- Home

- »

- Advanced Interior Materials

- »

-

Germany Hand Protection Equipment Market, Industry Report, 2030GVR Report cover

![Germany Hand Protection Equipment Market Size, Share & Trends Report]()

Germany Hand Protection Equipment Market Size, Share & Trends Analysis Report By Raw Material (Nitrile Gloves, Neoprene), By Distribution Channel (Online, Offline), By Type, By End-use, By Region And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-299-3

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

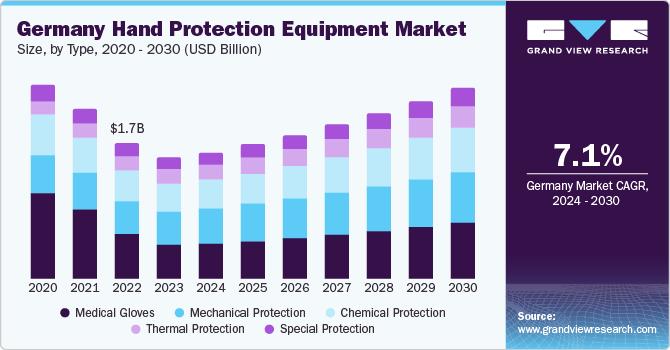

The Germany hand protection equipment market size was estimated at USD 1.52 billion in 2023 and is projected to grow at a CAGR of 7.1% from 2024 to 2030. The market is expected to experience growth due to rising awareness among industry players regarding the significance of worker safety and security in workplaces. This heightened awareness is attributed to strict regulations and substantial expenses linked to workplace hazards, both of which are expected to drive market expansion.

Public health campaigns promoting the importance of hygiene practices further fuel the demand for hand protection equipment in Germany. Such initiatives encourage the use of hand protection not only among professionals in various industries but also among the general public. Retailers and supermarkets in the country are now offering gloves to customers as a preventive measure, thereby illustrating the widespread adoption of hand protection equipment.

Germany has one of the highest proportions of the elderly population in the world. According to Germany Trade & Invest, approximately 24 million people will be 65 years or above in the country by 2035 that is 31% of its population. With age comes the surged chances of suffering from chronic diseases. This contributes to the requirement for frequent medical interventions, thereby necessitating increased visits of the elderly population to healthcare facilities. These facilities, in turn, focus increasingly on infection control practices to protect this vulnerable demographic, thereby leading to high consumption of hand protection equipment such as gloves. Geriatric care units and nursing homes in Germany are implementing stringent hand hygiene protocols, directly influencing the demand for hand protection equipment in the country.

Moreover, the trend toward automation and the use of advanced technologies in e-commerce logistics have also influenced the kind of hand protection equipment required. For instance, gloves that are compatible with touchscreen devices are becoming increasingly popular as they enable workers to operate scanners and tablets without removing their gloves, thereby maintaining productivity and safety simultaneously

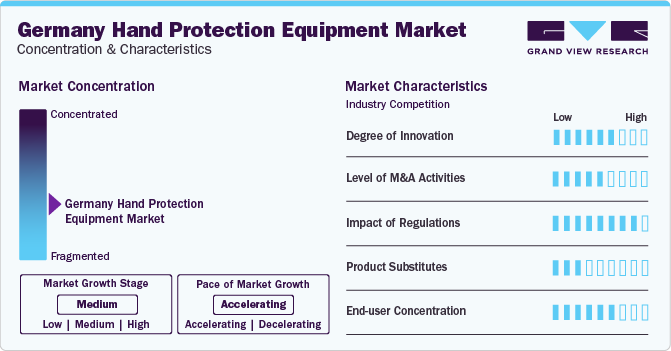

Market Concentration & Characteristics

Market growth stage is medium, and the pace of the market growth is accelerating. Germany exhibits a high degree of innovation in hand protection equipment, driven by a combination of factors, including advanced manufacturing capabilities, stringent safety standards, and a culture of continuous improvement. Renowned for its engineering prowess and commitment to quality, Germany's hand protection equipment sector thrives on innovation, constantly pushing the boundaries of design, materials, and technology to enhance worker safety and comfort.

The market experiences significant merger and acquisition (M&A) activity, indicative of the industry's dynamic nature and strategic imperatives. Companies within the hand protection sector engage in M&A transactions to consolidate market share, expand product portfolios, achieve cost synergies, and capitalize on emerging market opportunities. This heightened M&A activity reflects the industry's response to evolving market trends, regulatory changes, and competitive pressures.

Regulations exert a profound impact on the market, influencing various aspects of product development, manufacturing, distribution, and market dynamics. Germany, known for its rigorous standards and commitment to safety, enforces stringent regulations to safeguard workers, ensure product quality, and uphold environmental sustainability. Occupational safety standards, set by bodies like the German Social Accident Insurance (DGUV) and the Federal Ministry of Labour and Social Affairs (BMAS), dictate stringent requirements for hand protection equipment design and performance to mitigate workplace hazards effectively.

In the market, various product substitutes exist, offering alternatives to traditional gloves and protective gear. These substitutes include disposable gloves for applications requiring frequent changes, hand sanitizers and disinfectants promoting hand hygiene, skin barrier creams for irritation prevention, mechanical handling devices reducing direct contact with hazards, protective coatings offering chemical resistance, and automation and robotics minimizing manual labor. While providing alternatives, each substitute should be assessed for its suitability, ensuring it meets safety standards and effectively addresses specific application needs.

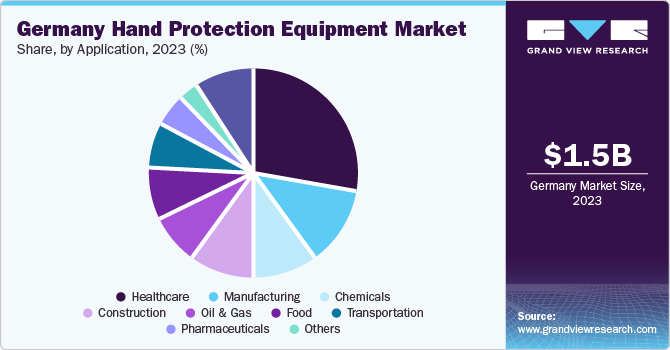

The end-user concentration in the market varies across sectors, reflecting the diverse industrial landscape and regulatory requirements. One significant sector driving demand is healthcare. Hospitals, clinics, and healthcare facilities are stringent users of hand protection equipment, particularly gloves, to uphold hygiene standards and prevent cross-contamination. The prevalence of infectious diseases and the emphasis on patient and staff safety contribute to the steady demand for high-quality gloves within this sector.

Type Insights

Medical protection type segment led the market and accounted for 28.08% of the revenue share in 2023 and is expected to grow at the highest CAGR during the forecast period. Medical protection gloves are specialized hand protection gear which are designed to provide a barrier to wearers against biological hazards, pathogens, and contaminants in healthcare settings such as hospitals, clinics, laboratories, and emergency response facilities. These gloves are typically made from materials such as latex, nitrile, or vinyl. They have different thicknesses and durability to suit the requirements of different medical procedures and tasks.

Chemical protection gloves is expected to grow lucratively during the forecast period. These gloves can prevent skin contact with harmful substances, reducing the risk of chemical burns, dermatitis, and other skin disorders. In addition, by creating a barrier between the hands and corrosive chemicals, these gloves safeguard the health and safety of workers in industries such as manufacturing, pharmaceuticals, laboratories, and agriculture.

Raw Material Insights

Nitrile gloves raw material dominated the market and accounted for largest revenue share in 2023 and is expected to grow at the highest CAGR during the forecast period. The demand for nitrile gloves is expected to increase significantly in Germany, owing to their surging adoption in the construction, manufacturing, chemicals, mining, and oil & gas industries. The greater resistance offered by nitrile reusable gloves to puncture and chemicals than reusable gloves developed from vinyl and latex is anticipated to augment the growth of the nitrile gloves segment in the coming years.

Neoprene gloves is expected to grow significantly during the forecast period. These gloves provide excellent resistance to various chemicals, including acids, oils, greases, and solvents. This makes them suitable for use in industries where workers are exposed to hazardous chemicals, such as laboratories, chemical processing plants, and manufacturing facilities. In addition, neoprene offers thermal insulation properties, making it suitable for use in hot and cold environments.

Distribution Channel Insights

Offline distribution channel accounted for largest market revenue share in 2023. Offline distribution channels in the market involve physical retail outlets, wholesalers, distributors, and specialized safety equipment stores. There is a growing trend toward specialization and the emergence of niche retailers focusing specifically on safety equipment, including hand protection gear.

The online distribution channel is expected to grow at the highest CAGR during the forecast period. This segment has experienced significant growth in recent years. The proliferation of e-commerce platforms and increasing digitization of business operations has increased the inclination of consumers and businesses toward online channels to procure hand protection products.

End-use Insights

Healthcare end-use segment led the market in 2023 and is expected to grow at the highest CAGR during the forecast period. The use of hand protection equipment in the healthcare industry is vital for ensuring the safety and hygiene of both healthcare professionals and patients. This equipment plays a crucial role in preventing the spread of infections and protecting against exposure to hazardous materials or substances.

The pharmaceutical segment is expected to show a lucrative growth, as the industry is experiencing a surge in investments, a trend that is significantly driving the demand for hand protection equipment. As the industry expands, fueled by increased funding for research and development, pharmaceutical production, and the establishment of new laboratories and manufacturing facilities, the need for stringent safety measures and hygiene protocols becomes more critical. This growth necessitates a higher volume of specialized hand protection equipment to safeguard workers against chemical, biological, and physical hazards inherent in pharmaceutical operations.

Key Germany Hand Protection Equipment Company Insights

Some of the key players operating in the market include Uvex Safety Group, Ansell Ltd., and Delta Plus Group.

-

Uvex Safety Group operates through 12 manufacturing facilities worldwide and maintains 49 offices in 23 countries. Most of its development and production activities are based in Germany and other European locations. The company oversees the entire value chain, from the initial concept through research and development to manufacturing with innovative techniques.

-

Ansell Ltd. provides protection equipment and solutions. It operates through three business segments, namely industrial, medical, and life sciences/cleanroom. Ansell Ltd. offers its products and protection solutions to various industries, including chemicals, construction, food processing, healthcare, and machinery & equipment. It has an extensive product portfolio of gloves.

ASATEX AG, Seiz, and NITRAS are some of the emerging market participants in the market.

-

ASATEX AG manufactures protective clothing with a storage area of over 8,500 square meters and a comprehensive, highly efficient, high-bay warehouse. It supplies high-quality protective workwear in Europe and Germany. Its manufacturing sites are located in Poland, Germany, Albania, Slovakia, Sri Lanka, Cambodia, Pakistan, India, and China

-

The SEIZ Group is comprised of two subsidiaries. While SEIZ industrial gloves focuses on the segment of the same name, its sister company, SEIZ Technical Gloves, develops and sells technical hand protection. The company's industrial safety gloves are awarded the OEKO-TEX STANDARD 100 label, which certifies that all components of the gloves have been tested to ensure that they are free of harmful substances and are harmless to health

Key Germany Hand Protection Equipment Companies:

- Uvex Safety Group

- Ansell Ltd.

- Delta Plus Group

- ASATEX AG

- Seiz

- NITRAS

- BIG Arbeitsschutz GmbH

- Friedrich Münch Gmbh + Co Kg (Niroflex)

- W+R INDUSTRY GmbH

- SAFET MEDEX GmbH

- JUNG Gummitechnik GmbH

- ALWIT

- Feldtmann

- HAT Hansaschutz GmbH & Co. KG

- PENKERT GMBH

- COFRA S.r.l.

- Wattana GMBH

- Globus Group

- Einkaufsbüro Deutscher Eisenhändler GmbH

- Scheibler Work & Wear

- Hase Safety Gloves GmbH

Recent Developments

-

In April 2024, Ansell Ltd announced that they would enter into a binding agreement to acquire 100% of assets that constitute Clark’s Personal Protective Equipment business (KCPPE) for USD 640.0 million. This acquisition is expected to be completed by September 2024. With this acquisition, the company is likely to improve its sales of specialist products designed for cleanroom applications.

-

In March 2024, Uvex Safety Group launched new Profi Pure HG gloves with its innovative Hydro Grip special polymer coating. This product has set a new standard in terms of grip in wet working conditions. These new gloves are compatible with skin and are produced carbon neutrally in Germany.

Germany Hand Protection Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.57 billion

Revenue forecast in 2030

USD 2.37 billion

Growth rate

CAGR of 7.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, raw material, distribution channel, end-use, region

Key companies profiled

Uvex Safety Group; Ansell Ltd.; Delta Plus Group; ASATEX AG; Seiz; NITRAS; BIG Arbeitsschutz GmbH; Friedrich Münch Gmbh + Co Kg (Niroflex); W+R INDUSTRY GmbH; SAFET MEDEX Gmb; JUNG Gummitechnik GmbH; ALWIT; Feldtmann; HAT Hansaschutz GmbH & Co. KG; PENKERT GMBH; COFRA S.r.l.; Wattana GMBH; Globus Group; Einkaufsbüro Deutscher Eisenhändler GmbH; Scheibler Work & Wear

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Germany Hand Protection Equipment Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Germany hand protection equipment market report based on type, raw material, distribution channel, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Mechanical Protection

-

General Purpose

-

Cut Resistant

-

Puncture Resistant

-

Anti-impact

-

-

Chemical Protection

-

Disposable

-

Reusable

-

-

Thermal Protection

-

Heat Resistant

-

Cold Resistant

-

-

Special Protection

-

Anti-vibration

-

Anti-syringe

-

Electrical Insulation

-

Arc Flash

-

Critical Environment

-

-

Medical Gloves

-

-

Raw Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural Rubber/latex

-

Nitrile Gloves

-

Neoprene

-

Vinyl Gloves

-

Leather

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

B2B

-

B2C

-

-

Offline

-

B2B

-

B2C

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Construction

-

Manufacturing

-

Oil & Gas

-

Chemicals

-

Food

-

Pharmaceuticals

-

Healthcare

-

Transportation

-

Mining

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

Baden-Württemberg

-

Bavaria

-

Berlin

-

Brandenburg

-

Bremen

-

Hamburg

-

Hesse

-

Mecklenburg-Western Pomerania

-

Lower Saxony

-

North Rhine-Westphalia

-

Rhineland-Palatinate

-

Saarland

-

Saxony

-

Sachsen-Anhalt

-

Schleswig-Holstein

-

Thuringia

-

Frequently Asked Questions About This Report

b. Germany hand protection market size was estimated at USD 1.52 billion in 2023 and is expected to be USD 1.57 billion in 2024.

b. The Germany hand protection market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.1% from 2024 to 2030 to reach USD 2.37 billion by 2030

b. The North Rhine-Westphalia region led the market and accounted for 20.3% of the revenue share in 2023. The region's robust industrial sector, including manufacturing, construction, and logistics, drives significant demand for hand protection products to ensure worker safety and compliance with stringent regulatory standards.

b. Some of the key players operating in the Germany hand protection market include Uvex Safety Group, Ansell Ltd., Delta Plus Group, ASATEX AG, Seiz, NITRAS, BIG Arbeitsschutz GmbH, Friedrich Münch Gmbh + Co Kg (Niroflex), W+R INDUSTRY GmbH, among others

b. The market is expected to experience growth due to rising awareness among industry players regarding the significance of worker safety and security in workplaces. This heightened awareness is attributed to strict regulations and substantial expenses linked to workplace hazards, both of which are expected to drive market expansion.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."