Glass Drinkware Market Size, Share & Trends Analysis Report By Product (Water Glasses, Wine & Champagne Glasses, Beer Glasses & Mugs, Cocktail Glasses, Tumbler), By End-use, By Distribution Channel, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-526-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Glass Drinkware Market Size & Trends

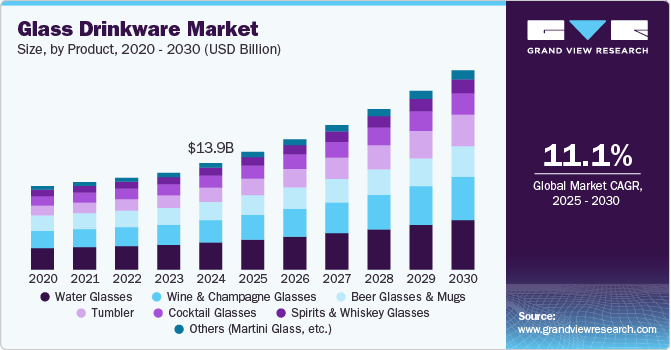

The global glass drinkware market size was valued at USD 13.95 billion in 2024 and is expected to grow at a CAGR of 11.1% from 2025 to 2030. The industry growth is attributed to the growing consumer preferences for eco-friendly and sustainable products, which boosted the demand for glass over plastic. Furthermore, the increasing beverage consumption and the rising trend of home bartending are further boosting the market growth.

The aesthetic appeal and premium feel of glass drinkware and its perceived health benefits over plastic alternatives have significantly contributed to its rising adoption. Moreover, advancements in glass manufacturing technology, which ensure durability and design innovation, are further driving the glass drinkware industry's growth. For instance, beaming, an innovation and technology-driven company, introduced its latest innovation-based product, the smart wine glass, in partnership with key online wine-commerce platform dagga. This advanced glass features a built-in chip that allows users to record wine information simply by touching the glass to an electronic identifier at each producer’s table. By streamlining the process of noting and remembering preferred wines, this technology alleviates common challenges faced during tastings, providing an enhanced and more accessible way for attendees to curate their wine selections.

The growing awareness of health and hygiene, especially post-pandemic, led consumers to prefer glass to plastic due to its non-toxic and easy-to-clean properties. This shift is driving the demand for glass drinkware in households and commercial settings. For instance, Glassette, the homeware marketplace co-founded by Laura Jackson, introduced its inaugural own-brand collection featuring an elegant assortment of everyday drinking glasses. The five-piece range, inspired by Parisian café culture, includes the popular Frenchette bistro glass, an oversized variant, two tumblers, and a refined champagne coupe. Designed for regular use with thin rims and short stems, Laura Jackson emphasizes the aim to provide accessible, stylish products that enhance daily dining experiences, whether for casual meals or formal gatherings.

Glass drinkware is increasingly popular as gift items for various occasions, such as weddings, anniversaries, and corporate events, contributing to steady market demand. Furthermore, the growing trend of personalized and customized glassware, such as engraved or specially designed pieces, is attracting consumers who seek unique and tailored products. For instance, In October 2024, The Portland Trail Blazers launched a commemorative glassware series featuring Donovan Clingan, Scoot Henderson, and Shaedon Sharpe for the 2024-25 season. The collectible glasses were available to the first 7,777 fans at select home games at Moda Center. Fans can ensure receipt of the entire set by purchasing the Blazers Collectible Glasses Flex Pack. Rip City United Members can secure a set during the annual RCU Rewards redemption.

Consumer Survey & Insights

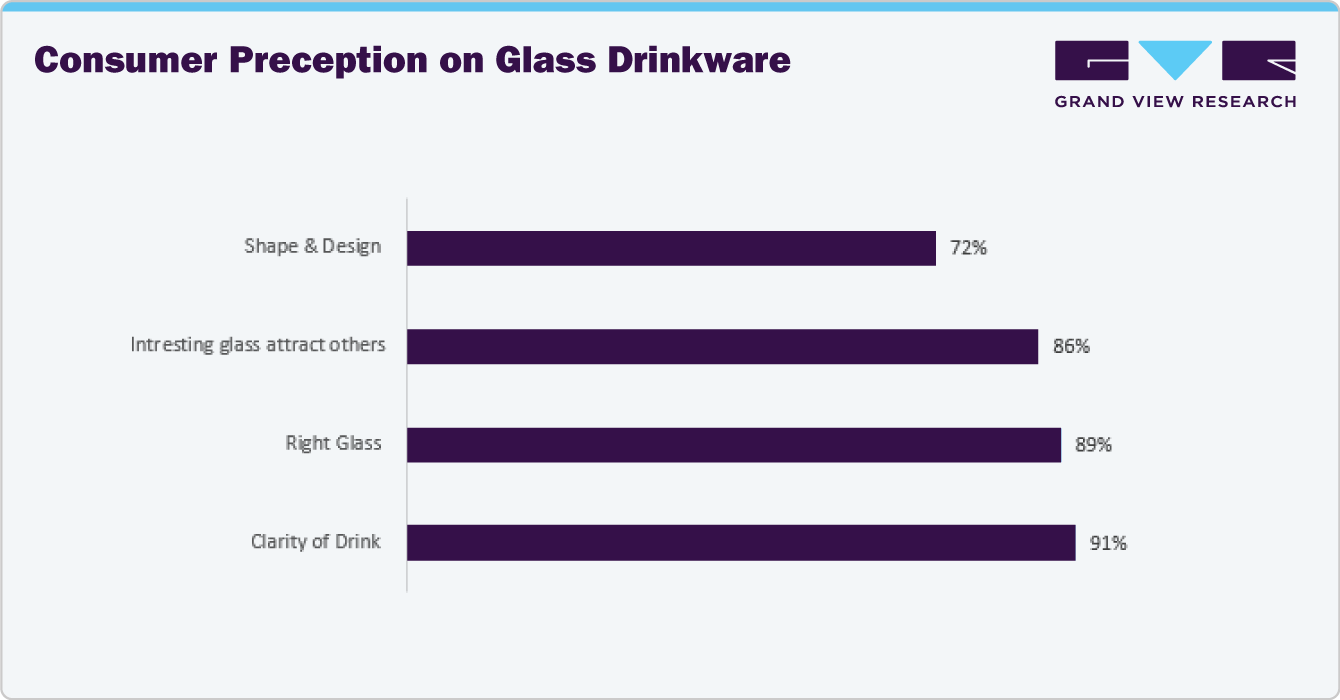

Glassware enhances the drinking experience by driving tactile brand engagement and supporting sustainable options. ADM Group interviews in 2022 with consumers aged 21-49 in France, Germany, Spain, and the U.S. reveal that 91% prioritize drink clarity, making it a key design consideration. Additionally, 89% believe the "right" glass improves their experience, while 86% are influenced by seeing others drink from unique glasses. Furthermore, 72% feel that a glass's shape and design represent the brand, highlighting the importance of glassware in consumer decision-making.

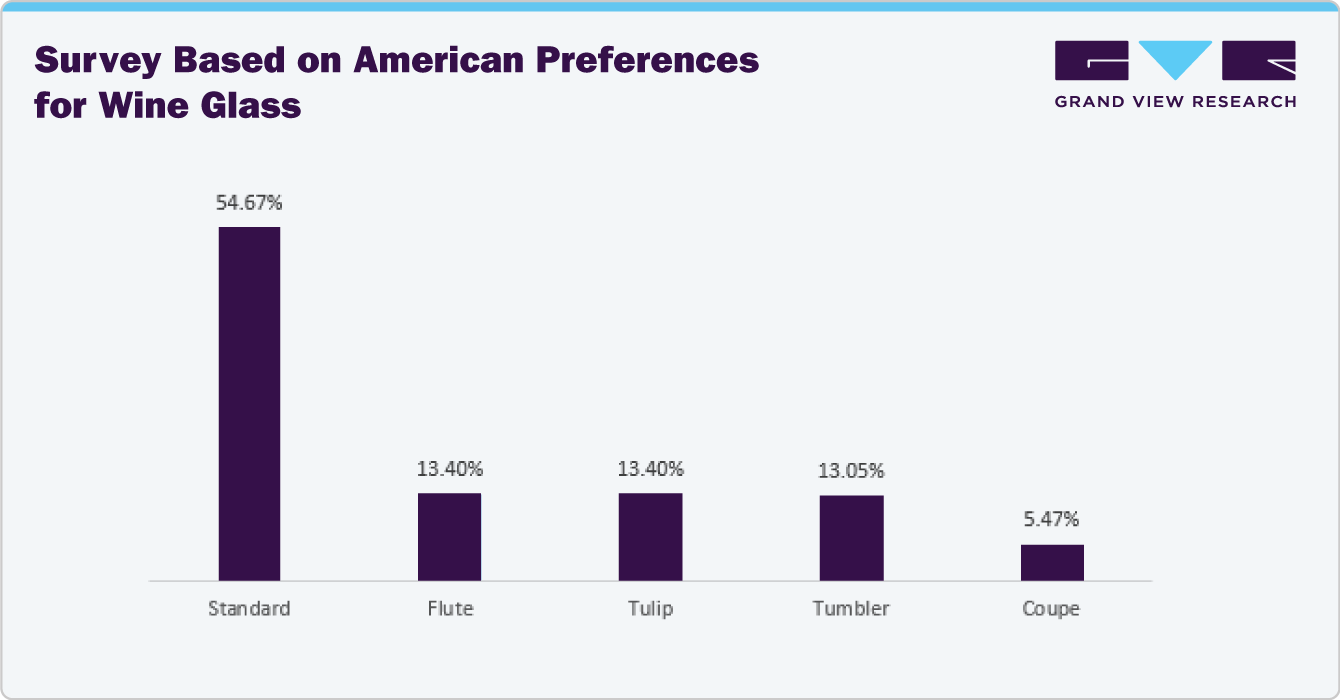

A survey of 567 Americans in 2022 revealed that standard wine glasses are the favorite, receiving 54.67% of the vote. These glasses typically hold 12-16 fluid ounces and are preferred for red wines due to their small rim, which softens forward flavors. Tied for second place, with 13.40% of the vote, are the flute and tulip glasses, ideal for sparkling wines as they preserve bubbles effectively. These glasses are recommended for those who enjoy Crémant and Prosecco.

The tumbler, favored by 13.05% of respondents, offers practicality with its sturdy design. Lastly, the shallow coupe glass, preferred by 5.47% of voters, completes the list of favorite wine glasses, each contributing to a distinct wine-drinking experience.

Product Insights

Water glasses accounted for a revenue share of over 25% in 2024, driven by the aesthetic appeal and premium feel of glass drinkware and its perceived health benefits over plastic alternatives. The increasing consumer preference for eco-friendly and sustainable products has significantly boosted the demand for glass over plastic. Additionally, the rising popularity of home bartending, the need to drink water from glasses, and the growing culture of beverage consumption, particularly in urban areas, have contributed to the market's growth.

Demand for spirits & whiskey glasses is projected to grow at a CAGR of 9.7% from 2025 to 2030. Increasing consumer preference for premium and artisanal spirits leads to a demand for high-quality glassware that enhances the drinking experience. Additionally, the rise of home bartending and cocktail culture has contributed to the need for specialized glassware. Furthermore, the expansion of the hospitality sector, including upscale bars and restaurants, is driving the market. The aesthetic appeal and superior sensory experience provided by spirits and whiskey glasses further support this growth trend.

End-use Insights

Glass drinkware use in residential settings accounted for a revenue share of over 80% in 2024. The growing trend of home entertaining and the rising popularity of home bartending have led to a higher demand for aesthetically pleasing and durable glass drinkware. The perception of glass as a healthier alternative to plastic, along with its premium look and feel, also contributes to its increased adoption in residential settings. For instance, In September 2024, Anthropologie unveiled its latest offering, the Lepelclub Bow Coupe Glass, priced at USD 37.09 each. This design exemplifies the ongoing trend of incorporating bows into home decor, which gained significant traction during the 2023 holiday season. Given the immediate popularity of these glasses, they are poised to become a prominent feature on dinner tables during the forthcoming hosting season.

Demand for glass drinkware in commercial settings is projected to grow at a CAGR of 12.0% from 2025 to 2030. The rising awareness of health benefits associated with glass drinkware, such as its non-toxic nature and resistance to chemical leaching, contributed to its popularity. High adoption of glass drinkware in cafes, restaurants, hotels, and others. Stylish and high-quality glassware can offer the hotel business a competitive edge. Guests appreciate unique drink presentations, showing the effort put into selecting glassware. Furthermore, the aesthetic appeal and premium feel of glass drinkware, combined with its durability and ability to retain clarity further drove the glass drinkware industry growth. Moreover, the expanding hospitality sector and the growing trend of home bartending also played crucial roles in the increased demand for glass drinkware in commercial settings.

Distribution Channel Insights

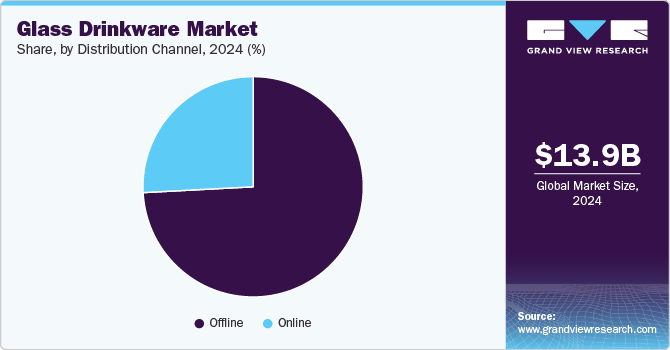

Sales of glass drinkware through offline channels accounted for a revenue share of over 74% in 2024. Glass drinkware's elegant and sophisticated appeal makes it a favorite for households, restaurants, and hotels. Its durability, including resistance to high temperatures, suits both home and professional use. Glass’ recyclability attracts environmentally conscious consumers, while social media marketing boosts sales by showcasing stylish table settings. Offline stores offer the advantage of hands-on inspection, enhancing the buying experience. Eye-catching displays and promotions in physical stores encourage impulse purchases, while established brands benefit from customer loyalty and trust, driving repeat sales.

The online channel is projected to grow at a CAGR of 12.0% from 2025 to 2030. Advancements in digital media technology, such as improved streaming capabilities, virtual reality (VR), augmented reality (AR), and artificial intelligence (AI), are enhancing the user experience and driving consumer interest in online offerings. Additionally, the rise of social media advertising and location-based video content has significantly contributed to the expansion of the online channel. The growing popularity of smartphones as the primary devices for accessing digital content has also played a crucial role in this growth, as mobile-friendly formats and dedicated apps cater to the preferences and behaviors of mobile users.

Regional Insights

North America glass drinkware market accounted for a share of over 28% of the global market in 2024. The rising disposable income and changing lifestyles of consumers which increased spending on glassware. Additionally, the growing emphasis on sustainability and eco-friendly products encouraged consumers to opt for reusable glass items. The expansion of residential and commercial spaces, particularly in the hospitality sector, also contributed to the market's growth.

In April 2024, Richard Brendon introduced the Optic Collection of glassware. Launched online and in key retail stores and hospitality venues across North America and the UK, the collection consists of a tumbler, highball, and carafe. Inspired by a centuries-old glass-making technique, each piece is handmade with spiraled ribbing, a reassuring weight, and a polished flat base. Available in Clear and Smoke, the lead-free glass pieces are dishwasher safe and resistant to clouding, ensuring durability and elegance.

U.S. Glass Drinkware Market Trends

The glass drinkware market in the U.S. is expected to grow significantly from 2025 to 2030. This growth is driven by increasing consumer demand for premium and aesthetically pleasing glassware, particularly in households and the hospitality industry. The rising trend of craft cocktails and mixology culture is also expected to boost the demand for specialized glassware in bars and restaurants. For instance, in February 2023, Dragon Glassware introduced licensed Astronaut Glasses, featuring a double-walled design with an astronaut figure inside, prominently displaying the NASA symbol and Artemis badge. Launched in conjunction with NASA's Artemis missions and the upcoming moon landing, these iridescent glasses were available for purchase on Dragonglassware.com and Amazon.

Europe Glass Drinkware Market Trends

The glass drinkware market in Europe accounted for a revenue share of over 33% of the global market revenue in 2024, driven by the rising disposable income and changing lifestyles of consumers, which increased spending on glassware. Additionally, the growing emphasis on sustainability and eco-friendly products encouraged consumers to opt for reusable glass items. The expansion of residential and commercial spaces, particularly in the hospitality sector, also contributed to the market's growth. In September 2024, Crystal Image, a prominent glassware manufacturer, unveiled a Birmingham-themed glassware collection for summer 2024. This exquisite range, handcrafted by skilled local engravers in Stourbridge, showcases notable historical and iconic landmarks from Birmingham's City Centre.

Asia Pacific Glass Drinkware Market Trends

The glass drinkware market in Asia Pacific is set to grow at a CAGR of 14.4% from 2025 to 2030. The growing consumer preferences for high-end glassware and the ever-increasing hospitality industry in this region are expected to drive market growth. Furthermore, rapid urbanization and high consumer spending capacity boost product demand. In addition, the presence of established key players and the introduction of new products, such as in July 2024, Lucaris, the renowned Modern Asian Crystal brand, launched its exquisite MUSE collection in India. This crystalware collection is designed to elevate the wine experience and offers modern luxury and innovative design. The MUSE collection features five distinct glasses: Burgundy, Bordeaux, Chardonnay, Cabernet, and Sparkling, each crafted from premium crystal. With 1,929 hospitality projects underway in Asia, including 481 in India, the MUSE collection is ideally suited for wine enthusiasts and luxurious HoReCa establishments.

Key Glass Drinkware Company Insights

The glass drinkware market is fragmented primarily due to the presence of several globally recognized players as well as regional players. Some prominent companies in this market are Ocean Glass Public Company Limited, Steelite International, Borosil, Hamilton Housewares Pvt. Ltd., Libbey Shop, and others.

-

Ocean Glass Public Company Limited is a leading manufacturer of high-quality glassware based in Thailand. The company has grown to become one of Asia's foremost glassware manufacturers, exporting to over 90 countries globally. Ocean Glass offers a wide range of products, including drinking glasses, wine glasses, beer glasses, juice glasses, and dining glass sets. Their products cater to various segments, such as households, hotels, restaurants, and corporate businesses. The company's commitment to innovation, operational excellence, and customer satisfaction has made it a trusted brand in the glass drinkware industry.

-

Steelite International is a renowned manufacturer and supplier of tabletop products, including glassware, based in the United Kingdom. The company offers an extensive portfolio of glassware that includes stemware, tumblers, beer glasses, water glasses, classic cocktail glasses, decanters, pitchers, carafes, bottles, jars, and shot glasses. Steelite's glassware is designed to enhance the dining experience by complementing the beverages being served.

Key Glass Drinkware Companies:

The following are the leading companies in the glass drinkware market. These companies collectively hold the largest market share and dictate industry trends.

- Ocean Glass Public Company Limited

- Steelite International

- Borosil

- Hamilton Housewares Pvt. Ltd.

- Libbey Shop

- Anhui Deli Household

- Anchor Hocking

- Cristal d'Arques Paris

- Lifetime Brands, Inc.

- Shandong Huapeng Glass Co., Ltd.

Recent Developments

-

In September 2023, Luxury glassmaker Bormioli Luigi finalized its merger with Bormioli Rocco. Following Bormioli Luigi’s acquisition of Bormioli Rocco in 2017, this merger aims to optimize corporate structure and know-how, benefiting from integrated, agile, and flexible processes to enhance profitability. The merger will improve strategic research using advanced IT systems, impacting production, marketing, human resources, finances, and various supplies. Bormioli Luigi operates globally, providing high-end glass bottles for perfumery, luxury spirits bottles, and glassware for the table and home.

-

In March 2022, Brazilian glass manufacturer Nadir Figueiredo acquired Colombian glass tableware group Cristar Tabletop from O-I. The merger combines Nadir and Cristar’s production capacities, making them the largest in Latin America and generating over USD 252 million in revenue in 2021. The combined company, with brands like Copo Americano, Marinex, Nadir, and Cristar, serves over 40 countries and is present in most Latin American households. The acquisition also accelerates Nadir’s internationalization, enhancing its presence in the Andean Region, the US, and Europe.

Glass Drinkware Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 15.42 billion |

|

Revenue forecast in 2030 |

USD 26.09 billion |

|

Growth Rate (Revenue) |

CAGR of 11.1% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, end-use, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; Argentina; South Africa; UAE |

|

Key companies profiled |

Ocean Glass Public Company Limited; Steelite International; Borosil; Hamilton Housewares Pvt. Ltd.; Libbey Shop; Anhui Deli Household; Anchor Hocking; Cristal d'Arques Paris; Lifetime Brands, Inc.; Shandong Huapeng Glass Co., Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Glass Drinkware Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global glass drinkware market report based on product, end-use, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Water Glasses

-

Tumbler

-

Wine & Champagne glasses

-

Beer glasses & Mugs

-

Cocktail Glasses

-

Spirits & Whiskey Glasses

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Offline

-

Home Improvement Stores

-

Hypermarkets/Supermarkets

-

Specialty Stores

-

Others

-

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia & New Zealand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."