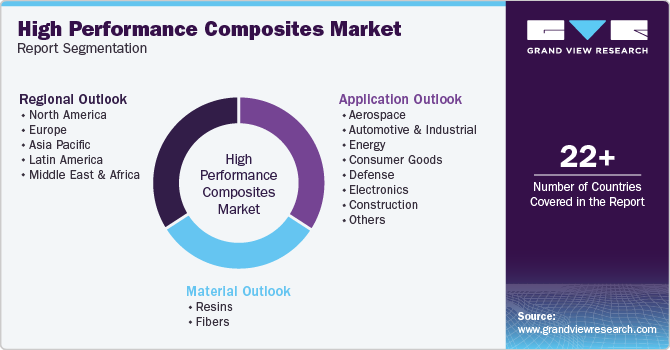

High Performance Composites Market Size, Share & Trends Analysis Report By Material (Resins, Fibers), By Application (Aerospace, Automotive & Industrial, Energy, Consumer Goods), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-558-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

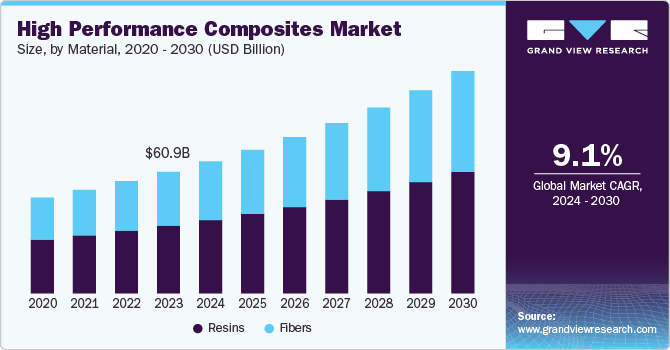

The global high performance composites market size was valued at USD 60.9 billion in 2023 and is projected to grow at a CAGR of 9.1% from 2024 to 2030. The market growth is driven by continued innovation in composite materials that enhance performance and functionality, making them increasingly attractive for aerospace, automotive, and construction industries. In addition, expanding applications in emerging sectors and a growing emphasis on sustainability further propel market demand. Furthermore, rising investments in infrastructure and the need for lightweight, durable materials in developing economies contribute to the robust growth trajectory anticipated for the market over the coming years.

Composites, commonly of fibers and resin types, substitute traditional materials such as metals and plastics. These materials can be designed to possess favorable qualities such as longevity, strength, and lightweight options while also being eco-friendly and capable of being recycled. Sophisticated materials like metals, ceramics, and polymers make up high performance composites (HPCs), which also consist of reinforcements like particles, fillers, and fibers. The strength and modulus of high-performance composites are established by using oriented continuous fibers as reinforcements. Moreover, the increasing demand for this product is primarily fueled by the aerospace, automotive, construction, and electronics industries as they value its versatility, ideal mechanical properties, and cost-effectiveness compared to other composite materials.

In addition, customer preferences and regulations drive the increasing demand for environment-friendly composite materials. Growing environmental awareness among customers and businesses influences purchasing choices, leading to a higher demand for products with minimal environmental impact. Stringent laws and government initiatives promoting the reduction of carbon emissions and sustainable behaviors drive the adoption of environmentally friendly composites. The automotive, aviation, building, and consumer product sectors are actively seeking new materials to reduce their environmental footprint.

Moreover, developments in composite manufacturing technology have enabled the creation of bio-derived and recycled composite materials, thus enhancing their market appeal. Generally, the shift towards sustainable composites demonstrates a greater dedication to protecting the environment and recognizing the need for lasting solutions to future issues.

Material Insights

Resins dominated the market and accounted for the largest revenue share of 55.7% in 2023. These advanced materials are pivotal in the aerospace, automotive, and construction industries. Factors such as continued innovation, expanding applications, and sustainability efforts will sustain this growth. Composite resins, critical components of high-performance composites, offer resistance to corrosion, chemicals, and extreme temperatures. Their versatility and flexibility in design and manufacturing processes contribute to their widespread adoption, further driving the need for sustainable and eco-friendly materials.

Fibers are anticipated to experience significant growth over the forecast period. High-performance fibers (HPF) have extensive applications in reinforcing composites for military vehicles, aircraft, electronics, and sports goods. Polybenzimidazole (PBI) fibers, known for their high glass transition temperature and heat deflection, are anticipated to register the fastest growth in the upcoming period. These fibers offer superior features such as high thermal and chemical resistance conductivity-the aerospace sector benefits from its characteristics, such as high durability, lightweight, and rigidity. However, regulations governing material usage in aviation impact the market. Technological advancements in additive manufacturing and research on HPF-reinforced composites are expected to drive growth.

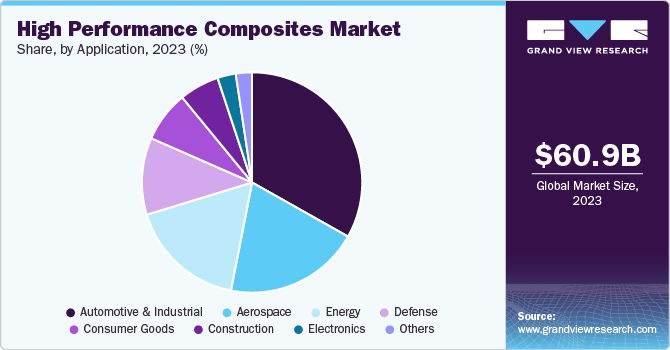

Application Insights

Automotive applications led the market and accounted for the largest revenue share in 2023. The key drivers include the increasing demand for lightweight materials in the automotive industry and a focus on fuel efficiency. High-performance composites, known for their remarkable strength-to-weight ratio, play a vital role in manufacturers seeking innovative materials to construct lighter vehicles, directly impacting fuel consumption. Moreover, stringent regulatory standards related to emissions and fuel efficiency incentivize the adoption of automotive composites. Research and development (R&D) investments further enhance composite applications, optimizing production processes and reducing costs. Innovations in manufacturing techniques, such as automated lay-up and continuous fiber reinforcement, enable the fabrication of high-performance composite parts.

Energy application is expected to grow at a CAGR of 9.7% over the forecast period. Global electricity demand is growing faster than renewable energy sources. Electricity generation from sustainable sources will experience significant international expansion in the next twelve years. Due to the rising need for energy, new technologies and materials have been developed to substitute for depleting traditional composite materials. Composite materials are mainly used in wind turbine blades within the renewable energy sector. However, they are also utilized in other areas like hydroelectric and tidal turbine blades and certain solar panel parts. Highly efficient composites, known for their remarkable strength, durability, and lightness, make it possible to create longer and more effective wind turbine blades. With the global increase in demand for renewable energy sources, demand for high performance composites witnesses significant growth.

Regional Insights

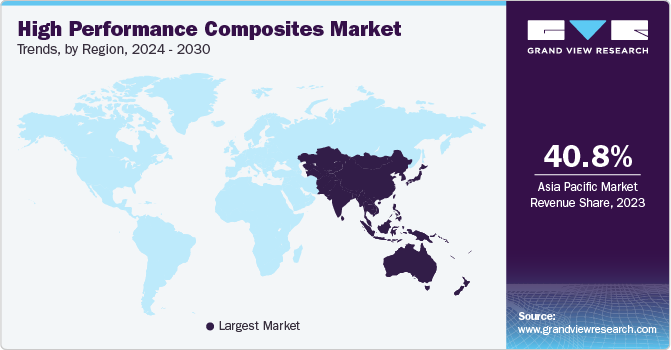

The Asia Pacific high-performance composites market dominated the global market and accounted for the largest revenue share of 40.8% in 2023. The robust growth in the Asia Pacific market is driven by rising demand in industries like aerospace, automotive, and construction. The market is being propelled by fast industrial growth, technological development, and a focus on lightweight and durable materials. Key stakeholders are concentrating on forming strategic partnerships and advancements to take advantage of the growing market opportunities in the region.

The high-performance composites market in China dominated the Asia Pacific market and accounted for the largest revenue share of 40.2% in 2023. The major growth drivers for this market are increasing demand for high-performance composites in the transportation industry, growth in the building and construction sector, and increased installation of wind turbines.

North America High Performance Composites Market Trends

The North America high performance composites market is expected to grow at a CAGR of 9.2% over the forecast period. The aviation sector is experiencing significant growth in North America due to strong aircraft production, increasing air travel, and a demand for lightweight military aircraft. The rise in aerospace manufacturing and air traffic is driving the need for high-performance composites in aircraft in North America to meet requirements for strength, lightness, shape constancy, and erosion protection coatings, consequently expanding their market opportunities.

U.S. High Performance Composites Market Trends

The high performance composites market in the U.S.is growing significantly due to technological advances and innovation. A broad range of applications in various sectors are driving this expansion. These composites are widely used in aerospace, automotive, wind energy, construction, and others.

Europe High Performance Composites Market Trends

Europe high performance composites market is expected to experience significant growth in the coming years. This growth is attributed to composites having high strength-to-weight ratios, corrosion resistance, and design flexibility, as well as being well-suited for automotive designs, interiors, and components. The increased use of high performance composites in the aerospace industry is driven by the need for lightweight materials to enhance fuel efficiency and lower emissions. These materials are essential for meeting the performance standards necessary in contemporary aircraft design, further escalating the high-performance composite market.

Key High Performance Composites Company Insights

Some of the key companies in the high-performance composites market include BASF, Arkema, Hexcel Corporation, Solvay, TenCate Protective Fabrics, SGL Carbon, and Owens Corning.

-

Akerma specializes in developing and manufacturing advanced composite materials. The company produces lightweight and durable composites catering to various industries, including aerospace, automotive, and construction. Akerma's solutions are designed to enhance performance and efficiency, leveraging cutting-edge technology to meet the growing demand for high-strength materials that can withstand extreme conditions while reducing overall weight, improving fuel efficiency and sustainability.

-

Owens Corning manufactures various products, including insulation, roofing, and composite materials for various applications, such as automotive and aerospace. Owens Corning emphasizes sustainability and innovation, developing high-performance composites with superior strength-to-weight ratios and thermal properties. Their commitment to research and development positions them at the forefront of the industry, addressing the evolving needs of customers seeking durable and efficient materials.

Key High Performance Composites Companies:

The following are the leading companies in the high performance composites market. These companies collectively hold the largest market share and dictate industry trends.

- BASF

- Arkema

- Hexcel Corporation

- Solvay

- TenCate Protective Fabrics

- SGL Carbon

- Owens Corning.

- TPI Composites

- DuPont.

- SABIC

Recent Developments

-

In May 2024, TPI Composites collaborated with the University of Maine and Oak Ridge National Laboratory to use the largest polymer 3D printer in the world, Ingersoll MasterPrint, to develop wind turbine tooling. This advanced printer can produce modular tooling at a rate of 500 pounds per hour, with precision suitable for wind blade manufacturing. The project aims to reduce tooling costs by up to 50% and enhance sustainability.

-

In March 2024, Arkema, in collaboration with Hexcel, completed their first aeronautical structure using high-performance thermoplastic composites. This initiative was a part of the HAICoPAS project, which optimized the production of composite tapes made from Arkema's Kepstan PEKK resin and Hexcel's carbon fibers. The collaboration project aimed to develop assembly technologies and replace traditional metallic materials in aircraft structures, improving efficiency and cost-effectiveness.

High Performance Composites Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 66.1 billion |

|

Revenue forecast in 2030 |

USD 111.4 billion |

|

Growth Rate |

CAGR of 9.1% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

January 2025 |

|

Quantitative units |

Volume in Kilotons, Revenue in USD Billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Material, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Saudi Arabia. |

|

Key companies profiled |

BASF; Arkema; Hexcel Corporation; Solvay; TenCate Protective Fabrics; SGL Carbon; Owens Corning.; TPI Composites; DuPont.; SABIC |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global High Performance Composites Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global high performance composites market report based on material, application, and region.

-

Material Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Resins

-

Fibers

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Aerospace

-

Automotive & Industrial

-

Energy

-

Consumer Goods

-

Defense

-

Electronics

-

Construction

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."