Germany Wearable Medical Devices Market Size, Share & Trends Analysis Report By Product (Diagnostic, Therapeutic), By Site (Handheld, Strap/Clip/Bracelet), By Application, By Grade Type, By Distribution Channel, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-243-5

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

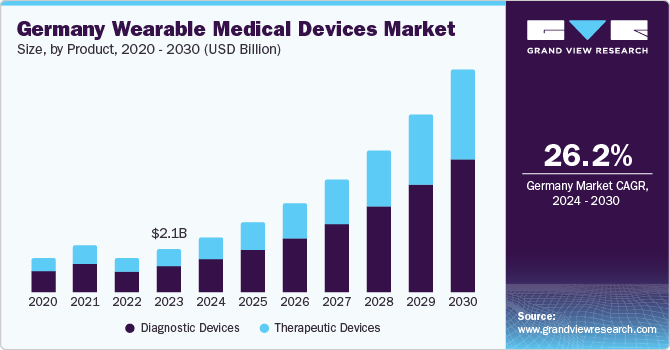

The Germany wearable medical devices market size was estimated at USD 2.13 billion in 2023 and is projected to grow at a CAGR of 26.2% from 2024 to 2030. Wearable medical devices offer benefits by supporting and monitoring a patient's activities over an extended period. The rising prevalence of lifestyle disorders, including obesity, diabetes, and hypertension, has led to a growing adoption of wearable medical devices to monitor health. For instance, according to an NCBI study published in September 2022, in Germany, over 53% of adults suffer from being overweight, with men experiencing the issue more often than women. In contrast to German health updates, GEDA 2012, there has been a persistent rise in the prevalence of obesity, especially among individuals aged 45 to 65.

Tech giants like Koninklijke Philips N.V., Omron Corporation, Everist Health, Polar Electro, and Medtronic are investing significantly in the research and development (R&D) of wearable medical devices. These companies are working to make wearable medical products more efficient and promote digitalization in Germany.

The Germany wearable medical devices market trends suggest that the growth is propelled by the rising demand for smartwatches among athletes and fitness enthusiasts, the adoption of advanced activity monitors to track general health the adoption of therapeutic devices, and the emerging need for remote patient monitoring devices to facilitate communication between providers and patients.

The emergence of 5G and advancements in Al technology are facilitating the development of smart glasses, which are expected to bring a novel wearable with a unique function to the market. With the rising number of Germans having various wearables and additional brands having entered the market over the years, ecosystem benefits are expected to become gradually fundamental for brands to bind consumers. As sustainable fashion explodes among Gen Zs, adopting recycled materials and working with sustainable fashion labels are excellent strategies to connect with them, a significant target market for wearables in Germany.

Wearable products exhibit significant opportunities to reduce the gap between private and specialized healthcare by positioning their devices with applications accessible on prescription in Germany. The popularity of wearable medical devices has allowed many patients to actively participate in self-care and take initiative for the well-being of other individuals. Due to the growing number of these individuals, referred to as ‘e-patients,’ medical departments must ensure that their patients receive adequate instruction to communicate with and treat them.

Munich’s wearable devices market has been experiencing steady growth in recent years, driven by increasing consumer demand for health and fitness tracking devices, smartwatches, and other wearable technologies is becoming increasingly significant in Munich, an internationally recognized hub for technical innovation and quality in healthcare. The giant companies including Apple are taking major steps that are contributing to wearable devices market growth. For instance, in February 2022, Apple Inc., announced to spend USD 1.1 billion to expand its microchip design hub in city Munich, Germany.

Market Concentration & Characteristics

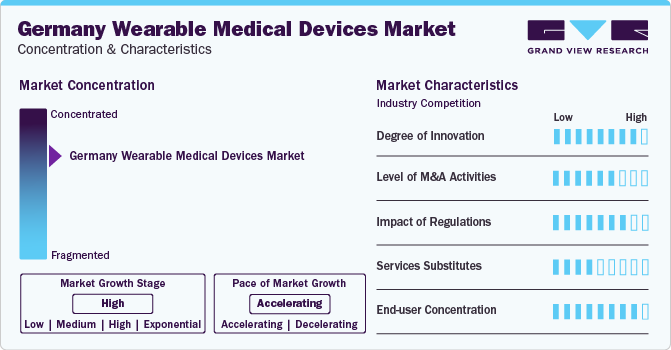

The market growth stage is high, and the pace of the growth is accelerating. The wearable medical devices market is characterized by a high degree of innovation owing to the rapid technological advancements driven by factors such as sensor reduction, wireless connectivity, data analytics, and AI, which have spurred the development of next-generation wearable devices personalized for healthcare applications. Subsequently, innovative AI applications are constantly emerging, disrupting existing industries and creating new ones.

The German wearable medical devices market is also characterized by the leading players' high level of merger and acquisition (M&A) activity. This is due to several factors, including the desire to gain access to new AI technologies and talent, the need to consolidate in a rapidly growing market, and the increasing strategic importance of health trackers and medical devices.

Germany's medical devices market is also subject to a significant rise in regulations. This is due to concerns about ensuring the safety, efficacy, and quality of these technologies. Regulatory bodies such as the Federal Institute for Drugs and Medical Devices (BfArM) and the German Institute for Medical Documentation and Information (DIMDI) lead in the approval and monitoring of wearable medical devices in Germany.

There are a limited number of direct product substitutes for wearable medical devices. However, a few technologies can be used to achieve similar outcomes to wearable medical devices, such as implantable medical devices offering continuous monitoring and intervention capabilities without the need for external accessories and mobile health applications. In addition, smart textiles embedded with sensor technology provide an easy alternative to traditional wearables, seamlessly integrating monitoring capabilities into everyday fashion. These technologies can be used as substitutes for AI in specific applications, but they typically do not offer the same performance or flexibility as wearable medical devices.

End-user concentration is a significant factor in the German wearable medical devices market. Several end-user industries are driving demand for these devices. The concentration of demand in a few end-user industries creates opportunities for companies that focus on developing AI solutions for these device providers. However, it also creates challenges for companies trying to compete in a crowded market.

Product Insights

The diagnostic devices segment dominated the market and accounted for a share of 62.1% in 2023. The growing prevalence of cardiovascular disorders in Germany is a primary driver for this growth. According to the Medscape study published in October 2023, over 121,100 individuals died due to CHD, and more than 45,100 people suffered an acute heart attack in 2021. Thus, there were 130.0 deaths per 100,000 people from CHD. Moreover, growing neurological disorders, including dementia, meningitis, stroke, migraine, epilepsy, neonatal encephalopathy, and other neurological complications, are commonly faced by people, which is driving the demand for diagnostic devices and propelling the overall growth of the wearable medical devices market in Germany.

The therapeutic device segment is expected to grow at the fastest CAGR of 27.1% over the forecast period, attributed to the rising inflow of therapeutic devices. Moreover, the market is anticipated to grow with a strong pipeline of therapeutic devices, such as wearable pain relievers, insulin control devices, and intelligent asthma management products. The segment has been divided into respiratory therapy devices, rehabilitation, pain management, and insulin monitoring, reflecting the wide range of applications in this rapidly growing sector.

Site Insights

The strap, clip, and bracelet segment accounted for the largest revenue share in 2023. This is attributable to the rising awareness and emphasis on personal health and well-being among consumers in Germany. Such high awareness has increased demand for wearable devices that can monitor various health metrics conveniently and continuously.

Moreover, technological advancements have enabled the development of more experienced and accurate wearable medical devices. These devices are becoming increasingly user-friendly and can track a wide range of health indicators, including respiratory rate, pulse rate, and mobility, together with cloud & Bluetooth connectivity, and smartwatches are constantly propelling the segment growth.

The strap, clip, and bracelet segment is also expected to register the fastest CAGR during the forecast period. Technological developments in wrist-worn devices, such as the Fitbit Ace 3 Next Generation Activity and Sleep Tracker for kids, provide fun fitness tracking by tracking heart rate, skin temperature, and activity levels, contributing to the market's growth. The introduction of suitable smartphone apps for wearable medical devices by major manufacturers such as Samsung and Apple encourages people to routinely monitor their health, promoting market growth overall in the country.

Grade Type Insights

The consumer-grade wearable medical devices segment dominated the market and accounted for the largest revenue share in 2023. These devices provide user-accessible features, aiming at individual health and fitness tracking, making them highly popular among customers. Features such as convenience, affordability, and growing health consciousness are significant drivers expected to contribute to the segment's growth.

The clinical-grade wearable medical devices segment is expected to register the fastest CAGR over the forecast period. The growth is attributed to the increasing demand for advanced monitoring technologies in healthcare settings. Moreover, the rising acceptance of these devices for remote healthcare management, continuous patient monitoring, and integration with healthcare systems are also anticipated to drive the growth of the segment. The changing demands of the healthcare sector are expected to drive significant growth in the clinical-grade wearable medical device market as increasing numbers of healthcare providers adopt modern technologies.

Distribution Channel Insights

The pharmacies segment dominated the market for wearable medical devices and accounted for the largest revenue share in 2023. Pharmacies contribute to this growth by extensively providing customers with a simple method to acquire these devices. The significant revenue share that pharmacies possess in the wearable medical device market results from their function as centers of health and wellness and their capacity to offer knowledgeable guidance.

The online channel segment is expected to witness the fastest CAGR over the forecast period. Consumers' growing preference for purchasing goods online is driving the growth, fueled by the variety of products, ease of use, and accessibility provided by e-commerce platforms. The wearable medical device market is expected to benefit from increased demand due to the convenient and efficient online shopping experience, driven by the ongoing expansion of the online retail sector.

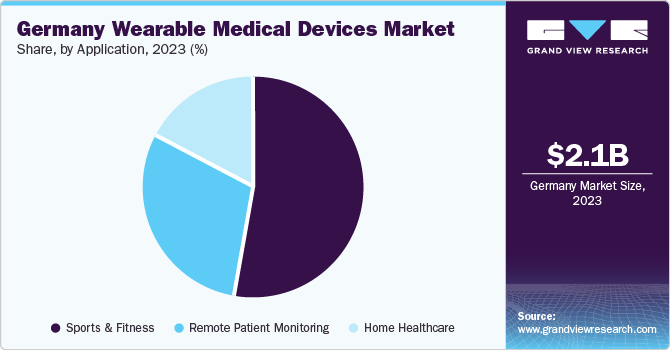

Application Insights

The home healthcare segment dominated the market in 2023. This is attributable to the aging population, rising prevalence of target diseases, and the growing necessity to reduce healthcare spending as a financially sound effort. For instance, as per the Konema demographics study, in December 2023, Germany's population aged 65 and above increased from over 14.0% in 1974 to approximately 30.0% in 2023 at an average annual rate of 0.91%.

The remote patient monitoring segment is expected to register the fastest CAGR over the forecast period. The growing rates of chronic illnesses and a growing elderly population in Germany are anticipated to significantly affect the growth of remote patient monitoring devices and boost the overall market demand.

Key Germany Wearable Medical Devices Company Insights

Some of the key players operating in the market include Koninklijke Philips N.V., Fitbit, Garmin, Covidien (Medtronic), and Omron Corp.

-

Koninklijke Philips N.V., commonly known as Philips, offers healthcare technology, consumer electronics, and lighting solutions. It offers consumer lifestyle products, including personal care appliances, home appliances, wearable medical devices, and entertainment products.

-

Medtronic is a medical technology company, offering a wide range of innovative healthcare solutions. With a focus on improving patient outcomes and enhancing clinical efficiency. The company's diverse portfolio includes products and therapies spanning from surgical solutions to patient monitoring and respiratory care. Leveraging cutting-edge research and development

Everist Health, Polar Electro, and Vital Connect are some of the other market participants.

-

Everist Health specializes in early cancer detection solutions, providing patients and healthcare providers with actionable insights for timely intervention and leading the way in advancing precision medicine approaches to cancer care.

-

Vital Connect offers wearable biosensor technology, developing healthcare through continuous monitoring solutions. Their innovative products enable real-time tracking of vital signs such as heart rate, respiratory rate, and skin temperature. With a focus on accuracy, reliability, and user-friendliness.

Key Germany Wearable Medical Devices Companies:

- Koninklijke Philips N.V.

- Omron Corporation

- Everist Health

- Polar Electro

- Covidien (Medtronic)

- Intelesens Ltd

- Withings

- Fitbit Inc.

- Garmin

- Vital Connect

- Henkel

- Apple Inc.

Recent Developments

-

In September 2023, Apple Inc. announced the launch of its Apple Watch Series 9 in several countries, including Germany, and opened pre-purchase bookings to the public. The new release offers features such as upgraded hiking and cycling applications, along with tools for mental health support.

-

In July 2023, Henkel announced its expansion of the portfolio for medical wearables in healthcare treatments. The expanded portfolio includes high-impact solutions for printed electronics, skin bonding, assembly adhesives, low-pressure molding technologies, and electronics.

-

In August 2020, Google acquired Fitbit under the European Merger Regulation, aiming to boost its positioning in the market by enhancing its access to large amounts of data for customizing the advertisements it displays and provides.

Germany Wearable Medical Devices Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2030 |

USD 10.9 billion |

|

Growth rate |

CAGR of 26.2% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, site, application, grade type, distribution channel |

|

Country scope |

Germany |

|

Key companies profiled |

Koninklijke Philips N.V.; Omron Corporation; Everist Health; Polar Electro; Covidien (Medtronic); Intelesens Ltd; Withings; Fitbit Inc.; Garmin; Vital Connect; Henkel; Apple Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Germany Wearable Medical Devices Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Germany wearable medical devices market report based on product, site, application, grade type, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostic Devices.

-

Vital sign monitoring devices

-

Heart Rate Monitors

-

Activity Monitors

-

Electrocardiographs

-

Pulse Oximeters

-

Spirometers

-

Blood Pressure Monitors

-

Others

-

-

Sleep monitoring devices

-

Sleep trackers

-

Wrist actigraphs

-

Polysomnographs

-

Others

-

-

Electrocardiographs fetal and obstetric devices

-

Neuromonitoring devices

-

Electroencephalographs

-

Electromyographs

-

Others

-

-

-

Therapeutic Devices

-

Pain management devices

-

Neurostimulation devices

-

Others

-

-

Insulin/glucose monitoring devices

-

Insulin pumps

-

Others

-

-

Rehabilitation devices

-

Accelometers

-

Sensing devices

-

Ultrasound platform

-

Others

-

-

Respiratory therapy devices

-

Ventilators

-

Positive airway pressure (PAP) devices

-

Portable oxygen concentrators

-

Others

-

-

-

-

Site Outlook (Revenue, USD Million, 2018 - 2030)

-

Handheld

-

Headband

-

Strap/Clip/Bracelet

-

Shoe Sensors

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Sports and Fitness

-

Remote Patient Monitoring

-

Home Healthcare

-

-

Grade Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumer-Grade Wearable Medical Devices

-

Clinical Wearable Medical Devices

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmacies

-

Online Channel

-

Hypermarkets

-

Frequently Asked Questions About This Report

b. The Germany wearable medical devices market size was estimated at USD 2.13 billion in 2023.

b. The Germany wearable medical devices market is expected to grow at a compound annual growth rate (CAGR) of 26.2% from 2024 to 2030 to reach USD 10.9 billion by 2030.

b. The diagnostic devices segment dominated the market with the largest market share of over 60% in 2023. This high share is attributable to the growing neurological disorders, including dementia, meningitis, stroke, migraine, epilepsy, neonatal encephalopathy, and other neurological complications.

b. Some key players operating in the Germany wearable medical devices market include Koninklijke Philips N.V.; Omron Corporation; Everist Health; Polar Electro; Medtronic; Intelesens Ltd; Withings; Fitbit Inc.; Garmin; Vital Connect; Henkel; and Apple Inc.; among others.

b. Key factors that are driving the market growth are the rising incidence of lifestyle disorders, increasing demand for smartwatches among athletes and fitness enthusiasts, and the growing adoption of advanced activity monitors to track general health in Germany.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."