- Home

- »

- Animal Health

- »

-

Germany Pet Insurance Market Size, Industry Report, 2030GVR Report cover

![Germany Pet Insurance Market Size, Share & Trends Report]()

Germany Pet Insurance Market Size, Share & Trends Analysis Report By Coverage Type (Accident & Illness, Accident Only), By Animal Type, By Sales Channel, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-322-5

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Germany Pet Insurance Market Trends

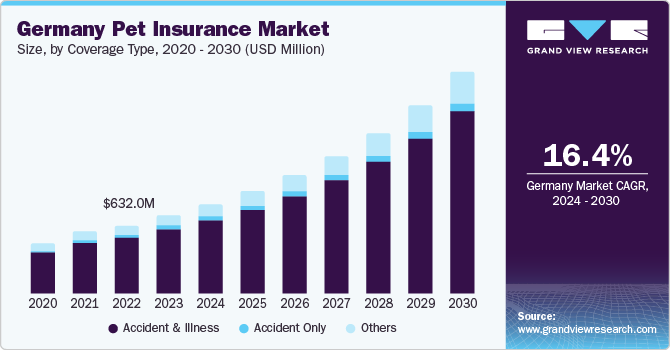

The Germany pet insurance market size was estimated at USD 719.37 million in 2023 and is projected to grow at a CAGR of 16.40% from 2024 to 2030. Increasing pet ownership, humanization of pets, supportive regulations, and initiatives by market players are anticipated to drive the regional market growth. As per the German Pet Trade Association (ZZF), in 2022, there were 15.2 million cats and 10.6 million dogs residing in German households. A recent Nordlight Research study reveals that just 30% of those who own dogs and 23% of cat owners presently possess comprehensive pet health insurance. Additionally, only 27% of dog owners and 18% of cat owners have insurance specifically covering pet surgeries.

Lifetime costs of abandoned dogs/year, dog waste fines, and dog waste survey factors were considered under the cost, regulation, and ownership category. The results indicated a rising trend of pet humanization that leads to more expenditure on pets and the premiumization of pet products and services. Veterinary treatments such as cruciate ligament tear, ear infection, gastric torsion, skin tumor, and vaccination can cost around EUR 1,500, EUR 500, EUR 2,000, EUR 1,000, and EUR 70, respectively. The growing veterinary costs are thus another key driver expected to fuel the market growth.

Market players, for example, Balunos offer multiple insurance plans for dogs, including dog accident insurance. The plan covers outpatient and inpatient treatment after an accident, surgery, unlimited annual compensation, body replacements (prostheses), follow-up treatment including accommodation costs after an operation, and physiotherapy. Balunos offers dog accident insurance in 3 price variants: bronze, silver, and gold, priced at EUR 8.58, EUR 12.14, and EUR 13.6 per month, respectively.

Certain German states, including Brandenburg, Hamburg, Berlin, Lower Saxony, Thüringen, Niedersachsen, and Schleswig-Holstein, now require dog owners to have liability insurance, further driving market growth. This, combined with the rising need to lower the financial burden on damages caused by pets, is expected to increase the adoption of pet liability insurance. Liability insurance providers mainly offer plans for dogs and horses. For small pets such as cats, private liability insurance often covers the damage caused by small animal pets, and no separate insurance is required.

BavariaDirekt, Helden, Barmenia Insurance, and DFV are some of the key players providing pet liability insurance in Germany. Barmenia Insurance, for example, offers owner liability insurance for both dog and horse owners. Its horse owner liability insurance covers property damage, personal injury, financial loss, rental property damage, rescue & recovery costs, and damage to borrowed or rented riding equipment by horse, pony, donkey, or mule. Additionally, the increasing disposable income of pet owners, especially in developing economies, has made pet insurance more affordable and accessible, further driving market growth.

The COVID-19 pandemic also played a role, as it led to heightened demand for health and liability insurance plans for pets and a significant increase in pet adoption and ownership during periods of lockdown and movement restrictions.

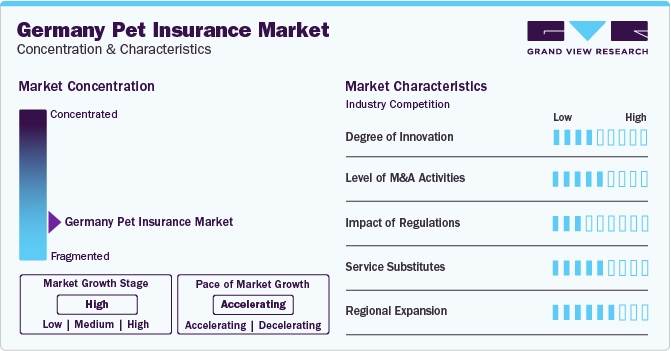

Market Concentration & Characteristics

The market growth stage is high, and the pace of growth is accelerating. The Germany pet insurance market is characterized by a high degree of innovation owing to advancements in veterinary medicine and availability of a wide range of pet insurance plans for different animal species. Similarly, costs associated with veterinary care, including diagnostic tests, surgeries, medications, and specialized treatments, have been steadily rising. Pet insurance provides financial protection against these escalating costs, making it an attractive investment for pet owners and driving the market growth.

The competitive scenario in the German pet insurance market features several major players vying for market share, such as Allianz, Agila (a subsidiary of HanseMerkur), Gothaer, Helvetia, DEVK, HanseMerkur, AXA, and Petplan. These companies offer various coverage options and compete through marketing strategies, customer service excellence, product innovation, and pricing competitiveness. Additionally, smaller insurers and niche players catering to specific segments of pet owners, are contributing to the market's dynamism and diversity.

Coverage Type Insights

The accident & illness segment held the largest revenue share of 81.61% in 2023. This is owing to the comprehensive nature of accident and illness coverage, high veterinary costs, and increasing pet ownership in Germany. The comprehensive nature of accident and illness policy nearly covers all illnesses along with accidents, making it the most favorable policy for young animals and stimulating its adoption rate.

The accident & illness segment is also expected to grow fastest within the health insurance segment, followed by the others segment. Since, veterinary care in Germany is more expensive, especially for emergency treatments, surgeries, and ongoing medical care, pet owners are expected to choose accident & illness insurance for pets. Accident and illness insurance helps offset these costs by reimbursing pet owners for eligible expenses incurred due to accidents or illnesses. Given the high cost of veterinary care, pet owners prefer insurance that provides financial assistance when their pets require medical treatment.

Animal Type Insights

The dogs segment dominated the market with a share of more than 49.79% in 2023. The others segment, on the other hand, is expected to grow at the fastest CAGR from 2024 to 2030. This is due to an increase in the number of companion animals, chronic diseases in pets, expensive veterinary treatments, and the need to lower financial risk. Veterinary care for dogs is more expensive than for cats due to their size, specific healthcare needs, and potential for breed-related health issues. Dog owners are more inclined to purchase insurance to help manage these higher healthcare costs and ensure their dogs receive necessary medical care without financial strain.

However, pet insurance provides coverage for such treatments, protecting pet owners from financial risks. Pet insurance plans for dogs cover a wide range of conditions, such as outpatient and inpatient treatment, health checks, preventive measures such as vaccinations, dental prophylaxis, flea & tick prevention, costs for medication, bandages, castration & sterilization, and operations. Growing need to lower financial risk and safeguard pet health is expected to drive the market growth.

Sales Channel Insights

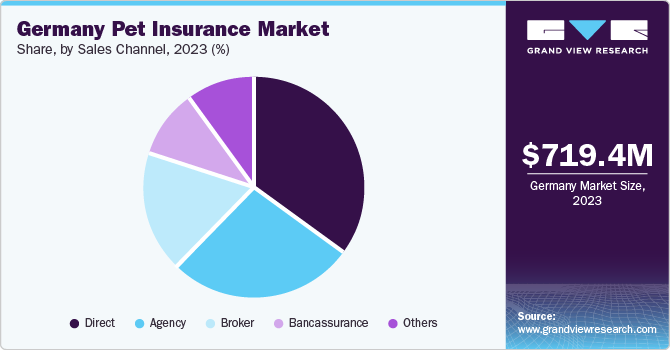

The direct sales segment held the largest revenue share of over 35.23% in 2023. This is attributable to the high usage of direct sales strategies by key pet insurance providers. Deutsche Familienversicherung AG for instance, reported in its 9M investor report, a growth of 7.6% in direct insurance revenue from 2022 to 2023. The company also reported increase in online sales compared to previous year.

The others segment is expected to advance at the fastest CAGR of over 17.32% from 2024 to 2030. This is due to increasing number of companies onboarding veterinary care providers and pet stores as a means to reach consumers or pet parents.

Bancassurance combines banking and insurance industries, in which, banks sell insurance products in a partnership. This can benefit both entities, as the bank earns a fee or commission, whereas the insurance firm increases its customers & market reach. The bank acts as an intermediary and often works with a long-term insurance partner, facilitating insurance companies to reach their target customer base. This segment is popular and is expected to grow at a steady pace over the next few years.

Key Germany Pet Insurance Company Insights

According to the German Pet Trade & Industry Association (ZZF) and Industrial Association of Pet Care Producers (IVH), pet population in Germany stood at 34.4 million in 2022. As pet owners increasingly prioritize the health and well-being of their furry companions, there is growing awareness of pet insurance benefits in mitigating the financial burden of veterinary expenses. Additionally, advancements in veterinary care and evolving pet care culture contribute to increasing demand for comprehensive pet insurance coverage. As a result, the pet insurance market in Germany is expected to experience steady growth in the coming years, providing opportunities for insurance companies to expand their offerings and cater to the needs of pet owners.

The German pet insurance market is competitive. Major companies engage in deploying strategic initiatives that include custom insurance plans, various pricing models, partnerships, and expansion of global footprint. For instance, in January 2022, Luko, a French Insurtech startup, expanded its reach by acquiring Coya, gaining both customers and an insurance license in Germany.

Key Germany Pet Insurance Companies:

- Trupanion, Inc.

- Deutsche Familienversicherung AG (DFV)

- Petplan (Allianz)

- Pinnacle Pet Group

- Figo Pet Insurance, LLC

- Direct Line

- Nationwide Mutual Insurance Company

- Embrace Pet Insurance Agency, LLC

- Anicom Insurance

- DEVK

- Gothaer Group

- Helvetia Group.

Recent Developments

-

In July 2023, Pets Best Insurance Services, LLC, in collaboration with JAB's Independence Pet Group, has expanded its partnership to offer comprehensive pet insurance underwriting services through Independence American Insurance Company, aiming to meet the growing demand for pet insurance nationwide.

-

In June 2023, DFV Deutsche Familienversicherung AG has introduced a fresh lineup of pet health insurance offerings, utilizing inventive marketing strategies through engaging television advertisements and dynamic social media campaigns to promote them effectively.

-

In July 2022, JAB's European pet insurance platform, Pinnacle Pet Group (PPG), has completed the acquisition of AGILA Tierversicherung, a German pet insurance provider.

Germany Pet Insurance Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 2,046.54 million

Growth rate

CAGR of 16.40% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Report updated

March 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Coverage type, animal type, sales channel

Key companies profiled

Trupanion, Inc.; Deutsche Familienversicherung AG (DFV); Petplan (Allianz); Pinnacle Pet Group; Figo Pet Insurance, LLC; Direct Line; Nationwide Mutual Insurance Company; Embrace Pet Insurance Agency, LLC; Anicom Insurance; DEVK; Gothaer Group; Helvetia Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Germany Pet Insurance Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Germany pet insurance market report based on coverage type, animal type, and sales channel:

-

Coverage Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Accident & Illness

-

Accident only

-

Others

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Others

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Agency

-

Broker

-

Direct

-

Bancassurance

-

Others

-

Frequently Asked Questions About This Report

b. The Germany pet insurance market size was estimated at USD 719.37 million in 2023 and is expected to reach USD 822.62 million in 2024.

b. The Germany pet insurance market is expected to grow at a compound annual growth rate of 16.4% from 2024 to 2030 to reach USD 2,046.54 million by 2030.

b. By coverage type, the largest share of the German pet insurance market was held by the health insurance segment in 2023. This is owing to a growing number of pet health insurance policies offered by market players, pet humanization, and rising veterinary costs.

b. Some key players operating in the Germany pet insurance market include Trupanion, Inc., Deutsche Familienversicherung AG (DFV), Petplan (Allianz), Pinnacle Pet Group, Figo Pet Insurance, LLC, Direct Line, Nationwide Mutual Insurance Company, Embrace Pet Insurance Agency, LLC, Anicom Insurance, DEVK, Gothaer Group, Helvetia Group

b. Key factors that are driving the Germany pet insurance market growth include growing pet ownership, supportive regulations, humanization of pets, and initiatives by market players.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."