- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Flat Glass Market Size And Share, Industry Report, 2030GVR Report cover

![Flat Glass Market Size, Share & Trends Report]()

Flat Glass Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Basic, Tempered, Laminated, Insulated), By End Use (Architectural, Automotive), By Region, And Segment Forecasts

- Report ID: 978-1-68038-437-6

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Flat Glass Market Summary

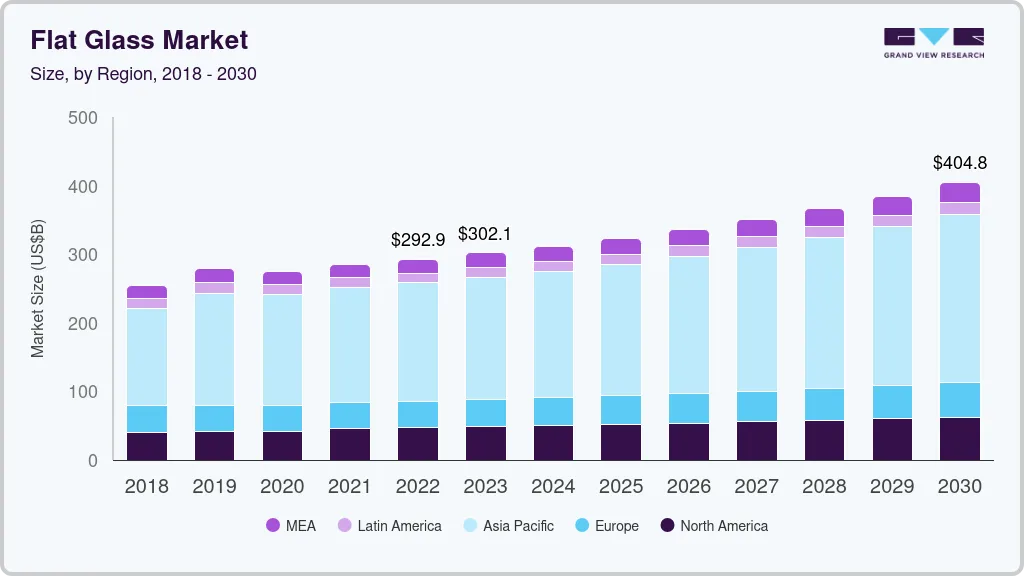

The global flat glass market size was estimated at USD 311.44 billion in 2024 and is projected to reach USD 404.76 billion by 2030, growing at a CAGR of 4.6% from 2025 to 2030. New solar capacity expansions will positively impact the demand for glass.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Rising construction activities in the region, along with increasing penetration of glass-based architecture in residential and non-residential applications, are likely to further fuel the demand for flat glass.

- In terms of product, tempered glass accounted for a revenue share of 36.0% in 2024.

- Tempered glass is used in various applications, including household appliances, commercial refrigeration, vehicles, and other industrial areas.

Market Size & Forecast

- 2024 Market Size: USD 311.44 Billion

- 2030 Projected Market Size: USD 404.76 Billion

- CAGR (2025-2030): 4.6%

- Asia Pacific: Largest market in 2024

The growing trend of floating solar farms is further anticipated to boost the requirement for solar panels. This, in turn, is expected to boost growth over the forecast period. Also, the increasing adoption of electric vehicles (EVs) is anticipated to increase flat glass demand.

The governmental push toward aligning itself with the global decarbonization goals, in line with the 2021 Paris Agreement, has accelerated the production of EVs across the world. Several incentives have been provided for its sales and purchase. By 2035, automakers have committed to converting their existing production lines into EV production facilities.

Drivers, Opportunities & Restraints

The flat glass industry is primarily driven by its growing adoption in the building and construction industry for applications such as facades, windows, and energy-saving solutions. According to IEA, buildings account for 35% of global final energy consumption, there is a rising demand for energy-efficient materials, such as low-emissivity (low-E) glass, which enhances thermal insulation and reduces HVAC energy costs.

Recent trends, such as the establishment of building codes like China’s Design Standard for Energy Efficiency in Residential Buildings, and large-scale investments in smart cities, such as India’s USD 9.62 billion Smart Cities Mission, further highlight the market's growth potential.

The flat glass industry faces challenges from the high cost of advanced energy-efficient glass technologies, which can deter adoption in cost-sensitive markets. Additionally, the production process for glass is energy-intensive, raising concerns about its environmental footprint and adherence to strict emissions regulations.

Advancements in glass technology, such as low-E coatings and solar control features, present lucrative opportunities for market growth by aligning with global energy efficiency goals. The increasing focus on sustainable urbanization, exemplified by India’s Smart Cities Mission and similar initiatives worldwide, creates substantial demand for flat glass in infrastructure development. Furthermore, the transition to net-zero buildings offers potential for innovative glass products to play a pivotal role in reducing energy consumption while enhancing architectural aesthetics.

Product Insights

The tempered segment led the market with the largest revenue share of 36.0% in 2024. It is used in various applications, including household appliances, commercial refrigeration, vehicles, and other industrial areas. As tempered glass is safer in comparison to basic float glass, it is widely used in passenger vehicles to reduce the chances of injury in case of accidents. In the architectural segment, it is used in building and construction projects for windows, doors, and walls in some cases. Furthermore, it is used in the manufacturing of mobile devices and in the food service industry to produce equipment for cooking and baking activities.

The laminated glass segment accounted for second largest revenue share of 26.0% in 2024. This is virtually a safety glass comprising two pieces of glass, held together by one or several transparent plastic films. The use of laminated glass is increasing in automotive sunroofs due to increasing emphasis on safety and changing regulatory norms. Companies such as Tesla, Volvo, and Ferrari use laminated glass in all their cars that have panoramic sunroofs. However, the usage is less, as majority of manufacturers still use tempered glass.

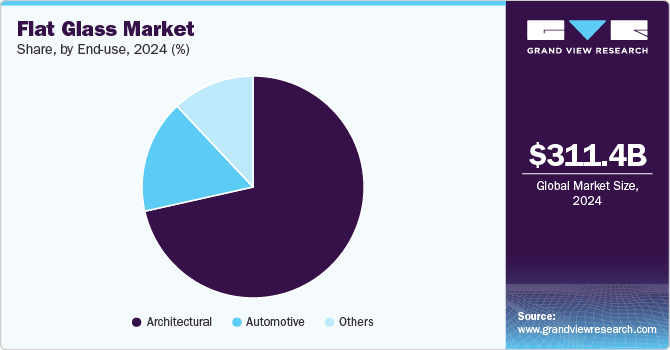

End Use Insights

Based on end use, the architectural segment led the market with the largest revenue share of 71.5% in 2024. Applications pertaining to the building & construction industry are major contributors triggering the growth of this segment. The segment also includes the consumption of flat glass in furniture and other indoor applications. Increasing construction activities in developing countries such as India and ASEAN countries are expected to have a positive impact on the global market.

Besides, growing awareness regarding environmental protection and greenhouse gas reduction is expected to have a positive impact on green building projects, which is expected to augment demand for flat glass over the forecast period.

The other segment is anticipated to witness at the fastest CAGR during the forecast period. Advancements in solar panel technology and its declining prices are boosting the demand for solar panels. It consists of six main components: extruded aluminum frame, glass (preferably tempered glass), silicon PV cells, encapsulation with EVA film layers, polymer rear back sheet, and a junction box consisting of diodes and connectors. Glass is a key component as it protects the PV cells from external elements of weather.

Automotive was the second-largest segment of the global market in 2024. The segment is inclusive of flat glass consumption in automotive, aerospace, and marine applications. The consumption of flat glass is quite evident in automotive applications. Tempered glass and laminated glass are the major types of flat glass used in this segment.

Flat glass mainly finds applications in windows, windshields, side panels, sunroofs, and lights. The production output of automobiles has a direct impact on the consumption of glass. The increasing demand for lightweight vehicles and EVs is anticipated to propel the consumption of flat glass in automotive applications over the forecast period.

Regional Insights

The flat glass market in North America is anticipated to grow at the fastest CAGR during the forecast period. This high share is attributable to favorable government initiatives to encourage the adoption of electric vehicles and the construction of sustainable and ecologically friendly green buildings. Moreover, increasing government initiatives to reduce the reliance on conventional energy sources are expected to boost the demand for solar panels over the forecast period. Flat glass is an important component of solar panels. Increasing installation of solar panels is expected to have a positive impact on the demand for flat glass in the region.

U.S. Flat Glass Market Trends

The flat glass market in the U.S. is one of the leading producers of automobiles, including commercial and passenger vehicles, with the presence of several global leading manufacturers such as General Motors, Stellantis North America, and Ford Motors. Volkswagen is targeting 50% of the automobile sales to be of EVs by the year 2030. Increasing incentives to promote the usage of EVs are expected to drive the production of EVs and thereby increase the demand for the U.S. market over the forecast period.

Asia Pacific Flat Glass Market Trends

Asia Pacific dominated the flat glass market with the largest revenue share of 58.9% in 2024. Rising construction activities in the region, along with increasing penetration of glass-based architecture in residential and non-residential applications, are likely to further fuel the demand for flat glass, especially from the emerging economies of the region. Factors such as rapid economic growth, rising disposable incomes, and subsequent increases in the demand for residential housing and solar installations are expected to benefit the demand for flat glass in the region.

Europe Flat Glass Market Trends

The flat glass market in Europe is driven by the region's stringent energy efficiency regulations and focus on sustainable construction. Countries like Germany, France, and the UK are key contributors due to their advanced building codes and widespread adoption of low-emissivity glass. In addition, the region's expanding solar energy market, particularly in Spain and Italy, is bolstering demand for flat glass used in photovoltaic modules, further accelerating market growth.

Central & South America Flat Glass Market Trends

The flat glass market in Central & South America is anticipated to grow at the fastest CAGR during the forecast period. Rapid urbanization and infrastructure development in Central and South America are fueling the market growth, with Brazil, Mexico, and Argentina leading the charge. Moreover, the region’s growing automotive industry also boosts demand for flat glass in vehicle manufacturing. Sustainability is becoming a focus, with rising interest in energy-efficient building practices, especially in Mexico, where government-backed housing programs are increasingly incorporating advanced glass technologies.

Middle East & Africa Flat Glass Market Trends

The flat glass market in the Middle East & Africa is growing due to large-scale infrastructure projects and investments in energy-efficient buildings. Key countries like Saudi Arabia, the UAE, and South Africa are spearheading growth, with initiatives like Saudi Arabia’s Vision 2030, which includes mega projects such as NEOM City, driving demand for advanced glass solutions. The region’s harsh climate is also promoting the adoption of solar control and low-emissivity glass to reduce cooling costs.

Key Flat Glass Company Insights

Some of the key players operating in the market include AGC, Inc., and Saint-Gobain are among the major manufacturers of flat glass in the world.

-

AGC Inc. has classified its operations into four reportable segments, namely, glass, electronics, chemicals, and ceramics & others. In 2022, the glass segment accounted for the largest revenue share of the total revenue of the company. This segment has been further divided into architectural and automotive.

-

Saint Gobain offers various types of flat glass, including float glass, laminated glass, silvered glass, patterned glass, and coated glass. This segment also offers safety & fireproof glass, solar control glass, and acoustic protection glass for buildings, as well as windshields and glass sunroofs for automotive and aeronautic applications.

-

Euroglas is engaged in the production and processing of float glass, extra-white glass, laminated safety glass, and coated glass for thermal insulation and solar control applications. The company’s four production lines are located in Germany - in Hombourg, Haldensleben, Osterweddingen, and Ujazd with an overall basic glass production capacity of around 3,000 tons per day.

Key Flat Glass Companies:

The following are the leading companies in the flat glass market. These companies collectively hold the largest market share and dictate industry trends.

- AGC Inc.

- Central Glass Limited

- CEVITAL Group

- China Glass Holding Ltd.

- Euroglas

- Fuyao Glass Industry Group Co., Ltd.

- Guardian Industries

- Nippon Sheet Glass Co., Ltd

- Saint-Gobain

- ÅžiÅŸecam Group

- Vitro

- Xinyi Glass Holdings

Recent Developments

-

In October 2023, Vitro announced that it had signed an additional contract with First Solar to provide high-tech glass front sheets for the solar panels that First Solar manufactures in North America. Vitro will invest approximately USD 180 million in adapting its current facilities to meet the demands of the new contract expansion. The expansion is expected to generate additional sales of approximately USD 1.3 billion over the next 10 years, in addition to the initial 1.2-billion-dollar contract.

-

In July 2023, Cardinal Glass Industries Inc. made an announcement regarding the consolidation and expansion of Cardinal CT Company’s Custom Tempering Operations in the Western United States. Cardinal CT had acquired the Dixon, California tempering facility less than two years ago and has recently completed the planned building expansion, improved floor layout, and installed new equipment at the site. All of these changes have resulted in increased capacity, efficiency, and productivity.

-

In December 2022, Saint-Gobain India announced its plans to invest around USD 215 million towards its capacity expansion plans in 2023. This is part of its long-term plans to spend up to USD 970 million between 2022 and 2025.

Flat Glass Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 323.19 billion

Revenue forecast in 2030

USD 404.76 billion

Growth rate

CAGR of 4.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Volume in Kilotons, Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Russia; Belgium; Poland; Czech Republic; China; Japan; India; Australia; Brazil; Argentina; Colombia; KSA; UAE; Iran; South Africa

Key companies profiled

AGC Inc.; Central Glass Limited; CEVITAL Group; China Glass Holding Ltd.; Euroglas; Fuyao Glass Industry Group Co., Ltd.; Guardian Industries; Nippon Sheet Glass Co., Ltd; Saint-Gobain; ÅžiÅŸecam Group; Vitro; Xinyi Glass Holdings

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Flat Glass Market Report Segmentation

This report forecasts revenue & volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global flat glass market report based on the product, end use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Basic

-

Tempered

-

Laminated

-

Insulated

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Architectural

-

Automotive

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Russia

-

Italy

-

Spain

-

Russia

-

Belgium

-

Poland

-

Czechia

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Iran

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global flat glass market size was estimated at USD 311.44 billion in 2024 and is expected to reach USD 323.19 billion in 2025.

b. The global flat glass market is expected to grow at a compound annual growth rate of 4.6% from 2025 to 2030 to reach USD 404.76 billion by 2030.

b. Based on product segment, tempered dominated the global flat glass market and held the largest volume share of more than 36.0% in 2024. The demand from applications such as curtain walls, storefronts, overhead glazing, non-vision locations, and commercial and operable windows, is likely to remain a key factor driving the segment growth.

b. The Asia Pacific dominated the flat glass market and accounted for over 60.0% share of the global revenue in 2024. Infrastructural developments in developing economies of the region are expected to augment market growth over the forecast period.

b. The key factors driving the flat glass market include increasing infrastructural developments across world, especially in developing countries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.