Germany Automotive Aftermarket Size, Share & Trends Analysis Report By Replacement Part, By Distribution Channel (Retail, W&D), By Service Channel (DIY, DIFM, OE), By Certification, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-136-8

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

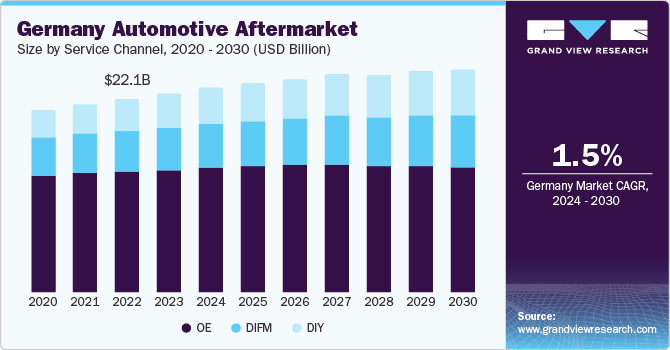

The Germany automotive aftermarket size was valued at USD 22.10 billion in 2023 and is projected to grow at a CAGR of 1.5% from 2024 to 2030. This growth is driven by factors such as an increase in demand for used vehicles and the rise in the number of vehicle owners seeking to upgrade the performance of their vehicles. The ease of availability associated with tires, engine parts, turbochargers, body parts, and other products distributed by original manufacturers adds to the growth of this market.

The rising shift towards vehicles that are empowered by hybrid technology to ensure lower carbon emissions is influencing the growth of this market. A growing inclination towards using electric vehicles and hybrid passenger cars has contributed to the demand in this market. However, this is expected to shift the aftermarket concentration from replacing parts to replacing turbochargers, batteries, and more.

Demand for repairs, customizations, and performance enhancement measures are enabling the growth of Germany's automotive aftermarket. The growing popularity of accessories, personalized capacity upgrades, and the inclusion of specific parts are also contributing to the development of demand. In addition, stringent regulations and compliance requirements regarding the maintenance and driving condition of vehicles fuel demand for replacement products to address wear and tear, gradual damages, and deterioration caused by continuous use over a long period.

Replacement Part Insights

The tire segment dominated the market and accounted for a revenue share of 22.2% in 2023. The growth of this segment is primarily influenced by recent changes in consumer behavior which highlights inclination towards highest quality products over brand loyalty. Availability of multiple alternatives including premium quality-premium price tires, budget tires, all-season tires, and others also adds to the dominance of the segment in the Germany automotive aftermarket. Presence of large number of manufacturers, wholesalers, and distributors that specialize in tires of different sorts of vehicles is expected to assist growth of this segment during forecast period.

The turbochargers segment is expected to grow at fastest CAGR during the forecast period. Turbochargers are used in a variety of automotive offerings including motorcycles, buses, passenger cars, crossovers, coupes, hatchbacks, sports cars and others. The strict rules regarding emissions also contribute to the change and new installations. Furthermore, rises in the customization of vehicles have resulted in increased demand for turbochargers as it helps in enhancing the performance of cars. The youth generation of population upgrade their vehicles with turbochargers in order to improve performance.

Distribution Channel Insights

The retail segment accounted for the largest revenue share in 2023. Law passed regarding limiting the design protection of visible automotive spare parts has influenced this segment significantly. The availability of spare parts and repair-related accessories through accessible retail markets, e-commerce platforms, and multiple large organizations focused on retail-level automotive aftermarkets in Germany are key growth driving factors for this segment. The original equipment manufacturers also prefer retail distribution and other spare parts developers as they offer enhanced brand visibility and increased customer engagement.

The Wholesale and Distributors (W&D) segment is expected to grow at the fastest CAGR over the forecast period. The growing trend of do-it-yourself (DIY) and do-it-for-me (DIFM) repairs among consumers is significantly driving the demand for automotive aftermarket parts in Germany. As more vehicle owners take on repairs and maintenance tasks, the need for accessible, high-quality parts has surged. Wholesalers and distributors recognizing this shift capitalize on the opportunity by offering an extensive range of products for DIY enthusiasts and those preferring professional services. By developing user-friendly online platforms, these businesses make it easier for consumers to find, purchase, and receive the necessary parts quickly and conveniently.

Service Channel Insights

Based on service channel, the Original Equipment (OE) segment dominated the global market in 2023. The growth of this segment is influenced by the increase in the demand for OE, as customers prefer the original parts, which are more reliable and have a longer life. Customers upgrade their old vehicles with original parts to enhance their performance and increase the economy. Original equipment installation ensures compatibility, safety, and reliability as the car manufacturing company manufactures them, driving the segment's growth.

The DIY segment is expected to grow at the fastest CAGR over the forecast period. The availability of online guidelines, videos, and information that assist in using DIY products for new installations and replacements contributes significantly to the growth of this segment. Reduced servicing costs and immersive experiences attained through DIY products are expected to increase demand for this segment during the forecast period.

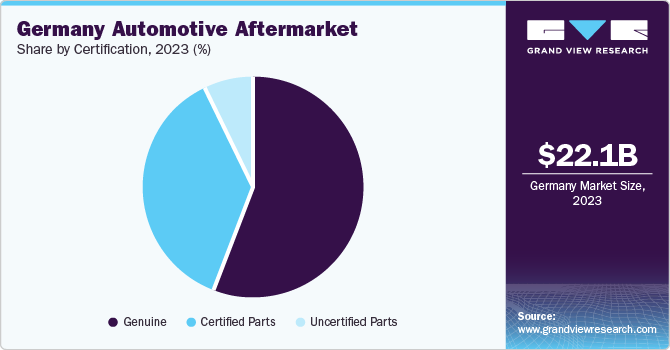

Certification Insights

The genuine segment held the largest revenue share of Germany automotive aftermarket in 2023. This is attributed to the rise in the demand for genuine automotive parts, which are authentic and reliable because the car companies or OEMs manufacture them. The parts provide superior quality and long life. Customers choose genuine parts to ensure the proper functioning of their vehicles. Genuine parts also offer a warranty, therefore helping to increase reliability and driving the segment's growth.

The certified parts segment is projected to grow at the fastest CAGR over the forecast period. These parts are produced under strict manufacturing guidelines that align with the original equipment manufacturers' (OEM) specifications, meaning they are crafted to the same high standards as the parts originally used in the vehicle's production. This precision in manufacturing guarantees that certified parts fit perfectly and function seamlessly within the vehicle's systems, maintaining the integrity and optimal performance of the car. The high quality of these parts reduces the likelihood of malfunctions and breakdowns, providing consumers with a dependable solution that enhances the longevity of their vehicles. By meeting OEM specifications, certified parts ensure compatibility with the latest automotive technologies and maintain the vehicle's warranty, driving the segment's growth.

Key Germany Automotive Aftermarket Company Insights

Some of the key companies in the Germany automotive aftermarket include 3M, Continental AG, PHINIA Inc., Denso Corporation, Robert Bosch GmbH, and others. Organizations are focusing on launching vehicles parts that aid in enhancing and optimizing the performance of the vehicles with the help of technological enhancements and better manufacturing processes.

- Continental AG is an automotive parts manufacturer offers products and innovation related with automotive, tires, and ContiTech. The elements included in these three groups include passive safety, brake, chassis, motion and motion control systems, tires, smart mobility, autonomous mobility, architecture & networking, user experiences and more.

- Denso Corporation is a global automotive components company. It manufactures parts such as hybrid vehicle components, climate control components, airbag systems, spark plugs, and more.

Key Germany Automotive Aftermarket Companies:

- 3M

- Continental AG

- PHINIA Inc.

- Denso Corporation

- Federal-Mogul Corporation (Tenneco Inc.)

- Marelli Holdings Co., Ltd.

- Robert Bosch GmbH

- The Goodyear Tire & Rubber Company

- ZF Friedrichshafen AG

- OE Germany GmbH

Recent Developments

-

In June 2024, The Goodyear Tire & Rubber Company, one of the prominent companies in the market, launched a subscription-based tires-as-a-service offering aimed at reducing fleet total ownership costs. The service is available in Europe and the U.S. for last-mile delivery and commercial fleets.

-

In April 2024, Foxconn (Hon Hai Technology Group) completed the acquisition of 50% of ZF Chassis Modules GmbH. The new name of the joint venture, ZF Foxconn Chassis Modules, is expected to explore new opportunities in the global market for axle system assembly.

Germany Automotive Aftermarket Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 22.70 billion |

|

Revenue forecast in 2030 |

USD 24.80 billion |

|

Growth Rate |

CAGR of 1.5% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

October 2024 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Replacement part, distribution channel, service channel, certification |

|

Key companies profiled |

3M; Continental AG; PHINIA Inc.; Denso Corporation; Federal-Mogul Corporation (Tenneco Inc.); Marelli Holdings Co., Ltd.; Robert Bosch GmbH; The Goodyear Tire & Rubber Company; ZF Friedrichshafen AG; OE Germany GmbH |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Germany Automotive Aftermarket Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Germany automotive aftermarket report based on replacement part, distribution channel, service channel, and certification:

-

Replacement Part Outlook (Revenue, USD Billion, 2018 - 2030)

-

Tire

-

Battery

-

Brake parts

-

Filters

-

Body parts

-

Lighting & Electronic components

-

Wheels

-

Exhaust components

-

Turbochargers

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Retail

-

W&D

-

-

Service Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

DIY

-

DIFM

-

OE

-

-

Certification Outlook (Revenue, USD Billion, 2018 - 2030)

-

Genuine

-

Certified Parts

-

Uncertified Parts

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."