- Home

- »

- Healthcare IT

- »

-

Germany Digital Health Market Size, Industry Report, 2030GVR Report cover

![Germany Digital Health Market Size, Share & Trends Report]()

Germany Digital Health Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Tele-healthcare, mHealth), By Component (Hardware, Software, Services), By Application, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-222-0

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Germany Digital Health Market Size & Trends

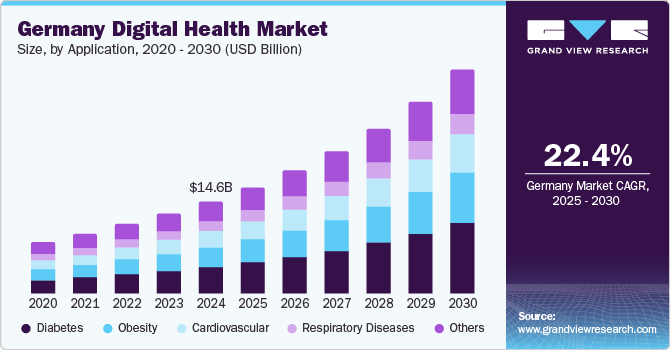

The Germany digital health market size was estimated at USD 14.62 billion in 2024 and is projected to grow at a CAGR of 22.4% from 2025 to 2030. The rising adoption of digital healthcare services such as telemedicine, remote monitoring, and electronic health record systems, among many others is anticipated to drive the market growth. The rise in challenges faced by the healthcare industry including the increasing prevalence of chronic diseases, the rapidly aging population, and the shortage of medical professionals in Germany, are some of the major factors anticipated to accelerate the demand for digital health. Germany's e-health infrastructure has been expanding, emphasizing technological supply and demand, patient acceptance, and utilization of online healthcare solutions.

The Digital Care Act (DVG) in Germany provides prescription access to online health applications, paving the way for their widespread adoption and reimbursement. A "Fast Track" process has been established to ensure that all 73 million Germans with public health insurance (90%) have access to online health applications to integrate them into the statutory health system. Rising healthcare costs have been a problem for Germany and many other developed countries that support the adoption of digital health to manage costs. In 2019, the World Health Organization (WHO) reported that Germany's healthcare expenditure accounted for roughly 11.7% of the country's GDP.

Telemedicine provides remote medical care and other related health services using information and communication technologies. Over 200 telemedicine projects are operating in Germany at present, with many more arising in the last few years. Deutsche Telemedizinportal, a component of the eHealth Initiative established by the Federal Ministry of Health, offers comprehensive information about completed and ongoing projects. The initiative aims to open the door for significant applications beyond the project stage and into routine care.

The rapidly increasing population in Germany is contributing to an increased prevalence of chronic diseases and a higher demand for healthcare services. Online health technologies can assist in managing and monitoring chronic conditions effectively. According to a report by the German Federal Statistical Office, the percentage of the population 65 and older is expected to rise from 21% in 2015 to almost 33% by 2060.

During the COVID-19 pandemic, Germany benefited from digital health infrastructure. The country has advanced significantly in using digital health solutions for doctors and patients, allowing for accurate resource allocation and effective crisis management. Over 90% of general practitioners use e-health solutions. In 2021, 61% of outpatient physicians provided digital services to their patients, primarily through telemedicine (37%), online booking (21%), and others. The 2.7 million teleconsultations in 2020 were surpassed by 3.5 million in 2021, a 29% increase, owing to the offered benefits.

Market Concentration & Characteristics

Market growth stage is high, and pace of the market growth is accelerating. The market is characterized by a high degree of innovation. The government is actively pushing the digital transformation of the healthcare system through the Digital Healthcare Act (DVG), causing significant digitalization in Germany's healthcare system.

The market is also characterized by the mergers and acquisitions (M&A) activities owing to the several factors, including the rising usage of telemedicine, adoption of digital health apps, and other digital health solutions driving this trend.

The digital health market in Germany is also subject to increasing regulatory scrutiny. This is owing to concerns about the German Federal Ministry of Health releasing drafts of the Digital Act (DigiG) and the Health Data Use Act (GDNG) to the public in June 2023. The German government's digitalization plan for the health sector includes these drafts. Companies in the industry are likely to be able to access patient health data for research purposes owing to the Health Data Use Act.

Germany's massive digitalization of the healthcare sector is driving the emergence of a wide range of services and substitutes in the country's digital health market. Under the EU Medical Device Regulation (MDR), individuals in Germany who possess health insurance are eligible for coverage benefits for digital health applications, which include medical products classified as class I or II. These digitally based applications serve various purposes, including monitoring, treatment, and detection.

End-user concentration is a significant factor in Germany's market since several end-user industries drive demand for digital health. The market is characterized by the growing presence of telemedicine, the development of novel digital health solutions, the influence of regulations, the growing adoption of digital health applications, and the empowerment of patients.

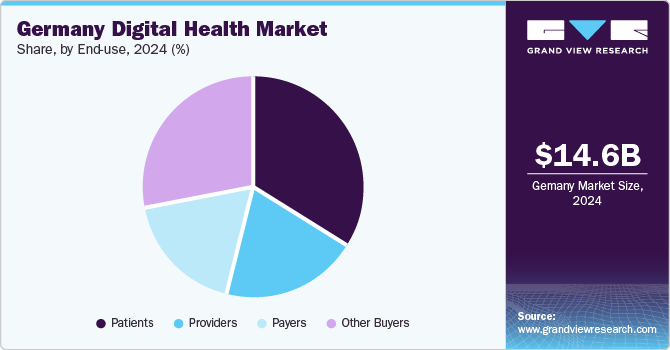

End-use Insights

Based on end-use, the patient segment held the market with the largest revenue share of 34.47% in 2024 and is expected to witness the fastest CAGR from 2024 to 2030. The digital health market in Germany is experiencing a significant shift towards patient-centered care and increased awareness among individuals regarding managing their health. Several factors, including the aging population, rising healthcare costs, and technological advancements, drive this trend. The German government's initiatives to promote patient-centered care and the increasing demand for remote patient monitoring are further fueling the growth of the digital health market in Germany.

The provider segment was the second-largest revenue share, driven by the broad use of cutting-edge technologies including digital therapeutics and telemedicine. To provide individualized treatment plans, evidence-based therapies, and remote consultations outside of traditional care settings, healthcare providers are increasingly turning to digital solutions. By incorporating digital tools, healthcare professionals can provide more individualized and accessible care, which enhances patient outcomes.

Technology Insights

Based on technology, the mHealth services segment led the market with the largest revenue share of 44.98% in 2024, pertaining to the rise in smartphone users and mHealth apps for wellness, health, and medical applications. The segment growth is also anticipated to be fueled by an increase in mobile healthcare applications for tracking patients, managing medications, managing diseases, women's health, fitness and wellness, and managing personal health records. According to a JMS publication in 2023, in Germany, the majority of mHealth users are patients with endocrine or mental health issues between the ages of 30 and 50. DiGAs and mHealth applications were previously used by 292 (27%) respondents in total; of these, 47 (16%) were either current users or had previously used prescription based DiGAs.

The tele-healthcare segment is anticipated to register the fastest CAGR during the forecast period, owing to the increasing benefits offered by tele-healthcare technology, particularly in non-emergencies and situations where direct or in-person interactions between patients and providers are unnecessary. For instance, in 2018, the German Medical Association modified the laws that describe the professional legal framework for physicians in Germany to permit remote treatment.

Component Insights

Based on component, the services segment held the market with the largest revenue share of 37.89% in 2024, owing to the rising demand for tele-healthcare component maintenance, staffing, training, resource allocation, and optimization services. It is projected that the market players can concentrate more on offering these services to maintain their dominant positions, which can fuel the segment growth. The market share of this category is also anticipated to grow as electronic health platforms develop and customer expectations for improved services rise. The major players' extensive range of pre-and post-installation services is expected to contribute to the segment growth.

The software segment is anticipated to register the fastest CAGR over the forecast period. The rapid adoption of software and applications among healthcare institutions, patients, providers, and insurance payers is driven by increasing demand for digital healthcare, technological advancements, regulatory support, collaboration and partnerships, and cost savings. These factors drive the development and implementation of digital healthcare solutions that improve healthcare outcomes and make healthcare more convenient and accessible for all.

Application Insights

Based on application, the diabetes segment led the market with the largest revenue share of 24.65% in 2024 and is expected to witness the fastest CAGR from 2025 to 2030. The prevalence of diabetes and its associated complications has positioned it as the largest segment in the digital health space. According to the International Diabetes Federation's Diabetes Atlas, from 2019, 9.5 million Germans are projected to have diabetic complications. Digital health technologies offer innovative solutions to address the needs of individuals with diabetes.

From smartphone applications for glucose monitoring to wearable devices that track physical activity and provide real-time health data, digital health tools empower patients to participate actively in their diabetes management. Moreover, these technologies facilitate remote patient monitoring, enabling healthcare providers to receive timely data, make informed decisions, and offer timely interventions, ultimately contributing to more effective diabetes management.

Furthermore, the rising prevalence of diabetes has led to a surge in demand for preventive strategies and early intervention methods. According to an NCBI publication, in 2023, the prevalence of diabetes in Germany ranges from 7.2% to 9.9% and rises gradually with age to over 30% in the 75-79 age group. Digital health solutions are essential as they provide individualized, data-driven insights that enable people to successfully manage risk factors and change their lifestyle.

Key Germany Digital Health Company Insights

Some of the key players operating in the market include Siemens Healthineers, IBM Corporation, and Allscripts Healthcare Solutions Inc.

-

Siemens Healthineers, a German supplier of healthcare products and services, has undertaken a wager regarding using artificial intelligence (AI) in healthcare services. The company provides various services and products in molecular medicine, laboratory and point-of-care diagnostics, and diagnostic and therapeutic imaging

-

IBM Corporation has a strong presence in the German digital health market owing to its knowledge of digital technologies and healthcare and its emphasis on innovation and teamwork. It is anticipated that the company's presence in the market is likely to support the expansion and advancement of the industry, especially in fields including digital health, mHealth apps, and smart healthcare

Medkitdo, InterComponentWare (ICW), eGym, Ada, and Freeletics are some of the other market participants in the Germany market.

-

Medkitdoc is transforming telemedicine using the "MedKitDoc" platform to enable digital physician treatments, including diagnostics. The platform is built on a combination of highly skilled professionals, connected medical devices, and an intuitive app for physicians and patients

-

InterComonentWare provides services to life science users in the U.S., Germany, and other countries, as well as health information exchanges, care delivery organizations, payers and health plans

Key Germany Digital Health Companies:

- Cerner Corporation

- GE Healthcare

- Abbott

- Olympus Corporation

- Resideo Technologies

- Cisco

- Telefonica SA.

- Softserve

- Computer Programs and Systems, Inc.

- Vocera Communications

- CISCO Systems, Inc.

- Apple Inc.

- McKesson Corporation

- Epic Systems Corporation

- Vodafone Group

- Airstrip Technologies

- Google, Inc.

- Samsung Electronics Co. Ltd.

- Orange

- Qualcomm Technologies, Inc.

- CompuGroup Medical

Recent Developments

-

In November 2023, Siemens Healthineers established investments in the application of AI to health care. It has developed 84 AI-enabled products and holds over 800 AI-related patents. In addition, it has produced several AI applications, including digital twins for the liver and heart and the AI RAD companion for radiology

-

In September 2023, Germany's national agency for digitalizing the healthcare system approved T-Systems' digital identity service for the healthcare industry. Thus, insurance policyholders possess a central key for health applications such as e-prescriptions, electronic patient files, and other digital health tools

-

In December 2020, Siemens Healthineers and IBM Deutschland are launching an open digital platform that can boost the infrastructure for the delivery of digital services and enhance the networking of the German healthcare system. For the project, both partners are combining their experience and knowledge

-

In February 2020, Cerner Corporation and CompuGroup Medical SE announced an agreement to acquire a portion of Cerner's healthcare IT portfolio in Germany and Spain. This Acquisition Enhances CompuGroup Medical's Standing in Spain and Germany

-

In October 2019, Cerner announced the launch of the EHR training framework, a new cognitive health platform. Cerner's technology and cooperative initiatives are going to spark a wave of disruptive innovation aimed at improving healthcare"

Germany Digital Health Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 17.62 billion

Revenue forecast in 2030

USD 48.10 billion

Growth rate

CAGR of 22.24% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, component, application, end-use

Country scope

Germany

Key companies profiled

Siemens Healthineers; IBM Corporation; Allscripts Healthcare Solutions Inc; Cerner Corporation; GE Healthcare; Abbott; Olympus Corporation; Resideo Technologies; Cisco; Telefonica S.A; Softserve; Computer Programs and Systems, Inc; Vocera Communications; CISCO Systems, Inc; Apple Inc; McKesson Corporation; Epic Systems Corporation; Vodafone Group; Airstrip Technologies; Google, Inc; Samsung Electronics Co. Ltd; Orange; Qualcomm Technologies, Inc; and CompuGroup Medical.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Germany Digital Health Market Report Segmentation

This report forecasts revenue growth at country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. Grand View Research has segmented the Germany digital health market report based on technology, component, application, and end-use.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Tele-healthcare

-

Tele-care

-

Activity Monitoring

-

Remote Medication Management

-

-

Tele-health

-

LTC Monitoring

-

Video Consultation

-

-

-

mHealth

-

Wearables

-

BP Monitors

-

Glucose Meters

-

Pulse Oximeters

-

Sleep Apnea Monitors

-

Neurological Monitors

-

Activity Trackers/Actigraphs

-

-

mHealth Apps

-

Medical Apps

-

Fitness Apps

-

-

mHealth Service, By Type

-

Monitoring Services

-

Independent Aging Solutions

-

Chronic Disease Management & Post-acute Care Services

-

-

Diagnosis Services

-

Healthcare Systems Strengthening Services

-

Others

-

-

mHealth Services, By Participants

-

Mobile Operators

-

Device Vendors

-

Content Players

-

Healthcare Providers

-

-

-

Healthcare Analytics

-

Digital Health Systems

-

EHR

-

E-prescribing Systems

-

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Hardware

-

Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Obesity

-

Diabetes

-

Cardiovascular

-

Respiratory Diseases

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Patients

-

Providers

-

Payers

-

Other Buyers

-

Frequently Asked Questions About This Report

b. The Germany digital health market size was estimated at USD 14.62 billion in 2024.

b. The Germany digital health market is expected to grow at a compound annual growth rate (CAGR) of 22.4% from 2025 to 2030 to reach USD 48.1 billion by 2030.

b. The mHealth services dominated the market, with the largest market share of 44.98% in 2024. This high share is attributable to the rise in smartphone users and mHealth apps for wellness, health, and medical applications. The segment's growth is also anticipated to be fueled by an increase in mobile healthcare applications for tracking patients, managing medications, managing diseases, women's health, fitness and wellness, and managing personal health records.

b. Some of the key players operating in the Germany digital health market include Siemens Healthineers; IBM Corporation; Allscripts Healthcare Solutions Inc; Medkitdo; InterComponentWare (ICW); eGym; Ada; Freeletics; Cerner Corporation; GE Healthcare; Abbott; Olympus Corporation; Resideo Technologies; and Cisco; among others.

b. Key factors driving the market growth include the rising use of digital healthcare services such as telemedicine, remote monitoring, electronic health record systems, and other healthcare services that are anticipated to drive the market. The growing challenges, such as the increasing prevalence of chronic diseases, the rising aging population, and the shortage of medical professionals in Germany, are the major factors anticipated to accelerate the growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.