Commercial Drone Market Size, Share & Trends Analysis Report By Product (Rotary Blade, Hybrid), By Application, By End Use, By Propulsion Type, By Range, By Operating Mode, By Endurance, By Maximum Takeoff Weight, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-482-6

- Number of Report Pages: 171

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

Commercial Drone Market Size & Trends

The global commercial drone market size was estimated at USD 30.02 billion in 2024 and is expected to grow at a CAGR of 10.6% from 2025 to 2030. The market growth is attributed to the increasing enterprise application of drones across various industry verticals. Several drone manufacturers are continually testing, inventing, and upgrading solutions for diverse markets used for various applications, including filming and emergency response. Besides, the integration of modern technologies in commercial drones to deliver enhanced solutions is opening new growth opportunities for the commercial drone market.

The business use cases of commercial drones have expanded significantly over the past few years. They are being increasingly adopted in the construction and real estate sectors due to their ability to survey the property, offer constant and exact project alerts, increase safety, and prevent harmful accidents on construction sites. Moreover, their conventional applications, such as monitoring, surveillance, and security, have instigated the product demand for search and rescue operations, identifying unstable roofs in dangerous and inaccessible positions, tracking out elevated infrastructure that might have damaged electrical cables, etc.

Technological advances allow companies to design and construct measurement and annotation tools for estimating area, volume, and distance. As a result, organizations are constantly adopting Artificial Intelligence (AI) and Machine Learning (ML) solutions to retrieve accurate findings from large volumes of data. Integration of these modern technologies provides the industry with ample opportunities as they facilitate real-time, data-driven decision-making through high-speed data capture, processing, and transfer. AI-powered drones also allow users to interact and observe footage captured by other drones in real-time and track their flight paths.

Furthermore, due to the worldwide COVID-19 outbreak, there has been a significant surge in the use of drone technology in various contexts, with drones claiming to be immensely beneficial in such scenarios. In order to speed up transportation turnaround times and reduce the risk of infection, drones are widely used in the healthcare industry for the pickup and delivery of test samples and the transportation of medical supplies. According to UNICEF, over eighteen countries have used drones for delivery and transportation throughout the pandemic.

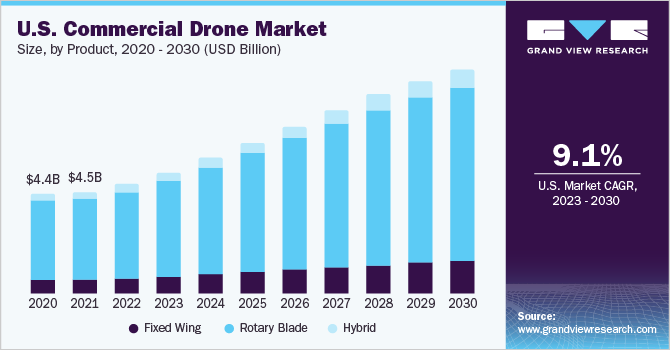

Product Insights

The rotary blade segment held the largest revenue share of over 78.9% in 2024. The demand for rotary blade drones is anticipated to surge for inspection activities owing to its ability to hover and execute agile maneuvering while maintaining a visual on a particular target for prolonged periods. These drones are often seen as a suitable alternative for various business applications such as surveillance, filmmaking, photography, and monitoring. In addition, they are easier to control than hybrid and fixed-wing counterparts.

The hybrid segment is expected to attain a CAGR of over 18% over the forecast period owing to the advantages associated with these commercial drones. These drones enhance their efficiency and power by integrating the capabilities of batteries and fuel. Moreover, these drones can fly for long periods with heavier payloads, even in severe weather conditions. Tech giants like Facebook and Amazon use hybrid drones to transport packages effectively and quickly while enabling internet access in remote locations.

Application Insights

The commercial application segment accounted for a revenue share of over 74.02% in 2024. Applications such as filming & photography are increasingly using drones for key shots in movies. Photographers are rapidly adopting drones which are quickly becoming a vital element of professional photography.

Companies such as DJI are developing small drone cameras capable of capturing high-quality images for professional photographers. The elevated procurement of drones for aerial cinematography and photography, such as the Autel EVO II, Parrot Anafi FPV, DJI Mavic 2 Pro, DJI Mini 2, and DJI Mavic 2 Zoom, is likely to fuel segment growth.

End Use Insights

The media & entertainment segment accounted for a revenue share of over 21.4% in 2024 and is expected to record a notable growth from 2025 to 2030. Drones have numerous applications in media and entertainment. Filmmakers are now using professional drones for the most cost-effective and exact frame capture possible. The increasing demand from clients and owners for aerial photography to advertise amusement parks, public spaces, tourist attractions, hotels, and resorts is expected to drive the segment's expansion.

The delivery & logistics segment is expected to witness the fastest CAGR of 14.3% from 2025 to 2030 with the expansion of the e-commerce sector across the globe. With the increased demand for quick delivery of goods, drones are being increasingly used in e-commerce warehouses for product warehousing and delivery. Warehouses worldwide are making significant investments to enhance the level of automation. In this regard, drones find an important usage in operations, such as barcode scanning, that require more person-hours.

Range Insights

The visual line of sight (VLOS) segment accounted for the largest revenue share of over 69% in 2024. The varying legislation and regulations regarding the operation of commercial drones is a key factor for the segment. Similarly, the ease of flying drones in a visual line of sight is popular due to the ability to avoid obstacles and other hindrances. Thus, the segment dominated the commercial drone market.

The beyond visual line of sight (BVLOS) segment is expected to grow at the fastest CAGR of over 11.2% over the forecast period. The use of commercial drones for long-distance and complex commercial tasks is expected to grow the segment. In addition, the autonomous capabilities of these drones are enabling operators to use them in increasing instances. These key factors are attributed to be the reason behind the positive segment growth.

Operating Mode Insights

The remotely piloted segment accounted for the largest revenue share of over 59% in 2024. The existing popularity of commercial drones in applications such as agriculture, videography, surveillance, and more, is attributed to the dominance of the segment. In addition, remote pilots operating commercial drones satisfy the need for manual operation and intervention in times of distress. This, in turn, is expected to drive the segment demand positively.

The fully autonomous segment is expected to grow at the fastest CAGR of 12.4% over the forecast period. The segment is expected to grow as fully autonomous operated drones can perform operations with no human intervention from take-off to a landing entirely on their own, relying on onboard sensors, algorithms, and the implementation of artificial intelligence. In addition, fully autonomous drones offer the potential for scalable operations. Multiple drones can be deployed simultaneously, working in a coordinated pattern, covering large areas, or performing critical tasks, such as rescue missions, and agriculture surveys, among others. This, in turn, is expected to further fuel the segment's growth.

Endurance Insights

The <5 hours segment accounted for the largest market share of over 70% in 2024. Commercial drones carrying heavy payloads and modern equipment for various applications such as pesticide spraying and surveillance, among others, are expected to add to the segment’s growth. Also, the popularity of affordable drones in this endurance type is a key factor for its high demand. This, in turn, is predicted to help the segment be most prominent through the next seven years.

The 5 - 10 hours segment is anticipated to grow at the fastest CAGR of 11.2% over the forecast period. The segment growth is attributed to the capability of these drones to carry larger payloads for longer duration efficiently. In addition, drones in this segment are popular among enterprises that require large amounts of data gathering and monitoring. Similarly, the trend of fully autonomous drones enables operators to deploy these drones on a pre-planned route for maximum effectiveness and output.

Maximum Takeoff Weight Insights

The <25 kg segment accounted for the largest revenue share of 80.5% in 2024. The strong segment presence in the market is credited to the operational flexibility and easy operational functionality of such drones. Moreover, the takeoff weight makes the drone suitable for a wide range of applications while adhering to stringent regulations. Similarly, the drones are capable of maneuverability in compact areas while maintaining efficient flight capabilities that are expected to add to the segment demand.

The 25 kg - 500 kg segment is expected to grow at the fastest CAGR of over 11.8% over the forecast period. Such drones are increasingly deployed in complex commercial applications as they can easily carry heavy payloads with the help of cameras, sensors, and autonomous capabilities. Also, these drones have already been widely used to transfer medicines and other healthcare supplies to remote areas. During the COVID-19 pandemic, the safety and efficiency factor of drones in this segment helped increase demand to transport healthcare products and in search & rescue and disaster support operations.

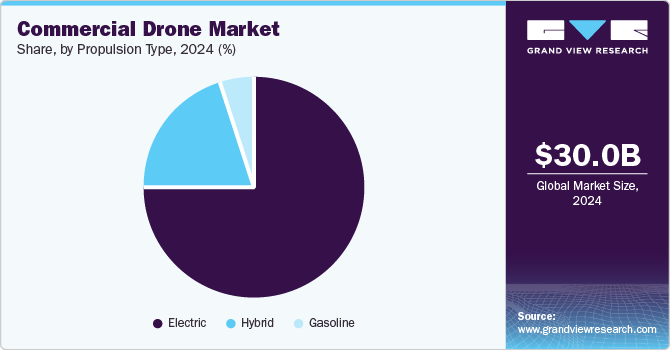

Propulsion Type Insights

The electric propulsion type segment accounted for the largest revenue share of over 72% in 2024. The segment dominance is attributed to the popularity of electric drones using rechargeable batteries. These drones have gained widespread adoption due to numerous advantages such as quiet operations, flight efficiency, longer flight times, and easy maintenance, among others. This, in turn, is expected further to drive the segment demand over the forecast period.

The hybrid segment is expected to grow at the fastest CAGR of 11.1% over the forecast period. The segment growth can be attributed to the trend of efficient power solutions in drones with the use of gasoline and electric types in hybrid solutions. In addition, the advantage of improved flight performance in terms of distance and stability offered by hybrid propulsion in drones is a key factor for growth. The trend of reducing emissions caused by drones with the help of electric motors is further expected to add to the segment growth.

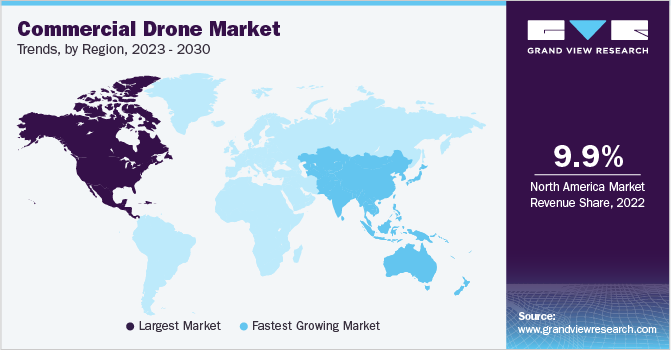

Regional Insights

The North America commercial drone market is expected to grow at a considerable CAGR of 6.7% over the forecast period, owing to the ongoing advancements in drone technology, favorable government initiatives, and growing demand from enterprises across numerous industries. For instance, in the U.S., the Federal Aviation Administration (FAA) has issued new regulations to create more coherent and consistent standards for the legal and safe operation of UAVs in commercial spaces. These rules and regulations are anticipated to decrease entry barriers and boost product usage, thereby favoring the market expansion further.

U.S. Commercial Drone Market Trends

The U.S. commercial drone market anticipated to grow at a CAGR of above 8% from 2025 to 2030. The region is expected to witness steady growth considering the developments in UAV technology, favorable government initiatives, and growing demand from enterprises across industries. Furthermore, the Federal Aviation Administration (FAA) issued new regulations to facilitate more coherent and consistent standards for the legal and safe operation of UAVs in commercial spaces. These rules and regulations are anticipated to mitigate entry barriers and encourage product usage.

Asia Pacific Commercial Drone Market Trends

The Asia Pacific commercial drone market accounted for the largest market share of 30.8% in 2024. Regional dominance is attributed to the favorable regulatory scenario, especially among industrialized countries. Several governments are continually developing new regulations for commercial drone applications.

In February 2023, the Japanese Defense Ministry announced that drones would be included as conceivable targets upon relaxation of rules of the usage by the Self-Defense Forces against unidentified flying objects entering the country’s airspace. The growth of the regional commercial drone market is being further driven by the increasing commercial drone applications across start-up firms.

Key Commercial Drone Company Insights

The key market players are focusing on developing innovative solutions to attract large customer bases and gain a competitive edge in the industry. In January 2023, Autel Robotics launched the EVO Max 4T drone, a sophisticated and highly innovative flying platform that is suitable for both business and consumer applications. It provides considerable navigational and self-reliance capabilities due to high-end autonomous flying technology and Artificial Intelligence. It also comes with tri-anti interference and omnidirectional obstacle avoidance capabilities that ensure flight safety and stability in high-interference environments.

Key Commercial Drone Companies:

The following are the leading companies in the commercial drone market. These companies collectively hold the largest market share and dictate industry trends.

- Aeronavics Ltd.

- AeroVironment Inc.

- Autel Robotics

- SZ DJI Technology Co Ltd

- Draganfly Innovations Inc.

- Guangzhou EHang Intelligent Technology Co. Ltd

- Intel Corporation

- Parrot Drones SAS

- PrecisionHawk Inc.

- YUNEEC International

View a comprehensive list of companies in the Commercial Drone Market

Recent Developments

-

In May 2023, A2Z Drone Delivery, Inc., a developer of commercial drone delivery systems, introduced the RDSX Pelican, a new hybrid VTOL delivery drone. The Pelican utilizes an airframe without control surfaces, blending the stability and reliability of a multirotor system with the extended range of a fixed-wing craft. Its streamlined design, lacking ailerons, elevators, and rudders, minimizes common failure points and significantly increases the time between required maintenance.

-

In May 2023, Tinamu and Parrot formed a technology partnership to offer automated indoor monitoring solutions. Tinamu provides inventory management services to global companies in industries such as mining, commodity trading, and construction. The collaboration between Tinamu's software and Parrot’s high-quality UAVs will result in an advanced, fully automated robotic solution tailored for industrial use.

-

In November 2022, DJI, the global leader in civilian drones and aerial imaging technology, introduced the Mavic 3 Classic, making its high-performance camera drone more accessible. The Mavic 3 Classic offers creators the opportunity to experience the exceptional Hasselblad camera and impressive flight capabilities of the Mavic 3 Series. It retains the original model's 4/3 CMOS 20-megapixel camera, 46-minute flight time, and O3+ transmission system but excludes the telephoto lens, offering a more affordable option. It is compatible with DJI RC Pro, DJI RC, and DJI RC-N1 controllers.

Commercial Drone Market Report Scope

|

Report Attribute |

Details |

|

Market size in 2025 |

USD 33.04 billion |

|

Revenue forecast in 2030 |

USD 54.64 billion |

|

Growth rate |

CAGR of 10.6% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Volume in thousand units, revenue in USD million, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, end User, propulsion type, range, operating mode, endurance, maximum takeoff weight, region |

|

Regional Scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country Scope |

U.S.; Canada; Germany; UK; Germany; France; Italy; Spain; Ireland, Sweden; Denmark; Norway; Finland; China; India; Australia; Japan; South Korea; Brazil; Mexico; UAE; Saudi Arabia, South Africa |

|

Key companies profiled |

Aeronavics Ltd.; AeroVironment Inc.; Autel Robotics; DJI; Draganfly Innovations Inc.; EHang, Inc.; Intel Corporation; Parrot Drones SAS; PrecisionHawk Inc.; YUNEEC |

|

Pricing and purchase options |

Free re Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Commercial Drone Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global commercial drone market report based on product, application, end use, propulsion type, range, endurance, maximum takeoff weight, and region:

-

Product Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Fixed wing

-

Hybrid

-

Rotary blade

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Filming & Photography

-

Inspection & Maintenance

-

Mapping & Surveying

-

Precision Agriculture

-

Surveillance & Monitoring

-

Others

-

-

Government & Law Enforcement

-

Firefighting & Disaster Management

-

Search & Rescue

-

Maritime Security

-

Border Patrol

-

Police Operations

-

Traffic Monitoring

-

Others

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Agriculture

-

Delivery & Logistics

-

Energy

-

Media & Entertainment

-

Real Estate & Construction

-

Security & Law Enforcement

-

Others

-

-

Propulsion Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Gasoline

-

Electric

-

Hybrid

-

-

Range Outlook (Revenue, USD Million, 2018 - 2030)

-

Visual Line of Sight (VLOS)

-

Extended Visual Line of Sight (EVLOS)

-

Beyond Visual Line of Sight (BVLOS)

-

-

Operating Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Remotely Piloted

-

Partially Piloted

-

Fully Autonomous

-

-

Endurance Outlook (Revenue, USD Million, 2018 - 2030)

-

<5 Hours

-

5 - 10 Hours

-

>10 Hours

-

-

Maximum Takeoff Weight Outlook (Revenue, USD Million, 2018 - 2030)

-

<25 Kg

-

25 - 500 Kg

-

>500 Kg

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Ireland

-

Sweden

-

Denmark

-

Norway

-

Finland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa (MEA)

-

UAE

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global commercial drone market size was estimated at USD 30.02 billion in 2024 and is expected to reach USD 33.04 billion in 2025.

b. The global commercial drone market is expected to grow at a compound annual growth rate of 10.6% from 2025 to 2030 to reach USD 54.64 billion by 2030.

b. The rotary blade segment accounted for the largest share of more than 78.0% in terms of volume in the commercial drone market in 2024 and is expected to continue its dominance over the forecast period.

b. The filming and photography application segment accounted for the largest revenue share of over 29.0% in 2024 in the commercial drone market and is expected to continue dominating the market over the forecast period.

b. The security and law enforcement end-use segment accounted for a share of over 23.0% of the commercial drone market in 2024.

b. North America dominated the commercial drone market with a share of 27.07% in 2024. Owing to the ongoing advancements in drone technology, favorable government initiatives, and growing demand from enterprises across numerous industries.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."