Glass Scintillator Market Size & Trends

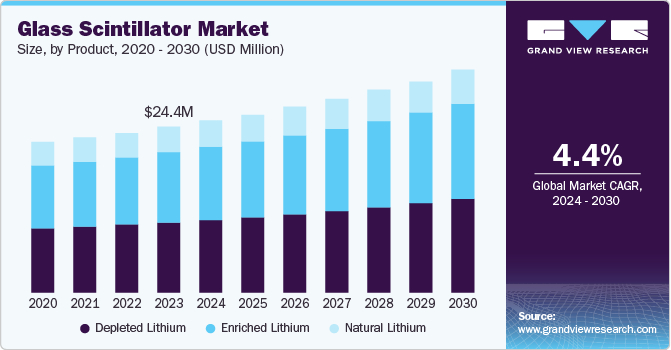

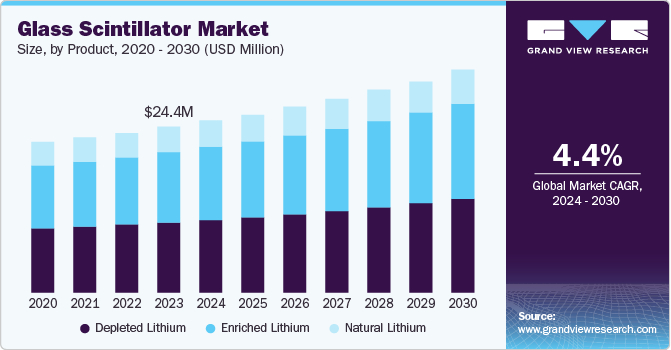

The global glass scintillator market size was valued at USD 24.4 million in 2023 and is projected to grow at a CAGR of 4.4% from 2024 to 2030. The increasing use of glass scintillator in oil & gas applications, rising number of nuclear power plants, and advancements in radiation detection technology are the factors driving the glass scintillator market.Glass scintillators are used in detectors as they help in monitoring energy radiations from nuclear reactors. It is also useful in oil and gas exploration due to its ability to perform under the harsh working conditions of temperature and pressure. It is used for the detection of pore pressure and rock mechanical properties. The determination of mechanical properties of rock benefits the drillers in terms of effective drilling decision, which in turn helps in enhancing the drilling efficiency. The drilling efficiency, in turn, depends on drilling speed, borehole pressure, and other similar characteristics.

The demand for lithium-based scintillators is increasing on account of shortage in the supply of helium, which is used as a material for thermal neutron detection. The lithium-based material is useful due to lower atomic number, which imparts gamma transparency, and is thus advantageous.

The scintillator has useful properties which include higher resolution, broad transmission, better mechanical hardness, and enhanced energy proportionality. Lithium interacts with neutron to produce high energy particles, which are easier to detect and measure. Neutron detection finds large applications in nuclear power plant, particle physics, and nuclear medicine

Product Insights

Depleted lithium dominated the market and accounted for a share of 42.8% in 2023. The increasing well complexity coupled with rising cost of carrying out drilling operations has driven the need for measurement while drilling, which in turn helps in gaining valuable information about the well or reservoir conditions. Increasing need for logging while drilling (LWD) and measurement-while-drilling (MWD) solutions in upstream oil and gas industry is expected to drive the glass scintillator market growth. Precise formation evaluation has become an essential element in the exploration business as it helps to enhance productivity while drilling. The use of lithium-based glass scintillator in logging while drilling process contributes toward reducing the time for proper data required to take a decision. This, in turn, also reduces the environmental impact of drilling in the area.

The North America region has abundant oil and gas fields with lower exploration costs. This, coupled with advanced research techniques used in measurement while drilling, can help in yielding higher profitability. The advances in measurement while drilling is likely to boost the growth of lithium-based glass scintillators in the North America region, especially the U.S., which has been a center for shale boom, changing the pricing dynamics of the oil industry

Enriched lithium is expected to register the fastest CAGR of 4.6% during the forecast period. This is mostly due to its important function in advanced nuclear technologies, such as fusion reactors and next-generation batteries. With the increasing popularity of these technologies, the demand for high-purity enriched lithium has greatly increased. In addition, improvements in technology for separating lithium isotopes have increased the efficiency of producing enriched lithium, helping to drive its rapid expansion in the market.

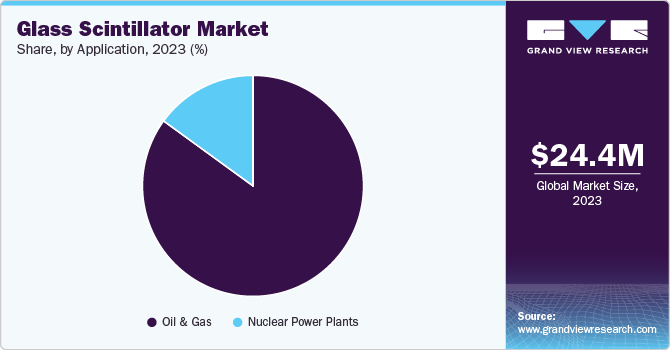

Application Insights

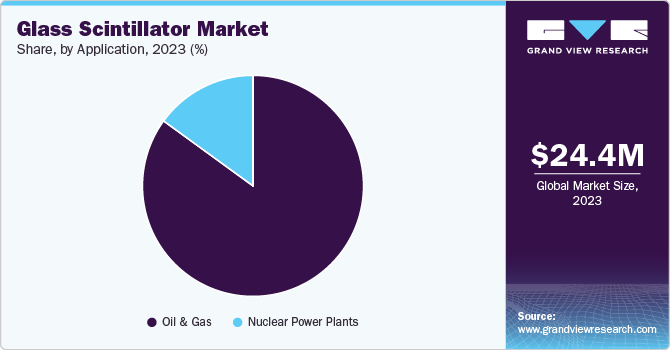

Oil & gas accounted for the largest market revenue share of 84.6% in 2023. This increase is credited to the industry's growing dependence on scintillation technology for well logging, reservoir characterization, and radiation safety procedures in exploration and production operations. Companies in the oil and gas business are exploring new investment opportunities for the development of oil rigs before investing in one. This is possible with the aid of lithium-based glass scintillators used for data collection during the drilling process, which ensures return on investment.

The measurement-while-drilling (MWD) technology is useful for formation evaluation, which is, in turn, beneficial for directional and horizontal drilling of wells. Lithium-based glass scintillators provide reliable data from well logging by employing different techniques such as measurement-while-drilling and logging-while-drilling. Real-time data transmission during drilling enables the operator to take correct decisions, which reduces the turnaround time for drilling, resulting in cost savings. In addition to these benefits, the product possesses the ability to perform under extreme conditions, of temperature, pressure, vacuum, magnetic field, and humidity, which makes it an ideal choice for oil & gas exploration. These factors together are anticipated to boost the overall demand over the forecast period.

The nuclear power plants segment is projected to grow at a CAGR of 5.5% over the forecast period due to strict safety protocols and the crucial importance of accurate radiation detection and monitoring in the nuclear energy industry. Glass scintillators are essential for safeguarding nuclear power facilities and personnel due to their inherent accuracy and reliability.

Regional Insights

North America glass scintillator market dominated the market with a revenue share of 36.5% in 2023. North America held a crucial position due to the presence of major manufacturers, research institutions, and a strong emphasis on technological advancements in radiation detection.

U.S. Glass Scintillator Market Trends

The U.S. dominated the North America market with a share of 82.9% in 2023. U.S. research institutions and universities are participating in a variety of scientific research endeavors that necessitate the use of radiation detection and measurement.

Asia Pacific Glass Scintillator Market Trends

The glass scintillator market in the Asia Pacific is anticipated to witness significant growth in the coming years. Changing population dynamics from rural to urban center, coupled with increasing demand for electricity, are projected to boost nuclear power plant installations in the Asia Pacific region.

Key Glass Scintillator Company Insights

Some key companies in the glass scintillator market include Rexon Components, Inc, Saint-Gobain, Scintacor, and others. The companies are emphasizing new product development, partnerships, and acquisitions with key players to increase the share and strengthen competitive aspect.

Key Glass Scintillator Companies:

The following are the leading companies in the glass scintillator market. These companies collectively hold the largest market share and dictate industry trends.

- Rexon Components, Inc

- Saint-Gobain

- Scintacor

- Collimated Holes Inc.

- Amcrys

- Albemarle Corporation

- FMC Corporation

- Dynasil Corporation

- Epic Cystal Co. Ltd

Glass Scintillator Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 25.31 million

|

|

Revenue forecast in 2030

|

USD 31.77 million

|

|

Growth Rate

|

CAGR of 4.4% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD thousands/million and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, application, region

|

|

Regional scope

|

North America, Europe, Asia Pacific, Latin America, MEA

|

|

Country scope

|

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Brazil, and Saudi Arabia

|

|

Key companies profiled

|

Rexon Components, Inc; Saint-Gobain ; Scintacor; Collimated Holes Inc.; Amcrys; Albemarle Corporation; FMC Corporation; Dynasil Corporation; Epic Cystal Co. Ltd

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

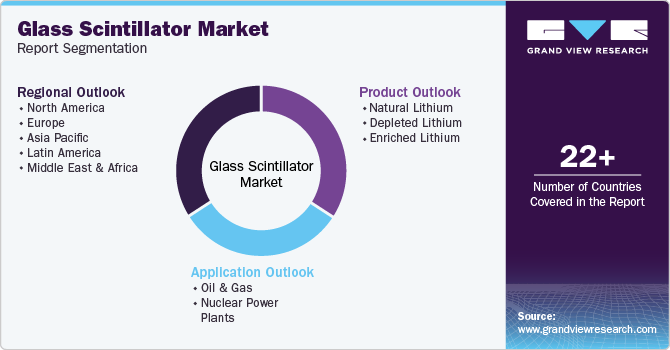

Global Glass Scintillator Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global glass scintillator market report based on product, application, and region.

-

Product Outlook (Revenue, USD Thousands, 2018 - 2030)

-

Natural Lithium

-

Depleted Lithium

-

Enriched Lithium

-

Application Outlook (Revenue, USD Thousands, 2018 - 2030)

-

Oil & Gas

-

Nuclear Power Plants

-

Regional Outlook (Revenue, USD Thousands, 2018 - 2030)