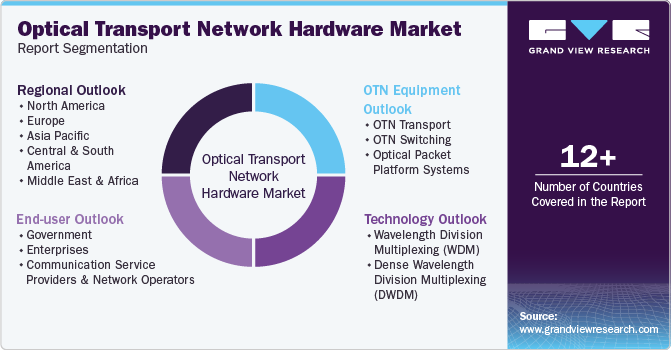

Optical Transport Network Hardware Market Size, Share & Trends Analysis Report By OTN Equipment (OTN Transport, OTN Switching, OPPS), By Technology (WDM, DWDM), By End-user (Government, Enterprises), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-473-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

OTN Hardware Market Size & Trends

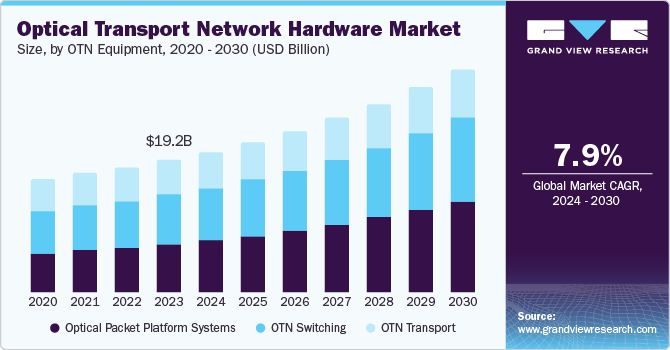

The global optical transport network hardware market size was valued at USD 19.21 billion in 2023 and is projected to grow at a CAGR of 7.9% from 2024 to 2030. Technological innovations in the telecommunications industry and the constant demand for high-speed communications by consumers and enterprises are expected to enable market expansion. Carriers are compelled to improve data transmission speeds and enhance network capacity to address the high-speed internet requirements of these end-users while improving bandwidth and minimizing latency issues. Growing congestion issues in mobile networks have driven the need for a higher level of bandwidth to maintain pace with the increasing network traffic. A growing demand from carriers to manage network costs effectively has resulted in a shift towards multipurpose OTN architectures.

Growing congestion issues in mobile networks have driven the need for a higher level of bandwidth to maintain pace with the increasing network traffic. A growing demand from carriers to manage network costs effectively has resulted in a shift towards multipurpose OTN architectures.

Moreover, the growing proliferation of 40G & 100G technologies is expected to fuel the growth of the OTN hardware market in the coming years. The former allows data transmission at 40 gigabits per second, while the latter does the same at 100 gigabits per second. Increasing capital investment in installing and maintaining network equipment is anticipated to facilitate the demand for these components. The emergence of smart cities has highlighted the significance of having an efficient communication infrastructure, as it dictates the operational capabilities of cities and the way they offer services to citizens. Governments globally have launched a range of internet initiatives and fiber policies to allow free public access to an advanced network infrastructure. For instance, in China, the government aims to make all its public services available online to improve citizen convenience and accelerate the pace of solving their issues or queries. The ultra-high bandwidth offered by optical networks supports such initiatives by providing high security and avoiding data loss and network freezing. Such factors are expected to enable market expansion.

The deployment of OTN hardware enables better networking capabilities with faster data rates, thereby allowing network carriers to scale and handle the tremendous data traffic over the network. Technological innovations by OTN hardware manufacturers have led to the introduction of advanced features that add value to data transfer in a network. The OTN hardware equipment combines an optical channel data switching unit (ODU) with advanced features such as tandem connection monitoring (TCM). The rapid expansion in Ethernet services and changing user requirements are driving advancements in OTN hardware components. They serve a variety of data- and network-intensive applications such as video, voice, and storage by facilitating the transparent handling of the Ethernet and providing opportunities for better operations, administration, maintenance & provisioning management, and service transparency. The constantly rising popularity and use of social media, live webcasting, video conferencing, and online gaming have led to substantial growth in the adoption of OTN technology.

OTN Equipment Insights

The optical packet platform systems segment led the market with a revenue share of 37.1% in 2023. Rapid advancements in the telecom industry and a constant demand for cost savings and latency minimization in network performance are anticipated to drive segment growth during the forecast period. Telecom equipment companies have been compelled to introduce advanced solutions to address end-user requirements and improve their competitive positioning. For instance, Infinera Corporation, which caters to the telecommunications industry by offering a range of Wavelength division multiplexing-based packet optical transmission equipment and IP transport technologies, has multiple products in the packet optical networking segment. These include the XTM application-optimized metro access and aggregation platform, the 7100 packet optical transport series that provides flexible and future-proof networks, and the mTera packet optical transport platform that offers multi-service network aggregation and universal switching capabilities.

The OTN switching segment is anticipated to witness substantial growth during the forecast period. The demand for OTN switching equipment has increased as enterprises focus on migrating from 10G to 100G and beyond, leading to its use as a high-transmission technology. OTN switching has gained significant momentum as it can utilize high-speed wavelengths efficiently by combining traffic from various client interfaces with traffic from other directions. This results in the need for fewer wavelengths and high-speed line interfaces, which leads to substantial cost savings in the case of long-haul networks. Also, these solutions offer a greater spectral efficiency due to using a few unique wavelengths, ensuring reduced risk of wavelength-blocking situations and leading to extended functioning of DWDM networks. These benefits are expected to drive significant contributions from this segment to the overall market in the coming years.

Technology Insights

The wavelength division multiplexing (WDM) segment accounted for the largest revenue share in the OTN hardware market in 2023. WDM allows the movement of multiple data streams over a single optical fiber simultaneously, thus enhancing the capabilities of an optical fiber network by improving network efficiency and bandwidth. The constantly rising demand for improved telecom network performance and data transmission has highlighted the importance of this technology in optical networking. WDM offers several other benefits, such as reduced latency compared to serialization, increased flexibility, lower power consumption, high reliability, and cost savings due to fewer cables. Additionally, recent advancements have steadily improved the security features of this technology, leading to increased integrity and confidentiality of data.

The dense wavelength division multiplexing (DWDM) is expected to witness the fastest growth from 2024 to 2030. Conventional WDM systems have evolved in recent years from a few wavelengths to highly sophisticated networks that leverage DWDM technologies, thus improving the services and offerings of the telecommunications sector. Using DWDM technology in optical transport networks leads to better bandwidth optimization and enhanced network efficiency. Moreover, it ensures reduced use of additional cables and other equipment, leading to higher network stability and capacity to address increasing data demands from end-use industries. DWDM is a dense form of WDM, which utilizes the same multiplexer technique to de-multiplexer transmission while fitting a much higher number of channels. This efficient transmission of large amounts of data over very long distances makes this technology ideal for long-haul transmission.

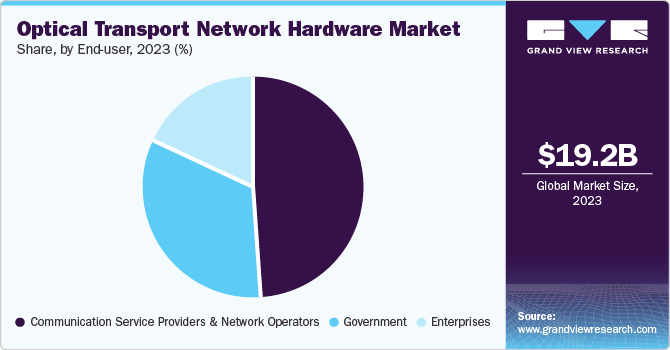

End-user Insights

The communication service providers (CSPs) and network operators segment dominated the market in 2023. The increasing focus on addressing challenges such as increasing digital traffic and steady user growth has led CSPs and network operators to utilize technical solutions such as optical transport networks. These enterprises are required to constantly meet the high-speed data service demands of customers such as internet content providers and large businesses while frequently upgrading their networks to support higher transport capacities. In September 2024, International Gateway Company Limited, a Thailand-based telecom company, announced that it would leverage Nokia’s Dense Wavelength Division Multiplexing (DWDM) solution to overlay and elevate its existing infrastructure and effectively manage the growing capacity demand.

The government segment is expected to witness the fastest growth from 2024 to 2030. Implementing ambitious initiatives such as smart cities by governments globally is expected to drive substantial demand for OTN hardware from this segment. Countries such as India, China, the U.S., and economies in Western Europe have accelerated their efforts to improve the infrastructure across major cities, including the modernization of telecommunication systems. The urgent need to provide high-speed data transmission capabilities and ensure effective voice, data, and video signal transmission over large distances has compelled governments to introduce policies that can positively shape the optical transport network industry.

Regional Insights

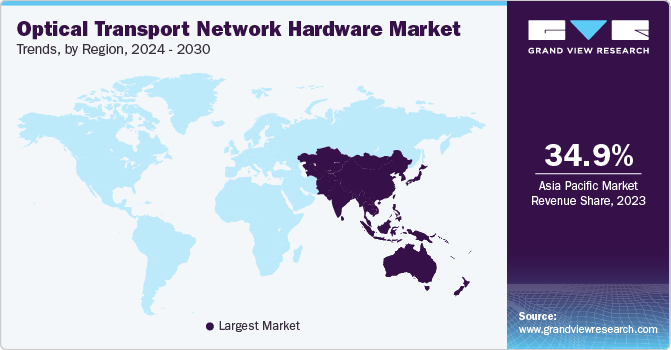

North America held a notable share of the global market in 2023. The region is well-known as an early adopter of advanced telecommunication technologies, owing to the presence of several major organizations such as Ciena, Adtran, and Ribbon Communications. Furthermore, the steadily growing demand for high-speed Internet among consumers in the U.S. and Canada is expected to strengthen market expansion in the coming years. Industrial transformation and increased adoption of smart homes and IoT technologies are poised to further drive developments in this segment.

U.S. Optical Transport Network (OTN) Hardware Market Trends

The U.S. accounted for the largest share of the regional market in 2023. The country has witnessed an expanded rollout of 5G technology in recent years, leading to increased high-speed Internet usage across major sectors such as healthcare, manufacturing, retail, and oil and gas. The declining costs of mobile data tariffs in the economy are expected to boost mobile data consumption, driving demand for 5G networks with powerful optical transport features to ensure seamless coverage and connectivity.

Asia Pacific Optical Transport Network (OTN) Hardware Market Trends

Asia Pacific led the global market with a revenue share of 34.9% in 2023. This is aided by the increasing pace of technological advancements in emerging economies such as China and India, coupled with significant improvements in the region’s communications infrastructure. The regional population is expanding steadily, which has resulted in increased internet penetration, particularly in areas such as online gaming and video streaming. Furthermore, rapid developments in 5G and the Internet of Things (IoT) are expected to create significant growth opportunities for this market in the coming years.

China accounted for a significant contribution to the regional market in 2023. The presence of a well-established telecom infrastructure in the country, coupled with government initiatives to develop citywide infrastructure, is expected to drive the demand for advanced technologies such as OTN. Cities such as Guangzhou, Beijing, and Shanghai are being transformed into smart cities, which is expected to offer several growth opportunities to companies in this market through the expanded application scope for optical transport networks. The country has also announced plans to digitize over 70% of its large-scale enterprises by 2025 and invest heavily in robotics and smart manufacturing technologies. Such factors are expected to sustain a substantial demand for the market.

Middle East & Africa Optical Transport Network (OTN) Hardware Market Trends

The Middle East & Africa region is anticipated to grow significantly from 2024 to 2030. Accelerated developments in economies such as Saudi Arabia and the UAE are expected to improve the region’s communication infrastructure. Initiating several ambitious projects, such as The Line in Saudi Arabia, has presented a major opportunity for network operators to develop advanced solutions to ensure seamless service availability to citizens.

Saudi Arabia accounted for a significant share of the regional OTN hardware market in 2023 and is expected to contribute to the industry over the forecast period substantially. Continued efforts by the Saudi Arabian government to launch initiatives concerning smart city projects and extensively integrate technology in transportation and communication infrastructures are expected to drive industry expansion. For instance, in March 2023, Saudi Telecom Company signed a MoU with Huawei to establish an all-optical strategic partnership to address the needs of ultra-high speed and ultra-large bandwidth services in the region.

Key Optical Transport Network Hardware Market Company Insights

Some key companies involved in the optical transport network (OTN) hardware market include Adtran, Cisco Systems, and Ribbon Communications, among others.

-

Adtran specializes in developing open networking and communications software, systems, and services for the broadband access market. Products offered by the company include FSP 3000 Open Terminals, pluggables & subsystems, optical network terminals, fiber aggregation, cloud-managed Wi-Fi, enterprise switching, access routers and IP gateways, and enterprise wireless solutions, among others. Adtran mainly addresses the requirements of service providers, including utilities, private enterprises, cable/MSOs, small- and medium-sized businesses, government organizations, and individual users globally. The company announced a significant merger with the European telecom vendor ADVA in August 2021, continuing their operations under the Adtran name.

-

Ribbon Communications offers secure cloud communications and IP and optical networking solutions to enterprises, service providers, and critical infrastructure sectors worldwide. The company specializes in edge software-based solutions, cloud-based offerings, security and analytics tools, and 5G-focused optical networking solutions. Ribbon Communications has several notable customers globally, including Verizon, BT, Deutsche Telekom, Tata, and Softbank, and it sells its products through channel partners, service providers, and independent software vendors.

Key Optical Transport Network (OTN) Hardware Companies:

The following are the leading companies in the optical transport network (OTN) hardware market. These companies collectively hold the largest market share and dictate industry trends.

- Actelis Networks, Inc.

- Adtran

- Infinera Corporation

- ALE International

- Cisco Systems, Inc.

- Ribbon Communications Operating Company, Inc.

- Telefonaktiebolaget LM Ericsson

- Extreme Networks

- Dell Inc.

- Huawei Technologies Co., Ltd.

Recent Developments

-

In July 2024, Ribbon Communications announced its partnership with Converge ICT Solutions to deploy its advanced Apollo optical networking system in the Philippines, thus optimizing data transmission. Converge is expected to utilize Ribbon’s 5 nanometer-140Gbaud transmission chipset to expand its fiber network capacity from 800 Gigabits per second to 1.2 Terabits per second per channel. This expansion is expected to allow Converge to address the surging data consumption in the economy and accelerate the development of cloud-based applications and services.

-

In July 2024, Infinera announced that SECOM, the broadband subsidiary of Southeast Colorado Power Association (SECPA), would undertake the modernization of its business and middle-mile Ethernet access network by leveraging Infinera’s XTM Series of optical transport solutions. This would help SECOM offer multi-gigabit broadband services to previously underserved rural communities in southern Colorado. Infinera collaborated with World Wide Technology (WWT) to design and deploy the network for SECOM.

Optical Transport Network Hardware Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 20.41 billion |

|

Revenue Forecast in 2030 |

USD 32.20 billion |

|

Growth Rate |

CAGR of 7.9% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2017 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

OTN equipment, technology, end user, region |

|

Regional scope |

North America, Europe, Asia Pacific, Central & South America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Brazil, Argentina, UAE, Saudi Arabia, South Africa |

|

Key companies profiled |

Actelis Networks, Inc.; Adtran; Infinera Corporation; ALE International; Cisco Systems, Inc.; Ribbon Communications Operating Company, Inc.; Telefonaktiebolaget LM Ericsson; Extreme Networks; Dell Inc.; Huawei Technologies Co., Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Optical Transport Network Hardware Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the optical transport network (OTN) hardware market report based on OTN equipment, technology, end user, and region.

-

OTN Equipment Outlook (Revenue, USD Million, 2017 - 2030)

-

OTN Transport

-

OTN Switching

-

Optical Packet Platform Systems

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Wavelength Division Multiplexing (WDM)

-

Dense Wavelength Division Multiplexing (DWDM)

-

-

End User Outlook (Revenue, USD Million, 2017 - 2030)

-

Government

-

Enterprises

-

Communication Service Providers and Network Operators

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

India

-

China

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."