- Home

- »

- Medical Devices

- »

-

Gerontology Market Size, Share And Trends Report 2030GVR Report cover

![Gerontology Market Size, Share & Trends Report]()

Gerontology Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Social Gerontology, Environmental Gerontology, Biogerontology), By Application (Fitness & Wellness Services, Non-Profit Organizations), By Age, By Technology, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-347-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Gerontology Market Summary

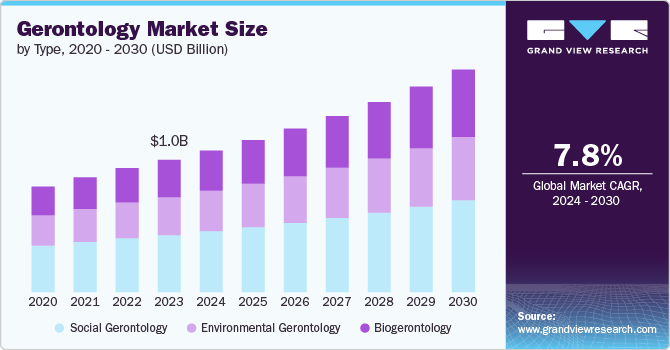

The global gerontology market size was estimated at USD 1,342.1 million in 2023 and is projected to reach USD 2,259.6 million by 2030, growing at a CAGR of 7.8% from 2024 to 2030. This market includes healthcare services, assistive devices, pharmaceuticals, and wellness programs designed to address the specific needs of older adults.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- In terms of segment, social gerontology accounted for a revenue of USD 1,342.1 million in 2023.

- Social Gerontology is the most lucrative type segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 1,342.1 Million

- 2030 Projected Market Size: USD 2,259.6 Million

- CAGR (2024-2030): 7.8%

- North America: Largest market in 2023

As the global population ages, the demand for gerontology-related services is rapidly increasing. According to the United Nations, the proportion of individuals aged 65 and older is growing more rapidly than those under 65. As a result, the global percentage of people aged 65 and above is projected to increase from 10% in 2022 to 16% by 2050. This market is also driven by technological advancements, increasing awareness of healthy aging, and a growing focus on preventive healthcare. The gerontology market is poised for significant growth, fueled by several key factors.

One of the primary drivers of the gerontology market is the increasing aging population worldwide. The global demographic shift towards an aging population, with the number of individuals over 60 is projected to double by 2050 to nearly 2.1 billion, presents both unique challenges and opportunities. This demographic shift creates a substantial demand for age-related healthcare services, products, and support systems. As life expectancy increases, there is a growing need for solutions that address chronic diseases, mobility issues, cognitive decline, and other age-related health concerns. These expanding elderly population ensures a sustained demand for gerontology services and innovations.

In addition, technological advancements play a crucial role in the growth of the gerontology market. Innovations in medical devices, telemedicine, and health monitoring systems are transforming the way care is delivered to older adults. Technologies such as wearable health monitors, smart home systems, and robotic assistance devices enhance the independence and safety of the elderly. Additionally, advancements in pharmaceuticals and biotechnology are leading to the development of more effective treatments for age-related diseases. These technological innovations improve the quality of life for older adults and drive market growth by offering new solutions and opportunities.

Furthermore, rising healthcare expenditure, particularly in developed countries, is another significant factor contributing to the growth of the gerontology market. Governments and private sectors are investing heavily in healthcare infrastructure and services to accommodate the needs of the aging population. In October 2023, elder care platform Age Care Labs raised USD 11 million in a pre-Series B funding round led by Rainmatter Capital and Gruhas. The funds will be used to expand its presence across India, invest in product and technology enhancements for an improved customer experience, and explore acquisition opportunities within the country. Increased funding for research and development in geriatrics and aging-related diseases is leading to the discovery of new treatments and therapies. Moreover, higher healthcare spending supports the expansion of long-term care facilities, home healthcare services, and rehabilitation centers, all of which are essential components of the gerontology market.

Type Insights

The social gerontology segment held the largest share of 43.3% in 2023. Social gerontology focuses on the social aspects of aging, including community support, social engagement, and quality of life for older adults. This market segment is experiencing significant growth due to the increasing aging population and the rising demand for services that enhance social well-being. Factors such as the development of senior living communities, support groups, and social programs are driving this growth. In July 2023, the government reported that it is maintaining 1,658 old age homes across India, with a total of USD 38.6 million disbursed to these facilities. Additionally, advancements in technology facilitating social connectivity and engagement among the elderly are contributing to the expansion of the social gerontology market.

The environmental gerontology segment is projected to grow fastest in the coming years, This market segment is growing as societies adapt to accommodate aging populations with infrastructure and services tailored to their needs. Innovations in urban planning, housing design, and transportation systems are driving this growth, aiming to enhance accessibility and quality of life for seniors. Additionally, increased awareness of environmental factors influencing aging, such as air quality and community design, is shaping the expansion of the environmental gerontology market.

Application Insights

The fitness and wellness services segment held the largest share of 29.2% in 2023, driven by increasing awareness of the health benefits associated with active aging. As older adults seek to maintain their physical fitness and overall well-being, there is a rising demand for tailored fitness programs, health coaching, and wellness therapies. According to Assisted Living Education in July 2024, Senior Exercise Programs are Vital for Health and Wellness Promotion. As the population ages, residential care facilities for the elderly (RCFEs) are increasingly important in supporting the health and well-being of their residents. This market expansion is further propelled by advancements in healthcare technology, which enable personalized fitness monitoring and virtual wellness platforms. Moreover, the integration of holistic health approaches, including yoga, meditation, and nutrition counseling, is enhancing the appeal and accessibility of fitness and wellness services among aging populations.

The healthcare segment is expanding rapidly in response to the growing elderly population worldwide. This market encompasses a wide range of healthcare services and products tailored to meet the unique needs of older adults, including chronic disease management, geriatric care, and specialized medical equipment. Factors driving market growth include advancements in medical technology, which improve diagnostic accuracy and treatment outcomes for age-related conditions. Additionally, the increasing prevalence of chronic diseases among seniors necessitates innovative healthcare solutions. Government initiatives and healthcare reforms aimed at improving elder care further contribute to the expansion of the healthcare market in aging.

Age Insights

The 65-75 years segment dominated the market with a share of 54.2% in 2023 due to several key factors. As this demographic cohort grows, there is an increased demand for healthcare services, including preventive care, chronic disease management, and geriatric specialists. Innovations in medical technology are also enhancing the quality of life for older adults in this age bracket, with advancements in mobility aids, telemedicine, and personalized health monitoring systems. Moreover, societal shifts towards active aging and wellness programs tailored to this age group are driving market expansion. This demographic's economic influence and healthcare needs continue to shape the evolving gerontology market landscape.

The 75-85 years segment is experiencing substantial growth driven by demographic trends and healthcare advancements. With an increasing number of individuals entering this age bracket, there is a rising demand for specialized healthcare services such as long-term care, assisted living facilities, and home healthcare solutions. Innovations in medical technology, including wearable health devices and telehealth services, are enhancing accessibility to healthcare and improving quality of life for seniors in this age group. Moreover, government policies and healthcare reforms aimed at supporting aging populations are contributing to the expansion of the gerontology market for the 75-85 years age segment.

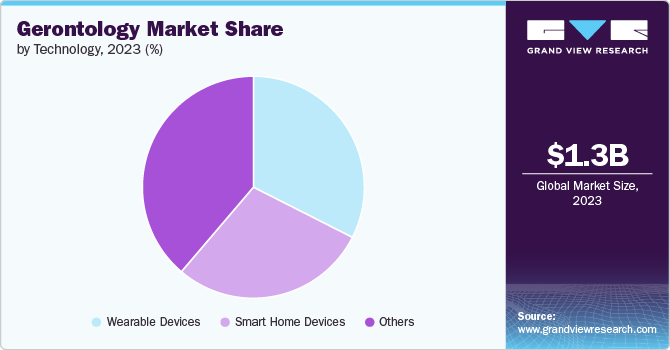

Technology Insights

The wearable devices segment held the largest share of 32.5% in 2023, due to its ease of use and effectiveness in health tracking. These devices, ranging from smartwatches to fitness trackers, enable seniors to monitor vital signs, activity levels, and even sleep patterns conveniently. According to a recent review in the Journal of Medical Internet Research by JMIR Publications, older adults residing independently in communities show increased likelihood of continuing their use of wearable monitoring devices like trackers, pedometers, and smartwatches when they receive support from healthcare professionals or peers. As older adults prioritize health management and preventive care, the demand for wearable technologies that provide real-time data and insights continues to grow. This market growth is driven by innovations improving usability and the integration of advanced health monitoring features tailored to elderly needs.

The smart home devices segment is expanding rapidly, driven by advancements in technology tailored to senior needs. These devices, such as voice-activated assistants, smart sensors, and automated home systems, enhance safety, comfort, and independence for older adults. Amazon reported in February 2024 that there has been a 200% increase in smart home devices connected to Alexa over the past three years. Innovations like remote monitoring and emergency response systems contribute to the market's growth, addressing concerns about aging in place. As older populations seek integrated solutions for daily living challenges, the demand for smart home devices continues to rise, promoting a more accessible and supportive aging experience.

Regional Insights

North America Gerontology Market Trends

North America gerontology market dominated the overall global market and accounted for the 41.54%-revenue share in 2023, driven by factors such as an aging population and advancements in healthcare technology. Currently, approximately 62 million adults aged 65 and older reside in the U.S., constituting 18% of the population. By 2054, projections suggest that 84 million adults aged 65 and older will comprise an estimated 23% of the population. Increasing healthcare expenditure, along with government initiatives supporting elder care, contributes to market expansion. Innovations in medical devices and pharmaceuticals tailored for older adults further bolster growth. Additionally, the rise in chronic diseases among seniors fuels demand for specialized geriatric care services. As North America continues to adapt to demographic shifts, the gerontology market is poised for continued expansion and innovation.

U.S. Gerontology Market Trends

The U.S. gerontology market held a significant share of North America market in 2023, mainly driven by heightened awareness of aging-related health issues. Increasing public and healthcare provider awareness of age-related diseases and the importance of senior care services drive growth in this dynamic market segment.

The Europe gerontology market is experiencing significant growth propelled by a combination of aging demographics and increased awareness of elderly healthcare needs. As of January 1, 2023, the EU population was estimated to be 448.8 million people, with individuals aged 65 years and older comprising over one-fifth (21.3%). Additionally, the median age of the EU population on that date stood at 44.5 years. As the population ages, there is a heightened focus on age-related diseases and the importance of geriatric care. This awareness drives demand for innovative healthcare solutions and services tailored to the needs of older adults across Europe.

The Asia Pacific gerontology market is experiencing the fastest growth with rapid technological innovations and government support for elderly care. Enhanced healthcare technologies tailored for aging populations, including telemedicine and smart healthcare devices, are driving market growth. Governments across the region are implementing policies to improve elderly healthcare services and facilities, fostering a supportive environment for the aging population. For instance, in January 2024, the Indian government announced plans to soon open its fifth Old Age Home, featuring world-class facilities for destitute elderly residents. This combination of technological advancement and governmental initiatives is poised to significantly enhance the quality of life for older adults in the Asia Pacific region.

The Latin America gerontology market is experiencing significant growth propelled by increasing awareness of aging-related healthcare needs. Governments and organizations are allocating more funding to improve elder care services and facilities across the region. With a growing aging population, there is a heightened focus on addressing age-related diseases and enhancing the quality of life for older adults in Latin America.

The Middle East and Africa gerontology market is experiencing the notable growth by government support and advancements in wearable devices and digital technologies. Governments are investing in elder care infrastructure, while wearable technologies and digital innovations are enhancing healthcare access and monitoring for aging populations. This combination is driving growth and improving the quality of elderly care in the region.

Key Gerontology Company Insights

The competitive scenario in the gerontology market is highly competitive, with key players such as Centre of Ageing Better; Care Centers; Keele Centre for Social Gerontology; HelpAge India; Administration on Aging, Gerontology Research Center; National Aging Research Institute; World Health Organization; British Geriatrics Society holding significant positions. The major companies are undertaking various strategies such as new age & services development, collaborations, acquisitions, mergers, and regional expansion for serving the unmet needs of their customers.

Key Gerontology Companies:

The following are the leading companies in the gerontology market. These companies collectively hold the largest market share and dictate industry trends.

- Centre of Ageing Better

- Care Centers

- Keele Centre for Social Gerontology

- HelpAge India

- Administration on Aging, Gerontology Research Center

- National Aging Research Institute

- World Health Organization

- British Geriatrics Society

Recent Developments

-

In June 2024, WIPO launched AgeTech innovations under the banner "AgeTech: Shaping a New Era in Assistive Technology for the Elderly."

-

In April 2023, Innerva introduced a ready-made solution designed to assist operators in establishing successful power-assisted exercise studios, aimed at tapping into the potential of the UK’s aging population.

-

In April 2023, LifeQ, unveiled the findings of its study titled "Wearable-ome meets epigenome: A novel method for assessing biological age using wearable devices," published in bioRxiv. The study demonstrated significant correlations between behavioral and physiological data collected from wearables and the methylation of genes associated with aging pathways.

Gerontology Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.4 billion

Revenue forecast in 2030

USD 2.3 billion

Growth rate

CAGR of 7.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, age, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Centre of Ageing Better; Care Centers; Keele Centre for Social Gerontology; HelpAge India; Administration on Aging, Gerontology Research Center; National Aging Research Institute; World Health Organization; British Geriatrics Society

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gerontology Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the gerontology/aging market report on the basis of type, age, technology, application, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Social Gerontology

-

Environmental Gerontology

-

Biogerontology

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fitness and Wellness Services

-

Non-Profit Organizations

-

Business Communities

-

Hospitality

-

Travel

-

Healthcare

-

-

Age Outlook (Revenue, USD Billion, 2018 - 2030)

-

65-75 years

-

75-85 years

-

85 and above

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Wearable Devices

-

Smart Home Devices

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global gerontology market size was estimated at USD 1.34 billion in 2023 and is expected to reach USD 1.44 billion in 2024.

b. The global gerontology market is expected to grow at a compound annual growth rate of 7.8% from 2024 to 2030 to reach USD 2.26 billion by 2030.

b. North America gerontology market dominated the overall global market and accounted for the 41.54%-revenue share in 2023, driven by factors such as an aging population and advancements in healthcare technology.

b. Some key players operating in the gerontology market include Centre of Ageing, Better Care Centers, Keele Centre for Social Gerontology, HelpAge India, Administration on Aging, Gerontology Research Center, National Aging Research Institute, World Health Organization, and British Geriatrics Society

b. As the global population ages, the demand for gerontology-related products and services is rapidly increasing. This market is also driven by technological advancements, increasing awareness of healthy aging, and a growing focus on preventive healthcare.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.