- Home

- »

- Automotive & Transportation

- »

-

Automotive Telematics Market Size & Growth Report, 2030GVR Report cover

![Automotive Telematics Market Size, Share & Trends Report]()

Automotive Telematics Market (2023 - 2030) Size, Share & Trends Analysis Report By Technology (Embedded, Tethered, Integrated), By Solution, By Vehicle, By Sales Channel, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-074-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Telematics Market Summary

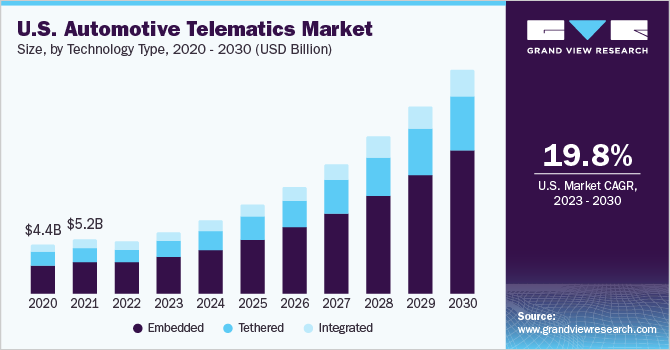

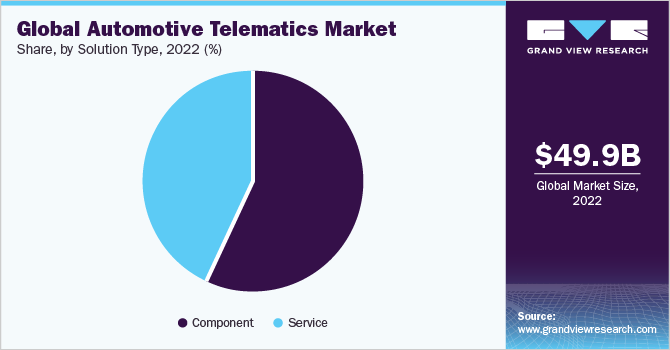

The global automotive telematics market size was estimated at USD 49.85 billion in 2022 and is projected to reach USD 170.43 billion by 2030, growing at a CAGR of 16.6% from 2023 to 2030. Increasing demand for high-performance, fuel-efficient, technologically advanced vehicles is increasing the integration of automotive telematics systems.

Key Market Trends & Insights

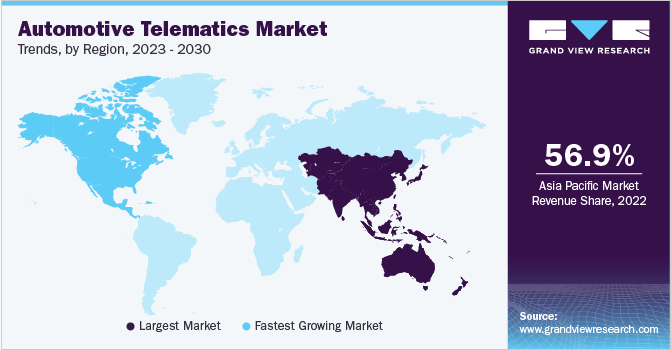

- Asia Pacific region is expected to dominate the market with a share of over 56.87% in 2022.

- North America is expected to witness significant growth of 20.1% in the market.

- On the basis of technology type, the embedded segment holds a significant market share of more than 65% of the global market in 2022.

- By solution type, the component segments hold a major share of more than 50% in the market in the year 2022.

- On the basis of vehicle type, the passenger vehicle segment held a significant market share of more than 75% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 49.85 Billion

- 2030 Projected Market Size: USD 170.43 Billion

- CAGR (2023-2030): 16.6%

- Asia Pacific: Largest market in 2022

- North America: Fastest growing market

In addition, prominent players such as Ford Motors Company in the automobile industry are making various efforts by expanding their existing telematics offerings. They are developing a telematics system compatible with different vehicle models, thereby fueling the growth of the market. Although the automotive telematics industry witnessed significant growth till 2018, the COVID-19 pandemic in 2019 has hampered the market growth. The global lockdown, and supply chain disruptions, have had negative impacts on the automobile industry.

As vehicle production poised and the sales of automobiles declined which has a cascading effect on the market, thus the year 2020 witnessed a y-o-y drop of about -7%. However, the post-pandemic government initiatives to increase the adoption of new energy vehicles has boosted the sales of electric vehicle and created the demand for tracking device such as automotive telematics system in the market.

The key players in the automobile telematics industry are focusing on offering fleet management services for all the upcoming passenger car models in the market. For instance, in April 2021, Ford Motors Company started integrating fleet monitoring services for all its upcoming car models. The feature of vehicle management and monitoring services offered by the company and integrated with fleet-wide driver behavior dashboard, sent notifications to customers, thereby aids reducing the possibilities of human driving errors. The Ford telematics system provided by the company is compatible with non-Ford vehicles through the plug-in device; thus, the system can manage the fleet regardless of the automaker.

Moreover, the U.S. government is undertaking various initiatives to improve road safety which thereby, is expected to create numerous growth opportunities for the automotive telematics systems providers in the market. For instance, in January 2022, the U.S. Federal government provided a contract to Geotab Inc., one of the prominent players in the Internet of Things (IoT) and connected transport market to advance the existing vehicle fleet capabilities with connected vehicle technology. In addition, mandatory integration of the Electronic Logging Device (ELD) in U.S. commercial vehicles and ELD bundling with the telematics system is further expected to boost the sales of automotive telematics in the market.

Technology Type Insights

On the basis of technology type, the market is segmented into embedded, tethered, and integrated. The embedded segment holds a significant market share of more than 65% of the global market in 2022. The high share of the segment is attributed to the rising integration of automotive telematics systems from prominent automobile manufacturers in passenger and commercial vehicles. In addition, there is an increase in the penetration of cloud-based embedded telematics systems for fleet tracking in the autonomous vehicle which is further contributing to the embedded automotive telematics segment growth.

The tethered segment is anticipated to register a considerable growth of 17.4% during the forecast period. The easy integration of the phones as a modem with the Wi-Fi service and Bluetooth for navigation purposes is driving segmental growth. Additionally, the increasing demand for connected cars and their equipment with telematics software to provide drivers and vehicle owners to provide them alerts on their phone and prevent the potential danger of car crashes is further fueling the segmental growth.

Solution Type Insights

By solution type, the market is segmented into components and services. The component segments hold a major share of more than 50% in the market in the year 2022. government initiatives to increase road safety and develop intelligent transportation system by improving car connectivity and enhancing the existing driving monitoring technologies is attributing to high growth of the segment. In addition, the rise in aftermarket integration of the automotive telematics system in older automotive models is driving the market for automotive telematics.

The service segment is expected to witness significant CAGR growth of 18.1% in the year 2022. Automotive manufacturers are focusing on developing flexible tracking systems which provide services such as monitoring fuel usage cost, tracking of data of the ICE, gas and electric vehicles. The enhanced automotive telematics system developed by most of the manufacturers will automate the repair and maintenance tracking, additionally aid in new and renewal of the registration, and licensing of the vehicle all these services at a minimal subscription cost; thus these factor is expected to bode well for the growth of the segment.

Vehicle Type Insights

On the basis of vehicle type, the market is segmented into passenger vehicles and commercial vehicles. The passenger vehicle segment held a significant market share of more than 75% in 2022. Increasing consumers’ inclination towards luxury, comfortable, and secure cars with remote operation is contributing to a major share of passenger vehicles. Through the integration of the advanced automotive telematics system in vehicles, locking & unlocking, engine start-stop capabilities, and temperature control is possible, these features enhance the level of comfort thus the segment is expected to witness a high market share during the forecast period.

The commercial vehicle segment is expected to witness significant CAGR growth of 19.1% in the market in the year 2022. There is rising adoption of automotive telematics systems in the long distance or cross-country trucks to track down their locations, internal vehicle system, and speed. Besides, collection, organization, and report formation of the driver breaking statistics, fuel economy, hours-in-service, and idle time aids in monitoring the driver behavior which is widely used by the insurance companies is contributing to the segmental growth.

Sales Channel Insights

On the basis of sales channel, the market is segmented into the Original Equipment Manufacturers (OEM) and aftermarket. The OEM segment holds a share of more than 65% in the market, in the year 2022. Increasing automobile manufacturers’ emphasis on integrating advanced telematics systems in upcoming vehicles to align them with the insurance premium companies and improve driver and passenger safety is contributing to a high share of the segment.

The aftermarket segment is expected to witness a CAGR of 15.6%, during the forecast period. The easy and quick installation of automotive telematics systems to reduce fuel consumption, minimize labor costs, and improve vehicle safety is driving segmental growth. As with the usage of the fleet management system, it’s easier to find routes which reduces the time involved in determining the optimal routes thus improving the overall fuel efficiency of the vehicle. Further, during the idle time of the vehicle, the telematics system can remotely shut down the vehicle which aids in avoiding fuel waste.

Application Type Insights

On the basis of application, the market is segmented into information & navigation, safety & security, fleet management, insurance telematics, and others. The fleet management segment held the highest share of about 33% in 2022, in the market. Fleet management system provides cost-effective and productive services such as GPS vehicle tracking, driving behavior analysis, fleet alarms, route planning and monitoring, fuel management to consumers, automobile manufacturer, and insurance companies thus, they are widely deployed in the automobile market.

The safety and security segment is expected to witness a significant growth of 20.0% in the market in the year 2022 and is expected to maintain its dominance during the forecast period. The rising road congestion and people’s safety is a major concern for the government globally, thus governments are taking initiatives by mandating the integration of safety systems and features in vehicles. For instance, in Europe, there is a mandatory regulatory e-call-in-vehicle emergency service that automatically dials in case of a road accident.

Regional Insights

Asia Pacific region is expected to dominate the market with a share of over 56.87% in 2022. The high market share of the market is attributed to the increasing consumer preference for the affordable aftermarket automotive telematics system in the emerging economies of the Asia Pacific region such as China and India. Additionally, the government’s focus on the development of the cellular connectivity network and increase in internet penetration even to remote locations in the country is majorly contributing to a high share of the segment.

North America is expected to witness significant growth of 20.1% in the market. The high growth in the region is attributed to the increasing focus on technology providers’ expansion of the existing telematics enabled systems for passenger vehicles. For instance, in February 2022, Zonar Systems, Inc., the U.S.-based technology provider, partnered with SRM Technologies Private Ltd. to provide the next generation technology and digital transformation telematics services for light-duty vehicles, which enhances vehicle uptime and enhances aftermarket part sales.

Key Companies & Market Share Insights

The key players in the market are taking strategic initiatives such as merger and acquisition, partnerships and collaborations, and regional expansion to strengthen the business footprint. In addition, product launching activities is one of the key strategies for leading players based in North America. For instance, in September 2022, Ford Motors Company launched Ford Pro Fleet Management software that has added tools to the existing Ford Pro Intelligence fleet management solutions. The Ford Pro Fleet Management software provides vehicle tracking solutions, registration to vehicle health monitoring, and maintenance. Moreover, Ford Motors Company has worked on reducing the total cost of ownership of the automotive telematics system which makes the software system highly accessible for small and medium-sized businesses. Some prominent players in the global automotive telematics market include:

-

Ford Motor Company

-

Toyota Motor Corporation

-

Mercedes-Benz AG

-

Volkswagen AG

-

General Motors Company

-

BMW Motors

-

AB Volvo

-

Hyundai Motor Company

-

Tata Motors

-

Nissan Motor Co., Ltd

Automotive Telematics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 58.31 billion

Revenue forecast in 2030

USD 170.43 billion

Growth rate

CAGR of 16.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology type, Solution type, vehicle type, sales channel, application type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; China; India; Japan; Brazil; Mexico

Key companies profiled

Ford Motor Company; Toyota Motor Corporation; Mercedes-Benz AG; Volkswagen AG; General Motors Company; BMW Motors; AB Volvo; Hyundai Motor Company; Tata Motors; Nissan Motor Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Telematics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive telematics market report based on technology type, solution type, vehicle type, sales channel, application type, and region:

-

Technology Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Embedded

-

Tethered

-

Integrated

-

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Component

-

Service

-

-

Vehicle Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Passenger

-

Commercial

-

-

Sales Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

OEM

-

Aftermarket

-

-

Application Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Information & Navigation

-

Safety & Security

-

Fleet Management

-

Insurance Telematics

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Frequently Asked Questions About This Report

b. The global automotive telematics market size was estimated at USD 49.88 billion in 2022 and is expected to reach USD 58.31 billion in 2023 owing to the introduction of integrated telematics along with policies for driver safety.

b. The global automotive telematics market is expected to grow at a compound annual growth rate of 16.6% from 2023 to 2030 to reach USD 170.43 billion by 2030. The increased vehicular mishaps and rising occurrences of road accidents are expected to augment the market growth.

b. Asia Pacific dominated the automotive telematics market with a share of 56.8% in 2022. This is attributable to the introduction of government rules and regulations for telematics systems along with policies for driver safety in the region.

b. Some key players operating in the automotive telematics market include ID Systems Inc., Deere & Company, Teletrac Navman US Ltd, Omnitracs, FleetmaticsIrL Limited, DigiCore, MiX Telematics, Masternaut Limited, Verizon, and TomTom International BV.

b. Key factors that are driving the market growth include the rising importance of smartphones and the introduction of integrated telematics along with policies for driver safety.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.