- Home

- »

- Advanced Interior Materials

- »

-

Glass Fiber Reinforced Gypsum Market Size Report, 2030GVR Report cover

![Glass Fiber Reinforced Gypsum Market Size, Share & Trends Report]()

Glass Fiber Reinforced Gypsum Market Size, Share & Trends Analysis Report By Product (Type X, Type Y), By Application, By End-use (Residential, Non-residential), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-430-7

- Number of Report Pages: 200

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

“2030 Glass Fiber Reinforced Gypsum Market value to reach USD 5,379.3 million”

The global glass fiber reinforced gypsum market size was estimated at USD 3.39 billion in 2023 and is projected to grow at a CAGR of 6.9% from 2024 to 2030. The market driven by increasing demand for eco-friendly and sustainable construction materials, as GFRG offers a lightweight and durable alternative to traditional building materials Additionally, the growing construction industry in emerging economies is contributing to market expansion, with GFRG being favored for both residential and commercial applications due to its superior strength and ease of installation.

Drivers, Restraints & Opportunities

One of the primary drivers for the GFRG market is the increasing demand for lightweight and durable construction materials. GFRG offers a unique combination of strength and reduced weight, making it an attractive option for both residential and commercial construction. For instance, its use in high-rise buildings allows for easier handling and installation, which can significantly reduce labor costs and construction time. Additionally, the fire-resistant properties of GFRG make it a preferred choice in applications where safety is paramount, such as schools, hospitals, and public buildings.

One of the primary challenges for the industry is the high maintenance costs associated with GFRG products. While GFRG is durable, the installation and upkeep can be more expensive compared to traditional materials, which may deter some builders from adopting it. For instance, specialized skills and tools are often required for the installation of GFRG panels, leading to increased labor costs. Additionally, if not properly maintained, GFRG can be susceptible to damage from moisture, which can further escalate maintenance expenses.

The GFRG market presents numerous opportunities for growth, particularly in emerging economies where rapid urbanization is taking place. Countries like India and China are experiencing significant infrastructure development, creating a demand for innovative building materials. GFRG's lightweight and prefabricated nature makes it an ideal solution for addressing housing shortages and accelerating construction timelines in these regions. For example, the adoption of GFRG panels in India has been recognized as a viable solution to meet the country's growing housing needs efficiently.

Product Insights

“Type X emerged as the fastest growing product with a CAGR of 7.3%”

Type X dominated the market and accounted for a revenue share of approximately 46.8% in 2023. It is specifically designed to provide enhanced fire resistance, making it a preferred choice for applications where safety is a priority. This product of GFRG contains additives that improve its fire performance, allowing it to withstand higher temperatures compared to standard gypsum products. Type X GFRG is commonly used in commercial buildings, such as office complexes and hospitals, where fire safety regulations are stringent. Its ability to maintain structural integrity under fire conditions makes it suitable for use in walls, ceilings, and partitions that require a fire rating.

Type Y GFRG is another variant that offers a balance between strength and weight, making it ideal for a variety of architectural applications. Unlike Type X, Type Y is not specifically formulated for fire resistance but is known for its durability and versatility. This product is often used in interior applications, such as decorative moldings, ceiling tiles, and custom architectural features. For example, in the renovation of historical buildings, Type Y GFRG can be employed to replicate intricate designs while providing a lightweight solution that reduces the load on existing structures. Its adaptability allows architects and designers to create visually appealing spaces without compromising on structural integrity.

Other Products in GFRG market include custom shapes, decorative elements, and specialized panels that cater to unique architectural requirements. For instance, GFRG can be molded into complex shapes for use in theaters, museums, and exhibition spaces, where design flexibility is crucial. An example of this is the use of GFRG domes and medallions in high-end residential and commercial projects, which add a touch of elegance and sophistication to interiors. Furthermore, advancements in manufacturing techniques have enabled the production of GFRG products that incorporate recycled materials, appealing to environmentally conscious consumers.

Application Insights

“Exterior emerged as the fastest growing material with a CAGR of 7.3%”

Interior dominated the market and accounted for a revenue share of 61.8% in 2023. The interior applications of glass fiber reinforced gypsum (GFRG) encompass a variety of uses, including walls, ceilings, floors, columns, and light covers. GFRG is particularly valued for its lightweight nature and versatility, making it an ideal choice for modern architectural designs. For instance, GFRG panels are often used to create seamless wall surfaces that can be easily customized to fit specific design requirements. In commercial spaces, such as offices and retail environments, GFRG ceilings can be designed to incorporate intricate patterns and shapes, enhancing the aesthetic appeal while maintaining functionality.

In exterior applications, GFRG is increasingly being used for walls and cladding, offering a durable and aesthetically pleasing solution for building facades. The material's resistance to weathering and its lightweight properties make it suitable for various climates and architectural styles. For example, GFRG cladding can be found in modern residential buildings, where it is used to create sleek, contemporary exteriors that require minimal maintenance. Additionally, GFRG is often employed in commercial buildings, such as shopping malls and office complexes, where it can be molded into unique shapes and designs that enhance the overall architectural vision.

End-use Insights

“Residential emerged as the fastest growing form with a CAGR of 7.2%”

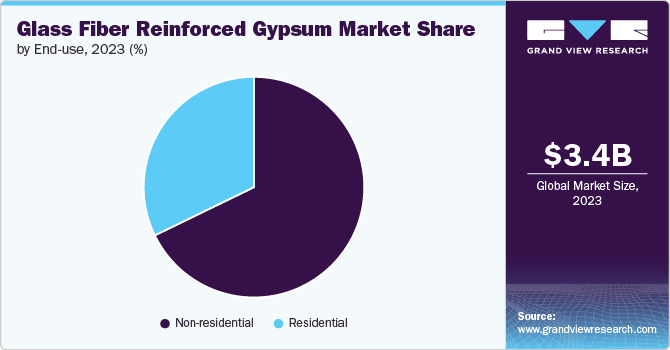

Non-residential applications dominated the market and accounted for a revenue share of approximately 67.8% in 2023. GFRG is widely utilized in various non-residential structures, including offices, educational institutions, hospitals, and entertainment venues such as theaters and museums. For instance, in the construction of modern office buildings, GFRG is often employed for interior walls and ceilings due to its lightweight nature and ease of installation, which significantly reduces construction time. Additionally, its fire-resistant properties make it an ideal choice for public buildings where safety regulations are stringent. The versatility of GFRG allows architects and builders to create aesthetically pleasing designs while ensuring compliance with safety standards, making it a preferred material in the non-residential sector.

In the residential End Use segment, GFRG is gaining popularity for its ability to enhance the aesthetic appeal and functionality of living spaces. Homeowners and builders are increasingly turning to GFRG for applications such as decorative ceilings, wall panels, and custom moldings. The lightweight nature of GFRG allows for easy installation, making it an attractive option for renovations and new constructions alike. For example, in upscale residential projects, GFRG is often used to create intricate ceiling designs and architectural features that add character to homes without the burden of heavy materials. Additionally, GFRG's thermal insulation properties contribute to energy efficiency, which is a significant consideration for modern homeowners looking to reduce energy costs.

Regional Insights

“Asia Pacific emerged as the fastest growing market with a CAGR of 7.4% from 2024 - 2030”

North America glass fiber reinforced gypsum market is experiencing significant growth, fueled by the increasing demand for lightweight and durable construction materials. The United States and Canada are at the forefront of this trend, with GFRG being widely used in both residential and non-residential applications. For example, in commercial buildings, GFRG is often utilized for ceilings, wall panels, and decorative elements due to its ease of installation and superior strength. The material's fire-resistant properties make it particularly appealing for public spaces, such as schools and hospitals, where safety is paramount.

Europe Glass Fiber Reinforced Gypsum Market Trends

The glass fiber reinforced gypsum market in Europe dominated the market and accounted for a 35.2% share in 2023. The region is characterized by a high demand for innovative materials that enhance both aesthetic appeal and structural integrity. Countries like the United Kingdom, France, and Italy are leading the way in adopting GFRG for various applications, including interior and exterior designs. For instance, in the renovation of historical buildings, GFRG is often used to replicate intricate architectural details while providing a lightweight solution that minimizes structural load. The region's stringent building regulations regarding fire safety and energy efficiency further propel the adoption of GFRG, making it a preferred choice for modern construction projects.

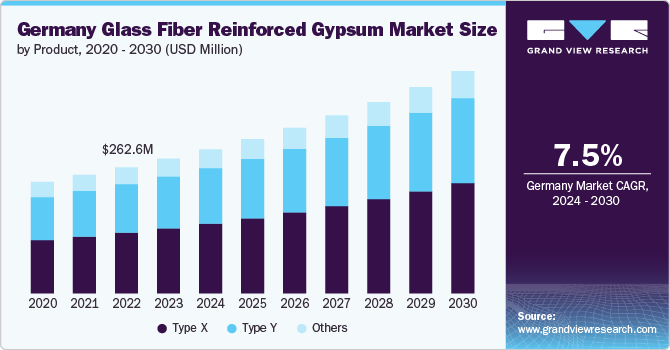

Germany glass fiber reinforced gypsum market plays a pivotal role in the European GFRG market, characterized by its advanced construction techniques and a strong emphasis on sustainability. The country is known for its rigorous building codes and standards, which promote the use of high-quality materials that enhance safety and energy efficiency. GFRG is increasingly being utilized in both residential and commercial projects, with applications ranging from decorative ceilings to fire-resistant wall panels.

Asia Pacific Glass Fiber Reinforced Gypsum Market Trends

The glass fiber reinforced gypsum market in Asia Pacific is emerging as a dynamic market for glass fiber reinforced gypsum, driven by rapid urbanization and infrastructure development. Countries such as China, India, and Japan are witnessing a surge in construction activities, leading to increased demand for innovative building materials like GFRG. In China, for instance, GFRG is being adopted in large-scale residential projects, where its lightweight nature and ease of installation significantly reduce construction time and labor costs. Additionally, the growing focus on sustainable building practices in the region is further propelling the adoption of GFRG, as it aligns with the environmental goals of many governments.

Key Glass Fiber Reinforced Gypsum Company Insights

The competitive environment of the market is characterized by a diverse array of players, ranging from established multinational corporations to emerging local manufacturers. Some manufacturers are focusing on developing fire-resistant and moisture-resistant GFRG solutions to cater to the growing demand in sectors such as healthcare and education, where safety and durability are critical. Additionally, companies are increasingly emphasizing sustainability by incorporating recycled materials into their GFRG products, aligning with global trends towards eco-friendly construction practices.

-

Georgia-Pacific LLC offers a variety of gypsum boards, including those reinforced with glass fibers, which are designed for enhanced durability and fire resistance. Georgia-Pacific's product portfolio includes wallboard, ceiling tiles, and specialty products that cater to both residential and commercial applications.

-

USG Corporation’s product portfolio includes a wide range of gypsum boards, ceiling systems, and finishing products. USG is particularly known for its innovative GFRG solutions that combine lightweight properties with superior strength and fire resistance. Their offerings include decorative ceiling tiles and wall panels that are ideal for commercial spaces, enhancing both functionality and aesthetics.

-

National Gypsum Company manufactures a variety of gypsum boards, including its PURPLE line, which is designed for moisture and mold resistance. National Gypsum’s product portfolio includes wallboard, cement board, and finishing products, catering to both residential and commercial construction needs.

Key Glass Fiber Reinforced Gypsum Companies:

The following are the leading companies in the glass fiber reinforced gypsum market. These companies collectively hold the largest market share and dictate industry trends.

- Georgia-Pacific LLC

- USG Corporation

- Saint Gobain Gyproc

- Knauf Danoline A/S

- Continental Building Products

- Yingchuang Building Technique Co. Ltd.

- Formglas Products Ltd.

- American Gypsum Co. LLC

- National Gypsum Company

Recent Developments

-

In April 2024, British Gypsum Company, a subsidiary of Saint-Gobain announced the decision to switch to a circular pallet re-use scheme in order to reduce its waste stream and achieve its ecological objectives, reducing its carbon footprint. The company plans to shift 70% of its production based on raw materials at the completion of the project.

-

In October 2023, USA Gypsum LLC (USAG) was acquired by Beneficial Reuse Management LLC (BRM). USAG will continue to to operate independently, giving an opportunity to BRM to diversify its sources of Gypsum including recycled scrap drywall.

Glass Fiber Reinforced Gypsum Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.60 billion

Revenue forecast in 2030

USD 5.37 billion

Growth rate

CAGR of 6.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in million Square Meters, Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Volume and Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Georgia-Pacific LLC; USG Corporation; Saint Gobain Gyproc; Knauf Danoline A/S; Continental Building Products; Yingchuang Building Technique Co. Ltd.; Formglas Products Ltd.; American Gypsum Co. LLC; National Gypsum Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

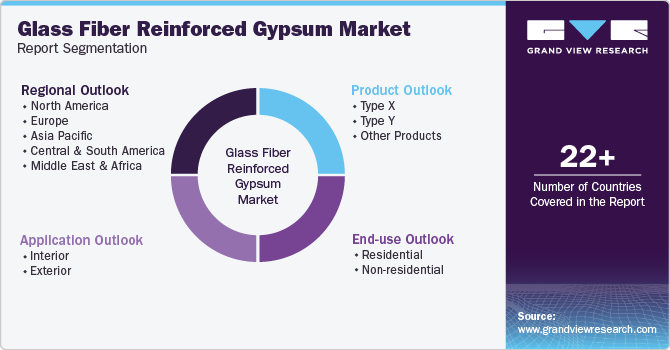

Global Glass Fiber Reinforced Gypsum Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global glass fiber reinforced gypsum market report based on product, application, end-use, and region:

-

Product Outlook (Volume, Million Square Meters, Revenue, USD Million, 2018 - 2030)

-

Type X

-

Type Y

-

Other Products

-

-

Application Outlook (Volume, Million Square Meters, Revenue, USD Million, 2018 - 2030)

-

Interior

-

Wall

-

Ceiling & Floor

-

Column & Light Cover

-

-

Exterior

-

Wall

-

Cladding

-

-

-

End-use Outlook (Volume, Million Square Meters, Revenue, USD Million, 2018 - 2030)

-

Residential

-

Non-residential

-

-

Regional Outlook (Volume, Million Square Meters, Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global glass fiber reinforced gypsum market size was estimated at USD 3.39 billion in 2023 and is expected to reach USD 3.61 billion in 2024.

b. The global glass fiber reinforced gypsum market is expected to grow at a compound annual growth rate (CAGR) of 6.9% from 2024 to 2030 to reach USD 5.37 billion by 2030.

b. Non-residential applications dominated the glass fiber reinforced gypsum market with a revenue share of 67.8% in 2023 as it is widely utilized in various non-residential structures, including offices, educational institutions, hospitals, and entertainment venues such as theaters and museums.

b. Some key players operating in the glass fiber reinforced gypsum market include Georgia-Pacific LLC, USG Corporation, Saint Gobain Gyproc, Knauf Danoline A/S, Continental Building Products, Yingchuang Building Technique Co. Ltd., Formglas Products Ltd., American Gypsum Co. LLC, and National Gypsum Company.

b. The key factors driving market growth include increasing demand for eco-friendly and sustainable construction materials, as GFRG offers a lightweight and durable alternative to traditional building materials.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."