Geosynthetic Clay Liner Market Size, Share & Trends Analysis Report By Application (Containment & Waste Water Treatment, Landfill, Roadways & Civil Construction), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-714-8

- Number of Report Pages: 101

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Geosynthetic Clay Liner Market Trends

The global geosynthetic clay liner market size was estimated at USD 241.8 million in 2024 and is projected to grow at a CAGR of 5.7% from 2025 to 2030. Geosynthetic clay liners (GCLs) are essential for environmental protection as they effectively resist contaminants, prevent leakage, and save groundwater from pollution. Increasing environmental regulations and advanced liners mitigate contamination risks. These factors are anticipated to drive market growth. In addition, the growing demand for infrastructure development and landfill expansion projects further drives market growth. Technological advancements in GCLs offer enhanced performance and cost-effectiveness, contributing to market expansion.

The rising awareness and adoption of sustainable construction practices are anticipated to drive market growth. As industries and governments increasingly prioritize environmental sustainability, the use of GCLs in construction and waste management has gained traction due to their ability to provide effective containment and reduce environmental impact. The growing emphasis on sustainability encourages the implementation of GCLs in various applications, including mining, oil and gas operations, and land reclamation projects, thereby boosting market demand.

The expanding global population and urbanization enlarge the need for effective waste management solutions and infrastructure expansion. As the urban landscape widens, the demand for reliable landfill liners and containment systems increases. GCLs offer a cost-effective and efficient solution for these needs, given their durability and ease of installation compared to traditional methods. Moreover, technological advancements in GCL materials, such as improved permeability and greater resistance to environmental stressors, enhance their appeal and applicability in projects, further propelling market growth.

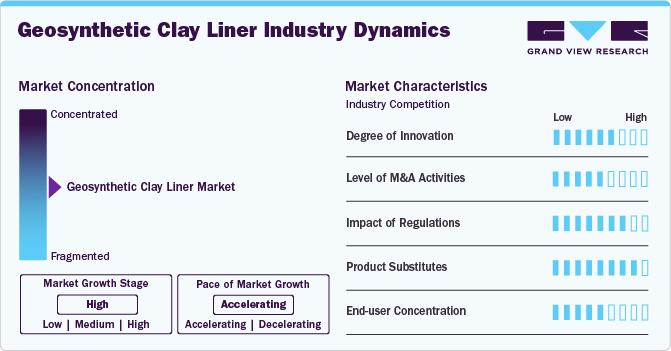

Market Concentration & Characteristics

The market growth stage is high with an accelerating pace. The global geosynthetics clay liner (GCL) industry is characterized by moderate market concentration, with a mix of established international players and regional manufacturers competing for market share. Key players dominate due to their technological expertise, extensive distribution networks, and ability to offer cost-effective solutions. These companies are often involved in continuous R&D to develop environmentally sustainable and efficient products to meet stringent regulatory standards. Meanwhile, regional manufacturers cater to localized markets, benefiting from lower production costs and closer proximity to projects. The market's competitive landscape is shaped by strategic alliances, acquisitions, and partnerships aimed at enhancing product portfolios and expanding geographical presence.

The market is driven by increasing demand from industries such as waste management, mining, and construction due to its effectiveness in containment applications like landfills, canals, and reservoirs. Regulatory frameworks focused on environmental protection and the rising adoption of green construction practices are significant growth factors. However, challenges such as fluctuating raw material prices and the availability of alternative solutions like geomembranes influence market dynamics. The industry also shows a growing trend toward innovation, with players developing multifunctional GCLs that integrate enhanced performance features like chemical resistance and self-healing properties.

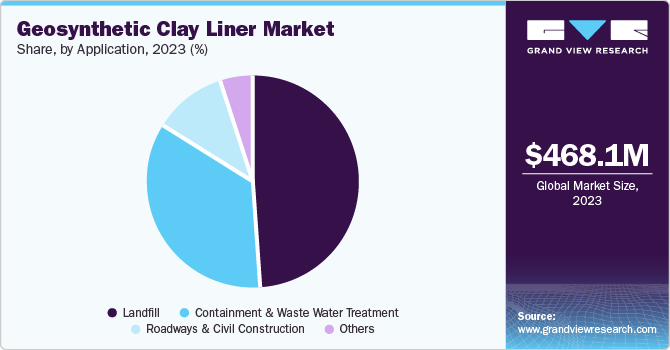

Application Insights

Landfill dominated the market and accounted for a revenue share of 48.3% in 2024, driven by the increasing volume of municipal and industrial waste requiring effective containment solutions. In addition, GCLs are highly valued in landfills for their superior barrier properties, which prevent leachate leakage and save groundwater from contamination. In addition, stringent regulatory requirements for landfill liners and the growing emphasis on waste management sustainability are anticipated to drive the demand for GCLs in this sector.

Roadways & civil construction are expected to register the fastest-growing CAGR of 6.7% during the forecast period due to the increasing demand for infrastructure development and improved road durability. GCLs are used in this sector for their superior drainage and stabilization properties, which enhance the performance and longevity of roadways. In addition, the growing emphasis on sustainable construction practices and effective soil management further drives the adoption of GCLs in civil engineering projects.

Regional Insights

North America geosynthetic clay liner market dominated globally with a revenue share of 29.2% in 2024. This is attributed to increased infrastructure development and stringent environmental regulations. The focus on advanced waste management solutions and enhanced landfill containment measures has driven the higher adoption of GCLs in municipal and industrial applications.

U.S. Geosynthetic Clay Liner Market Trends

The U.S. geosynthetic clay liner market dominated the North America region in terms of revenue share of 71.7% in 2024. This dominance is attributed to its extensive infrastructure projects and rigorous environmental regulations. The focus on advanced waste management practices and landfill containment has significantly boosted the demand for GCLs, driven by federal and state-level environment standards.

Asia Pacific Geosynthetic Clay Liner Market Trends

Asia Pacific geosynthetic clay liner market is anticipated to witness significant growth due to rapid urbanization and expanding infrastructure projects across the region. Increasing environmental regulations and the need for effective waste management solutions are driving the adoption of GCLs as the countries in the Asia Pacific continue to invest in sustainable development and enhanced landfill containment measures.

The geosynthetic clay liner market in China is driven by the rapid industrialization and urbanization that fuels the demand for GCLs in applications such as landfill containment, mining operations, and infrastructure development. Government initiatives aimed at pollution control and sustainable development, including strict regulations for waste disposal, have accelerated the adoption of advanced containment technologies like GCLs. Moreover, the country’s focus on water conservation projects, such as reservoirs and canals, boosts demand.

Europe Geosynthetic Clay Liner Market Trends

The geosynthetic clay liner market in Europe is witnessing growth due to extensive investments in large-scale infrastructure projects and the rising adoption of green construction materials. The European Union's strict environmental policies, including directives on landfill management and water conservation, encourage the use of GCLs as effective sealing and containment solutions. In addition, the demand is bolstered by increasing efforts to rehabilitate contaminated sites across the region.

The geosynthetic clay liner market in Germany is witnessing demand for geosynthetic clay liners (GCLs) due to the stringent environmental regulations and a strong emphasis on sustainable waste management. The country’s advanced industrial sector, particularly in renewable energy and infrastructure, also contributes to the adoption of GCLs in containment applications, such as landfills and water reservoirs, to meet high environmental standards. Germany’s focus on circular economy practices further stimulates demand for durable and eco-friendly materials like GCLs.

Central & South America Geosynthetic Clay Liner Market Trends

Central & South America geosynthetic clay liner market is anticipated to witness a CAGR of 5.7% over the forecast period. This growth is attributed to huge investments in infrastructure and waste management. In addition, rapid urbanization in the region and increasing industrial activity drive the need for effective environmental solutions. Furthermore, supportive government laws and initiatives for improving waste management and environmental protection have increased GCL adoption in these areas.

The geosynthetic clay liner market in Brazil is driven by the booming agricultural sector and growing urbanization that create a need for sustainable solutions for water storage and irrigation systems, boosting GCL adoption. In addition, the country’s expanding mining and energy industries rely on GCLs for containment and environmental protection. Brazil’s efforts to modernize waste management practices further contribute to market growth.

Middle East & Africa Geosynthetic Clay Liner Market Trends

The Middle East and Africa geosynthetic clay liner market growth is driven by the need for advanced water management solutions in arid regions, which is a key factor driving GCL demand. Countries in this region are investing heavily in water conservation projects, such as dams and reservoirs, to address water scarcity. In addition, rising industrial activities and urbanization necessitate effective waste management and containment systems, further increasing GCL usage.

The geosynthetic clay liner market in Saudi Arabia is driven by the demand for GCLs, which is fueled by large-scale infrastructure projects under the country’s Vision 2030 initiative that focuses on economic diversification and sustainable development. The country’s emphasis on water conservation and the construction of mega-projects like NEOM City has significantly increased the use of GCLs in reservoirs, canals, and landfills. Furthermore, the oil and gas industry’s waste containment needs contribute to steady demand.

Key Geosynthetic Clay Liner Company Insights

Some key companies in the global geosynthetic clay liner industry include GSE, Minerals Technologies Inc., Layfield, Polyfabrics Australia Pty Ltd., and others. Vendors in the market are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Minerals Technologies Inc. specializes in providing mineral-based products and technology solutions for industries including paper, steel, and environmental. Their offerings include performance minerals, advanced materials, and specialty chemicals designed to enhance the efficiency and quality of industrial processes.

-

TerraFix is a company that provides geosynthetic solutions for civil engineering and environmental applications, specializing in soil stabilization, erosion control, and drainage systems. Their product line includes geotextiles, geomembranes, and geogrids designed to enhance the performance and durability of infrastructure projects.

Key Geosynthetic Clay Liner Companies:

The following are the leading companies in the geosynthetic clay line market. These companies collectively hold the largest market share and dictate industry trends.

- GSE

- Mineral Technologies Inc.

- Climax

- Layfield

- Polyfabrics Australia Pty Ltd

- Geosyntec Consultants, Inc

- Terrafix

- HUESKER Synthetic GmbH

- Wall Tag Pte Ltd.

- GGPL

View a comprehensive list of companies in the Geosynthetic Clay Liner Market

Recent Developments

-

In July 2024, the city of Ballarat initiated its first geosynthetic cell capping project at the Ballarat Regional Landfill to enhance environmental protection. This project involves advanced geosynthetic materials to cap the landfill cells and effectively prevent leachate and harmful gases. The move underscores Ballarat's commitment to sustainable waste management practices and compliance with environmental regulations.

-

In July 2024, the Geosynthetics Magazine highlighted the significance of geosynthetics that meets stringent landfill leachate management requirements. It discusses the advances in geosynthetic materials that enhance their ability to contain and manage leachate, reducing environmental impact effectively.

Geosynthetic Clay Liner Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 254.5 million |

|

Revenue forecast in 2030 |

USD 336.1 million |

|

Growth Rate |

CAGR of 5.7% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Volume in Million Square Meters and Revenue in USD Million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application,region |

|

Regional scope |

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Argentina, Saudi Arabia, UAE |

|

Key companies profiled |

GSE; Minerals Technologies Inc.; Climax; Layfield; Polyfabrics Australia Pty Ltd; Geosyntec Consultants; Inc; terrafix; HUESKER Synthetic GmbH; Wall Tag Pte Ltd.; GGPL |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

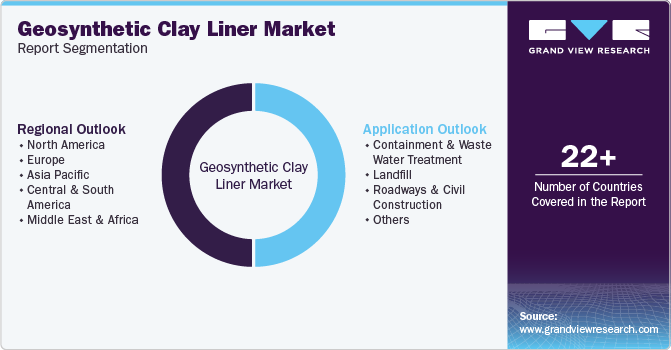

Global Geosynthetic Clay Liner Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global geosynthetic clay liner market report based on application and region.

-

Application Outlook (Volume, Million Square Feet; Revenue, USD Million, 2018 - 2030)

-

Containment & Waste Water Treatment

-

Landfill

-

Roadways & Civil Construction

-

Others

-

-

Regional Outlook (Volume, Million Square Feet; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global geosynthetic clay liner market size was estimated at USD 241.8 million in 2024 and is expected to reach USD 254.5 million in 2025.

b. The global geosynthetic clay liner market is expected to grow at a compound annual growth rate of 5.7% from 2025 to 2030 to reach USD 336.1 million by 2030.

b. Based on application, Landfill dominated the market and accounted for a share in 2024 driven by the increasing volume of municipal and industrial waste requiring effective containment solutions.

b. Key players operating in the market are GSE; Minerals Technologies Inc.; Climax; Layfield; Polyfabrics Australia Pty Ltd; Geosyntec Consultants; Inc; terrafix; HUESKER Synthetic GmbH; Wall Tag Pte Ltd.; and GGPL

b. The key factors that are driving the Geosynthetic Clay Liner include the growing demand for infrastructure development and landfill expansion projects further drives market growth

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."