- Home

- »

- Digital Media

- »

-

Enterprise Streaming Media Market, Industry Report, 2030GVR Report cover

![Enterprise Streaming Media Market Size, Share & Trends Report]()

Enterprise Streaming Media Market (2025 - 2030) Size, Share & Trends Analysis Report By Deployment (On-premise, Cloud), By Enterprise Size, By Application, By Solution, By Media Service, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-034-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Enterprise Streaming Media Market Trends

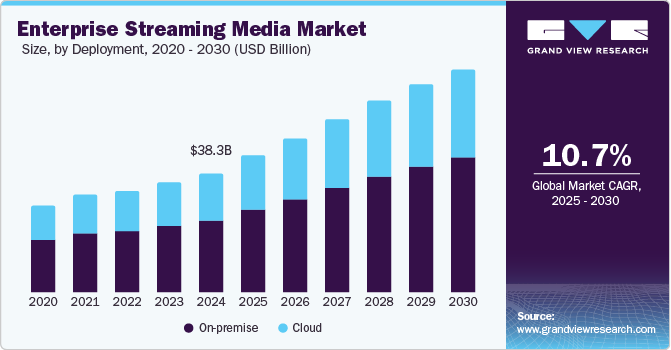

The global enterprise streaming media market size was estimated at USD 38.30 billion in 2024 and is anticipated to grow at a CAGR of 10.7% from 2025 to 2030. The increasing demand for remote and hybrid work has greatly influenced the market demand for streaming media solutions. Modern-day businesses need reliable communication tools to connect employees working from different locations. Solutions such as video conferencing, live streaming, and on-demand content have become essential for seamless collaboration. Popular platforms such as Zoom, Microsoft Teams, and Webex are aiding organizations to improve real-time communication and knowledge sharing. Hence, companies are investing in high-quality streaming infrastructure to boost productivity and efficiency. All such factors are encouraging the enterprise streaming media industry to grow consistently.

The increasing need for effective employee training and development drives the enterprise streaming media market. Companies are using video-based learning platforms to onboard new employees and enhance their skills. These platforms also support continuous education, helping employees stay updated with industry trends. Compared to traditional in-person training, video-based learning is cost-effective and scalable. On-demand access to training materials allows employees to learn at their own pace. This approach improves engagement and ensures consistency in training programs. As a result, businesses are increasingly relying on the enterprise streaming media industry.

In addition, advancements in streaming technology and integration of artificial intelligence (AI) are transforming enterprise streaming media. AI-driven tools improve video quality, automate transcriptions, and provide real-time insights into audience engagement. Adaptive streaming ensures smooth video playback by adjusting quality based on network conditions. Cloud-based content delivery enhances accessibility and scalability for businesses. Moreover, the improving network infrastructure, including 5G and edge computing, enables high-definition streaming without interruptions. Such technological innovations are making enterprise streaming media more efficient and user-friendly and encouraging businesses to invest in the enterprise streaming media industry.

Deployment Insights

The on-premises segment dominated the market with a 60.7% revenue share in 2024, attributed to its strong security, data control, and seamless integration with existing IT systems. Organizations handling sensitive data prefer on-premise solutions to comply with privacy regulations. Large enterprises and government institutions choose this deployment to reduce cybersecurity risks linked to cloud storage. Moreover, IT teams can customize these solutions to enhance performance and efficiency. Despite high initial costs, businesses prioritize reliability and dedicated infrastructure owing to data sensitivity and privacy. Hence, companies with strict security policies continue to invest in in-house streaming solutions for long-term scalability in the enterprise streaming media industry.

The cloud segment is projected to grow at the highest CAGR of 11.1% over the forecast period, The growth of the segment is fueled by factors such as cost-effectiveness, flexibility, and ease of deployment. Enterprises rapidly adopt cloud-based streaming platforms to support remote collaboration and workforce mobility. Scalability in cloud solutions enables businesses to handle fluctuating demands without requiring additional infrastructure investments. Moreover, AI and machine learning integration enhances video analytics and content management, providing better user engagement insights. The growing demand for high-definition video streaming encourages companies to shift to cloud platforms with optimized content delivery networks. Subscription-based pricing models also allow small and medium enterprises to access enterprise-grade streaming solutions without heavy capital expenditure. Furthermore, enhanced security measures and compliance certifications in cloud services build trust among organizations seeking secure streaming options.

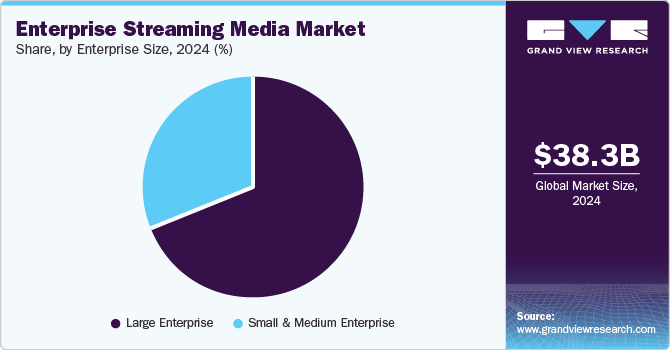

Enterprise Size Insights

The large enterprise segment dominated the market with the largest revenue share in 2024, driven by high demand for advanced video streaming solutions that support global operations. Large corporations use enterprise streaming for corporate communication, employee training, and customer engagement. Investments in high-quality streaming infrastructure ensure the smooth delivery of content across multiple locations. The need for robust data security measures has led enterprises to adopt sophisticated encryption and access control mechanisms. AI-powered video analytics help large enterprises to track user engagement and optimize content strategies. In addition, enterprises allocate substantial budgets for streaming solutions to enhance internal collaboration and marketing initiatives. Additionally, customization features in enterprise-grade streaming platforms cater to specific organizational requirements, improving operational efficiency and thus, it is preferred extensively by large enterprises.

The small & medium enterprise segment is predicted to grow at the highest CAGR over the forecast period in the enterprise-streaming media industry. The growth is majorly attributed to the increasing adoption of cloud-based streaming solutions by SMEs. Cost-effective streaming platforms enable Small & Medium Enterprises (SMEs) to enhance training, customer engagement, and brand awareness. Cloud-based streaming services eliminate the need for heavy infrastructure investments, making them accessible to smaller businesses. Furthermore, the rise of remote and hybrid work models is driving the demand for efficient video communication tools among SMEs. Additionally, AI-driven automation in content management helps SMEs streamline video creation and distribution available at competitive pricing and subscription models. All such factors encourage the growing reliance on digital marketing and live-streaming solutions for SMEs.

Application Insights

The training & development segment dominated the market with the largest revenue share in 2024, fueled by the increasing need for scalable employee training solutions. Enterprises invest in video-based training platforms to enhance workforce productivity and skill development. The shift toward remote and hybrid work environments has increased reliance on virtual learning tools. On-demand and live-streamed training sessions provide employees with flexible learning opportunities. High-quality interactive training content enhances knowledge retention and professional development. Integration with learning management systems enables seamless content delivery and performance assessment. Moreover, AI-powered analytics help organizations track employee progress and engagement with training materials and schedules.

The corporate communication segment is projected to grow at the highest CAGR over the forecast period, which can be attributed to the rising adoption of video-based internal communication tools. Enterprises use live and recorded video content to enhance executive messaging and company-wide announcements. Video conferencing solutions are improving collaboration across geographically dispersed teams. The shift to hybrid work models has created a strong demand for efficient virtual communication platforms. AI-powered transcription and translation tools make corporate communication more accessible and inclusive. Moreover, advanced content management features enable organizations to securely store and distribute internal communications. Personalized and interactive video messages enhance employee engagement and organizational transparency. All such factors are contributing to the fast growth of the corporate communication segment.

Solution Insights

The web conferencing segment dominated the market with the largest revenue share in 2024, fueled by widespread enterprise adoption of virtual collaboration tools. Businesses use web conferencing platforms for seamless communication across teams, clients, and stakeholders. Cloud-based web conferencing solutions are reducing infrastructure costs while improving accessibility. Moreover, high-definition video quality and real-time collaboration features enhance productivity in corporate meetings. The integration of AI-driven transcription and speech-to-text capabilities is improving accessibility and documentation. Web conferencing platforms with enhanced security features are further helping to mitigate data privacy concerns. Hence, scalable web conferencing solutions are supporting large enterprise deployments for global workforce communication.

The video conferencing segment is projected to grow at the highest CAGR over the forecast period, attributed to the increasing demand for immersive virtual meetings. Enterprises are adopting video conferencing solutions to facilitate real-time collaboration and reduce travel expenses. AI-powered background noise suppression and virtual backgrounds enhance meeting experiences. Moreover, high-quality video streaming with minimal latency is critical for business continuity in remote work settings. The development of advanced security protocols strengthens data protection in corporate video meetings. Additionally, Integration with productivity tools also makes video conferencing platforms more efficient for enterprise workflows. Hence, businesses leverage video conferencing for client interactions, product demonstrations, and training sessions.

Media Service Insights

The professional service segment dominated the enterprise streaming media industry with the largest revenue share in 2024, which can be attributed to the growing need for expert consultation and deployment support. Enterprises are investing in professional services to optimize their streaming infrastructure and ensure seamless implementation. Technical support and system integration services enhance the efficiency of enterprise streaming platforms. Furthermore, tailored streaming solutions help businesses meet industry-specific requirements and compliance standards. Data analytics services enable organizations to gain insights into viewer engagement and content performance. Moreover, ongoing maintenance and updates ensure that streaming solutions remain secure and up to date. Professional service providers assist enterprises in scaling their streaming capabilities to meet evolving business needs.

The managed service segment is projected to grow at a significant CAGR over the forecast period due to increasing demand for outsourced streaming solutions. Businesses are turning to managed services to reduce operational complexity and maintenance costs. Cloud-based managed services enable enterprises to access scalable and secure streaming solutions without in-house IT expertise. Continuous monitoring and technical support ensure high-performance streaming experiences. In addition, AI-driven automation helps optimize content delivery and enhances video quality. Besides, managed services also help enterprises to focus on core business activities while ensuring seamless streaming operations.

End Use Insights

The BFSI segment dominated the market with the largest revenue share in 2024, driven by the increasing adoption of secure video communication solutions. Financial institutions use enterprise streaming for different applications including virtual client consultations, internal training, and compliance updates. High-definition video conferencing enhances customer engagement and relationship management, and advanced encryption ensures secure communication in financial transactions and data sharing. AI-powered fraud detection tools integrated with video streaming platforms improve security measures. Hence, banks and investment firms leverage live streaming for financial advisory services and investor briefings. The growing focus on digital transformation is accelerating the adoption of enterprise streaming within the BFSI sector.

The healthcare segment is projected to grow at the highest CAGR over the forecast period, fueled by the rising use of video streaming for telemedicine and medical training. Healthcare providers rely on enterprise streaming for virtual consultations and remote patient monitoring. Moreover, AI-powered diagnostics and video-based medical education enhance healthcare delivery. Secure streaming solutions enable compliance with industry regulations and patient confidentiality standards. High-quality video communication supports collaboration between medical professionals across locations. The increasing adoption of digital health solutions is driving demand for enterprise streaming in healthcare. Hence, more hospitals and clinics are using video platforms to enhance patient engagement and post-treatment care.

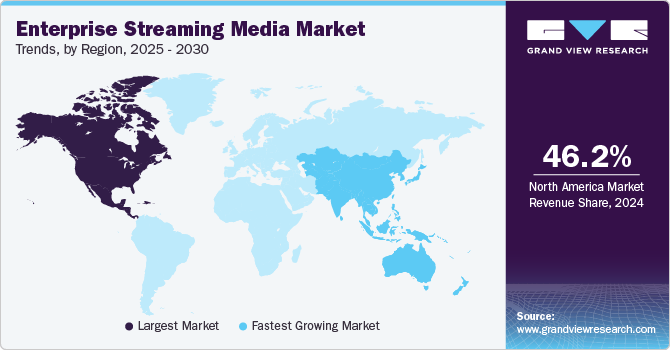

Regional Insights

North America enterprise streaming media market held the highest revenue share of 46.2% in 2024, driven by strong demand for digital collaboration tools and advanced video streaming solutions. Large enterprises across various local industries rely on enterprise streaming to enhance internal communication, training, and marketing efforts. The widespread adoption of cloud-based streaming platforms is enabling businesses to scale their video content delivery efficiently. AI-powered video analytics and automation tools improve content personalization and engagement. Thus, high-speed internet infrastructure and growing investments in digital transformation are supporting market expansion. Leading technology companies and streaming service providers are continuously innovating to offer feature-rich solutions. Moreover, the expanding remote and hybrid work models further reinforce the demand for secure and high-quality enterprise streaming platforms.

U.S. Enterprise Streaming Media Market Trends

The U.S. enterprise streaming media market dominated the regional market with a significant revenue share in 2024. This share is attributable to the rapid adoption of video-based communication across enterprises. Businesses leverage enterprise streaming for virtual meetings, employee training, and brand engagement. The strong local presence of major cloud service providers and technology firms is driving advancements in enterprise streaming solutions. High investments in AI-driven automation also improve video content management and delivery. In addition, the growing use of live streaming for corporate events and marketing campaigns accelerates demand for enterprise streaming platforms. Organizations are prioritizing cybersecurity measures to protect sensitive corporate data in video communications. The rise of remote work has further increased the reliance on enterprise streaming for seamless business operations.

Europe Enterprise Streaming Media Market Trends

Europe enterprise streaming media market held a substantial market share in 2024, driven by the increasing adoption of digital workplace solutions and virtual collaboration tools. Enterprises across industries such as finance, healthcare, and education are investing in video streaming to enhance communication and operational efficiency. Cloud-based streaming platforms are gaining traction due to their scalability and cost-effectiveness. AI-powered video analytics improves audience engagement and business content optimization, driving the regional market. The growing need for remote employee training and knowledge sharing also drives demand for enterprise streaming solutions. Businesses are integrating enterprise streaming with existing IT infrastructure to streamline workflows and improve content accessibility. Strong cybersecurity measures and compliance with data protection regulations influence the adoption of these services in the region.

Asia Pacific Enterprise Streaming Media Market Trends

Asia Pacific enterprise streaming media market is expected to register the highest CAGR of 14.0% over the forecast period, attributed to rapid digital transformation and increasing internet penetration. Businesses across emerging economies are embracing video-based communication tools to enhance productivity and customer engagement. Cloud adoption is accelerating as enterprises seek cost-effective and scalable streaming solutions. AI-driven automation in video content management improves the operational efficiency of businesses. Hence, the rising demand for remote learning and virtual corporate training fuels the market. Enterprises in sectors such as e-commerce, IT, and healthcare are actively investing in video streaming solutions. The expansion of 5G networks is further enhancing video streaming quality and accessibility across the region.

China enterprise streaming media market dominated the Asia Pacific region with a significant revenue share in 2024 due to the high adoption of video conferencing and digital collaboration tools. Enterprises are leveraging AI-powered video streaming solutions to enhance business communication and customer interactions. The rapid expansion of cloud computing infrastructure supports the widespread deployment of enterprise streaming platforms. Businesses increasingly rely on live streaming for corporate marketing and training purposes. The booming e-commerce and digital entertainment sectors also drive innovation in enterprise streaming solutions. Moreover, advanced video analytics tools are helping companies optimize content strategies and engagement. With increasing focus on hybrid work models, the demand for enterprise streaming is expected to continue in China.

Key Enterprise Streaming Media Company Insights

Some key companies operating in the market are Avaya LLC; Adobe; Apple Inc.; Spirent Communications; and Hive Streaming. Companies are undertaking strategic initiatives such as mergers, acquisitions, and product launches to expand their market presence and address the evolving healthcare demands in enterprise streaming media market.

-

Avaya LLC provides enterprise streaming media solutions through its Avaya Aura platform, integrating voice, video, messaging, and presence services for seamless collaboration. The Avaya one-X suite ensures intuitive communication across devices, while Unified Conferencing supports real-time audio, web, and video meetings. Its video communications solutions enable high-quality video interactions for desktops and conference rooms. These offerings enhance enterprise streaming and collaboration across networks.

-

Adobe offers a comprehensive suite of products and services tailored to the enterprise streaming media market. Its streaming media collection provides real-time monitoring and detailed analysis of streaming content, enabling actionable insights and monetization opportunities. For content creation, Creative Cloud for enterprise includes industry-leading tools such as Premiere Pro for video editing, After Effects for motion graphics, and Audition for audio editing-all designed to streamline production workflows.

Key Enterprise Streaming Media Companies:

The following are the leading companies in the enterprise streaming media market. These companies collectively hold the largest market share and dictate industry trends.

- Avaya LLC

- Adobe

- Apple Inc.

- Spirent Communications

- Hive Streaming

- Streambox

- Wowza Media Systems, LLC.

- Haivision Systems Inc.

- Microsoft

- HP Development Company, L.P.

- Cisco Systems, Inc.

- IBM Corporation

Recent Developments

-

In March 2024, Avaya and Zoom announced a strategic partnership to deliver enhanced collaboration experiences by integrating Zoom Workplace, an AI-powered collaboration platform, with Avaya’s Communication and Collaboration Suite. This integration was designed to help enterprises reimagine teamwork by combining Avaya’s robust communication solutions with Zoom’s advanced collaboration tools. The partnership was intended to enhance user experiences, streamline workflows, and provide businesses with innovative yet seamless communication capabilities.

-

In January 2024, Apple announced new options for apps to deliver in-app experiences, including streaming games and mini-programs. This would enable developers to submit a single app capable of streaming their entire game catalog. In addition, mini-apps, mini-games, chatbots, and plug-ins would be able to use Apple’s in-app purchase system, allowing users to access paid digital content or services. These changes will allow developers to expand their businesses while maintaining enhanced user experience and safety standards.

Enterprise Streaming Media Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 42.92 billion

Revenue forecast in 2030

USD 71.47 billion

Growth rate

CAGR of 10.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Deployment, enterprise size, application, solution, media service, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France,Japan, China, India, South Korea, Australia, Brazil, South Africa, Saudi Arabia, UAE.

Key companies profiled

Avaya LLC; Adobe; Apple Inc.; Spirent Communications; Hive Streaming; Streambox; Wowza Media Systems, LLC.; Haivision Systems Inc.; Microsoft; HP Development Company, L.P.; Cisco Systems, Inc.; IBM Corporation.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Enterprise Streaming Media Market Report Segmentation

This report forecasts global, regional, and country revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global enterprise streaming media market report based on deployment, enterprise size, application, solution, media service, end use, and region:

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small & Medium Enterprise

-

Large Enterprise

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Team Collaboration & Knowledge Transfer

-

Corporate Communication

-

Training & Development

-

Marketing

-

Others

-

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Video Conferencing

-

Video Content Management

-

Webcasting

-

Web Conferencing

-

-

Media Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Professional Service

-

Managed Service

-

Support & Maintenance

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Healthcare

-

Manufacturing

-

Government

-

IT & Telecom

-

Media & Entertainment

-

Retail

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.