Genome Editing Market Size, Share & Trends Analysis Report By Technology (CRISPR/Cas9), By Delivery Method (Ex Vivo), By Application(Genetic Engineering, Clinical Applications), By Mode(Contract, In-house), By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-399-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Genome Editing Market Size & Trends

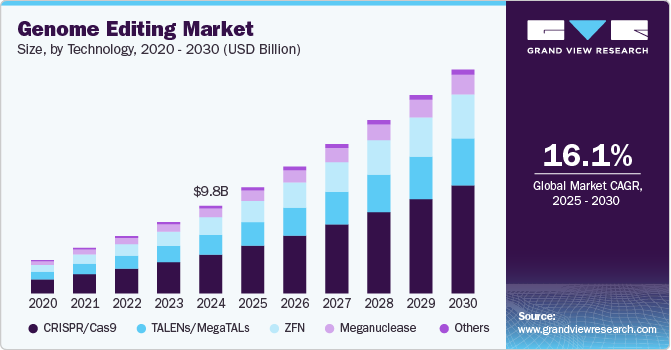

The global genome editing market size was estimated at USD 9.78 billion in 2024 and is projected to grow at a CAGR of 16.1% from 2025 to 2030. This growth can be attributed to the success in preclinical models driving the demand for genome editing therapeutics, rising competition among market participants for business development, technological advancements in gene editing technologies, and increasing adoption in agricultural biotechnology.

The COVID-19 pandemic had a significant impact on the market, causing disruptions in several aspects of the market, including clinical trial disruptions, supply chain challenges, and stringent regulations. Manufacturing & supply chains were also affected by lockdown measures, travel restrictions, and reduced workforce, leading to delays in the production & distribution of gene therapy products. Despite these challenges, companies in the genome editing industry have adjusted to the new normal by implementing adaptive measures and are expected to recover from the impact of COVID-19. The pandemic accelerated R&D activities in gene alteration technologies, specifically in response to the urgent need for effective treatments and vaccines for COVID-19. For example, researchers at Nanyang Technological University developed the VaNGuard (Variant Nucleotide Guard) diagnostic test in March 2021, which can detect SARS-CoV-2 strains with mutations. This advancement is anticipated to leverage the utilization of CRISPR genome editing technology.

The rapid evolution of CRISPR-based tools has significantly led to the expansion of the genome editing industry. The emergence of innovative genome editing tools, which allow easier manipulation of genomic DNA, has brought in a new phase in therapeutic development and disease detection. Consequently, service providers have a profitable opportunity to tap previously unexplored areas in this field. Moreover, increasing government funding, growing production of genetically modified crops, and a rising number of genomics projects are expected to drive the market growth.

Many companies are entering into licensing agreements with technology developers to strengthen their market presence, while key players are engaged in strategic initiatives like acquisitions and partnerships to expand their global presence. For instance, in February 2024, Precision BioSciences granted Caribou Biosciences a non-exclusive, global license to use its patented technology for targeted insertion of exogenous antigen binding receptors into the TRAC gene locus of human T cells. This agreement includes upfront payment, royalties on product sales, and potential milestone payments.

Gene editing technology CRISPR is projected to be the burgeoning technology in biotechnology. CRISPR harnesses the bacterial immune system to either knock genes out or insert new genes. Due to their time-consuming, ineffective, and labor-intensive nature, traditional genome editing methods are only partially capable of keeping pace with the rapidly evolving genome modification era. Additionally, technology also provides transformative results in various fields, such as plant, animal, & cell line genetic engineering and drug development & monitoring. Technology has the potential to investigate different gene combinations, control gene expression, and find the role of individual DNA bases.

Advancements in genomics and related technologies have significantly impacted crop genetics. Genomes and transcriptomes can now be sequenced for many crops. Major benefits of gene manipulation tools in agricultural sectors include the development of Genetically Modified (GM) plants/crops with various advanced features, such as increased crop productivity. They also help conserve biodiversity, reduce agricultural eco-footprint, mitigate climate change, and aid in alleviating poverty and hunger.

Expanding Therapeutic Horizons: Genome Editing Fuels Clinical Momentum

The rapid advancement of genome editing technologies is reshaping the therapeutic landscape, driving a surge in clinical trials aimed at treating a wide range of genetic, hematologic, metabolic, and infectious diseases. What began as a niche research tool has evolved into a transformative platform with expanding clinical applications and disease targets.

Increased precision, evolving delivery systems, and modular editing platforms have unlocked new possibilities for both in vivo and ex vivo therapies. This versatility is accelerating the transition from early-stage research to first-in-human studies and late-phase trials. Technologies like CRISPR-Cas9, base editing, and TALEN are being tailored to address disease-specific needs, improving therapeutic potential, and regulatory viability.

Clinical Trials Involving Genome Editing Technologies

|

# |

Trial / Therapy Name |

Target Disease |

Editing Technology |

Sponsor |

Trial Phase |

Delivery Type |

|

1 |

Exagamglogene Autotemcel (exa-cel) |

Sickle Cell Disease / Beta Thalassemia |

CRISPR-Cas9 (ex vivo) |

Vertex & CRISPR Therapeutics |

Approved / Post-trial |

Ex vivo (edited HSCs) |

|

2 |

EDIT-301 |

Severe Sickle Cell Disease / TDT |

CRISPR-Cas12a (ex vivo) |

Editas Medicine |

Phase 1/2 |

Ex vivo |

|

3 |

BEAM-01 |

Severe Sickle Cell Disease |

Base Editing (CRISPR-derived) |

Beam Therapeutics |

Phase 1/2 |

Ex vivo |

|

4 |

NTLA-2001 |

Hereditary Transthyretin Amyloidosis |

CRISPR-Cas9 (in vivo) |

Intellia Therapeutics |

Phase 1 |

In vivo (LNPs) |

|

5 |

NTLA-2002 |

Hereditary Angioedema (HAE) |

CRISPR-Cas9 (in vivo) |

Intellia Therapeutics |

Phase 1/2 |

In vivo (LNPs) |

|

6 |

PBGENE-HBV (ELIMINATE-B) |

Chronic Hepatitis B |

ARCUS Meganuclease |

Precision BioSciences |

Phase 1/2 |

In vivo |

|

7 |

VERVE-101 |

Heterozygous Familial Hypercholesterolemia |

Base Editing (in vivo) |

Verve Therapeutics |

Phase 1b |

In vivo (LNPs) |

|

8 |

CTX001 (early name of exa-cel) |

Beta Thalassemia / SCD (legacy trials) |

CRISPR-Cas9 (ex vivo) |

Vertex & CRISPR Therapeutics |

Concluded / Long-term follow-up |

Ex vivo |

As companies push for scalable solutions and long-term safety data, the volume and complexity of active genome editing trials are growing globally. This clinical momentum reflects the broader confidence in gene editing’s potential to deliver durable, one-time treatments for conditions once considered untreatable.

Expansion of In Vivo Applications

In vivo genome editing is emerging as a transformative force within the global therapeutic landscape. Unlike traditional ex vivo methods, in vivo approaches allow for direct gene modification inside the patient’s body, eliminating the need for complex cell extraction, manipulation, and reinfusion. This streamlines therapeutic workflows and enhances accessibility, particularly in regions with limited infrastructure.

Recent advancements in delivery technologies-such as lipid nanoparticles (LNPs), adeno-associated viruses (AAVs), and targeted ocular injections-have significantly improved the precision, efficiency, and safety of in vivo gene editing. These innovations are enabling the treatment of previously unreachable conditions, including hereditary liver disorders, cardiovascular diseases, retinal degeneration, and neurological conditions.

Key players are leading early-phase clinical programs with promising initial data. As regulatory frameworks evolve and clinical validation strengthens, in vivo editing is expected to unlock scalable, cost-effective, and globally deployable solutions, positioning it as a high-impact growth pillar in the broader genome editing industry.

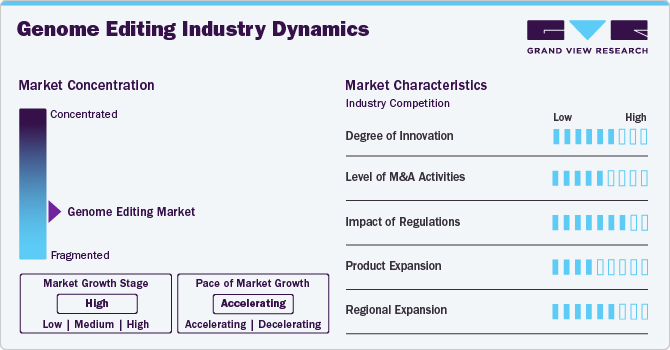

Market Concentration & Characteristics

The emergence of innovative genomics tools, which allow easier manipulation of genomic DNA, has brought in a new phase in therapeutic development and disease detection. Numerous industry players are launching technologically advanced and innovative products. For instance, in June 2023, CRISPR Therapeutics and Vertex Pharmaceuticals submitted its the Biologics License Applications to the U.S. FDA for an ex vivo CRISPR based gene edited therapy used in the treatment of sickle cell disease.

The market is also characterized by a moderate level of merger and acquisition activities undertaken by several industry players. This is due to several factors, including the desire to gain a competitive advantage in the industry and the need to consolidate in a rapidly growing market. For instance, in February 2024, Ginkgo Bioworks announced the acquisition of Proof Diagnostics by expanding Ginkgo’s product portfolio in gene editing toolkits for therapeutics.

The growth of the market is fueled by favorable government regulations related to synthetic biology, increasing demand for engineered genes and cells, and rising investments from the government and large companies. The invention and implementation of various unconventional gene editing methods is another significant advancement in gene therapy and molecular biology that has contributed to the market's growth.

Key players adopt this strategy to increase the production capacity and reach of their products in the market and improve their availability in diverse geographic areas. In addition, the growing strategic activities by key players to create awareness among students and launch of educational products is expected to drive growth in the genome editing industry. For instance, in March 2024, Carolina Biological Supply Company collaborated with the ChristianaCare Gene Editing Institute to develop an exclusive CRISPR in a Box educational kit for grades 9 to 12 and higher education, offering hands-on exercises to teach CRISPR techniques.

The industry is currently witnessing a moderate level of regional expansion, with growth prospects driven by an expanding customer base for gene editing products & services. For instance, In October 2023, Integrated DNA Technologies (IDT), a subsidiary of Danaher Corporation inaugurated a new therapeutic manufacturing facility to meet the increasing demand for genomic medicine. The new facility is equipped to support the production of therapeutic oligonucleotides, catering to the expanding needs in genomics and personalized medicine.

Technology Insights

The CRISPR/Cas9 segment held the largest market share of 44.36% of the global revenue in 2024. This can be attributed to high precision & efficiency, high versatility & adaptability to different experimental designs, and cost-effectiveness with relatively low expense associated. In addition, with the growing number of applications, the demand for CRISPR is anticipated to grow over the forecast period. The clinical applications of CRISPR have been widely accepted. This is evident from the increasing number of ongoing clinical trials using gene-editing techniques for the treatment of a wide range of diseases such as AIDS, cancer, and genetic diseases. In addition to human health, this technology is witnessing increasing usage in agriculture and animal breeding applications.

The ZFN segment is expected to witness a substantial growth with a CAGR of 17.7% over the forecast period. Zinc Finger Nuclease (ZFN) is a widely used technology in the field of genome editing. It is a kind of engineered nuclease that facilitates targeted modifications in DNA strands. ZFNs or homing endonucleases have been successfully used to target HBV, HIV, human papillomavirus, herpes simplex virus type, and human T-cell leukemia virus types, as these are susceptible to transcriptional suppression and gene disruption by ZFNs. Moreover, lower off-target activity does aid in gaining the approval for ZFNs as therapies. As a result, the technique is anticipated to hold immense economic potential for developing gene therapies in the coming years.

Delivery Method Insights

The in-vivo segment dominated in 2024. Many specialized cell types cannot be removed from the patient and maintained alive outside the body for the duration of the treatment or cannot be effectively returned to the patient after treatment (e.g., heart muscle cells, specialized neuronal cells). Therefore, the development of several in vivo genome editing techniques is expected to drive market growth in the near future.

The ex-vivo segment is projected to witness significant growth at a CAGR of 12.6% from 2025 to 2030. This dominance can be attributed to the ease of control in DNA modification provided, along with the precise regulation of strength and duration of nuclease expression to minimize off-target editing and maximize efficiency. Ex-vivo products such as CAR-T technology for oncology blood treatment are observed to be prioritized in the therapeutic molecular scissors pipeline.

Application Insights

The genetic engineering segment held the largest market share in 2024. It is further categorized into cell line engineering, animal genetic engineering, plant genetic engineering, and others. The use of gene therapy to develop novel molecules for the treatment of diseases such as lymphoma, sickle cell, and infectious diseases is anticipated to boost adoption toward the end of the forecast period.

The clinical applications segment is expected to grow at a significant CAGR of 12.34% over the forecast period. Clinical applications of genome editing include diagnostics and therapy development. The demand for such applications is primarily driven by their potential to address genetic diseases. Genome editing offers the prospect of precise and personalized treatments tailored to an individual's genetic makeup, which helps in advancing therapeutic development. Furthermore, advancements in genome editing technologies, coupled with an increase in understanding of the genetic basis of diseases, have fueled interest in the development of novel diagnostic tools, thereby driving the segment.

Mode Insights

The contract segment dominated the market in 2024 due to the high extent of outsourcing activities in the genomics space driven by the lower costs and greater flexibility in operations offered by such activities as compared to in-house development. The segment is projected to witness further growth because of the increasing strategic activities undertaken by outsourcing service providers. For instance, in December 2022, a CRO named Crown Bioscience, Inc. collaborated with ERS Genomics Limited to gain access to ERS’ CRISPR/Cas9 patent portfolio and strengthen its market presence in the gene editing space. Such initiatives are expected to boost the outsourcing opportunities in the genome editing domain and can positively impact market growth.

The in-house segment is expected to witness lucrative growth over the forecast period due to the ownership of supply channels, better troubleshooting abilities, and enhanced potential for future in-house scale-up activities. Hence, companies such as Precision BioSciences maintain internal manufacturing facilities compliant with current Good Manufacturing Practices (cGMP) to produce genome-edited products, including allogeneic CAR T cell therapies. These factors are anticipated to drive the revenue growth for the segment over the forecast period.

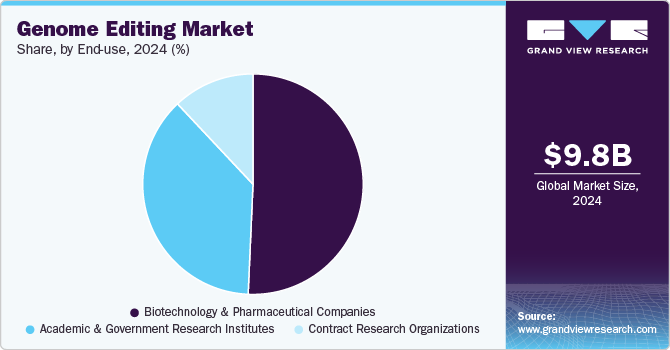

End Use Insights

The biotechnology and pharmaceutical companies segment accounted for the largest market share of 50.71% in 2024. The presence of a growing number of research activities for novel therapeutic development is the major factor contributing to revenue generation. Moreover, global pharmaceutical companies are collaborating with emerging companies to develop novel technologies. Increased research development efforts for novel treatments are the main factor fueling revenue growth. With rapid advancements in DNA engineering technology, such as the introduction of the CRISPR/Cas9 system, the process of creating knockout/knock-in transgenic in microorganisms, plants, and animals, including humans, has become very simple, easy, efficient, accurate, and less time-consuming.

The academic and research institutions segment is expected to grow at the fastest CAGR of 18.4% over the forecast period, due to the increasing usage of genome editing technology in academic settings such as college campuses. Several organizations are developing lessons for high school and college students to better understand gene editing techniques.

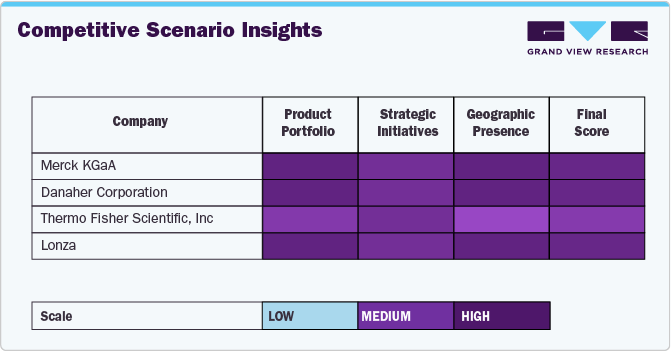

Competitive Scenario Insights

The genome editing industry is marked by intense competition, fueled by rapid technological advancements, strategic partnerships, and evolving regulatory frameworks. Leading developers are driving innovation in platforms such as CRISPR and zinc-finger nucleases, supported by a strong pipeline of clinical-stage therapies focused on hematologic, ocular, and rare genetic disorders. Their market position is further strengthened through collaborations with major pharmaceutical firms and long-term manufacturing agreements with contract development and manufacturing organizations (CDMOs), enhancing both commercial reach and operational scalability.

At the same time, emerging players are utilizing proprietary gene editing platforms to address unmet needs in fields like agriculture, regenerative medicine, and animal genetics. These organizations are gaining momentum through intellectual property development, licensing agreements, and focused expansion into specialized markets. Meanwhile, other innovators are advancing the frontiers of technologies such as TALEN, ARCUS, and base editing, positioning themselves as key contributors to the next wave of genome editing innovation.

Key players like Thermo Fisher Scientific, Danaher Corporation, Merck KGaA, and New England Biolabs support this competitive ecosystem by providing critical reagents, tools, and platforms that underpin R&D workflows. Their investments in automation, synthetic biology, and assay development are accelerating the translation of genome editing into scalable clinical and industrial solutions.

Regional Insights

North America genome editing market dominated the global market and accounted for a 44.59% share in 2024, owing to the growing investments in the R&D of gene editing technologies. Due to the presence of several biotechnology and pharmaceutical companies working on developing genome editing technologies, the region is projected to maintain its dominance over the projected period.

U.S. Genome Editing Market Trends

The presence of robust research infrastructure, the rise in genetically modified crops and the increase in the prevalence of genetic diseases are some of the major driving factors boosting the U.S. genome editing market. Moreover, in the U.S., genetic diseases such as cystic fibrosis are prevalent. On the other hand, rise in the number of patent approvals for U.S.-based companies has also accelerated the adoption of genome editing tools in the country, leading to positive market growth. Further, with increased government funding and support for scientific R&D, the U.S. held the largest market share for genome editing technology in North America.

Europe Genome Editing Market Trends

Europe genome editing market was identified as a lucrative region in this industry. This is attributed to the adoption of new rules related to genome editing by European countries creating an opportunity for the market.

The UK genome editing market presents several potential opportunities that favor an increase in the usage of advanced genome editing tools. Numerous efforts undertaken by UK-based genome editing companies and funding initiatives supported by private & public entities drive the UK genome editing market. In September 2021, the UK’S Department for Environment, Food and Rural Affairs (Defra) declared that by the end of 2021, researchers who wanted to conduct field trials of gene-edited plants will no longer be required to submit risk assessments.

The genome editing market in France is driven by rising prevalence of hereditary diseases, such as hemophilia and metabolic disorders. To cure such disorders, several researchers are using genome editing technologies. Furthermore, France is undertaking several efforts to drive innovation in plant genetics, thereby boosting market growth in the country. Some of the 28 leading private and public research organizations involved in plant breeding, plant science, and connected technologies formed the Plant Alliance.

Germany genome editing market generated significant revenue in the European genome editing market, which can be attributed to the presence of developed global companies, such as Merck KGaA & QIAGEN, which offer genome editing and related products. The collaboration and partnership models among key players strengthen their market presence in the country as well as at a global level, hence, driving the revenue in the country.

Asia Pacific Genome Editing Market Trends

Asia Pacific is anticipated to witness the fastest growth at a CAGR of 17.84% from 2025 to 2030 in the genome editing market. The regional market is expected to be driven by the increasing demand for gene editing technologies and the rising prevalence of genetic disorders and diseases across several countries like India and Australia. Moreover, the domestic companies providing gene editing products and services are attracting investments and funding. For instance, in April 2021, GenScript launched Research-Grade Lentiviral Vector Packaging Service for drug discovery, cell line development, and gene editing.

The China genome editing market is driven by the local presence of key market players, such as GenScript. The company is taking initiatives to promote genome engineering services such as CRISPR services and gene services. The region's genome editing market is ready for growth due to the Chinese government's increasing focus on precision medicine and the presence of major players such as BGI, and Hebei Senlang Biotechnology.

The genome editing market in Japan is characterized by an increasing number of Japanese companies that are acquiring licenses to the CRISPR-Cas9 technology, potentially driving market growth. In addition, an increasing prevalence of genetic diseases and diabetics coupled with growing genomic research initiatives is expected to drive the market in Japan. In Japan, around 13.5% of the total population either has type 2 diabetes or impaired glucose tolerance.

India genome editing market is expected grow in future as the country possesses high growth potential in the genome editing market due to high competency and intense demand for genome editing technology to improve agriculture productivity suitably. In the country, the Department of Biotechnology’s (DBT) National Agri-Food Biotechnology Institute is utilizing CRISPR genome editing technology to modify bananas. Moreover, ongoing research projects related to CRISPR/Cas9 by Indian researchers and scientists are expected to drive the India genome editing market.

Middle East and Africa Genome Editing Market Trends

The genome editing market in Middle East and Africa is projected to grow in near future due to the increasing applications of biotechnology in healthcare are contributing to the expansion of the market.

The Saudi Arabia genome editing market is characterized by several ongoing research projects related to CRISPR genome editing technology which are expected to boost the market growth over the forecast period. The rising adoption of CRISPR technology for enhancing immune system in plants is expected to drive market growth in the coming years.

The genome editing market in Kuwait is expected to witness rapid growth in the coming decade due to the increasing investment in scientific R&D, both by the government and private sector, which drives innovation in genetic technologies. This investment creates opportunities to develop new and improved genome editing tools and techniques.

Key Genome Editing Company Insights

Key players operating in the genome editing market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are playing a key role in propelling the market growth.

Key Genome Editing Companies:

The following are the leading companies in the genome editing Market. These companies collectively hold the largest market share and dictate industry trends.

- Merck KGaA

- Takara Bio Inc.

- Revvity, Inc.

- Danaher Corporation

- GenScript

- New England Biolabs

- Lonza

- Thermo Fisher Scientific, Inc.

- Charles River Laboratories

- Eurofins Scientific

Recent Developments

-

In January 2024, Danaher Corporation collaborated with the Innovative Genomics Institute (IGI). This partnership aims to develop CRISPR-based therapies for rare genetic disorders, leveraging Danaher’s diverse technological resources and IGI’s academic expertise.

-

In November 2023, Cellectis and AstraZeneca entered into a collaboration agreement to accelerate advanced therapeutics development in oncology and immunology.

-

In July 2023, Sangamo Therapeutics and Chroma Medicine collaborated to develop epigenetic medicines using Sangamo's Zinc Finger Proteins (ZFPs). Chroma will evaluate ZFPs for specific targets outside the central nervous system, potentially licensing them for development and commercialization.

-

In May 2023, a research program at the Lewis Katz School of Medicine at the University of Nebraska Medical Center reported successful treatment of HIV infection in animals using CRISPR.

-

In April 2022, LGC acquired Rapid Genomics to enhance its position in NGS application for high-throughput genotyping in agrigenomics market.

Genome Editing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 11.84 billion |

|

Revenue forecast in 2030 |

USD 25.00 billion |

|

Growth rate |

CAGR of 16.1% from 2025 to 2030 |

|

Historical data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Technology, method, application, mode, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; and Kuwait |

|

Key companies profiled |

Merck KGaA ; Takara Bio Inc.; Revvity, Inc.; Danaher Corporation; GenScript; New England Biolabs; Lonza; Thermo Fisher Scientific, Inc.; Charles River Laboratories; Eurofins Scientific |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Genome Editing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global genome editing market report based on technology, method, application, mode, end use, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

(CRISPR)/Cas9

-

TALENs/MegaTALs

-

ZFN

-

Meganucleases

-

Others

-

-

Delivery Method Outlook (Revenue, USD Million, 2018 - 2030)

-

Ex-vivo

-

In-vivo

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Genetic Engineering

-

Cell line engineering

-

Animal genetic engineering

-

Plant genetic engineering

-

Others

-

-

Clinical Applications

-

Diagnostics Development

-

Therapy Development

-

-

-

Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Contract

-

In-house

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Biotechnology and pharmaceutical companies

-

Academic and government research institutes

-

Contract research organizations

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global genome editing market size was estimated at USD 9.78 billion in 2024 and is expected to reach USD 11.84 billion in 2025.

b. The global genome editing market is expected to grow at a compound annual growth rate of 16.11% from 2025 to 2030 to reach USD 25.00 billion by 2030.

b. North America dominated the genome editing market with a share of 44.45% in 2024. The presence of strong research, as well as a commercial base for advanced therapy development coupled with a high number of clinical trials being conducted for gene and stem cell therapies in the region, has majorly contributed to the dominance of the region in the global market.

b. Some key players operating in the genome editing market include Merck KGaA ; Takara Bio Inc.; Revvity, Inc.; Danaher Corporation; GenScript; New England Biolabs; Lonza; Thermo Fisher Scientific, Inc.; Charles River Laboratories; Eurofins Scientific

b. Key factors that are driving the genome editing market growth include success in pre-clinical models drives demands for genome editing therapeutics, rising competition amongst market participants for business development, easy editing solutions for the development of therapeutics for a broad range of diseases, increasing demand for synthetic genes and genetically modified organisms, technological advancements in gene-editing technologies, and rising adoption in agricultural biotechnology.

b. The CRISPR/Cas9 segment dominated the market for genome editing and accounted for the largest revenue share of 44.36% in 2024.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."