- Home

- »

- Medical Devices

- »

-

Germany In Vitro Fertilization Market, Industry Report, 2030GVR Report cover

![Germany In Vitro Fertilization Market Size, Share & Trends Report]()

Germany In Vitro Fertilization Market (2024 - 2030) Size, Share & Trends Analysis Report By Instrument (Equipment, Disposable Devices), By Procedure Type (Fresh Donor, Frozen Donor), By Providers (Fertility Clinics, Hospitals & Other Setting), And Segment Forecasts

- Report ID: GVR-4-68040-270-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Germany In Vitro Fertilization Market Trends

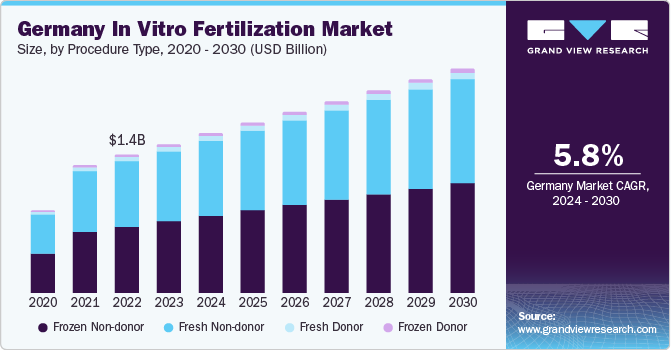

The Germany in vitro fertilization market size was estimated at USD 1.51 billion in 2023 and is projected to grow at a CAGR of 5.8% from 2024 to 2030. The growing number of infertility cases, development of new and advanced medical technologies, increasing awareness about infertility & its treatment options, and high success rates for IVF treatments are driving the market growth in the country. According to the National Library of Medicines, 3% of children in Germany are conceived with the help of in vitro fertilization (IVF) technology.

The German government implemented several policies that support the use of IVF treatments. For instance, in 2018, the government passed a law that allows couples to undergo up to three IVF cycles using public health insurance coverage. This has made IVF treatments more accessible and affordable, leading to an increase in demand for these treatments. There is a growing demand for IVF treatments from single women and same-gender couples who wish to start a family. This demand is driving the growth of the IVF market in Germany as clinics adapt their services to cater to this diverse group of patients.

The COVID-19 pandemic significantly impacted the IVF market in Germany, with disruptions in non-essential medical procedures, including elective fertility treatments like IVF, being temporarily halted or delayed. Financial uncertainties and global supply chain disruptions led to reevaluations and deferrals of fertility treatment plans wherein fertility clinics adapted telehealth solutions, offering virtual consultations and incorporating remote patient monitoring technology. The pandemic influenced lifestyle choices, potentially impacting reproductive health decisions. Government regulations and safety guidelines shaped the operational landscape of fertility clinics, influencing the scheduling and execution of IVF procedures in compliance with COVID-19 protocols. These factors collectively contribute to the growth of the market in Germany.

As the demand for IVF procedures rises, the need for associated products including cryopreservation media, embryo culture media, ovum processing media, and sperm processing media also increases. This can be influenced by factors such as delayed family planning, rising infertility rates, and greater societal acceptance of assisted reproductive technologies. The increasing age of parenthood is also a driver for the market. As more women delay childbirth due to career or personal reasons, they may face fertility issues that can be addressed through IVF treatments.

The Embryo Protection Act of 1990 in Germany established a legal framework for reproductive medicine, regulating the handling of emerging human life. It stipulates that only trained physicians can work on in vitro fertilization and forbids the fertilization of more than 3 eggs, donation of sperm and eggs to third parties, and surrogate motherhood. While several nations allow embryonic experiments, Germany outlaws them completely.

Market Concentration & Characteristics

The degree of innovation in the Germany In vitro fertilization market is high, with a constant flow of new technologies and techniques being developed and implemented. For instance, the introduction of time-lapse imaging systems has enabled continuous monitoring of embryo development, improving the selection of viable embryos and increasing the success rate of IVF treatments. In addition, the use of pre-implantation genetic testing (PGT) has become more widespread, allowing for the genetic screening of embryos to identify potential genetic disorders or chromosomal abnormalities before implantation.

Mergers and acquisitions (M&A) activities in the market have been moderate in recent years. Major players in the market have been looking to expand their footprint through strategic acquisitions of smaller clinics and laboratories or funding from various Ventures. For instance, in January 2022, Merck KGaA and Whitecap Venture Partners funded a medtech startup Future Fertility to develop an AI called Violet, which can predict the viability of cryopreserved eggs used for IVF.

Regulations play a significant role in shaping the IVF market. The country has strict regulations regarding IVF. For instance, Germany prohibits the creation of embryos for research purposes and allows IVF treatments only for couples where one partner has a verified medical reason for infertility. These regulations can limit the growth potential of the market and influence the strategies of companies operating within it. However, they also contribute to maintaining ethical standards and ensuring patient safety.

There are several product substitutes available in the market, including intrauterine insemination (IUI), ovulation induction, and surgical sperm retrieval techniques. While these alternatives may not be as effective as IVF in treating severe cases of infertility, they can be more affordable and less invasive. The availability of these alternatives can impact the demand for IVF treatments and influence market dynamics.

The market is characterized by a moderate level of end-user concentration. While there are several large hospitals and clinics offering IVF treatments, many patients also seek services from smaller, private clinics or specialized centers. This diversity in service providers allows patients to choose from various options based on factors such as cost, location, and success rates. However, it also means that competition among providers can be fierce, driving them to innovate and improve their offerings to attract and retain patients.

Instrument Insights

The culture media segment dominated the market with a revenue share of 41.1% in 2023. Innovations in culture media formulations, specifically in cryopreservation media, embryo culture media, ovum processing media, and sperm processing media, are expected to drive market growth. These advancements can improve success rates and outcomes for assisted reproduction techniques, making specific culture media products more popular. Advanced technologies enhancing gamete and embryo viability are also expected to drive the market growth.

The disposable devices segment is expected to grow at the fastest CAGR during the forecast period. Disposable products such as catheters, syringes, and culture dishes are crucial in maintaining a sterile environment in IVF procedures, reducing infection risk. The emphasis on hygiene and infection control drives the adoption of disposable items. They offer convenience, efficiency, and eliminate the need for cleaning and sterilization processes, saving time for healthcare professionals and facilitating a more streamlined workflow in IVF clinics. For instance, in August 2023, German startup Fertilly introduced a fertility test kit for use at home, which uses equipment for micro sampling dried blood. The anti-müllerian hormone is precisely analyzed by the test, giving women knowledge about their reserve of egg cells. Europe has granted medical clearance to Fertilly's product. The goal of the Fertilly test is to empower potential parents to manage their reproductive health at home.

Procedure Type Insights

Frozen non-donor segment accounted for the largest revenue share of 47.1% in 2023 and is expected to grow at the fastest CAGR of 6.1% during the forecast period. The advancements in cryopreservation techniques, including vitrification, have enhanced the survival rates of frozen embryos. This has increased the confidence of both healthcare providers and patients in the effectiveness of frozen non-donor IVF cycles, driving the growth of this segment.

Frozen embryo transfer allows for better synchronization between the patient's reproductive cycle and the transfer of embryos, optimizing the timing for increased chances of successful implantation. Frozen non-donor cycles may pose fewer health risks to patients compared to fresh cycles. The controlled ovarian stimulation used in fresh cycles can sometimes lead to ovarian hyperstimulation syndrome (OHSS), which can be mitigated with frozen cycles. Frozen embryos can be stored for longer periods, providing flexibility in planning and scheduling IVF cycles.

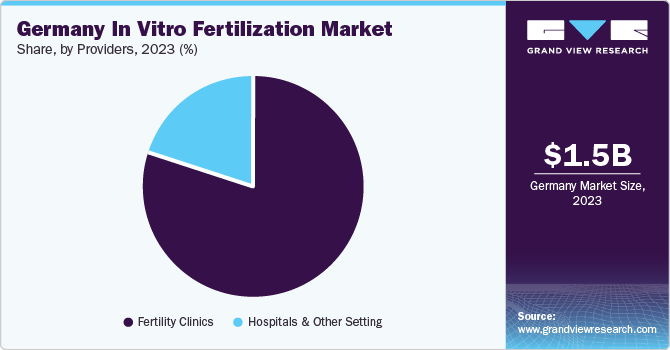

Providers Insights

The fertility clinic segment accounted for the largest revenue share of 79.9% in 2023 and is expected to grow at the fastest CAGR during the forecast period owing to the increasing number of individuals and couples seeking fertility treatments. Fertility clinics are specialized medical facilities that offer a range of services aimed at helping individuals and couples conceive. These services include artificial insemination, in vitro fertilization, intracytoplasmic sperm injection (ICSI), fertility preservation, and other assisted reproductive technologies (ART).

VivaNeo and The Fertility Partnership merged to form TFP, the largest fertility group in Northern Europe, with clinics in six countries and over 60 centers. It offers patient experience in 19 clinics and performs approximately 24,000 assisted reproduction cycles annually. It also includes a blood diagnostic laboratory in Germany, a sperm bank, and 9 IVF clinics.

Key Germany In Vitro Fertilization Company Insights

The competitive market of in vitro fertilization in Germany is dominated by numerous small and large companies offering a diverse range of products and procedures. These players are implementing initiatives such as R&D, mergers, collaborations and partnerships. Some of the key players operating in the market include VivaNeo, Bayer AG, Merck & Co., Inc. etc.

-

VivaNeo, a fertility clinic operator in Germany, the Netherlands, and Denmark, offers advisory and treatment services for fertility issues, including hormone therapies, test-tube fertilization methods, surgical measures, medical-technical measures, medical measures, and social freezing services to preserve fertility.

-

Merck is a science and technology company that specializes in fertility treatment and offers a comprehensive range of products for various stages of the reproductive cycle, including recombinant versions of natural hormones for infertility treatment. With over 60 years of expertise, the company has successfully delivered an estimated 2.4-2.7 million babies.

Key Germany In Vitro Fertilization Companies:

- Bayer AG

- Cook Medical LLC

- VivaNeo

- Ferring B.V.

- Genea Biomedx

- EMD Serono, Inc. (Merck KGaA)

- Merck & Co., Inc.

- Thermo Fisher Scientific, Inc.

- Vitrolife

Recent Developments

-

In September 2023, Merck, a German multinational, launched a fertility benefit program in Germany. The program covers fertility tests, IVF treatments, and hormonal treatments for Merck employees, regardless of their marital status. The offer also provides additional information services to employees struggling with infertility.

-

In February 2022, EMD Serono, a division of Merck KGaA, launched a new Slim Pack for the Gonal-fRFF Redi-ject pen, making it 40% smaller. This packaging improvement enhances portability, efficiency, and convenience for patients and customers. Gonal-fRFF contains follicle-stimulating hormone, which is used to induce ovulation and pregnancy in women dealing with infertility.

-

In May 2023, AIVF and Genea Biomedx launched an integrated system, combining AI-based solutions for IVF clinics and medical devices for laboratories. This system was aimed at enabling Genea Biomedx to power its time-lapse incubator, offering personalized and optimized IVF care.

Germany In Vitro Fertilization Market Report Scope

Report Attributes

Details

Market size value in 2024

USD 1.62 billion

Revenue forecast in 2030

USD 2.28 billion

Growth Rate

CAGR of 5.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Instrument, procedure type, providers

Country scope

Germany

Key companies profiled

Bayer AG; Cook Medical LLC; VivaNeo; Ferring B.V.; Genea Biomedx; EMD Serono, Inc. (Merck KGaA); Merck & Co., Inc.; Thermo Fisher Scientific, Inc.; Vitrolife

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Germany In Vitro Fertilization Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Germany In vitro fertilization market report based on instrument, procedure type, and providers.

-

Instrument Outlook (Revenue, USD Million, 2018 - 2030)

-

Disposable Devices

-

Culture Media

-

Cryopreservation Media

-

Embryo Culture Media

-

Ovum Processing Media

-

Sperm Processing Media

-

-

Equipment

-

Sperm Analyzer Systems

-

Imaging Systems

-

Ovum Aspiration Pumps

-

Micromanipulator Systems

-

Incubators

-

Gas Analyzers

-

Laser Systems

-

Cryosystems

-

Sperm Separation Devices

-

IVF Cabinets

-

Anti-vibration Tables

-

Witness Systems

-

Other

-

-

-

Procedure Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Fresh Donor

-

Frozen Donor

-

Fresh Non-donor

-

Frozen Non-donor

-

-

Providers Outlook (Revenue, USD Million, 2018 - 2030)

-

Fertility Clinics

-

Hospitals & Other Setting

-

Frequently Asked Questions About This Report

b. The Germany in vitro fertilization market size was valued at USD 1.51 billion in 2023 and is expected to reach USD 1.62 billion in 2024.

b. The Germany in-vitro fertilization market is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2030 to reach USD 2.28 billion by 2030.

b. The culture media segment dominated the Germany IVF market with a revenue share of more than 40% in 2023. Innovations in culture media formulations, specifically in cryopreservation media, embryo culture media, ovum processing media, and sperm processing media, are expected to drive market growth.

b. Some prominent players in the Germany in vitro fertilization market include Bayer AG; Cook Medical LLC; VivaNeo; Ferring B.V.; Genea Biomedx; and EMD Serono, Inc. (Merck KGaA), among others.

b. The growing number of infertility cases in Germany, the development of new and advanced medical technologies, increasing awareness about infertility and its treatment options, and high success rates for IVF treatments are driving the market growth in Germany.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.