Geotechnical Engineering Market Size, Share & Trends Analysis Report By Type (Underground City Space Engineering, Slope Excavation Engineering, Ground Foundation Engineering), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-374-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Geotechnical Engineering Market Trends

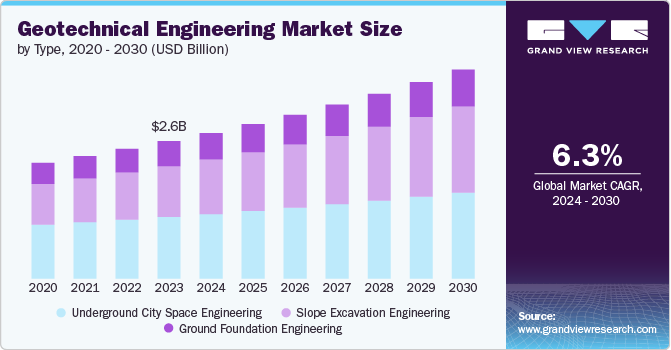

The global geotechnical engineering market size was estimated at USD 2.57 billion in 2023 and is estimated to grow at a CAGR of 6.3% from 2024 to 2030. Geotechnical Engineering, also referred to as geotechnical engineering, is a branch of civil engineering focused on the behavior of earth materials. It involves studying soil mechanics and rock mechanics to understand and predict their interactions with man-made structures. Geotechnical Engineering is essential in the design and construction of buildings, bridges, dams, tunnels, highways, and other infrastructure. It ensures that structures are safe, stable, and cost-effective by providing insights into the ground's properties and behaviors.

The shift toward renewable energy is driving the development of offshore renewable energy projects. According to the International Energy Agency, the generation of wind electricity surged by a record 265 TWh in 2022, reaching over 2,100 TWh, marking the second-highest growth among all renewable power technologies. This has led to increased demand for geotechnical engineering services, fueling market growth. For instance, in March 2024, the initial TotalEnergies and SSE Renewables' 500 MW Seagreen 1A offshore wind farm in Scotland geotechnical seabed surveys for have been completed. Phase 2 of the geotechnical work is slated to commence later in 2024 and is expected to take around two weeks to complete.

Type Insights

The underground city space engineering segment led the market and accounted for 43.8% of the global revenue in 2023. Underground City Space Engineering is an emerging area within the Geotechnical Engineering Market that focuses on the development and utilization of subterranean spaces in urban environments. This innovative field addresses the growing need for sustainable urban expansion by leveraging the underground for various infrastructures such as transportation systems, commercial spaces, and residential areas. By integrating advanced geotechnical engineering principles, it aims to ensure the stability and safety of underground structures, mitigating risks associated with soil and rock mechanics. The increasing urbanization and space constraints in cities worldwide are driving the demand for these specialized services. As a result, geotechnical services are playing a crucial role in the planning, design, and construction of underground city spaces, making them essential for future urban development.

The slope excavation engineering segment is estimated to grow significantly over the forecast period. This segment is a significant within the geotechnical engineering market, playing a crucial role in ensuring the stability and safety of slopes in various construction and infrastructure projects. This specialized field focuses on analyzing, designing, and implementing measures to prevent slope failures and landslides in both natural and man-made slopes. The demand for slope excavation engineering services has been growing steadily due to increased construction activities in hilly terrains, urban expansion into challenging topographies, and the need for infrastructure development in mountainous regions. These services are particularly important in projects such as road construction, mining operations, and building developments on sloped terrain. Geotechnical Engineering providers use advanced techniques and technologies to assess soil conditions, analyze slope stability, and design appropriate excavation and support systems

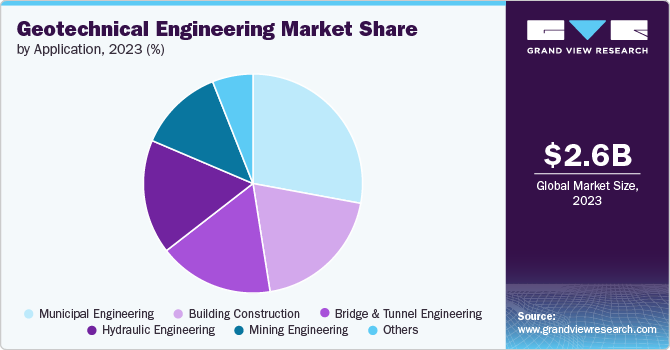

Application Insights

The municipal engineering segment led the market and accounted for highest revenue share in 2023. Municipal engineering in geotechnical engineering is experiencing several notable trends that are shaping the field. One key trend is the increasing focus on sustainable urban development, which involves implementing green infrastructure solutions and utilizing recycled materials in construction projects. This shift towards sustainability is driven by the need to address climate change impacts and reduce the environmental footprint of urban areas. Moreover, the adoption of advanced modeling and data analysis technologies. Municipal engineers are leveraging tools like Building Information Modeling (BIM) and artificial intelligence to improve project planning, design, and execution. These technologies enable more accurate predictions of soil behavior, optimize infrastructure designs, and enhance overall project efficiency.

The mining engineering segment is expected to witness significant revenue growth over the forecast period. Mining engineering in geotechnical engineering is experiencing several transformative trends. A major focus is on sustainability and environmental protection, with advances in waste management, land reclamation, and reducing the environmental footprint of mining activities. The use of automation and remote operation is increasing, enhancing safety and efficiency in hazardous environments. Innovations in ground support and stability, including improved rock reinforcement techniques and real-time monitoring systems, are enhancing mine safety. The application of big data, artificial intelligence, and machine learning is revolutionizing exploration and operational efficiency by enabling predictive maintenance and optimizing resource extraction.

Regional Insights

North America accounted for a 32.0% revenue share in 2023. This growth is primarily attributed to the widespread adoption of geotechnical services and the initiation of numerous infrastructure and substructure projects in the region. Additionally, the market growth in this region is driven by the presence of abundant natural gas reserves and other oil and gas activities. Additionally, numerous infrastructure projects and the increasing adoption of geotechnical services are expected to further accelerate market expansion in this area.

U.S. Geotechnical Engineering Market Trends

The U.S. Geotechnical Engineering Market in North America accounting for a substantial portion of the market share. Increasing investments in infrastructure development, urbanization, and the expansion of construction activities into challenging terrains are fueling the demand for geotechnical services. Additionally, the rising need for renewable energy sources, particularly wind energy, is creating new opportunities for geotechnical engineers in the design and placement of offshore wind turbines.

Europe Geotechnical Engineering Market Trends

The adoption of geotechnical engineering solutions in Europe is particularly strong in various industrial sectors. One of the primary drivers is the increasing focus on environmental consciousness and the adoption of government-backed environmental policies and initiatives. This shift towards sustainable development is creating new opportunities for geotechnical services across various sectors in this region.

Asia Pacific Geotechnical Engineering Market Trends

Asia Pacific is anticipated to witness the fastest growth during the forecast period, driven by regulatory laws requiring geotechnical monitoring of sites. Furthermore, the growing understanding and awareness of geotechnical equipment are crucial factors propelling the regional market growth. China is expected to hold the largest market share within the Asia Pacific, due to its vast population, which drives infrastructural investments and the construction of tunnels and bridges. Additionally, increasing awareness of sustainable construction practices and the rising number of geotechnical projects further contribute to market expansion in this region.

Key Geotechnical Engineering Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, partnerships, and collaborations contracts, agreements, as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, In March 2024, AECOM, a renowned infrastructure consulting firm, has announced a new collaboration with EarthSoft, a global leader in environmental data management software (EDMS). This partnership aims to merge AECOM’s extensive expertise in environmental remediation with EarthSoft’s advanced software solutions. By integrating AECOM’s interactive project and stakeholder engagement platform, PlanEngage, with EarthSoft’s environmental and geotechnical data platform, EQuIS, the initiative seeks to streamline and enhance the visualization of complex environmental data. This integration is expected to facilitate improved decision-making processes and foster greater alignment among stakeholders involved in remediation projects.

Key Geotechnical Engineering Companies:

The following are the leading companies in the geotechnical engineering market. These companies collectively hold the largest market share and dictate industry trends.

- AECOM

- Fugro

- HDR, Inc.

- Gardline Limited.

- Stantec Inc.

- Kiewit Corporation

- Bechtel Corporation

- Jacobs Solutions Inc.

- Black & Veatch

Recent Developments

-

In February 2023, two platform supply vessels, Topaz Energy and Topaz Endurance, was acquired by Fugro to repurpose them for supporting subsea surveys in the offshore renewable energy, oil, and gas industries. The acquisition of these key strategic assets aligns with Fugro’s net zero 2035 roadmap, as the vessels are considerably more energy efficient than Fugro’s existing fleet and provide potential for hybrid conversions or the use of alternative marine fuels in the future.

-

In May 2024, Black & Veatch announced its acquisition of Bird Electric Properties and Bird Electric Enterprises, both part of BASElectric Holdings, LLC. This agreement, prompted by the increasing demand for construction solutions to address global megatrends, enhances the growth of both companies by integrating essential industry expertise in engineering, construction, procurement, and business-enabling resources.

Geotechnical Engineering Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.73 billion |

|

Revenue forecast in 2030 |

USD 3.95 billion |

|

Growth rate |

CAGR of 6.3% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2017 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

AECOM; Fugro; HDR, Inc.; Gardline Limited.; Stantec Inc.; Kiewit Corporation; Bechtel Corporation; Jacobs Solutions Inc.; Black & Veatch |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Geotechnical Engineering Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global Geotechnical Engineering Market report based on type, application and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Underground City Space Engineering

-

Slope Excavation Engineering

-

Ground Foundation Engineering

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Municipal Engineering

-

Hydraulic Engineering

-

Bridge and Tunnel Engineering

-

Mining Engineering

-

Building Construction

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global geotechnical engineering market size was estimated at USD 2.57 billion in 2022 and is expected to reach USD 2.73 billion in 2023.

b. The global geotechnical engineering market is expected to grow at a compound annual growth rate of 6.3% from 2024 to 2030 to reach USD 3.95 billion by 2030.

b. North America dominated the geotechnical engineering market with a share of 32.0% in 2023. This growth is primarily attributed to the widespread adoption of geotechnical services and the initiation of numerous infrastructure and substructure projects in the region.

b. Some key players operating in the geotechnical engineering market include AECOM; Fugro; HDR, Inc.; Gardline Limited.; Stantec Inc.; Kiewit Corporation; Bechtel Corporation; Jacobs Solutions Inc.; and Black & Veatch.

b. Key factors that are driving the market growth include the significant shift toward renewable energy which is driving the development of offshore renewable energy projects propelling the geotechnics growth across the globe.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."