locations such as offices, schools, hospitals, and public transportation hubs. The expansion of vending machines into new settings and the integration of smart vending technologies are further propelling market growth.

Location Insights

Based on location, the manufacturing segment led the market with the largest revenue share of 35.47% in 2024. The demand for vending machines in manufacturing is increasing as companies seek to enhance workplace efficiency and employee convenience. These machines provide quick access to snacks, beverages, and essential tools or PPE, reducing downtime and improving productivity. The rise of Industry 4.0 and digital transformation further supports the expansion of vending machines in manufacturing by enhancing automation and optimizing supply chain management within industrial environments. With vending machines offering both essential work supplies and convenient meal options, companies can improve workforce efficiency while ensuring a seamless and well-managed supply chain.

The public places segment is projected to grow at the fastest CAGR of 4.9% from 2025 to 2030. These machines benefit high-foot-traffic areas like train stations, airports, malls, and parks by offering quick, cashless transactions and reducing reliance on staffed retail outlets. The growing consumer preference for healthier food options has also influenced the vending machine industry. Many machines now stock organic snacks, low-calorie beverages, and nutritious meal choices. Schools, hospitals, and fitness centers have embraced this trend by installing vending machines that offer healthier alternatives, catering to the increasing demand for wellness-focused products.

Payment Mode Insights

Based on payment mode, the cashless segment led the market with the largest revenue share of 75.41% in 2024. As consumers shift toward cashless transactions, vending machine operators are adapting by integrating mobile payments, credit/debit card readers, and QR code payment systems. This trend is particularly driven by the increasing use of smartphones, mobile wallets, and tap-to-pay cards, making cashless vending machines a more efficient and user-friendly solution. One of the primary reasons people prefer cashless payments is convenience. Cashless vending machines eliminate the need to carry physical money, making transactions faster and hassle-free. Consumers no longer have to worry about having the right amount of cash or dealing with loose change.

The cash segment is projected to grow at the fastest CAGR of 1.9% from 2025 to 2030. The demand for cash vending machines is increasing due to the continued reliance on cash transactions in various regions and the need for quick and convenient access to physical currency. Security and privacy concerns also contribute to the preference for cash. Some individuals prefer cash transactions to avoid digital tracking, identity theft risks, or potential cyber fraud. Cash transactions do not leave digital footprints, ensuring greater privacy, which is particularly important in regions where financial surveillance is a concern.

Regional Insights

The retail vending machine market in North America is projected to grow at the fastest CAGR of 4.4% from 2025 to 2030. There's a noticeable shift in consumer preferences towards nutritional and functional beverages, with a particular demand for probiotic drinks driven by health consciousness. Retail vending machine's reputation for aiding digestion, enhancing immunity, and offering antioxidants aligns perfectly with this trend, further boosting its popularity. In addition, changing lifestyles among millennials, who are increasingly opting for healthier alternatives to alcoholic beverages, contribute to the rising demand for retail vending machines. The surge in sales of convenient and organic 'on-the-go' beverages, including probiotic and fermented drinks like retail vending machines, reflects evolving consumer preferences

U.S. Retail Vending Machine Market Trends

The retail vending machine market in the U.S. demonstrates robust growth and market dominance, with over 7 million machines installed nationwide, serving approximately 100 million Americans daily. Key manufacturers are also driving market growth through continuous product innovations, introducing new flavors and formulations to meet changing consumer tastes.

In July 2024, PizzaForno, North America's leading automated pizzeria, demonstrated a remarkable expansion in the first half of 2024, launching operations across multiple U.S. states, including Utah, California, Delaware, New York, Florida, and Maryland.

Asia Pacific Retail Vending Machine Market Trends

Asia Pacific dominated the retail vending machine market with the largest revenue share of 56.78% in 2024. The rapid rise of self-service technology in this region has led to the creation of new business avenues for vending machines. Therefore, several vending machine operators are focusing on launching their businesses in strategic locations across the region. Countries such as Japan, China, and Australia are leading this trend, with a growing number of health-conscious individuals seeking out functional beverages like retail vending machines. Alongside domestic producers, international brands are also expanding their presence in the region to capitalize on this lucrative market opportunity.

Europe Retail Vending Machine Market Trends

The retail vending machine market in Europe is projected to grow at the fastest CAGR of 3.2% from 2025 to 2030. The market is experiencing rapid growth due to shifting consumer preferences, advancements in technology, and increasing demand for convenience. This expansion is driven by the widespread adoption of vending machines in various sectors, including food, beverages, cosmetics, electronics, and even pharmaceuticals. Another major trend driving vending machine adoption in Europe is the increasing focus on health and wellness. As consumers become more health-conscious, vending machine operators are shifting from traditional sugary snacks and sodas to healthier alternatives such as organic snacks, protein bars, and sugar-free beverages. The demand for fresh and nutritious options has led to the introduction of smart vending machines that dispense salads, smoothies, and even full meals.

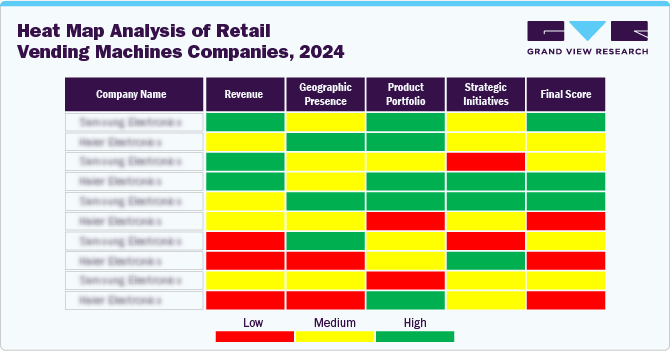

Key Retail Vending Machine Company Insights

The retail vending machine industry is highly competitive, driven by varying regional and cultural preferences, which lead brands and local producers to customize their offerings. As a highly innovative category, retail vending machines see the constant introduction of new varieties, ingredients, and formulations to attract consumers, fueling the emergence of new products and brands and further contributing to market fragmentation.

Manufacturers are expanding distribution, boosting brand visibility with strategic marketing, ensuring competitive pricing through efficient production, and adopting sustainable practices to attract eco-conscious consumers. Brand share analysis plays a crucial role in understanding market dynamics, helping businesses assess competitive positioning, and identify growth opportunities.

Key Retail Vending Machine Companies:

The following are the leading companies in the retail vending machine market. These companies collectively hold the largest market share and dictate industry trends.

- Azkoyen Group

- Westomatic Vending Services Limited

- Royal Vendors, Inc.

- Glory Ltd.

- Sanden Holding Corp.

- Seaga Manufacturing Inc.

- Orasesta S.p.A

- Sellmat s.r.l.

- Fuji Electric Co., Ltd.

- Selecta Group

- Express Vending

- DGA Vending GmbH

Recent Developments

-

In December 2024, Cantaloupe, a self-service commerce technology provider, launched smart stores as an innovative alternative to traditional vending machines. These 24/7 self-service solutions are designed for retailers, residential buildings, fitness centers, and hotel pantries. The system operates through a simple process where customers present payment at the POS to unlock the unit, select items, and complete their purchase by hitting "Pay.

-

In December 2024, SECO partnered with BDTA in an 11-year agreement to modernize Germany's tobacco vending machines. The collaboration will connect over 200,000 machines using SECO’s AI and IoT-powered Clea Vend, enabling predictive sales management, remote maintenance, monitoring, and cashless payments with age verification. SECO will also manage servers and ensure high service availability, enhancing efficiency and customer experience in the tobacco vending sector.

-

In September 2024, Better Fresh Farms introduced an innovative salad vending machine at Cool Beanz Espresso Bar in Statesboro, Georgia, offering fresh, hydroponically grown salads priced at USD 8.99 for a large portion. The machine features various salad options with protein add-ons, using locally grown fresh greens.

Retail Vending Machine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 74.79 billion

Revenue forecast in 2033

USD 98.75 billion

Growth rate

CAGR of 3.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, Units, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, location, payment mode, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Ireland; Germany; France; Italy; Switzerland; Poland; Portugal; Netherlands; Spain; China; Japan; Australia; South Korea; Mexico; Brazil; South Africa; Saudi Arabia; UAE.; Israel

Key companies profiled

Azkoyen Group; Westomatic Vending Services Limited; Royal Vendors, Inc.; Glory Ltd.; Sanden Holding Corp.; Seaga Manufacturing Inc.; Orasesta S.p.A; Sellmat s.r.l.; Fuji Electric Co., Ltd.; Selecta Group; Express Vending; DGA Vending GmbH

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Retail Vending Machine Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global retail vending machine market report based on the product, payment mode, location, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Beverage Vending Machines

-

Hot Beverage Vending Machines

-

Cold Beverage Vending Machines

-

-

Snacks Vending Machines

-

Food Vending Machines

-

Frozen Vending Machines

-

Tobacco Vending Machines

-

Games/Amusement Vending Machines

-

Beauty & Personal Care Vending Machines

-

Candy & Confectionery Vending Machines

-

Pharmaceuticals Vending Machines

-

Electronics Vending Machines

-

Book & Magazine Vending Machines

-

-

Location Outlook (Revenue, USD Million, 2021 - 2033)

-

Manufacturing

-

Offices

-

Colleges & Universities

-

Hospitals & Nursing Homes

-

Restaurants, Bars & Clubs

-

Public Places

-

Others

-

-

Payment Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

Cashless

-

Cash

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Ireland

-

Germany

-

France

-

Italy

-

Switzerland

-

Poland

-

Portugal

-

Netherlands

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Mexico

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Israel

-

-

Frequently Asked Questions About This Report

b. The global retail vending machine market size was valued at USD 72.10 billion in 2024 and is expected to reach USD 74.54 billion in 2025.

b. The global retail vending machine market size is expected to expand at a compound annual growth rate (CAGR) of 3.7% from 2025 to 2030 to reach USD 89.27 billion by 2030.

b. Beverage retail vending machine accounted for a 44.78% share of the global revenue in 2024, owing to the rising consumer preference for convenient, on-the-go refreshment options and advancements in vending technology. Additionally, the demand for healthier beverage choices, such as cold-pressed juices, functional drinks, and premium coffee, has led to the expansion of vending machines beyond traditional soft drinks. Businesses are also leveraging them as a cost-effective, 24/7 retail solution, further driving market growth. Technological advancements are further fueling the expansion of the beverage vending machine market. Smart vending machines equipped with AI, IoT, and mobile payment systems allow for a more seamless shopping experience. Consumers can now purchase drinks using contactless cards, QR codes, and mobile wallets, reducing the need for physical cash transactions

b. Some of the key players operating in the market include Azkoyen Group; Westomatic Vending Services Limited; Royal Vendors, Inc.; Glory Ltd.; Sanden Holding Corp.; Seaga Manufacturing Inc.; Orasesta S.p.A; Sellmat s.r.l.; Fuji Electric Co., Ltd.; Selecta Group; Express Vending; DGA Vending GmbH

b. The rising demand for on-the-go snacks and beverages, driven by consumers' hectic lifestyles, is fueling the growth of vending machine sales. This expansion is further supported by the speed and convenience these machines offer, allowing quick access to products without the need for traditional retail interactions. The growing demand for functional beverages positions retail vending machine as a health-focused drink that offers both hydration and wellness benefits, driving its market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.