- Home

- »

- Homecare & Decor

- »

-

Glass Straw Market Size, Share And Growth Report, 2030GVR Report cover

![Glass Straw Market Size, Share & Trends Report]()

Glass Straw Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Skinny, Regular, Smoothie, Boba/Bubble Tea), By End-use (Household, Institutional, Foodservice, Food Processing Industry), By Sales Channel (B2C, B2B), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-469-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Glass Straw Market Size & Trends

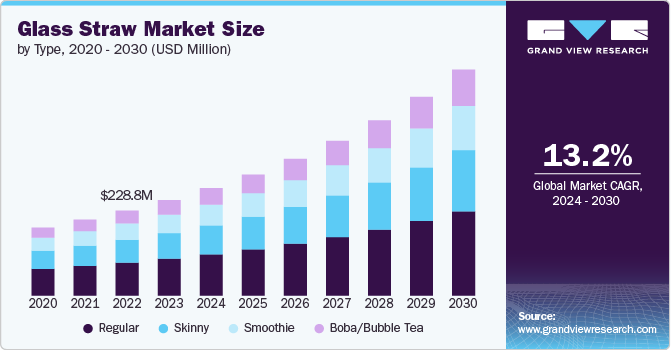

The global glass straw market size was estimated at USD 257.08 million in 2023 and is projected to grow at a CAGR of 13.2% from 2024 to 2030. The shift towards sustainability has fueled the popularity of reusable glass straws, particularly since the EU's 2021 ban on single-use plastics like straws and cutlery. As a result, consumers and businesses alike have turned to more eco-friendly options, with glass straws emerging as a top choice. Their reusability aligns with growing environmental awareness, offering an alternative to the waste associated with plastic straws. The clear visual appeal of glass, along with its ability to be washed and reused repeatedly, has driven up demand as more people seek to reduce their carbon footprint and plastic consumption.

One of the main reasons for glass straws' rise in popularity is their ability to preserve the taste of beverages, unlike metal alternatives that may give off a metallic aftertaste. Glass straws maintain the original flavor of both hot and cold drinks, making them a preferred option for coffee lovers and cocktail enthusiasts. Unlike bamboo or paper straws, which can deteriorate quickly, glass straws are durable and can last indefinitely when cared for properly. This durability and functionality make glass straws more appealing to both consumers and businesses looking for long-term, eco-friendly solutions.

The transparency of glass straws adds to their hygiene benefits. Unlike stainless steel or bamboo, where cleanliness can be difficult to gauge, glass allows users to see if the straw is thoroughly cleaned. This is particularly advantageous for health-conscious individuals who prioritize cleanliness in their reusable products. In addition, glass straws are dishwasher safe, offering a hassle-free cleaning option. The availability of cleaning brushes also makes it easy to maintain these straws for years, increasing their value as a reusable item and adding to their practicality.

Beyond functionality, glass straws have also become a style statement. They are available in various colors and can be customized with engravings or unique patterns, making them more personalized compared to other alternatives. This customization makes them popular for parties, events, and businesses that want to offer an aesthetically pleasing eco-friendly option to customers. Moreover, the visual appeal of glass straws complements their practical advantages, as consumers are increasingly drawn to stylish yet sustainable products in their daily lives.

Portability remains a limitation of glass straws. Unlike stainless steel or silicone alternatives, which are more resistant to breakage, glass straws are fragile and less ideal for use on the go. Despite this, many consumers still prefer to use them at home or in restaurants due to their sleek appearance and other benefits. Businesses, particularly in the hospitality industry, have also embraced glass straws as a way to showcase their commitment to sustainability, without compromising on aesthetics or taste.

Type Insights

Based on type, the regular segment led the market with the largest revenue share of 38.64% in 2023. These are highly preferred due to their versatile diameter, ideal for a wide range of beverages such as juice, water, soft drinks, and well-blended smoothies. Their width closely resembles that of typical restaurant straws, making them familiar and comfortable for consumers. This size is perfect for thin liquids, ensuring a smooth drinking experience without clogging. Their reusability, ease of cleaning, and aesthetic appeal, combined with their functionality for everyday drinks, make them a popular choice in the reusable straw market.

The boba/bubble tea segment is expected to grow at the fastest CAGR of 14.1% from 2024 to 2030. These straws, typically 8-12 millimeters wide, are specifically designed to handle the thick tapioca pearls and toppings found in bubble tea. With more consumers seeking sustainable alternatives, eco-conscious boba drinkers are turning to reusable glass straws for their durability and functionality. Available in 8" or 10" lengths, they ensure a smooth sipping experience while reducing plastic waste, making them a perfect choice for bubble tea lovers.

End-use Insights

Based on end use, the household segment led the market with the largest revenue share of 48.10% in 2023. Residential use of glass straws is on the rise, driven largely by the environmentally conscious Gen Z. As sustainability becomes a priority, more families are opting for eco-friendly alternatives to single-use plastics. The reduction of plastic straws, carrier bags, and packaging reflects a broader shift toward reusability. Glass straws, which are durable, easy to clean, and stylish, appeal to households seeking to minimize their environmental impact while maintaining convenience, making them a popular choice for everyday use.

The foodservice segment is expected to grow at the fastest CAGR of 15.1% from 2024 to 2030. Adoption in this sector is expected to rise as sustainability and style become key selling points for businesses. Hotels, bars, restaurants, and cafés are increasingly adopting reusable glass straws to align with eco-conscious consumer preferences. Glass straws offer a durable, hygienic, and visually appealing alternative to single-use plastics, enhancing the customer experience while reducing environmental impact. With glass straws suitable for various drinks-from smoothies to cocktails-food service establishments can showcase their commitment to both quality and sustainability.

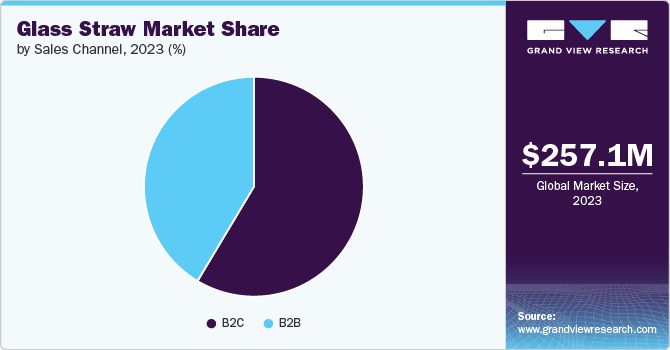

Sales Channel Insights

Based on sales channel, the B2C segment led the market with the largest revenue share of 58.58% in 2023. This is prevalent due to their eco-friendly appeal, durability, and health benefits. Consumers are increasingly prioritizing sustainable alternatives to single-use plastics, with glass straws offering a reusable solution that helps reduce plastic waste. Made from non-toxic, BPA-free materials, glass straws are safer for health and suitable for a wide range of beverages. Their elegant design, combined with versatility and ease of cleaning, makes them an attractive choice for households aiming to adopt a greener lifestyle.

The B2B segment is anticipated to grow at the fastest CAGR of 14.0% from 2024 to 2030. As businesses in the hospitality and foodservice industries prioritize sustainability and eco-friendly practices, adoption of glass straws is expected to rise. Glass straws offer a durable, reusable alternative to single-use plastics, reducing waste and appealing to environmentally-conscious customers. With increasing regulations on plastic usage and growing consumer demand for sustainable products, hotels, restaurants, and cafes are adopting glass straws to enhance their brand image while aligning with environmental goals. Their long lifespan also makes them cost-effective for businesses.

Regional Insights

North America dominated the glass straw market with the largest revenue share of 31.09% in 2023. Glass straw demand in North America is rising due to increasing environmental awareness and stringent regulations on single-use plastics, particularly in cities like New York and Seattle. In addition, health-conscious consumers prefer glass straws as they are free from chemicals like BPA, which can be found in plastic alternatives. The growing trend toward eco-friendly, reusable products and a surge in sustainability initiatives by businesses and individuals further drive demand in the region. Social media campaigns promoting zero-waste lifestyles also fuel interest in glass straws.

U.S. Glass Straw Market Trends

The glass straw market in the U.S. accounted for the largest market share of around 75% in 2023 in the North America market. This demand stems from growing environmental awareness and a shift toward sustainable living. Consumers are increasingly rejecting single-use plastics in favor of reusable options that reduce waste. In addition, glass straws are perceived as stylish and enhance the drinking experience, appealing to eco-conscious millennials and Gen Z. Trends such as zero-waste lifestyles and health-focused choices further drive their popularity, as glass straws are non-toxic and easy to clean. Brands are also innovating with designs and packaging that emphasize sustainability, attracting consumers seeking eco-friendly alternatives.

Europe Glass Straw Market Trends

The glass straw market in Europe accounted for the market share of 22.27% in 2023 in 2023. The EU's stringent measures against single-use plastics are driving demand for sustainable alternatives like glass straws. With over 80% of marine litter comprising plastics, consumers are increasingly aware of the environmental impact, prompting a shift towards reusable products. As single-use plastics are banned, glass straws offer a stylish and eco-friendly solution that aligns with the EU's sustainability goals. In addition, the emphasis on reducing plastic waste encourages consumers to adopt more responsible choices, further boosting the appeal of durable and non-toxic options like glass straws.

Asia Pacific Glass Straw Market Trends

The glass straw market in Asia Pacific is anticipated to grow at the fastest CAGR of 15.1% from 2024 to 2030. This is due to increasing environmental awareness and a shift towards sustainable products. As consumers become more conscious of plastic waste, glass straws offer a reusable, eco-friendly alternative. In addition, the rising trend of health and wellness encourages individuals to opt for safer, non-toxic drinking solutions. Government initiatives promoting eco-friendly practices further support this transition, driving demand across various markets in Asia Pacific.

Key Glass Straw Company Insights

The market is fragmented. Many brands have identified untapped opportunities within their product lines and are taking steps to address these market gaps. This often involves developing new product designs or marketing campaigns to meet consumer needs and preferences better.

Key Glass Straw Companies:

The following are the leading companies in the glass straw market. These companies collectively hold the largest market share and dictate industry trends.

- Simply Straws

- Hummingbird Glass Straws

- Strawesome

- GlassSipper

- VASO

- Soma

- HALM Straws

- Le Parfait

- SCHOTT

- Zwilling

Recent Developments

-

In December 2023, SCHOTT announced the significant investment in expanding its innovation and development center in Landshut. The objective of this project was to improve global competitiveness by implementing new workspaces and streamlined processes. The new facility, set to be 100% climate-neutral and powered entirely by renewable energy, is expected to be completed by fall 2025

-

In January 2022, theLe Parfait brand was fully acquired by Berlin Packaging, a well-known global supplier of hybrid packaging, from O-I France SAS. This move enhanced Berlin Packaging's position in the high-quality glass container market, expanding its reach into the consumer sector. Le Parfait, renowned for its iconic glass jars, straws, and lids, was celebrated for its commitment to homemade food preservation. The glass products, manufactured in France and Spain, continued to be produced under a long-term supply agreement with O-I France, ensuring a stable supply

Glass Straw Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 289.12 million

Revenue forecast in 2030

USD 608.80 million

Growth rate

CAGR of 13.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, sales channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Simply Straws; Hummingbird Glass Straws; Strawesome; GlassSipper; VASO; Soma; HALM Straws; Le Parfait; SCHOTT; Zwilling

Customization

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Glass Straw Market Report Segmentation

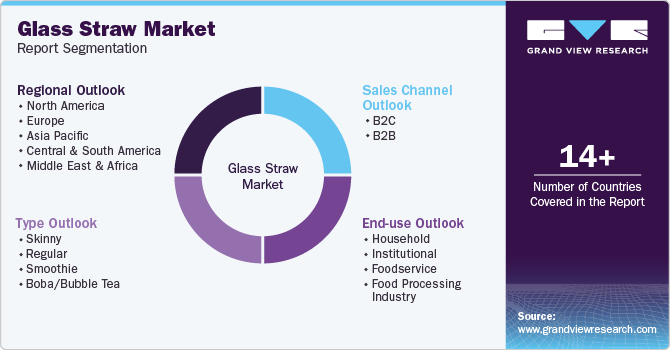

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global glass straw market report based on type, end-use, sales channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Skinny

-

Regular

-

Smoothie

-

Boba/Bubble Tea

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Household

-

Institutional

-

Foodservice

-

Food Processing Industry

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

B2C

-

B2B

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global glass straw market was estimated at USD 257.08 million in 2023 and is expected to reach USD 289.12 million in 2024.

b. The global glass straw market is expected to grow at a compound annual growth rate of 13.2% from 2024 to 2030 to reach USD 608.80 million by 2030.

b. North America dominated the glass straw market with a share of around 30% in 2023. This is due to high environmental awareness in the region and strong demand for sustainable alternatives to plastic.

b. Key players in the glass straw market are Simply Straws; Hummingbird Glass Straws; Strawesome; GlassSipper; VASO; Soma; HALM Straws; Le Parfait; SCHOTT; Zwilling.

b. Key factors that are driving the glass straw market growth include increasing environmental awareness, growing demand for sustainable products, government regulations against single-use plastics, and rising consumer health consciousness.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.