- Home

- »

- Next Generation Technologies

- »

-

Smart Building Market Size, Share And Growth Report, 2030GVR Report cover

![Smart Building Market Size, Share & Trends Report]()

Smart Building Market Size, Share & Trends Analysis Report By Solution, By Service, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-964-3

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Smart Building Market Size & Trends

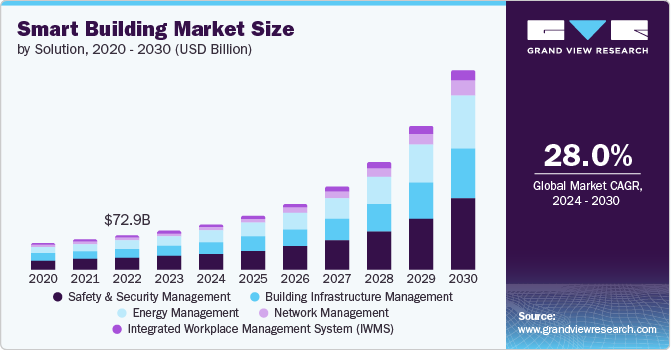

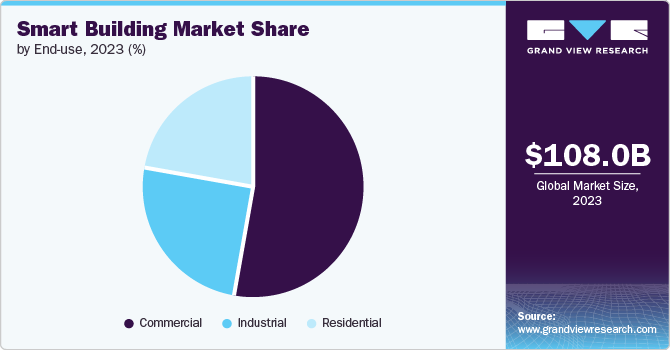

The global smart building market size was valued at USD 108.00 billion in 2023 and is projected to grow at a CAGR of 28.5% from 2024 to 2030. The growing adoption of Business Information Modeling (BIM), Artificial Intelligence (AI), Internet-of-things (IoT), Virtual Reality (VR), cloud computing, and data analytics is driving the growth of the market. Furthermore, the growing popularity of home automation, and rising preference towards working from home is propelling the market growth.

Furthermore, the growing use of technologies to recycle & reuse through waste management solutions and increasing demand for commercial buildings consisting of smart features, such as intelligent glass, smart thermostats, and smart elevators is expected to create positive outlook for the market in the forecast period.

The growing need for energy-efficient structures and rising public & private investment in smart cities is fueling the growth of the market. The concept of smart cities has been gaining traction in recent years, and favorable initiatives are being introduced by governments in developing countries across Asia Pacific, MEA, and Latin America. These country’s governments have been undertaking increasingly diverse roles, such as solutions enablers, stewards, and strategists, by providing effective ecosystems for building solutions. Furthermore, the growing population necessitates the development of smart cities, such as intelligent lighting, electric transportation, smart buildings, and renewable energy generation systems, creating a favorable environment for market growth.

A smart building is a structure that employs the Internet of Things (IoT) and automated technologies to regulate various building systems, such as lighting, security, heating, ventilation, and air conditioning. The increasing usage of IoT for efficient management of connected devices is anticipated to create robust opportunities for the smart building industry. For instance, in March 2023, Siemens, a smart infrastructure provider, announced the launch of a smart IoT solution called Connect Box to manage smart buildings. Connect Box offers a user-friendly approach for monitoring building performances, helps optimize energy, and substantially improves the air quality inside small to medium buildings such as retail shops, schools, apartments, and small offices in smart city projects.

Smart building solutions assist in reducing the greenhouse effects by using smart utility solutions across waste management, water management, and energy management solutions, thereby boosting market growth. The growing demand for green initiatives among OEMs, emphasizing reducing operating costs and greenhouse emissions, has increased the demand for smart building solutions over recent years. For instance, in September 2023, Johnson Controls announced a partnership with BT aimed at combining Johnson Controls' expertise in building automation and energy management with BT's digital connectivity and services. Together, the companies aimed to provide innovative solutions that enhance energy efficiency, reduce carbon footprints, and support sustainable practices, helping businesses accelerate their journey toward net zero carbon emissions for enterprises.

Various academic institutions, international standards, and governments are designing a smart city and smart building industry framework to enable governments to quickly implement the relevant solution in the country. Several regulatory firms and academic institutes are partnering to design standards and regulatory frameworks for smart cities, creating a positive outlook for the market. For instance, the Smart Cities Innovation Partnership is a pilot program being launched by the Israel Innovation Authority (IIA), the Governor's Office Technology & Innovation Portfolio, and Empire State Development (ESD). Its goal is to make it easier for new technologies to be developed and integrated into public services. Through this program, ESD and IIA will offer financial assistance to promote regional initiatives that use smart city technologies to enhance local public services and residents’ well-being.

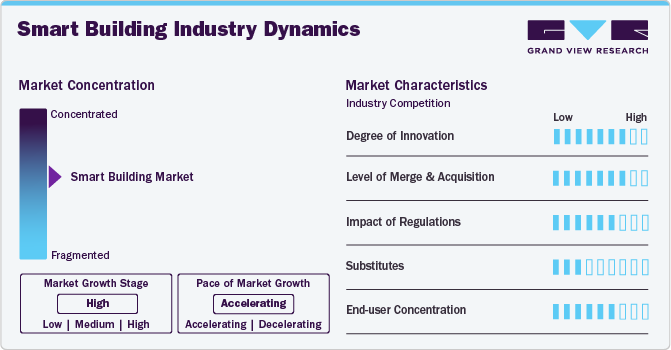

Market Concentration & Characteristics

The smart building industry is experiencing a significant degree of innovation, driven by advancements in technology and the growing demand for sustainable, efficient, and interconnected building environments. The integration of the Internet of Things (IoT) and artificial intelligence (AI) is at the forefront of innovation in the market. IoT devices, such as sensors and smart meters, are being used to collect real-time data on various building parameters, including energy consumption, occupancy, temperature, and humidity. AI algorithms then analyze this data to optimize building operations, predict maintenance needs, and improve energy efficiency. This seamless integration enables buildings to become more responsive and adaptive to the needs of occupants and the environment.

Key players in the market are making strategic decisions such as mergers and acquisitions to strengthen their market positioning and increase their market share. For instance, in May 2024, ABB Swiss multinational technology corporation, broadens its electrification offerings by acquiring Siemens' Electrical Fittings division in China. This strategic move enhances ABB's presence in the market and augments its product lineup in the smart building sector. The products being integrated into ABB's portfolio encompass electrical fittings, intelligent home technologies, advanced door-locking mechanisms, and other additional home automation solutions. These products will retain the Siemens branding as per a licensing arrangement.

Many energy regulations are designed to promote sustainability and reduce the carbon footprint of buildings. Regulations such as LEED (Leadership in Energy and Environmental Design) and BREEAM (Building Research Establishment Environmental Assessment Method) provide frameworks for designing and constructing sustainable buildings. These frameworks encourage the use of smart technologies that monitor and optimize energy usage, water consumption, and indoor air quality. As a result, the demand for smart building solutions that meet these regulatory standards is increasing, driving market growth.

The threat of substitutes to the market is a significant concern, given the rapid evolution of technology and the diverse array of solutions available for building management and efficiency. Traditional building automation systems (BAS) continue to be a formidable substitute for smart building solutions. Many organizations rely on these established systems due to their proven reliability, lower initial costs, and familiar operation.

The concentration of end users in the market is a significant trend that reflects the varied adoption of smart technologies across different sectors. The concentration of end users is driven by diverse sectors such as commercial real estate, residential, industrial, healthcare, educational, government, and hospitality, each driven by specific needs and benefits. Smart building solutions are widely used across sectors to improve efficiency, enhance experiences, and meet regulatory requirements in modern infrastructure.

Solution Insights

The safety & security management segment accounted for the largest market share of 35.2% in 2023. Safety and security segment includes consolidated administration, integration with other in-house systems, and data collection & analysis. Smart buildings are often equipped with Internet Protocol (IP)-)-enabled safety and security devices that provide facilities managers with new capabilities to improve the security and safety of the building, propelling the expansion of the market. Further, stringent government law related to the safety & security of the building is anticipated to contribute to the segment growth in the forecast period.

The energy management segment is expected to grow at a CAGR of 29.7% during the forecast period. The remarkable growth can be attributed to the increasing importance of implementing Energy Management Systems (EMS) across residential, commercial, and industrial properties. The companies in the market have been coming up with sustainable smart home energy management solutions, attracting customers to the market. For instance, in January 2023, Schneider Electric unveiled its home energy management solution, which enables homeowner energy independence and comfort at CES (Consumer Electronics Show). The newly unveiled solution includes a high-power solar inverter, home battery for clean energy storage, connected electric socket and light switches, electric vehicle charger, and smart electric panel.

Service Insights

The implementation segment accounted for the largest market share of 38.9% in 2023. The segment growth can be attributed to the rising adoption of smart building software & services across various business sectors. To develop a smart building, service providers first connect the fundamental systems, such as fire alarms, water pumps, power meters, lighting, and heating systems, with sensors and control systems. The implementation service providers assist building owners, facility managers, and operators in easy deployment and improving the operational efficiency of the fundamental systems. The benefits of implementation services will improve segment growth through 2030.

The support and maintenance segment is expected to grow at a CAGR of 31.9% over the forecast period. The increasing implementation of smart building solutions globally is creating robust opportunities for segment growth. The support and maintenance services offer smart building management solutions support, maintenance, and upgradation to the building operators. Moreover, these service vendors also assist smart building operators in intelligent automation & techniques implementation for the efficient and cost-effective operations of smart buildings. These capabilities, if support and maintenance services, will supplement the segment growth from 2023 to 2030.

End-use Insights

The commercial segment held a market share of 53.6% in 2023 and is expected to dominate the market by 2030. The large segment share can be attributed to the rising implementation of smart building solutions in IT companies, shopping malls, stadiums, and healthcare. Companies in the market have been coming up with various technology solutions aimed at offering better solutions, which has been driving the growth of the commercial segment. For instance, in March 2023, ABB Ltd. unveiled its new smart building management tool, ABB Ability Building Analyzer, which enables commercial building operators to reduce energy consumption and emissions.

The residential segment is expected to grow at a CAGR of 28.3% over the forecast period. The growth of the residential segment can be attributed to the demand for Heating, Ventilation, & Air Conditioning (HVAC) management, smart door lock security systems, smart home lighting, and smart meters to manage and monitor the building's mechanical and electrical systems. Further, the COVID-19 pandemic propelled the use of smart home technologies to curb virus transmission, creating a positive outlook for segment growth in the market. Consumers used video doorbells to ensure hands-free operation, robotic vacuum cleaners for house cleaning, and advanced security cameras for safety. Moreover, the segment is expected to benefit from improved power line communication, growth of the consumer electronics sector, and rising disposable income in developing economies.

Regional Insights

The North America smart building market dominated globally in 2023 and accounted for a market share of 35.3%. The regional market growth can be attributed to the advancements in digital infrastructure solutions and rising public & private investments in smart city solutions. The companies operating in the North America smart building industry are unveiling their innovations to stay competitive.

U.S. Smart Building Market Trends

The smart building market in the U.S. is growing significantly at a CAGR of 25.9% from 2024 to 2030 in the North America region. The rising government investments in digital infrastructure to accelerate the country’s transition toward a digital economy are creating a positive outlook for smart buildings in the U.S.

Asia Pacific Smart Building Market

The Asia Pacific smart building market is anticipated to grow as the fastest-developing regional market at a CAGR of 25.6% over the forecast period. This growth is owing to the rising adoption of smart buildings due to increasing high urbanization, internet penetration, and shifting consumer focus on remote management services via IoT technology. Governments such as Singapore, Japan, India, and China are investing heavily in smart building infrastructure. The modifying focus of consumers aimed at converting their existing buildings into smart buildings is driving the Asia Pacific market growth.

The smart building market in India is growing significantly at a CAGR of 34.6% from 2024 to 2030. Rising residential construction owing to the rising population and government initiatives to improve building safety, security, and productivity are driving India's smart building market growth.

The smart building market in China is growing significantly at a CAGR of 30.1% from 2024 to 2030. Supportive government initiatives for smart cities and rising concerns related to energy consumption among buildings are driving this growth.

The smart building market in the Japan is growing significantly at a CAGR of 31.6% from 2024 to 2030. Rising public and private investments in smart city projects in Japan create a positive outlook for the growth of the smart building market.

Europe Smart Building Market

Europe smart building market is anticipated to grow at a CAGR of 27.4%. The smart building market is witnessing significant growth in Europe owing to the rising adoption of Industry 4.0 technologies and the development of emerging technologies such as big data analytics, IoT, AI, and ML. Governments of countries such as Sweden, Norway, Italy, and France focus on digitalizing building operations to improve consumer safety and building efficiency.

The smart building market in the UK is growing significantly at a CAGR of 26.6% from 2024 to 2030. The rising popularity of smart buildings in the UK is encouraging global industry players to set up their business operations in the region, thereby contributing to market expansion.

The smart building market in Germany is growing significantly at a CAGR of 27.7% from 2024 to 2030. The increasing need to save energy is significantly driving the growth of smart buildings in Germany. As energy costs continue to rise, building owners and operators seek innovative ways to reduce consumption and lower expenses.

The smart building market in Frane is growing significantly at a CAGR of 31.5% from 2024 to 2030. The smart building market in France is experiencing significant growth, particularly in the capital city of Paris. The city hosts nearly 45% of startups in the smart building industry and accounts for nearly 27.6% of the national construction market. France is committed to reducing energy consumption in the building sector by 28% by 2030 and aims for carbon neutrality across buildings by 2050.

Middle East & Africa Smart Building Market

The Middle East & Africa smart building market is anticipated to grow at a CAGR of 30.3%. The high demand for smart building solutions and services owing to high government investments in smart cities and notable penetration by global market players is expected to drive the MEA smart building market growth. State governments of various Middle Eastern cities such as Dubai, Abu Dhabi, Riyadh, Tel Aviv, Istanbul, Doha, and Jeddah are providing contracts to the key market players to implement smart building solutions in various commercial buildings.

Key Smart Building Company Insights

Some of the key players operating in the market include ABB Ltd., Cisco Systems Inc., and Legrand.

-

ABB Ltd is a technology company that specializes in providing electrification and automation solutions, including for the smart building industry. ABB offers a range of solutions to help optimize energy consumption and building automation. These include products such as Connect Box, an IoT solution for small-to-medium-sized buildings, and its smart building control systems. The company's primary activities involve the development and distribution of products, systems, solutions, and services related to electrification, motion, and industrial automation.

-

Cisco Systems, Inc. is a technology company that designs and manufactures networking hardware, telecommunications equipment, software, and other high-technology services and products. Cisco's offerings in the smart building industry include its IoT solutions, which help optimize building operations, enhance energy efficiency, and improve occupant experiences. One of Cisco's notable smart building solutions is the Cisco IoT Control Center, which enables building managers to monitor and control various building systems, such as HVAC, lighting, and access control, through a centralized platform

Johnson Controls and Schneider Electric SE are some of the emerging market participants in the market.

-

Johnson Controls is a provider of smart and sustainable building solutions, offering a wide range of building technology, software, and services. Their key offerings in the market include solutions that optimize building performance using smart, machine-learning-driven technology to create comfortable spaces.

-

Schneider Electric SE is a leading global company that specializes in digital automation and energy management solutions. The company provides integrated solutions that combine energy management, automation, and software to help its customers achieve greater operational efficiency and sustainability. Schneider Electric's EcoStruxure platform is a key offering, providing a comprehensive suite of connected products, edge control, and analytics to optimize building performance.

Key Smart Building Companies:

The following are the leading companies in the smart building market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd.

- BOSCH

- Cisco Systems Inc.

- Emerson Electric Co.

- Hitachi, Ltd.

- Honeywell International Inc.

- INTEL Corporation

- Johnson Controls

- KMC Controls

- LG Electronics Inc.

- Legrand

- Schneider Electric SE

- Siemens

- Sierra Wireless

- Telit

Recent Developments

-

In May 2024, ABB Ltd. partnered with Powrmatic to provide electrical distribution solutions in the Canadian market. This partnership combines ABB's advanced electrical products with Powrmatic's extensive distribution network. The collaboration aims to enhance the availability and implementation of high-quality, reliable electrical solutions across Canada, catering to various sectors, including residential, commercial, and industrial applications, and supporting the growing demand for efficient electrical distribution systems.

-

In September 2023, Johnson Controls announced a partnership with BT aimed at combining Johnson Controls' expertise in building automation and energy management with BT's digital connectivity and services. Together, the companies aimed to provide innovative solutions that enhance energy efficiency, reduce carbon footprints, and support sustainable practices, helping businesses accelerate their journey toward net zero carbon emissions for enterprises.

-

In July 2023, Siemens announced a partnership with Prodea Investments aimed at developing smart, sustainable buildings in Greece. This collaboration focused on integrating Siemens' advanced building technologies to enhance energy efficiency, comfort, and digital connectivity in Prodea's real estate projects. The partnership aims to set new standards for sustainability and smart building solutions in the Greek market, contributing to greener, more efficient, and technologically advanced infrastructures.

Smart Building Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 126.35 billion

Market Value forecast in 2030

USD 570.02 billion

Growth Rate

CAGR of 28.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Market value in USD billion and CAGR from 2024 to 2030

Report coverage

Market value forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Solution, service, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, Australia, South Korea, Australia, Brazil, Argentina, Saudi Arabia, UAE, and South Africa.

Key companies profiled

ABB Ltd.; BOSCH; Cisco Systems Inc.; Emerson Electric Co.; Hitachi, Ltd.; Honeywell International Inc.; INTEL Corporation; Johnson Controls; KMC Controls; LG Electronics Inc.; Legrand; Schneider Electric SE; Siemens; Sierra Wireless; Telit.

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Building Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart building market based on solution, services, end-use, and region:

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Safety & Security Management

-

Access Control System

-

Video Surveillance System

-

Fire And Life Safety System

-

-

Energy Management

-

HVAC Control System

-

Lighting Management System

-

Others (Data Management, Asset Performance Optimization, and Application Platform)

-

-

Building Infrastructure Management

-

Parking Management System

-

Water Management System

-

Others (Elevators and Escalators Management and Waste Management)

-

-

Integrated Workplace Management System (IWMS)

-

Real Estate Management

-

Capital Project Management

-

Facility Management

-

Operations and Services Management

-

Environment and Energy Management

-

-

Network Management

-

Wired Technology

-

Wireless Technology

-

-

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Consulting

-

Implementation

-

Support & Maintenance

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

Healthcare

-

Retail

-

Academic

-

Others (Hotels, Public Infrastructure, and Transport)

-

-

Industrial

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global smart building market size was estimated at USD 108.00 billion in 2023 and is expected to reach USD 126.35 billion in 2023.

b. The global smart building market is expected to grow at a compound annual growth rate of 28.5% from 2024 to 2030 to reach USD 570.02 billion by 2030.

b. The North America regional market dominated the smart building market in 2023 and accounted for a market share of 35.3%. The regional smart building market growth can be attributed to the advancements in digital infrastructure solutions and rising public & private investments in smart city solutions.

b. Key players operating in the smart building market include ABB Ltd.; BOSCH; Cisco Systems Inc.; Emerson Electric Co.; Hitachi, Ltd.; Honeywell International Inc.; INTEL Corporation; Johnson Controls; KMC Controls; LG Electronics Inc.; Legrand; Schneider Electric SE; Siemens; Sierra Wireless; and Telit.

b. The growing adoption of Business Information Modeling (BIM), Artificial Intelligence (AI), Internet-of-Things (IoT), Virtual Reality (VR), cloud computing and data analytics is driving the growth of the smart building market. Further, the growing popularity of home automation, and rising preference towards working from home is further propelling the smart building market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."